Working assets of children's camps

Information agency Credinform has prepared a ranking of the largest Russian children’s recreation camps. The largest enterprises (TOP-10) in terms of annual revenue were selected according to the data from the Statistical Register for the available periods (2016-2018). Then the companies were ranged by working capital to current assets ratio (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Working capital to current assets ratio (x) is calculated as difference between equity and non-current assets to working assets. The indicator shows ability of an enterprise to finance current activcities by means of own working funds. Recommended value of the ratio is > 0,1.

For the most full and fair opinion about the company’s financial position the whole set of financial indicators and ratios should be taken into account.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Working capital to current assets ratio (x),> 0,1 | Solvency index Globas | |||

| 2017 | 2018 | 2017 | 2018 | 2017 | 2018 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| DOLP IM. A.V. KAZAKEVICHA LLC INN 9104000322 Republic of Crimea |

82,28 82,28 |

96,00 96,00 |

8,78 8,78 |

1,09 1,09 |

0,89 0,89 |

0,99 0,99 |

207 Strong |

| LLC DOL VOLNA INN 7802143863 Leningrad region |

85,88 85,88 |

97,86 97,86 |

2,19 2,19 |

11,61 11,61 |

-1,21 -1,21 |

0,60 0,60 |

154 Superior |

| LLC DSOL KD BEREZOVAYA ROSHCHA INN 3711003188 Ivanovo region |

97,46 97,46 |

95,77 95,77 |

1,15 1,15 |

0,96 0,96 |

0,02 0,02 |

0,09 0,09 |

210 Strong |

| LLC DSOL MORSKAYA VOLNA INN 2365013436 Krasnodar region |

270,21 270,21 |

304,00 304,00 |

1,11 1,11 |

4,54 4,54 |

0,49 0,49 |

0,09 0,09 |

259 Medium |

| LLC DOL ZELENYI GOROD IM. T. TRUSHKOVSKO INN 7814623261 St. Petersburg |

71,59 71,59 |

74,87 74,87 |

0,19 0,19 |

0,37 0,37 |

0,03 0,03 |

0,03 0,03 |

187 High |

| ZAO UDOL ENERGETIK INN 2301012388 Krasnodar region |

140,12 140,12 |

195,52 195,52 |

0,03 0,03 |

-2,16 -2,16 |

-1,92 -1,92 |

-0,58 -0,58 |

265 Medium |

| LLC DOL ELEKTRON INN 2301034007 Krasnodar region |

101,78 101,78 |

94,45 94,45 |

31,84 31,84 |

14,98 14,98 |

-3,59 -3,59 |

-1,14 -1,14 |

198 High |

| CHU DOL ELANCHIK PAO CHTPZ INN 7415033126 Chelyabinsk region |

92,22 92,22 |

91,48 91,48 |

0,16 0,16 |

1,04 1,04 |

-2,76 -2,76 |

-2,96 -2,96 |

236 Strong |

| NAO SANATORII TSIOLKOVSKII INN 6376012086 Samara region Dissolved due to the reorganization in the form of merger, 25/12/2018 |

175,44 175,44 |

256,59 256,59 |

0,11 0,11 |

0,06 0,06 |

-1,65 -1,65 |

-2,96 -2,96 |

600 Insufficient |

| LLC DOLST NIVA INN 6166049717 Rostov region |

87,47 87,47 |

103,49 103,49 |

-18,89 -18,89 |

-19,85 -19,85 |

-2,61 -2,61 |

-6,04 -6,04 |

295 Medium |

| ТОP-10 average value |  120,44 120,44 |

141,00 141,00 |

2,67 2,67 |

1,26 1,26 |

-1,23 -1,23 |

-1,22 -1,22 |

|

growth of indicator in comparison with prior period,

growth of indicator in comparison with prior period,  decline of indicator in comparison with prior period.

decline of indicator in comparison with prior period.

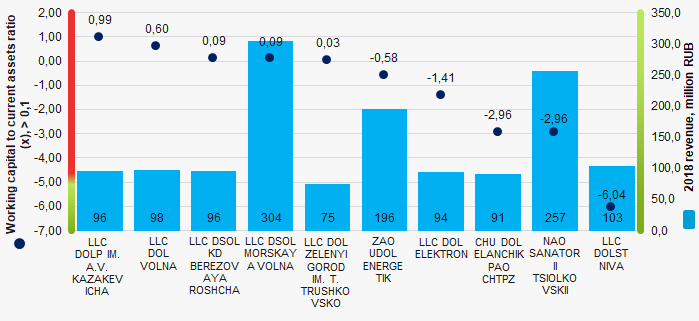

Within the last two years, the average value of the working capital to current assets ratio of the TOP-10 group was in the zone of negative values. Only two companies have indicators above the recommended value. In 2018, six companies improved the results.

Picture 1. Working capital to current assets ratio and revenue of the largest children’s recreation camps (ТОP-10)

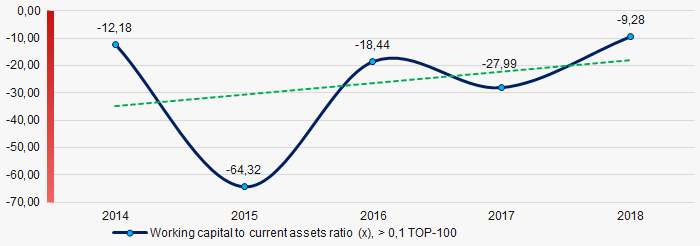

Picture 1. Working capital to current assets ratio and revenue of the largest children’s recreation camps (ТОP-10)Over a five-year period, the average industrial values of the working capital to current assets ratio of TOP-100 were in the zone of negative values with an upward trend. (Picture 2).

Picture 2. Change in the average industrial values of the working capital to current assets ratio of the largest children’s recreation camps in 2014 – 2018 (ТОP-100)

Picture 2. Change in the average industrial values of the working capital to current assets ratio of the largest children’s recreation camps in 2014 – 2018 (ТОP-100)Systemically important credit institutions

The Central Bank of the RF approved the list of systemically important credit institutions, whose share in the total assets of the country's banking sector is more than 60%.

The methodology for classifying of banks as systemically significant is determined by the Order №3737-U of the Central Bank of the RF dated 22.07.2015 and includes quantitative indicators of activity, international activity criteria, and other information about credit institutions.

Quantitative indicators include the following:

- assets;

- invested assets;

- borrowings;

- volume of deposits of individuals;

- summarizing result.

Internationally active banks include:

- parent credit institutions of banking groups, which share of assets of participants registered in the territory of a foreign state exceeds 10% of the total assets of the banking group;

- credit institutions, in which the total amount of funds raised from non-residents exceeds 100 billion rubles;

- credit organizations that are part of a banking group or holding, which parent organization is a non-resident of the RF and calculates the short-term liquidity ratio in accordance with the prudential regime (i.e. guaranteeing stability and safeguarding interests), being in force in the country where the parent organization is located.

Other information on credit institutions, in accordance with Appendix 3 to the Order №3737-U of the Central Bank of the RF, includes 10 indicators, characterizing the degree of influence of the parent organization on the activities of a banking group or holding.

The list of systemically important credit institutions is approved annually by the Chairman of the Central Bank of the RF as advised by the Banking Supervision Committee. In 2019, the list includes 11 banks:

UNICREDIT BANK NJSC , GAZPROMBANK NJSC, BANK VTB PJSC, ALFA-BANK NJSC , SBERBANK OF RUSSIA PJSC, CREDIT BANK OF MOSCOW PJSC, BANK OTKRITIE FINANCIAL CORPORATION PJSC, ROSBANK PJSC , PROMSVYAZBANK PJSC, RAIFFEISENBANK NJSC, RUSSIAN AGRICULTURAL BANK NJSC .

Subscribers of the Information and Analytical system Globas have the opportunity to get acquainted with the activity of all banking and non-bank credit organizations, as well as their branches with existing and revoked licenses. In total, Globas contains more than 6 700 banks and about 150 thousand organizations, whose activity is regulated by the Central Bank of the RF.