Equity funds in automotive manufacture

Information agency Credinform represents the ranking of the largest Russian automotive companies. The automobile manufacturers with the largest volume of annual revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available periods (for 2015 - 2017). Then they were ranked by current assets to equity ratio (Table 1). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Current assets to equity ratio (х) characterizes company’s ability to maintain the level of own working capital and to finance current assets with own sources. The ratio is calculated as the relation of own current assets of a company to total value of equity. The recommended value is in the range from 0,2 up to 0,5.

Decrease in the ratio indicates a possible slowdown in payment of receivables or tightening of conditions for granting trade credit from suppliers and contractors. The increase points to the growing opportunity to pay off current liabilities.

The experts of the Information agency Credinform, taking into account the actual situation both in the economy as a whole and in the sectors, has developed and implemented in the Information and Analytical system Globas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry. For automobile manufacturers the industry average practical value of the current assets to equity ratio made from 0,41 up to 1,00 in 2017.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all combination of indicators and financial ratios.

| Name, INN, region, type of activity | Revenue, billion RUB | Net profit (loss), billion RUB | Current assets to equity ratio (x), from 0,2 up to 0,5 | Solvency index Globas | |||

| 2016 | 2017 | 2016 | 2017 | 2016 | 2017 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| AVTOVAZ PJSC INN 6320002223 Samara region Car production |

190,0 190,0 |

233,8 233,8 |

-35,5 -35,5 |

-12,4 -12,4 |

3,02 3,02 |

2,43 2,43 |

267 Medium |

| FORD SOLLERS HOLDING LLC INN 1646021952 Republic of Tatarstan Manufacture of motor vehicles |

53,9 53,9 |

67,1 67,1 |

-23,8 -23,8 |

-13,6 -13,6 |

2,74 2,74 |

1,98 1,98 |

311 Adequate |

| ELLADA INTERTREID LLC INN 3906072056 Kaliningrad region Manufacture of motor vehicles |

83,2 83,2 |

135,7 135,7 |

3,4 3,4 |

7,8 7,8 |

-0,15 -0,15 |

0,82 0,82 |

207 Strong |

| HYUNDAI MOTOR MANUFACTURING RUS LLC INN 7801463902 St. Petersburg Manufacture of motor vehicles |

116,9 116,9 |

151,2 151,2 |

5,9 5,9 |

6,7 6,7 |

-0,04 -0,04 |

0,12 0,12 |

209 Strong |

| RENAULT RUSSIA NJSC INN 7709259743 Moscow Manufacture of motor vehicles |

94,6 94,6 |

126,2 126,2 |

-2,6 -2,6 |

3,1 3,1 |

-0,38 -0,38 |

-0,07 -0,07 |

219 Strong |

| KAMAZ PJSC INN 1650032058 Republic of Tatarstan Truck production |

120,8 120,8 |

145,2 145,2 |

1,2 1,2 |

3,0 3,0 |

-0,45 -0,45 |

-0,59 -0,59 |

192 High |

| NISSAN MANUFACTURING RUS LLC INN 7842337791 St. Petersburg Manufacture of motor vehicles |

96,7 96,7 |

105,8 105,8 |

-13,8 -13,8 |

-7,6 -7,6 |

-0,43 -0,43 |

-1,14 -1,14 |

284 Medium |

| VOLKSWAGEN GROUP RUS LLC INN 5042059767 Kaluga region Manufacture of motor vehicles |

191,1 191,1 |

237,6 237,6 |

-5,6 -5,6 |

5,3 5,3 |

-2,40 -2,40 |

-1,36 -1,36 |

237 Medium |

| LADA IZHEVSKII AVTOMOBILNYI ZAVOD LLC INN 1834051678 Udmurtian Republic Manufacture of motor vehicles |

45,2 45,2 |

52,3 52,3 |

0,0 0,0 |

-0,9 -0,9 |

-3,71 -3,71 |

-5,83 -5,83 |

324 Adequate |

| AVTOMOBILNYI ZAVOD GAZ LLC INN 5250018433 Nizhny Novgorod region Manufacture of internal combustion engines of motor vehicles |

75,2 75,2 |

85,2 85,2 |

0,5 0,5 |

0,1 0,1 |

-4,44 -4,44 |

-14,14 -14,14 |

219 Medium |

| Total by TOP-10 companies |  1067,5 1067,5 |

1340,2 1340,2 |

-70,2 -70,2 |

-8,4 -8,4 |

|||

| Avearge value by TOP-10 companies |  106,7 106,7 |

134,0 134,0 |

-7,0 -7,0 |

-0,8 -0,8 |

-0,63 -0,63 |

-1,78 -1,78 |

|

| Industry average value |  0,8 0,8 |

1,0 1,0 |

-0,02 -0,02 |

-0,04 -0,04 |

-1,62 -1,62 |

-3,18 -3,18 |

|

— improvement of the indicator to the previous period,

— improvement of the indicator to the previous period,  — decline in the indicator to the previous period.

— decline in the indicator to the previous period.

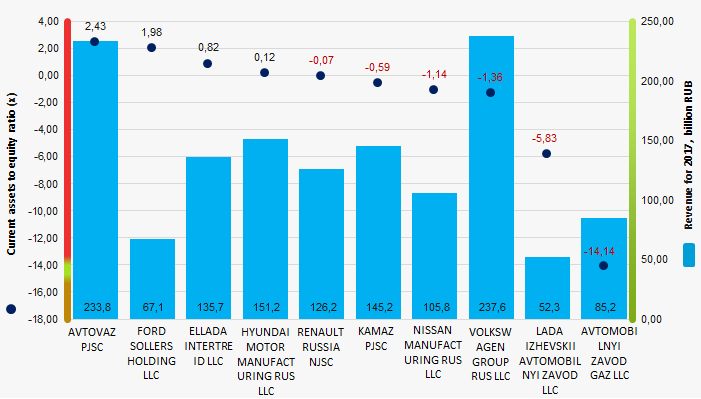

The average value of the current assets to equity ratio of TOP-10 enterprises is above industry average, but below recommended and practical values. Four companies from the TOP-10 list improved the indicators in 2017 compared to the previous period.

Picture 1. Current assets to equity ratio and revenue of the largest Russian automotive companies (TOP-10)

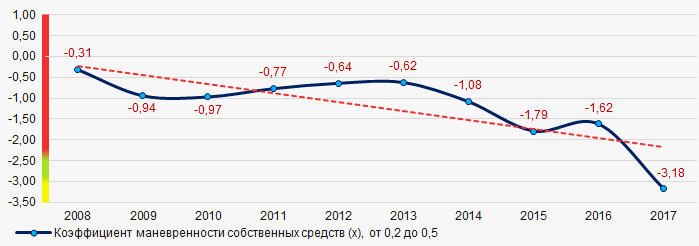

Picture 1. Current assets to equity ratio and revenue of the largest Russian automotive companies (TOP-10)The industry average indicators of the current assets to equity ratio have a downward trend over the course of 10 years (Picture 2).

Picture 2. Change in the industry average values of the current assets to equity ratio of Russian automotive companies in 2008 – 2017

Picture 2. Change in the industry average values of the current assets to equity ratio of Russian automotive companies in 2008 – 2017Fiscal offences

62 articles on economic offences are covered under chapter 22 of the Tax Code of Russia. The following four of them are focused on fiscal offences:

Article 198. Evasion of taxes, fees payable by natural person, and (or) insurance premium payments due from individual payer;

Article 199. Evasion of taxes, fees payable by the company, and (or) insurance premium payments due from public payer;

Article 199.1. Breach of tax agent duties;

Article 199.2. Concealment of funds or assets of the company or individual entrepreneur, which should be used to collect tax in default, fees, insurance premium payments.

According to the Judicial Department at the Supreme Court of the Russian Federation , 273 sentences under these articles were given for 6 month of 2018.

It is worth reminding the content of the articles and punishments for offences:

| Article | Description | Sanctions | ||

| fine, thousand RUB. | forced labor | imprisonment | ||

| Part 1 Art. 198 | Evasion of taxes, fees, insurance premium payments due from natural person on a large scale, i.e. at the amount exceeding 900 thousand rubles for the period of up to 3 consecutive financial years, provided that the share of unpaid amounts exceeds 10% of total payable amount, or at the amount exceeds 2 million rubles. | 100 - 300 | up to 1 year | up to 1 year |

| Part 2 Art. 198 | Evasion of taxes, fees, insurance premium payments due from natural person on a grand scale, i.e. at the amount exceeding 4,5 million rubles for the period of up to 3 consecutive financial years, provided that the share of unpaid amounts exceeds 20% of total payable amount, or at the amount exceeds 13,5 million rubles. | 200 - 500 | up to 3 years | up to 3 years |

| Part 1 Art. 199 | Evasion of taxes, fees, insurance premium payments due from company by failure to submit tax return (calculation) or other documents being mandatory to submit, or by inclusion of false information in the tax return (calculation) or such documents on a large scale, i.e. at the amount exceeding 5 million rubles for the period of up to 3 consecutive financial years, provided that the share of unpaid amounts exceeds 25% of total payable amount, or at the amount exceeds 15 million rubles. | 100 - 300 | up to 2 years | up to 2 years |

| Part 2 Art. 199 | Evasion of taxes, fees, insurance premium payments due from company by failure to submit tax return (calculation) or other documents being mandatory to submit, or by inclusion of false information in the tax return (calculation) or such documents, committed by a group of persons on the basis of prior agreement or on a grand scale, i.e. at the amount exceeding 15 million rubles for the period of up to 3 consecutive financial years, provided that the share of unpaid amounts exceeds 50% of total payable amount, or at the amount exceeds 45 million rubles. | 200 - 500 | up to 5 years | up to 6 years |

| Part 1 Art. 199.1 | Self-interest breach of tax agent duties for the calculation, withholding or transfer of taxes and fees to be calculated, as well as withheld from the taxpayer and transfer to the appropriate budget, committed on a large scale, i.e. at the amount exceeding 5 million rubles for the period of up to 3 consecutive financial years, provided that the share of uncalculated, not withheld or not transferred taxes and fees exceeds 25% of total payable amount, or at the amount exceeds 15 million rubles. | 100 - 300 | up to 2 years or detention for up to 6 months | up to 2 years |

| Part 2 Art. 199.1 | Self-interest breach of tax agent duties for the calculation, withholding or transfer of taxes and fees to be calculated, as well as withheld from the taxpayer and transfer to the appropriate budget, committed on a grand scale, i.e. at the amount exceeding 15 million rubles for the period of up to 3 consecutive financial years, provided that the share of uncalculated, not withheld or not transferred taxes and fees exceeds 50% of total payable amount, or at the amount exceeds 45 million rubles. | 200 - 500 | up to 5 years | up to 6 years |

| Part 1 Art. 199.2 | Large-scale concealment of funds or assets of the company or individual entrepreneur, which should be used to collect tax in default, fees, insurance premium payments | 200 - 500 | up to 3 years | up to 3 years |

| Part 2 Art. 199.2 | Grand-scale concealment of funds or assets of the company or individual entrepreneur, which should be used to collect tax in default, fees, insurance premium payments | 200 - 500 | up to 5 years | up to 7 years |

If those committed crimes under these articles for the first time, they will be exempted from criminal liability in case of payment of arrears and corresponding penalties in full, as well as fine at the amount determined by the Tax Code of the Russian Federation.