Activity trends of Samara companies

Information Agency Credinform presents a review of activity trends of the largest real economy companies of the Samara region. The companies from the Samara region with the highest volume of annual revenue (TOP-10 and TOP-1000) have been selected for the analysis, according to the data from the Statistical Register for the latest available accounting periods (2012 — 2017). The analysis was based on the data from the Information and Analytical system Globas.

Net assets indicate fair value of corporate assets that is calculated annually as assets on balance less company’s liabilities. Net assets value is negative (insufficiency of property) if liabilities are larger than the property value.

| № | Name, INN, type of activity |

Net assets value, billion RUB |

Solvency index Globas | ||||

| 2013 | 2014 | 2015 | 2016 | 2017 | |||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 1 | PJSC Russian innovation fuel and energy company INN 7736036626 Crude petroleum extraction In process of reorganization in the form of transformation, since 30.07.2018 |

109.65 109.65 |

143.09 143.09 |

181.40 181.40 |

213.10 213.10 |

245.17 245.17 |

183 High |

| 2 | NJSC TRANSNEFT-PRIVOLGA INN 6317024749 Oil and oil products transportation via pipelines |

99.39 99.39 |

101.28 101.28 |

129.86 129.86 |

156.20 156.20 |

168.32 168.32 |

211 Strong |

| 3 | LLC LEVIT INN 6330030244 Investment in securities |

78.32 78.32 |

85.50 85.50 |

109.86 109.86 |

145.30 145.30 |

125.38 125.38 |

245 Strong |

| 4 | PJSC TOGLIATTIAZOT INN 6320004728 Manufacture of fertilizers and nitrogen compounds |

34.07 34.07 |

47.61 47.61 |

68.95 68.95 |

67.30 67.30 |

68.18 68.18 |

199 High |

| 5 | NJSC SAMARANEFTEGAS INN 6315229162 Extraction of crude petroleum |

88.91 88.91 |

129.59 129.59 |

91.53 91.53 |

62.83 62.83 |

98.06 98.06 |

184 High |

| 996 | NJSC Enterprise of Heating Networks (PTS) INN 6315530348 Distribution of steam and hot water (thermal energy) |

-0.20 -0.20 |

-0.22 -0.22 |

-0.07 -0.07 |

-1.45 -1.45 |

-2.65 -2.65 |

267 Medium |

| 997 | LLC World of Soft Toys INN 6321135890 Wholesale of games and toys Process of being wound up, since 24.01.2017 |

0.04 0.04 |

0.05 0.05 |

-1.14 -1.14 |

-2.65 -2.65 |

-2.59 -2.59 |

600 Insufficient |

| 998 | PJSC VOLGABURMASH INN 6314007329 Manufacture of machinery for mining and construction Process of being wound up, since 20.07.2016 |

0.60 0.60 |

-2.47 -2.47 |

-1.78 -1.78 |

-3.89 -3.89 |

-4.56 -4.56 |

600 Insufficient |

| 999 | PJSC VOLZHSKI OIL SHIPPING COMPANY VOLGOTANKER INN 6317019185 Sea freight water transport Process of being wound up, since 17.03.2008 |

-3.67 -3.67 |

-3.66 -3.66 |

-4.29 -4.29 |

-7.80 -7.80 |

-7.82 -7.82 |

600 Insufficient |

| 1000 | PJSC AVTOVAZ INN 6320002223 Manufacture of motor cars |

26.01 26.01 |

0.59 0.59 |

-43.12 -43.12 |

-51.37 -51.37 |

-64.24 -64.24 |

305 Adequate |

— growth compared to prior period,

— growth compared to prior period,  — decline compared to prior period.

— decline compared to prior period.

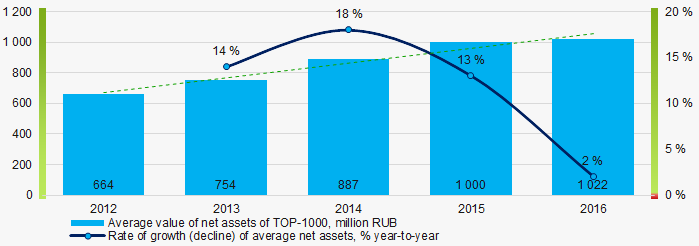

Average values of net assets of TOP-1000 companies tend to increase during the last 5 years. However, growth rate itself declines (Picture 1).

Picture 1. Change in average net assets value of TOP-1000 companies in 2012 — 2016

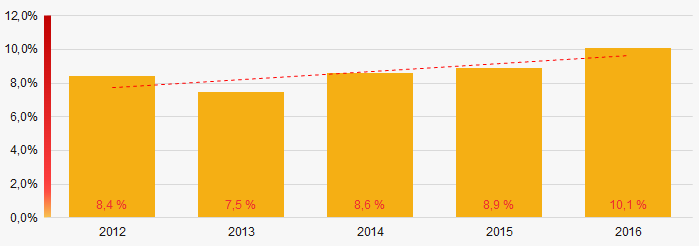

Picture 1. Change in average net assets value of TOP-1000 companies in 2012 — 2016The share of TOP-1000 companies with insufficiency of property tends to increase within the last 5 years (Picture 2).

Picture 2. Share of TOP-1000 companies with negative value of net assets

Picture 2. Share of TOP-1000 companies with negative value of net assets Sales revenue

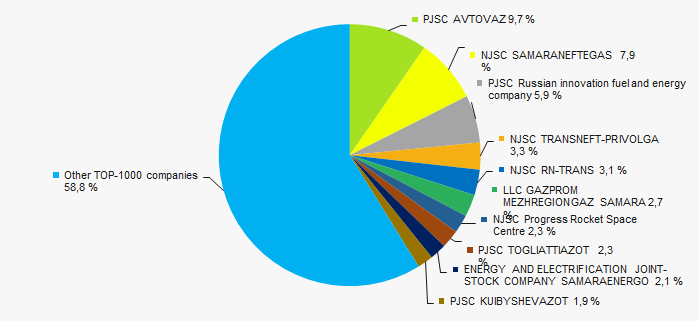

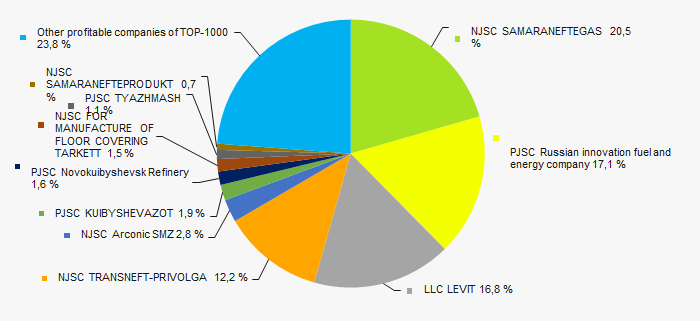

In 2016 sales revenue of 10 regional industry leaders amounted to 41% of total revenue of TOP-1000 companies (Picture 3). This is an indicator of concentration of large companies in the Samara region.

Picture 3. TOP-10 companies by their share in 2016 total revenue of TOP-1000 companies

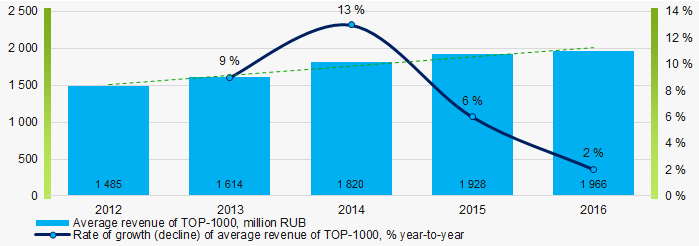

Picture 3. TOP-10 companies by their share in 2016 total revenue of TOP-1000 companiesIn general, revenue tends to increase, and growth rate decreases (Picture 4).

Picture 4. Change in average revenue of TOP-1000 companies in 2012 — 2016

Picture 4. Change in average revenue of TOP-1000 companies in 2012 — 2016Profit and loss

In 2016 profit of 10 regional industry leaders amounted to 76% of total profit of TOP-1000 companies (Picture 5).

Picture 5. TOP-10 companies by their share in 2016 total profit of TOP-1000 companies

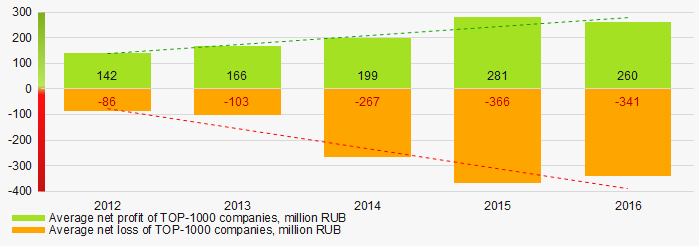

Picture 5. TOP-10 companies by their share in 2016 total profit of TOP-1000 companiesAverage net profit values of TOP-1000 companies within the last 5 years tend to increase, as well as average loss value (Picture 6).

Picture 6. Change in average net profit and loss of TOP-1000 companies in 2012 — 2016

Picture 6. Change in average net profit and loss of TOP-1000 companies in 2012 — 2016Key financial ratios

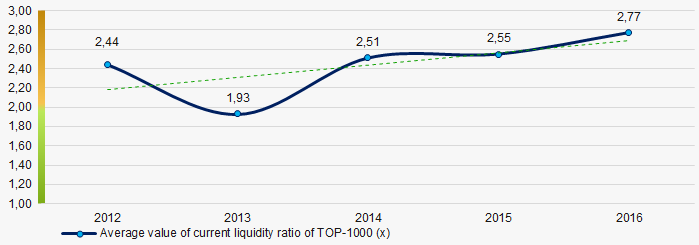

During the last 5 years average values of total liquidity ratio of TOP-1000 were above the recommended value — from 1,0 to 2,0, tending to grow (Picture 7).

Total liquidity ratio (a ratio of current assets to current liabilities) reveals the sufficiency of a company’s funds for meeting its short-term liabilities.

Picture 7. Change in average values of total liquidity ratio of TOP-1000 companies in 2012 — 2016

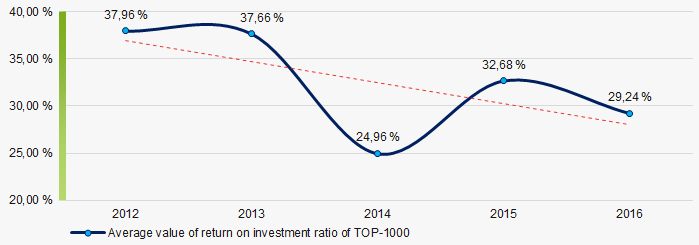

Picture 7. Change in average values of total liquidity ratio of TOP-1000 companies in 2012 — 2016During the last 5 years average values of return on investment ratio tended to decrease (Picture 8).

It is a ratio of net profit to total equity and noncurrent liabilities, and it demonstrates benefit from equity engaged in business activity and long-term raised funds of the company.

Picture 8. Change in average values of return on investment ratio of TOP-1000 companies in 2012 — 2016

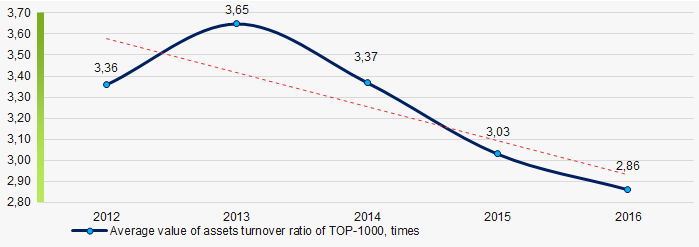

Picture 8. Change in average values of return on investment ratio of TOP-1000 companies in 2012 — 2016Assets turnover ratio is a ratio of sales revenue to average total assets for the period, and it measures resource efficiency regardless of the sources. The ratio indicates the number of profit-bearing complete production and distribution cycles per annum.

During the last 5 years, this activity ratio tended to decrease (Picture 9).

Picture 9. Change in average values of assets turnover ratio of TOP-1000 companies in 2012 — 2016

Picture 9. Change in average values of assets turnover ratio of TOP-1000 companies in 2012 — 2016Activities structure

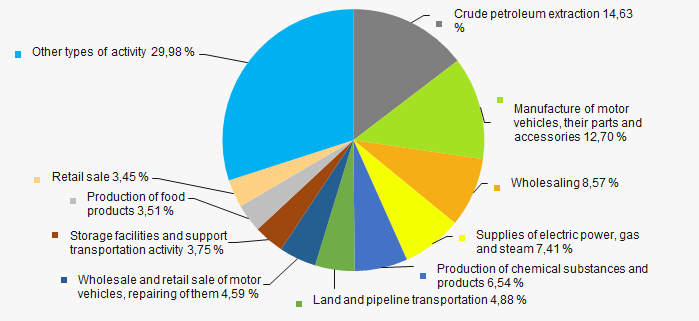

Crude petroleum extraction companies and manufacturers of motor vehicles have the largest share in total revenue of TOP-1000 companies (Picture 10).

Picture 10. Types of activity by their share in total revenue of TOP-1000 companies

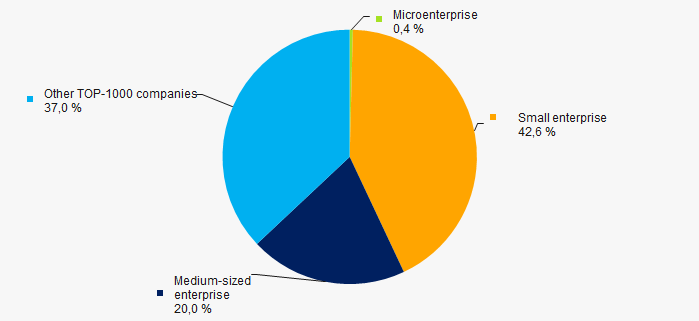

Picture 10. Types of activity by their share in total revenue of TOP-1000 companies63% companies of TOP-1000 are included in the register of small and medium-sized businesses of the Federal Tax Service of the Russian Federation (Picture 11).

Picture 11. Shares of small and medium-sized enterprises in TOP-1000 companies

Picture 11. Shares of small and medium-sized enterprises in TOP-1000 companiesFinancial position score

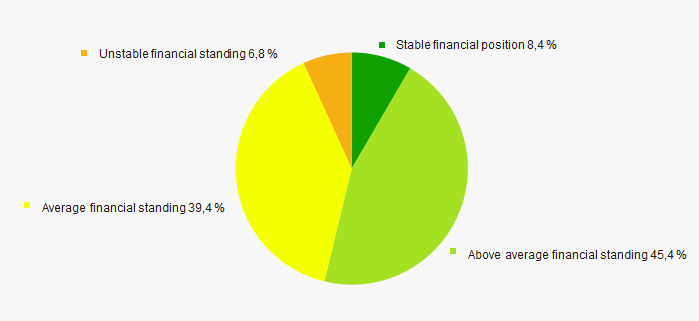

Assessment of financial state of TOP-1000 companies indicates that most of the companies have a stable and above average financial standing (Picture 12).

Picture 12. TOP-1000 companies by their financial position score

Picture 12. TOP-1000 companies by their financial position scoreSolvency index Globas

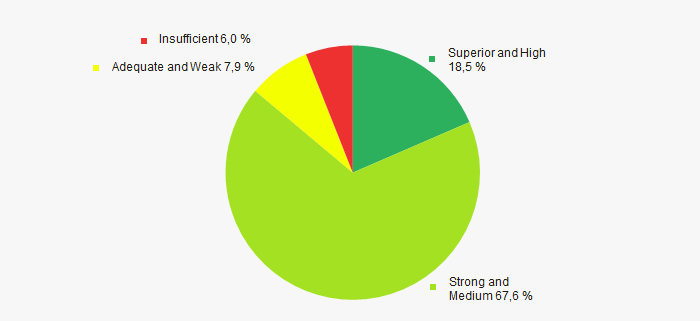

The majority of TOP-1000 companies have got a superior, high, strong and medium Solvency index Globas, that indicates their capability to meet liabilities timely and in full (Picture 13).

Picture 13. TOP-1000 companies by Solvency index Globas

Picture 13. TOP-1000 companies by Solvency index Globas Conclusion

A comprehensive assessment of the largest real economy companies of the Samara region, that considers key indexes, financial figures and ratios, is indicative of predominance of positive trends within the sector, such as growing of net assets, sales revenue and net profit. However, decrease in average net assets' growth rate, increasing share of companies with insufficiency of funds, growing of net loss, decrease in return on investment and assets turnover ratios are the alarming factors.

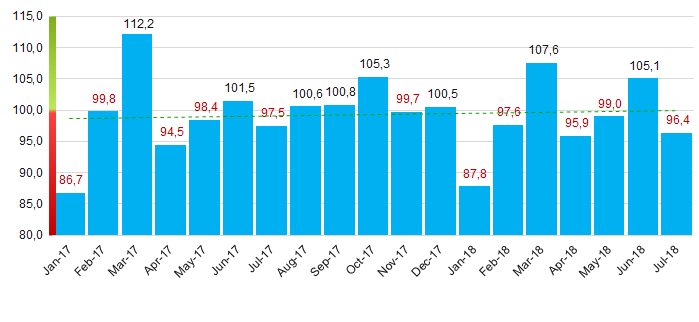

According to the Federal State Statistics Service, in 2017 - 2018 the trend of some increase in indexes of industrial production is observed (Picture 14).

Picture 14. Index of industrial production in the Samara region, month-to-month (%)

Picture 14. Index of industrial production in the Samara region, month-to-month (%) According to the same data, the share of the Samara region in all-Russian revenue from sales of goods, products and services amounted to 1.5% for 6 months of 2018.

The largest foreign companies owned by Russian business

The experience of investing of domestic companies in foreign enterprises is small, Russian investors are second to global transnational corporations in investment volume. However, since the 90s (the period of the formation of Russian business), many enterprises had both feet firmly on the ground and started opening offices abroad or buying foreign business by acquiring a share in capital.

Leaders in terms of the amount of investment in foreign assets are mainly companies of the fuel and energy sector. They own about 80% of Russian assets abroad.

The main direction of the expansion of Russian capital is Western Europe, whose economic ties with us are traditionally in the first place, regardless of the events on exchanges and in the political arena.

The rest of world's regions are not yet of a significant interest for domestic business.

Russia's investment activity, much less the growing expansion of China, as well as of some rich oil-producing Arab countries, is not welcomed by all. The signs of protectionism are increasingly coming out in Europe and the USA.

The companies, belonging to Russians, are not yet sufficiently large by world standards: the most significant of them, WINGAS (Germany), has revenue of 18 bln USD for 2017. For comparison, the revenue of the world's largest company in terms of turnover, Walmart (USA), is 500 bln USD for the same period.

Table 1 shows the largest foreign companies (TOP-10), whose the major part of capital (more than 50%) belongs to Russian business. From the rating are excluded: countries-offshores, as well as states and territories - low-tax jurisdictions.

| № | Company | Country | Revenue, bln USD, for 2017 | Industry | Parent company or ultimate owner |

| 1 | WINGAS | Germany | 18.0 | Fuel and energy sector | GAZPROM PJSC |

| 2 | Isab | Italy | 3.6 (2016 г.) |

Fuel and energy sector | LUKOIL PJSC |

| 3 | Lukoil Neftohim Burgas | Bulgaria | 3.4 | Fuel and energy sector | LUKOIL PJSC |

| 4 | Beltransgaz | Belarus | 3.0 (2015 г.) |

Fuel and energy sector | GAZPROM PJSC |

| 5 | Gefco France | France | 2.8 | Transport, logistics | RUSSIAN RAILWAYS PJSC |

| 6 | Gazprom Marketing & Trading Limited | Great Britain | 2.8 (2016 г.) |

Trade | GAZPROM PJSC |

| 7 | Universal Cargo Logistics Holding | Netherlands | 2.5 | Transport, logistics | Lisin Vladimir Sergeevich |

| 8 | Uralkali Trading | Latvia | 2.5 | Trade | URALKALI PJSC |

| 9 | Naftna Industrija Srbije (NIS) | Serbia | 2.4 | Fuel and energy sector | GAZPROM NEFT PJSC |

| 10 | Oy Teboil Ab | Finland | 2.3 | Fuel and energy sector | LUKOIL PJSC |

- WINGAS GmbH - wholesale and storage of natural gas; supply of hydrocarbons to customers in Germany (more than 20% of the market), as well as in Austria, Belgium, Great Britain, the Netherlands, the Czech Republic and other countries

- Isab - is the third refinery in Europe in terms of throughput.

- Lukoil Neftohim Burgas - is the largest oil refinery in the Balkan Peninsula, the main supplier of fuel to the domestic market of the Republic of Bulgaria.

- Beltransgaz - gas supply to consumers of the Republic of Belarus; transit supplies of Russian natural gas to Kaliningrad region, as well as Lithuania, Ukraine, Poland.

- Gefco France - transportation of components and finished vehicles.

- Gazprom Marketing & Trading Limited – trade operations with energy commodities, including gas, electricity, oil and oil products, carbon credits, LNG and currency in the markets of Europe and the world

- Universal Cargo Logistics Holding - cargo transportations by rail and water transport, their transshipment in Russian ports; services in logistics and shipbuilding.

- Uralkali Trading - supplies of high-quality potassium chloride to consumers around the world, marketing functions and customer support in Europe and CIS countries.

- Naftna Industrija Srbije (NIS) - oil and gas extraction and processing, sale of oil products, as well as implementation of projects in the field of energy and petro-chemistry.

- Oy Teboil Ab – is the main manufacturer and supplier of lubricants in Finland.