Trends among the largest companies of Moscow's real economy

Information agency Credinform represents an overview of trends among the largest companies of Moscow’s real economy.

Enterprises of Moscow’s real economy with the largest volume of annual revenue (TOP-10 and TOP-500) were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2015 and 2016). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net assets

Indicator of real cost of corporate assets, which is annually calculated as the difference between assets of the company and its debt liabilities. If the company’s debts exceed net worth value, net assets indicator is considered negative (insufficiency of property).

| Position in TOP-1000 | Name | Net assets value, mln RUB* | Solvency index Globas | ||

| 2014 | 2015 | 2016 | |||

| 1. | PJSC GAZPROM | 9 089 213 | 9 322 339 | 10 414 000 | 141 Superior |

| 2. | PJSC RUSSIAN RAILWAYS | 3 553 400 | 3 578 080 | 4 237 344 | 179 High |

| 3. | JSC ROSNEFTEGAZ | 2 248 951 | 2 827 708 | 3 196 019 | 286 Medium |

| 4. | PJSC ROSNEFT OIL COMPANY | 1 355 532 | 1 436 002 | 1 534 962 | 188 High |

| 5. | JSC ROSENERGOATOM CONCERN | 1 181 245 | 1 298 091 | 1 389 225 | 166 Superior |

| 996. | JSC SPETSENERGOTRANS | -4 671 | -10 077 | -11 616 | 313 Adequate |

| 997. | PJSC FOREIGN ECONOMIC ASSOCIATION TECHNOPROMEXPORT | 1 169 | -10 290 | -14 934 | 600 Insufficient |

| 998. | JSC GLAVMOSSTROY HOLDING COMPANY | 264 | -4 527 | -21 435 | 550 Insufficient |

| 999. | PJSC YAMAL LNG | -66 437 | -183 259 | -25 754 | 236 Strong |

| 1000. | JSC UNITED CHEMICAL COMPANY URALCHEM | -76 947 | -82 991 | -40 923 | 228 Strong |

*) – indicators of growth or reduction compared to the previous period are marked with green and red in columns 4 and 5 respectively.

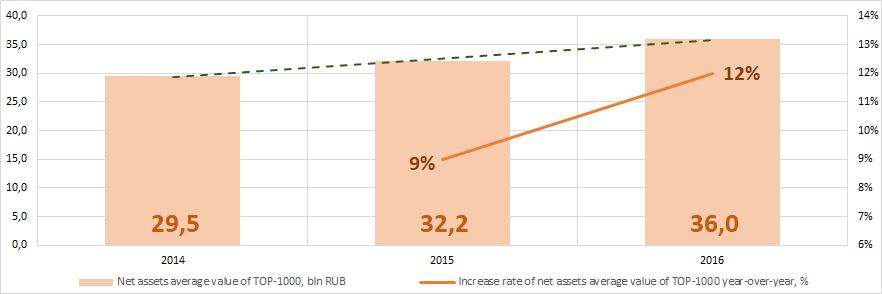

Picture 1. Change in average net assets value of the largest companies of Moscow’s real economy in 2014 – 2016

Picture 1. Change in average net assets value of the largest companies of Moscow’s real economy in 2014 – 2016Sales revenue

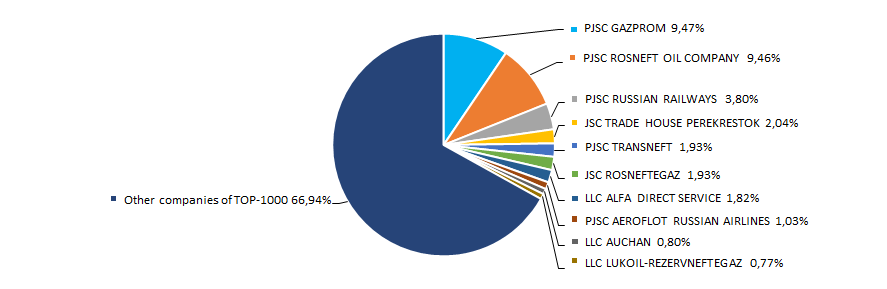

The revenue of the largest 10 companies of Moscow’s real economy made 33% of the total revenue of TOP-1000 companies in 2016 (Picture 2).

Picture 2. Shares of participation of TOP-10 enterprises in the total revenue of TOP-1000 companies for 2016

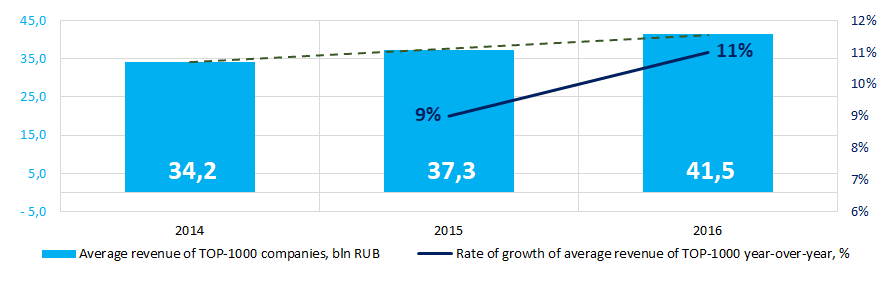

Picture 2. Shares of participation of TOP-10 enterprises in the total revenue of TOP-1000 companies for 2016Trend to increase in revenue volume is observed (Picture 3).

Picture 3. Change in the industry average revenue indicators of companies of Moscow’s real economy in 2014 – 2016

Picture 3. Change in the industry average revenue indicators of companies of Moscow’s real economy in 2014 – 2016Profit and loss

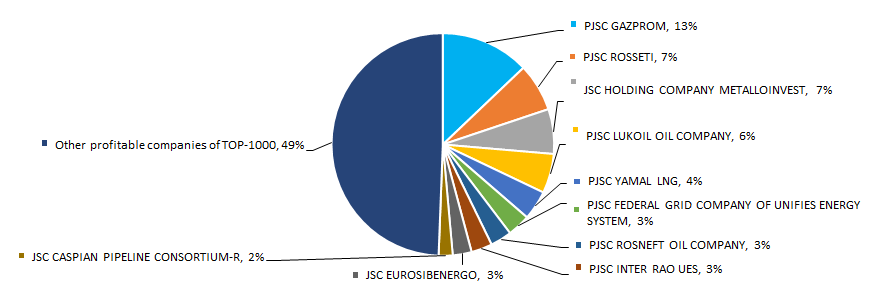

Profit volume of the largest 10 companies of Moscow’s real economy made 51% of the total profit of TOP-1000 companies in 2016 (Picture 4).

Picture 4. Shares of participation of TOP-10 enterprises in the total profit volume of TOP-1000 companies for 2016

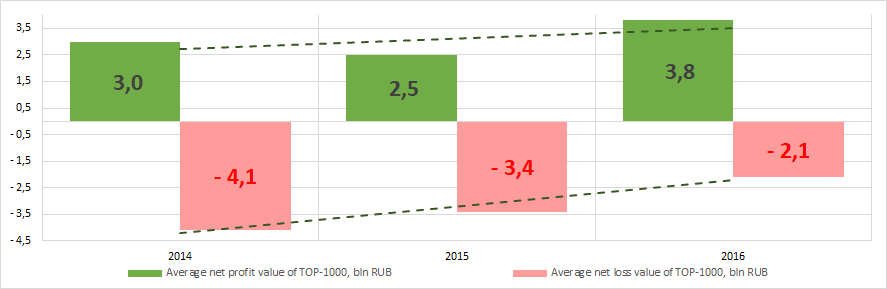

Picture 4. Shares of participation of TOP-10 enterprises in the total profit volume of TOP-1000 companies for 2016Industry average values of the profit indicators of companies for the three-year period have a trend to increase; average net loss value decreases (Picture 5).

Picture 5. Change in the average profit indicators of the largest companies of Moscow’s real economy in 2014 – 2016

Picture 5. Change in the average profit indicators of the largest companies of Moscow’s real economy in 2014 – 2016Key financial ratios

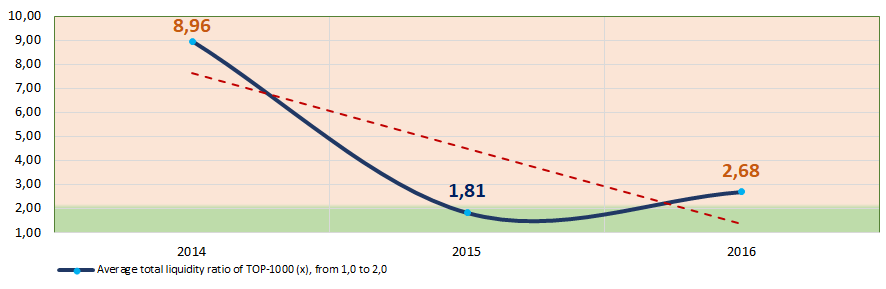

Average industry indicator of the total liquidity ratio of TOP-1000 companies in 2014 – 2016 were above or within the recommended values – from 1,0 to 2,0 (Picture 6).

The total liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 6. Change in the industry average values of the total liquidity and solvency ratios of the largest companies of Moscow’s real economy in 2014 – 2016

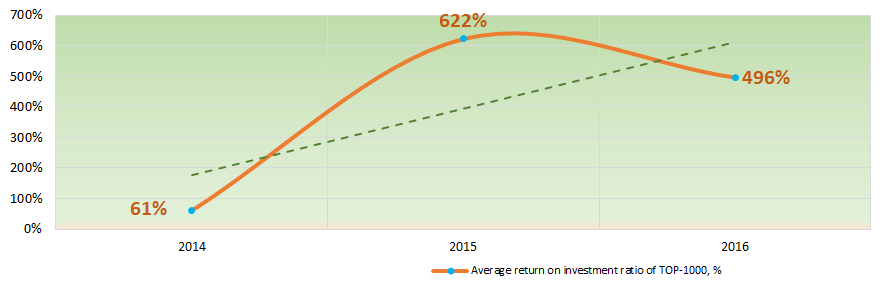

Picture 6. Change in the industry average values of the total liquidity and solvency ratios of the largest companies of Moscow’s real economy in 2014 – 2016For three years, the instability of return on investment ratiowith trend to increase was observed (Picture 7).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity and the long-term borrowed funds of an organization.

Picture 7. Change in the industry average values of the return on investment of the largest companies of Moscow’s real economy in 2014 – 2016

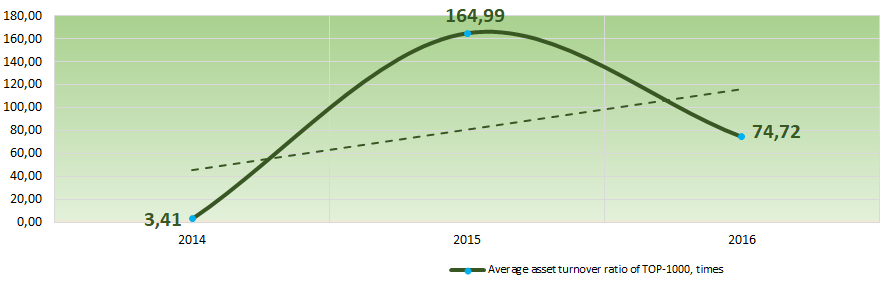

Picture 7. Change in the industry average values of the return on investment of the largest companies of Moscow’s real economy in 2014 – 2016Asset turnover ratio is calculated as the relation of sales proceeds to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. the coefficient shows how many times a year a complete cycle of production and circulation is made, yielding profit.

For the three-year period, this ratio had a trend to increase (Picture 8).

Picture 8. Change in the industry average values of asset turnover ratio of the largest companies of Moscow’s real economy in 2014 – 2016

Picture 8. Change in the industry average values of asset turnover ratio of the largest companies of Moscow’s real economy in 2014 – 2016Production and services structure

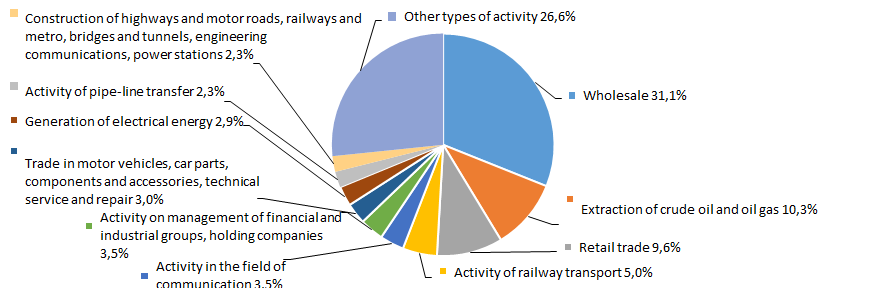

Companies engaged in wholesale and oil extraction have the highest share in total revenue among TOP-1000 enterprises (Picture 9).

Picture 9. Distribution of types of activity to total revenue of TOP-1000 companies, %

Picture 9. Distribution of types of activity to total revenue of TOP-1000 companies, %Financial position score

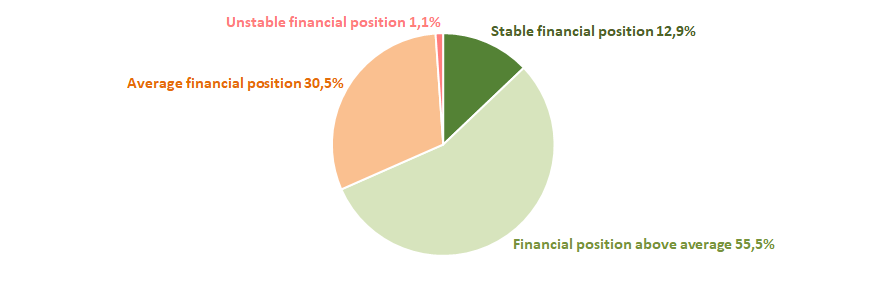

An assessment of the financial position of TOP-1000 companies shows that more than a half of enterprises are in financial situation above average (Picture 10).

Picture 10. Distribution of TOP-1000 companies by financial position score

Picture 10. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

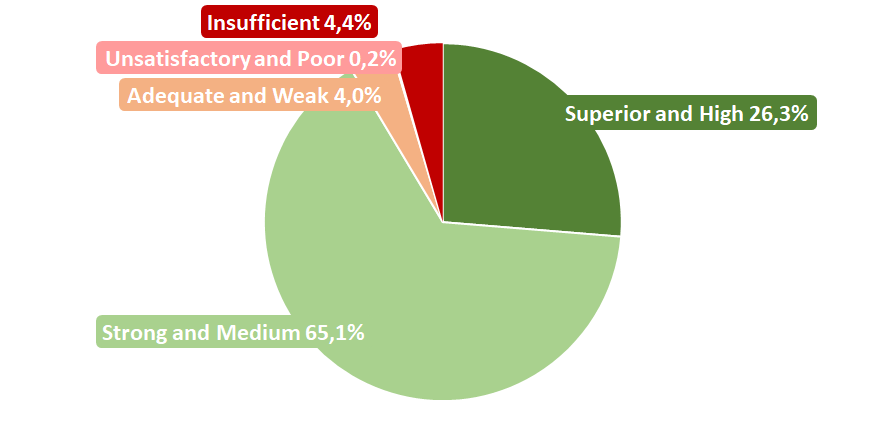

The majority of TOP-1000 companies got Superior, High, Strong or Medium Solvency index Globas, that indicates their ability to timely and fully fulfill debt liabilities (Picture 11).

Picture 11. Distribution of TOP-1000 companies by Solvency index Globas

Picture 11. Distribution of TOP-1000 companies by Solvency index GlobasThus, a comprehensive assessment of the largest companies of Moscow’s real economy, taking into account the main indices, financial indicators and ratios, points to prevalence of favorable trends.

ROI ratio of the largest companies of Moscow's real economy

Information Agency Credinform has prepared the ranking of the largest companies of Moscow's real economy. The largest enterprises (TOP-1000 and TOP-10) in terms of annual revenue were selected according to the data from the Statistical Register for the available periods (from 2007 to 2016). Then the companies were ranged by ROI ratio (Table 1). The analysis was based on data of the Information and Analytical system Globas.

Return on investments (%) is the ratio of net profit (loss) and net assets value. It demonstrates the return level from each ruble, received from the investments. In other words it shows how many monetary units the company used to obtain one monetary unit of net profit. The ratio is used for the assessment of fund raising at interest.

In general, normative values for ROI ratio are not set as they are changing due to the industry in which company operates.

For the most full and fair opinion about the company’s financial position, the whole set of financial indicators and ratios of the company should be taken into account.

| Name, INN, region | Revenue, bln RUB | Net profit, bln RUB | ROI ratio, % | Solvency index Globas | |||

| 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | ||

| LLC LUKOIL-REZERVNEFTEPRODUKT INN 7709825967 Wholesale of solid, liquid and gaseous fuels and related products |

400,9 | 320,7 | 5,0 | 4,7 | 49,98 | 48,60 | 215 Strong |

| PAO AEROFLOT INN 7712040126 Passenger air transport |

366,3 | 427,9 | -18,9 | 30,6 | -38,04 | 38,08 | 168 Superior |

| LA SOCIETE A RESPONSABILITE LIMITEE AUCHAN INN 7703270067 Retail sale in non-specialised stores with food, beverages or tobacco predominating |

344,2 | 333,1 | 11,9 | 10,9 | 23,23 | 18,35 | 237 Strong |

| LLC ALFA DIRECT SERVICE INN 7728308080 Legal and accounting activities |

603,2 | 756,2 | 0,3 | 0,2 | 22,32 | 16,94 | 186 High |

| Oil Transporting Joint-Stock Company Transneft INN 7706061801 Oil and oil products transportation via pipelines |

756,9 | 803,1 | 12,8 | 30,6 | 7,74 | 16,69 | 158 Superior |

| NAO TRADE HOUSE PEREKRIOSTOK INN 7728029110 Retail sale in non-specialised stores with food, beverages or tobacco predominating |

726,4 | 848,3 | 18,0 | 10,6 | 14,39 | 7,82 | 211 Strong |

| PAO ROSNEFT OIL COMPANY INN 7706107510 Extraction of crude petroleum |

3 831,1 | 3 930,1 | 239,4 | 99,2 | 16,67 | 6,47 | 188 High |

| PAO GAZPROM INN 7736050003 Wholesale of solid, liquid and gaseous fuels and related products |

4 334,3 | 3 934,5 | 403,5 | 411,4 | 4,33 | 3,95 | 141 Superior |

| PAO RUSSIAN RAILWAYS INN 7708503727 Activities of railway transport |

1 510,8 | 1 577,5 | 0,3 | 6,5 | 0,01 | 0,15 | 179 High |

| NAO ROSNEFTEGAZ INN 7705630445 Holding companies management activities |

79,5 | 800,4 | 149,4 | -90,4 | 5,28 | -2,83 | 286 Medium |

| Total for TOP-10 group of companies | 12 953,5 | 13 731,7 | 821,6 | 514,4 | |||

| Average value within TOP-10 group of companies | 1 295,4 | 1 373,2 | 82,2 | 51,4 | 10,59 | 15,42 | |

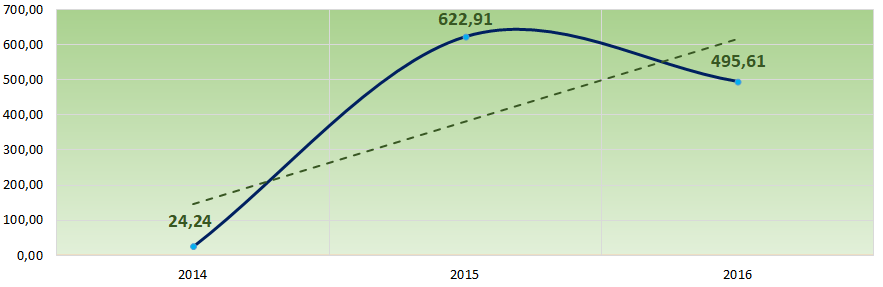

| Average value within TOP-1000 group of companies | 37,2 | 41,5 | 2,0 | 2,9 | 622,91 | 495,61 | |

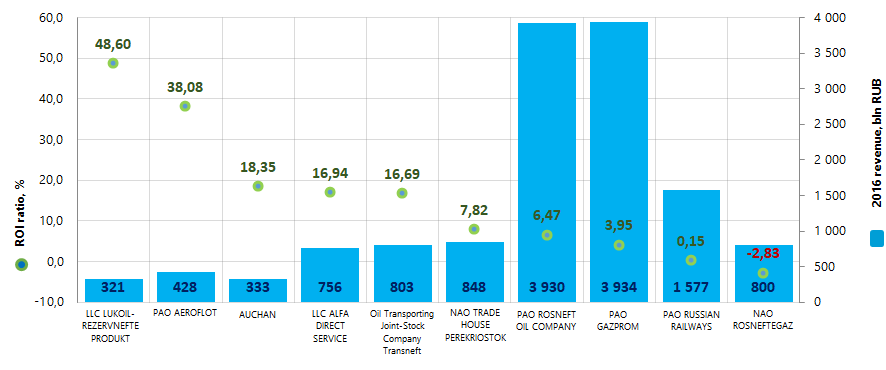

The average value of ROI ratio within TOP-10 group of companies is significantly lower than average value of TOP-1000 companies.

In 2016, only three companies from TOP-10 list increased the revenue and net profit in comparison with 2015. The companies with decrease in net profit, revenue, ROI ratio are marked red in columns 2-7 of Table 1.

Picture 1. ROI ratio and revenue of the largest companies of Moscow's real economy (TOP-10)

Picture 1. ROI ratio and revenue of the largest companies of Moscow's real economy (TOP-10)For the last 3 years, the average values of ROI ratio showed increasing trend (Picture 2).

Picture 2. The change of ROI ratio average values within 2014 – 2016 for the largest companies of Moscow's real economy

Picture 2. The change of ROI ratio average values within 2014 – 2016 for the largest companies of Moscow's real economyAll companies from TOP-10 list have the upper levels of solvency index Globas, this fact shows the ability of the companies to meet their obligations in time and fully.