Corporate bankruptcy: meeting the challenges of time

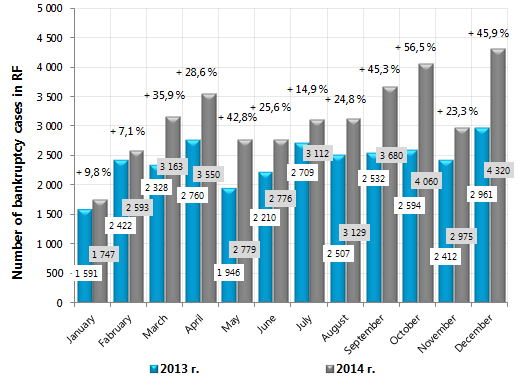

Last year there has been a tendency of increasing in number of new arbitration cases on corporate bankruptcy. In 2014 the proceedings for 37 884 cases were initiated in the courts of the sub-federal units; that is 30,8% (28 972 new cases) higher than in 2013. Learning the annual dynamic by months, the most intensive increase was in October and December 2014. The number of new cases has respectively increased by 56,5% and 45,9% (to October, December 2013).

The second half of 2014 was rather difficult for the Russian economy: Western countries’ sanctions and counter-sanctions, falling of prices on energy resources have resulted in devaluation of the national currency, acceleration of inflation and increase of the key rate of the Central Bank to 17% that has called the lending prospects into question for many Russian companies inland.

All these have adversely affected the national business environment. Significant increase in number of new bankruptcy cases will occur in 2015 with high probability. Programs for import substitution and entrepreneurship development under the conditions of expensive credit resources will unfortunately not be carried out without the state support.

Figure 1. Monthly dynamic of new cases on corporate bankruptcy in Russia for 2013-2014, increase rate, %

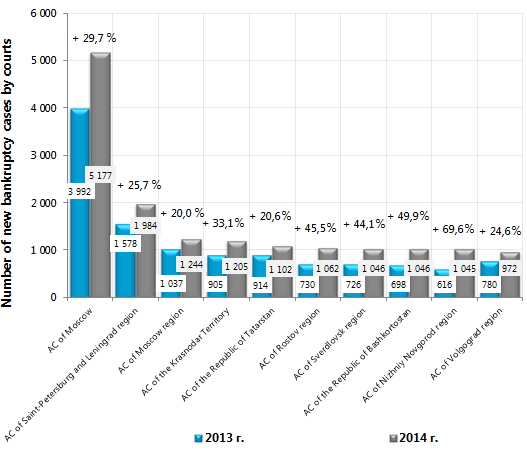

From the angle of regional courts of arbitration, the total amount of new bankruptcy cases is traditionally higher in the largest subjects of the country – Moscow, Saint-Petersburg, Moscow and Leningrad regions. However the highest increase in new cases (for the Top-10 regions) was recorded in Nizhniy Novgorod region with 69,6% (1045 new cases against 616 cases in 2013).

Figure 2. The number of new cases on corporate bankruptcy in the arbitration courts of the sub-federal units in 2013-2014, Top-10, increase rate, %

According to the data of the Information and analytical System GLOBAS-i®, the number of new cases on bankruptcy (insolvency) of major companies were initiated in 2014. The country’s № 1 enterprise in terms of assets in respect of which the monitoring procedure was introduced is NPO Mostovik LLC, Omsk. The enterprise was engaged in engineering and construction of bridges throughout Russia (“Zhivopisniy Bridge” in Moscow, cable-stayed bridge in Russky Island), sports facilities for the Olympic Games in Sochi; the enterprise also had several major contracts for construction of subway in Omsk, the opening of which was indefinitely postponed.

The statement of insolvency has griped one more big company engaged in the Olympic construction - TransKomStroy LLC. The company implemented the following projects: “Gorky Gorod” on the Shore of Mzymta River, sports and tourist complex “Gornaya Karusel”, Olympic mediavillages. Payables have exceeded the value of the company’s assets.

NPO Kosmos LLC closes the anti-ranking top three of the new bankruptcy cases against the largest enterprises. The company is regarded as one of the major road contractors in Moscow. It was the general contractor of the “Bolshaya Leningradka” project – reconstruction of Leningradksy prospect and Leningradskoye highway from Belorussky Train Station to Zelenograd; the company was also engaged in reconstruction of Dmitrovskoye and Leningradskoye highways, Bolshaya Akademicheskaya Street, and construction of the Alabyano-Baltic Tunnel.

| № | Name | Region | Assets, mln. RUB | Payables, mln. RUB | Case number |

|---|---|---|---|---|---|

| 1 | NPO Mostovik LLC INN: 5502005562 |

Omsk region | 75 093,50 | 32 629,30 | А46 - 4042/2014 |

| 2 | TransKomStroy LLC INN: 7724655847 |

The Krasnodar territory | 55 390,30 | 56 636,80 | А32 - 33424/2014 |

| 3 | NPO Kosmos LLC INN: 7720068118 |

Moscow | 29 736,10 | 14 593,80 | А40 - 4760/2014 |

Trying to struggle against macroeconomic challenges, the government of RF has developed a turnaround plan, which has been announced on the 28th January 2015. According to the plan, government support programs in Russia will be applied at a wider range of small and medium-sized businesses, than the existing rules allow. This will happen due to the twofold increase for annual revenue ceiling from sale of goods and works, which is the criterion at classifying the enterprise as micro-sized business. Ceiling increase in term of turnover will allow to transfer about 8 thousand companies to this category, which are now formally considered as medium-sized. Due to this more companies will be able to participate in public procurement for small-sized business.

Moreover, according to the turnaround plan it was obtained the right to reduce tax rates in form of the single imputed income tax (UTII) from 15% to 7,5% for the separate activity types. The subjects of RF will be allowed to reduce taxes from 6% to 1% for enterprises with the simplified tax system. They will also get the right to reduce by half the maximum amount of potential annual income (from 1 mln. RUB to 500 th. RUB) which is possible to be received by a sole entrepreneur.

Attempted measures should support the national business and change the negative tendency of bankruptcy increasing.

Dynamics of investment activity in Russia: state and prospects

In 2014 there was a slump of foreign investment in the Russian economy. According to the data of the Bank of Russia, direct foreign investment in the non-banking sector of RF were amounted to USD 20, 2 bln., following the results of the first half of 2014; that is 52% less than in the same period of 2013.

Sanctions from the Occident as well as economic slowdown and devaluation of the rouble have resulted in reduction of the foreign capital inflows. A high degree of uncertainty concerning the country’s economy development still remains; that makes investors to wait for better period. At the same time active investment inflow in 2018 is expected due to the gas supply through the Sila Sibiri (the Power of Siberia) gas pipeline and holding FIFA World cup in Russia.

One of the sources of investment in the economy of RF can be foreign legal entities, acting as shareholders of Russian companies. According to the data of the Information and analytical System GLOBAS-i of Credinform agency, 47 954 companies with foreign shareholders are registered in Russia. 53% of them own 100% of authorized capital. It bears reminding, that in 2013 this index was 52%.

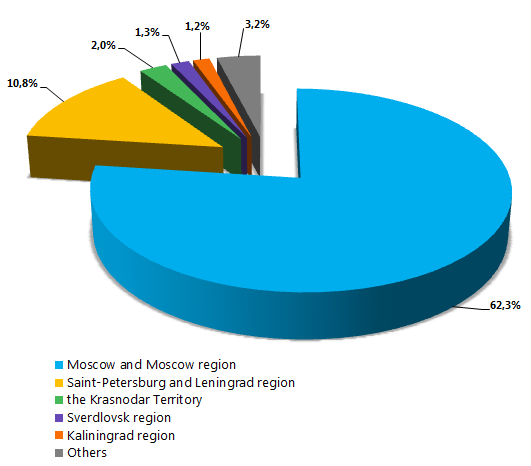

The majority of 47 954 companies with foreign capital are located in Moscow and Moscow region (62,3%), Saint-Petersburg and Leningrad region (10,8%) and the Krasnodar Territory (2%). Companies with the following activity types are leaders among Russian enterprises: wholesale, lease of own real estate and consulting in the field of business and management.

Figure. Allocation of companies with foreign capital by the subjects of Russia

Slump of foreign investment in the Russian economy is observed against capital outflow. According to the data of the Higher School of Economics, net capital outflow from Russia has exceeded USD 110 bln from January 2014; that goes beyond all official forecasts. As a reminder, in the estimation of the Ministry of Economic Development of the Russian Federation net capital outflow for 2014 had to be amounted to USD 100 bln. At the same time the Bank of Russia has announced USD 90 bln amount.

However devaluation of the rouble together with food embargo have resulted in total imports reduction; this helped to strengthen the trade balance under the conditions of export revenue stagnation. As a result monies transferred in Russia not only exceeded payments to other countries and international organizations, but also doubled for 3 quarters of 2014 and amounted to USD 52,3 bln in comparison with the same period of the previous year. Almost two-thirds of its growth is accounted for reduction of visible imports by 6,4%, to the amount of USD 232,7 bln. At the same time export remains at last year’s level with amount of USD 383,8 bln.

Foreign investment play a major role in the development of the country’s economy, because modern technologies, new management methods, highly qualified specialists are attracted together with investment; manpower skills also grows.

Along with that the general trend of capital outflow from emerging markets should be noted. Investors are waiting for stabilization of the situation with the object of getting high return on investment. But in spite of even the most favorable rates, the situation can be stabilized not earlier than in the second half of 2015.