Changes in legislation

Decree of the Government of the Russian Federation of November 30, 2020 No. 1969 amended the procedure for conducting annual scheduled inspections of legal entities and sole entrepreneurs in 2021.

In particular:

- remote inspections using audio or video communication are allowed;

- starting from July 1, 2021, inspection visits may replace the scheduled on-site inspections included in the annual plan for 2021. The decision on this must be made no later than 20 working days before the date of the start of the audit;

- the period for scheduled inspections starting after June 30, 2021 cannot exceed 10 working days, taking into account the specifics of calculating the deadlines established by legislation;

- scheduled inspections of small businesses, information about which is contained in the Unified Register, is not included in the annual inspection plan. The exceptions are inspections of persons with a high level of risk, inspections aimed at license control, etc.

It should be recalled that the Article 70 of the Federal Law of July 31, 2020 No. 248-FL "On state control (supervision) and municipal control in the Russian Federation" determines an inspection visit as a control or supervisory measure carried out by interacting with specific controlled persons, owners or users at the location of production facilities, including branches, representative offices, and separate structural units.

The inspection visit involves examinations, interviews, instrumental examinations, obtaining written explanations, and requesting documents.

It is carried out within one working day without prior notification of controlled persons and owners, who are obliged to ensure unhindered access of controllers to buildings, structures and premises.

The subscribers of the Information and Analytical system Globas have access to complete information about all scheduled and unscheduled inspections of a particular organization containing in the section "Inspections' plan of supervisory authorities" of the company’s report.

The largest companies in Russia

Information agency Credinform continues a series of publications about the largest companies in Russia. This time the experts of the Agency have analyzed the net profit and identified where the most profitable companies work.

The first ranking consisted a review on Top-30 of the largest companies in Russia by revenues for 2019.

| No. | Name | Net profit for 2019, billion RUB | Change to 2018 | Business activity |

| 1 | GAZPROM |

651,1 | -30,2% | Oil and gas |

| 2 | MMC NORILSK NICKEL |

514,7 | +212,0% | Metallurgy |

| 3 | LUKOIL |

405,8 | +84,9% | Oil and gas |

| 4 | OIL COMPANY ROSNEFT |

396,5 | -13,9% | Oil and gas |

| 5 | YAMAL LNG |

251,6 | - | Oil and gas |

| 6 | NOVATEK |

237,2 | +49,0% | Oil and gas |

| 7 | GAZPROM NEFT |

216,9 | +140,5% | Oil and gas |

| 8 | TATNEFT |

156,0 | -21,0% | Oil and gas |

| 9 | ROSSETI |

135,2 | - | Electric power |

| 10 | LUKOIL-WEST SIBERIA |

113,7 | +0,1% | Oil and gas |

| 11 | SIBUR HOLDING |

111,9 | +3,2% | Chemical industry |

| 12 | EVRAZ NTMP |

110,8 | +2,9% | Metallurgy |

| 13 | POLYUS |

106,2 | +213,0% | Gold mining |

| 14 | SEVERSTAL |

105,7 | -14,9% | Metallurgy |

| 15 | SURGETNEFTEGAZ |

105,5 | -87,3% | Oil and gas |

| 16 | GAZPROMNEFT-YAMAL |

102,8 | +15,0% | Oil and gas |

| 17 | ROSENERGOATOM |

101,1 | +155,0% | Electric power |

| 18 | LUKOIL-NIZHNEVOLZHSKNEFT |

97,6 | -5,3% | Oil and gas |

| 19 | KURGANMASHZAVOD |

90,4 | +46780,7% | Defense industry |

| 20 | ARCTIC GAS COMPANY |

85,2 | -3,0% | Oil and gas |

| 21 | NOVOLIPETSK STEEL MILL |

83,4 | -29,2% | Metallurgy |

| 22 | URALKALI |

78,9 | - | Chemical industry |

| 23 | TRANSNEFT |

76,4 | +655,3% | Oil and gas |

| 24 | LUKOIL-PERM |

73,5 | -8,0% | Oil and gas |

| 25 | ORENBURGNEFT |

72,2 | +22,0% | Oil and gas |

| 26 | SAMOTLORNEFTEGAZ |

70,0 | -8,9% | Oil and gas |

| 27 | Taas-Yuryakh Neftegazodobycha |

67,1 | +27,0% | Oil and gas |

| 28 | METALLOINVEST |

66,3 | +45,6 | Metallurgy |

| 29 | MTS |

64,6 | +605,4% | Telecommunication |

| 30 | IRKUTSKAYA NEFTYANAYA KOMPANIYA |

64,0 | -29,0% | Oil and gas |

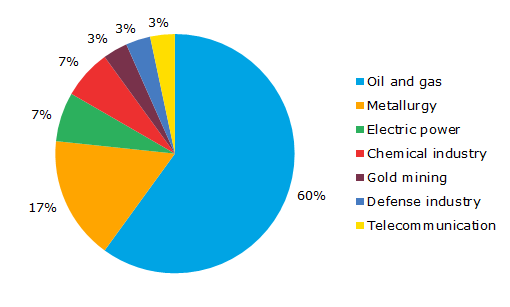

The enterprises of the fuel and energy complex have the leading positions among the Top-30 companies as in the first ranking. Their share amounts to 60%. Picture 1 represents distribution of shares among 30 leading companies in Russia by the net profit.

Picture 1. Distribution of companies by the industry

Picture 1. Distribution of companies by the industryFollowing the results of the ranking, the oil and gas companies still have the leading positions not only by revenues, but also by net profit.

*The introduction of KURGANMASHZAVOD among Top-30 leading companies is worth making specific mention. Growth of the net profit for 2019 amounted to +46780%. Such a result was achieved due to an increase of other incomes, which were generally generated after recovery of estimated liabilities.

MTS is as well listed among Top companies. Growth of the net profit for 2019 amounted to +605%, due to removal of provision for payment of fine resulting from investigation concerning the activity in Uzbekistan.

KURGANMASHZAVOD manufactures fighting vehicles and MTS renders mobile communication, internet and broadcasting services.