Absolute liquidity ratio of the largest Russian manufacturers and suppliers of equipment for the food industry

Information agency Credinform represents the ranking of the largest Russian manufacturers and suppliers of equipment for the food industry. The enterprises with the largest volume of annual revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available periods (for 2014-2016). Then they were ranked by the absolute liquidity ratio (Table 1). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Absolute liquidity ratio (х) is calculated as the ratio of the amount of cash, being at the disposal of a company, to short-term liabilities. It determines the share of short-term liabilities, which an enterprise can pay off in the near future. The recommended value is from 0,1 up to 0,15. The higher is the indicator, the better is the solvency of an enterprise.

However, a too high value of the ratio may indicate an irrational capital structure and unused assets in the form of cash and funds on accounts that, over time and as a result of inflation, depreciate and lose their initial liquidity.

The experts of the Information agency Credinform, taking into account the actual situation both in the economy as a whole and in the sectors, has developed and implemented in the Information and Analytical system Globas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry.

For manufacturers and suppliers of equipment for the food industry the industry average practical values of the absolute liquidity ratio made in 2016 from 0,01 up to 0,34 and 0,37, respectively.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all combination of indicators and financial ratios.

| Name, INN, region, type of activity | Revenue, mln RUB | Net profit, mln RUB | Absolute liquidity ratio (x) | Solvency index Globas | |||

| 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | ||

| MELINVEST NJSC INN 5257003490 Nizhny Novgorod region Manufacture of machinery and equipment for production of food, beverages and tobacco products |

1 401 1 401 |

1 392 1 392 |

169 169 |

137 137 |

1,24 1,24 |

2,24 2,24 |

180 High |

| MASHINOSTROITELNAYA KOMPANIYA TEKHNEKS LLC INN 6678049565 Sverdlovsk region Manufacture of machinery and equipment for production of food, beverages and tobacco products |

1 156 1 156 |

1 787 1 787 |

68 68 |

156 156 |

0,78 0,78 |

0,66 0,66 |

169 Superior |

| KHS RUS LLC INN 7706502693 Moscow Wholesale of machinery and equipment for production of food, beverages and tobacco products |

1 114 1 114 |

1 230 1 230 |

95 95 |

91 91 |

0,28 0,28 |

0,44 0,44 |

211 Strong |

| ZAVOD BRANDFORD LLC INN 4401143067 Kostroma region Manufacture of machinery and equipment for production of food, beverages and tobacco products |

2 375 2 375 |

3 931 3 931 |

348 348 |

372 372 |

0,05 0,05 |

0,42 0,42 |

198 High |

| ALFA LAVAL POTOK NJSC INN 5018035564 Moscow region Manufacture of machinery and equipment for production of food, beverages and tobacco products |

6 064 6 064 |

4 232 4 232 |

174 174 |

55 55 |

0,20 0,20 |

0,21 0,21 |

245 Strong |

| AIRCOOL CO LLC INN 7825124257 St. Petersburg Wholesale of machinery and equipment for production of food, beverages and tobacco products |

1 498 1 498 |

1 293 1 293 |

75 75 |

50 50 |

0,22 0,22 |

0,18 0,18 |

230 Strong |

| TEKNOPAK LLC INN 7701372708 Moscow Wholesale of machinery and equipment for production of food, beverages and tobacco products |

50 50 |

1 338 1 338 |

2 2 |

13 13 |

0,48 0,48 |

0,08 0,08 |

258 Medium |

| ANTES LLC INN 5018023992 Moscow region Wholesale of machinery and equipment for production of food, beverages and tobacco products |

1 349 1 349 |

1 318 1 318 |

70 70 |

135 135 |

0,29 0,29 |

0,07 0,07 |

191 High |

| BRANDFORD LLC INN 4401045285 Kostroma region Manufacture of machinery and equipment for production of food, beverages and tobacco products |

1 389 1 389 |

2 054 2 054 |

2 2 |

118 118 |

0,00 0,00 |

0,05 0,05 |

229 Strong |

| NKH-LOGISTIK LLC INN 5257154509 Nizhny Novgorod region Wholesale of machinery and equipment for production of food, beverages and tobacco products |

48 48 |

1 247 1 247 |

2 2 |

31 31 |

0,00 | 0,00 | 260 Medium |

| Total by TOP-10 companies |  16 444 16 444 |

19 821 19 821 |

1 005 1 005 |

1 159 1 159 |

|||

| Average value by TOP-10 companies |  1 644 1 644 |

1 982 1 982 |

100 100 |

116 116 |

0,36 0,36 |

0,44 0,44 |

|

| Industry average value in the manufacture of machinery and equipment for production of food |  67 67 |

68 68 |

3 3 |

3 3 |

0,14 0,14 |

0,13 0,13 |

|

| Industry average value in the wholesale of machinery and equipment for production of food |  48 48 |

51 51 |

1 1 |

3 3 |

0,13 0,13 |

0,12 0,12 |

|

— growth of the indicator to the previous period,

— growth of the indicator to the previous period,  — decline of the indicator to the previous period.

— decline of the indicator to the previous period.

The average value of the absolute liquidity ratio of TOP-10 companies in 2016 is higher than the recommended and practical intervals and above the industry average indicators.

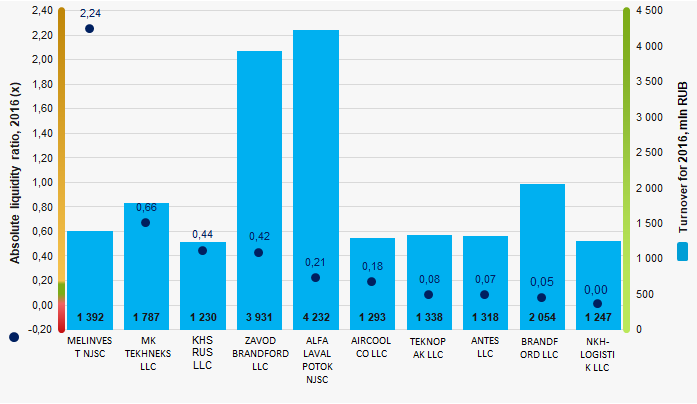

Picture 1. Absolute liquidity ratio and revenue of the largest Russian manufacturers and suppliers of equipment for the food industry (TOP-10)

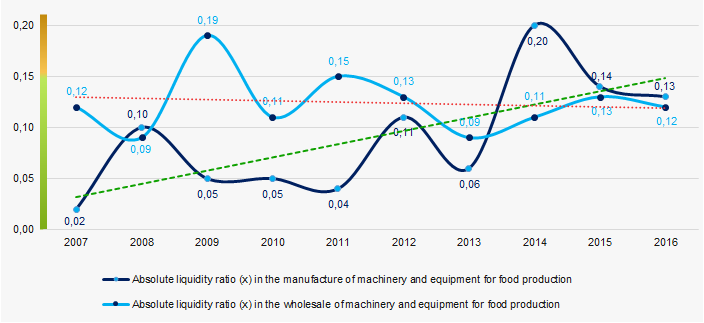

Picture 1. Absolute liquidity ratio and revenue of the largest Russian manufacturers and suppliers of equipment for the food industry (TOP-10)Over the course of 10 years, the industry average indicators of the absolute liquidity ratio in the manufacture of machinery and equipment for food production tend to increase, and in the wholesale of machinery and equipment for food production — to decrease (Picture 2).

Picture 2. Change in the industry average values of the absolute liquidity ratio of the largest Russian manufacturers and suppliers of equipment for the food industry in 2007 — 2016

Picture 2. Change in the industry average values of the absolute liquidity ratio of the largest Russian manufacturers and suppliers of equipment for the food industry in 2007 — 2016The definition of «foreign investor» is specified

The definition of «foreign investor» is specified by the Federal Law of 31.05.2018 № 122-FL.

In particular, it is determined that legal entities, registered in offshore zones, according to the «List of states and territories, representing preferential tax regime and (or) not requiring disclosure and provision of information while carrying out financial transactions (offshore zones)», approved by the Order of the Ministry of Finance of the RF of 13.11.2007 № 108n (edited from 02.11.2017) and not disclosing data about their beneficiaries and controlling parties according to the procedure established by the Government of Russia cannot buy state and municipal property.

Earlier privatization of state property was forbidden for any legal entities registered in offshore zones.

Consequently, amendments made to the Federal Law «On procedure of foreign investments to business entities, having strategic importance for national defense and security», provide foreign investors with an opportunity to establish control over the enterprises having strategic importance, granted provision of data about beneficiaries and controlling parties to the authorized federal authority of executive power, performing control over foreign investments to Russia.

Besides, foreign companies, controlled by legal entities or citizens of Russia, are no longer determined as «foreign investor».

The definitions of «controlling party», «foreign investment» are also specified by the Federal Law.

According to the experts, such changes in the legal status of foreign investors should contribute to return to the national economy of funds of citizens of Russia, locating abroad, and increase visibility of incoming foreign investments.

For information:

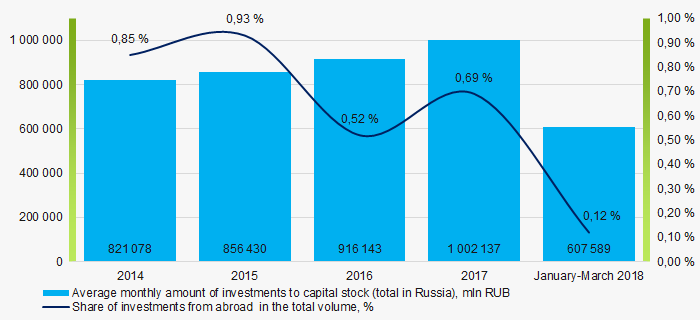

Puctire 1. Average monthly amount of investments to capital stock and share of investments from abroad in the total volume in Russia in 2014 — 2018 (according to the data from the Federal State Statistics Service on 05.06.2018)

Puctire 1. Average monthly amount of investments to capital stock and share of investments from abroad in the total volume in Russia in 2014 — 2018 (according to the data from the Federal State Statistics Service on 05.06.2018)