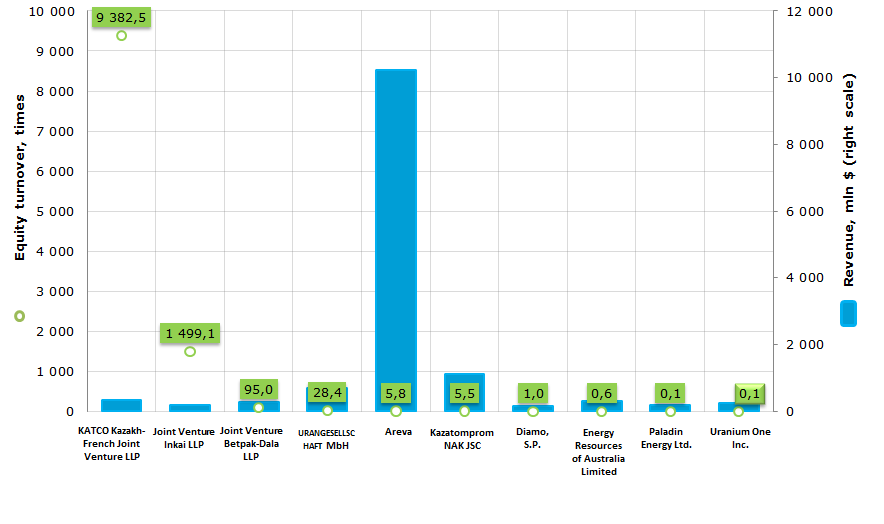

Equity turnover of the key global uranium producers (Top-10)

Information agency Credinform prepared a ranking based on equity turnover ratio of key global companies engaged in mining and enrichment of uranium. Companies with the highest volume of revenue for 2014 were selected for this ranking. The enterprises were ranked by Equity turnover number per year.

Equity turnover (times) is a ratio of revenue to the year average amount of equity capital. This ratio indicates the intensity of use of total available assets by the organization.

Equity turnover shows the rate of equity capital turnover. For the joint-stock companies this means the activity of funds being at the risk of the enterprise’s owners. The low ratio indicates inactivity of the part of equity capital. Increase in turnover shows that equity is implemented and serves the corporate proposes.

| № | Name | Country | Revenue, mln $ 2014 | Equity turnover, times |

|---|---|---|---|---|

| 1 | KATCO Kazakh-French Joint Venture LLP | Kazakhstan | 343,7 | 9382,5 |

| 2 | Joint Venture Inkai LLP | Kazakhstan | 180,0 | 1499,1 |

| 3 | Joint Venture Betpak-Dala LLP | Kazakhstan | 289,8 | 95,0 |

| 4 | URANGESELLSCHAFT MbH | Germany | 689,5 | 28,4 |

| 5 | Areva | France | 10 220,3 | 5,8 |

| 6 | Kazatomprom NAK JSC | Kazakhstan | 1 109,5 | 5,5 |

| 7 | Diamo, S.P. | Czech Republic | 174,55 | 1,0 |

| 8 | Energy Resources of Australia Limited | Australia | 318,7 | 0,6 |

| 9 | Paladin Energy Ltd. | Australia | 198,6* | 0,1* |

| 10 | Uranium One Inc. | Canada | 260,9 | 0,1 |

* Indicators are given following the financial accounts as of 30.06.2015 being a financial year and accounting period end.

Equity turnover of the global key players in the uranium market (Top-10) varies form 0,1 (Uranium One Inc.) to 9383 (KATCO Kazakh-French Joint Venture LLP) times. Areva with turnover of 6 times per period is a leader in the industry.

Picture 1. Equity turnover and revenue of key global uranium ore producers (top-10)

Uranium is the main energy supplier in the nuclear power engineering; about 20% of electric power accrues to this source. Uranium industry covers all stages of the uranium production, including exploration, development and enrichment of ore.

In 2014 more than 41% of uranium mining accounted for Kazakhstan.

| № | Country | U, tons | %, of world production |

|---|---|---|---|

| 1 | Kazakhstan | 23 127 | 41,1 |

| 2 | Canada | 9 134 | 16,2 |

| 3 | Australia | 5 001 | 8,9 |

| 4 | Niger | 4 057 | 7,2 |

| 5 | Namibia | 3 255 | 5,8 |

| 6 | Russia | 2 990 | 5,3 |

| 7 | Uzbekistan (estimated) | 2 400 | 4,3 |

| 8 | USA | 1 919 | 3,4 |

| 9 | PRC (estimated) | 1 500 | 2,7 |

| 10 | Ukraine | 926 | 1,6 |

| Total for the world | 56 217 |

Kazatomprom NAK JSC in Kazakhstan accumulates 25% of the global uranium production.

| № | Company | U, tons | %, of world production |

|---|---|---|---|

| 1 | Kazatomprom NAK JSC | 13 801 | 24,5 |

| 2 | Cameco | 8 956 | 15,9 |

| 3 | ARMZ - Uranium One | 6 944 | 12,4 |

| 4 | Areva | 6 496 | 11,6 |

| Total for top-4 | 36 197 | 64,4 | |

| Total | 56 217 | 100% |

KATCO Kazakh-French Joint Venture LLP with the turnover of 9382,5 is the leader of the ranking. The enterprise was established in 1996. Founders are NAC Kazatomprom JSC and AREVA (France). JV Katco LLP carries out uranium mining by in-situ leaching method at Moiynkum deposit located in the South-Kazakhstan oblast.

Joint Venture Inkai LLP’s turnover is 1499,1 times. Joint Venture Inkai, established in March 1996, is owned by Canadian company Cameco Corporation and by National Atomic Company Kazatomprom JSC. The enterprise carries out uranium mining by in-situ leaching method at Inkai deposit in South-Kazakhstan region.

Quite high values of these indicators of the ranking leaders indicate the active use of enterprises’ equity.

Joint Venture Betpak-Dala LLP with turnover of 95 times was established on the base of Dala mine on February 20, 2004 for industrial production and the continuation of work on the further exploration of mineral resources. In September 2005, the company received uranium mining, exploration and production rights in South Inkai mine. The founders of the enterprise are NAC Kazatomprom JSC and “Astana” Kazakhstan Investment Group LLP.

URANGESELLSCHAFT MbH (28,4 times) is engaged in the exploration and development of uranium and thorium deposits, operation of mines and processing plants, trade with uranium and thorium in the form of ores. The enterprise is 100% subsidiary of AREVA.

Areva (5,8 times) is a French enterprise for development and production of equipment for atomic energy industry and production of electric power of alternative sources. Areva is the only company engaged in all activity types connected with nuclear power production only.

Kazatomprom NAK JSC (5,5 times) is the national operator of the Republic of Kazakhstan, for import and export of uranium, rare metals, nuclear fuel for power plants, special equipment technologies and dual-purpose materials. Today, the Company has more than 27,000 employees. The Sole Shareholder of the Company is «Samruk-Kazyna» JSC.

Strategic goals of «NAC «Kazatomprom» JSC are focused on holding key positions in the world nuclear power market, maximum diversification of the Company’s activity into the front end nuclear fuel cycle (NFC) through participation in foreign assets of NFC (in stages of conversion, uranium isotope separation, nuclear fuel fabrication, power plants construction), as well as diversification into the allied high technological areas with the development and use of scientific and technical potential of the Company.

Diamo, S.P. (1 time) is Czech state-owned company responsible for the development of uranium deposits in Rožnov. Uranium mining in the Czech Republic, the volume of which once amounted to more than 2,500 tons per year, was sharply reduced after the collapse of the communist government in 1990. In 1994 the production fell to 600 tons of uranium per year and gradually decreased over the past decade to 228 tons in 2012. The last underground mine is a mine Rožná in Dolní Rožínka, located 50 kilometers northwest of the city of Brno. In 2003 the mine was going to be closed, but due to the increase in the uranium price it was not happened. In 2014 the mine was significantly exhausted, and the government announced its intention to close the mine in 2017. Diamo has completed a feasibility study on the revival of the Brzkov mine of the 1980s near Jihlava, which contains 3000-4000 tons of uranium at a depth of 300 m. Diamo plans that commissioning the mine will take about 6-7 years.

Energy Resources of Australia Limited (0,6 times) is a publicly listed company on the Australian Stock Exchange. Rio Tinto, a diversified resources group, owns 68,39% of ERA shares. The company is one of the largest uranium producers in the world, operating the Ranger uranium mine in the Northern Territory.

Paladin Energy Ltd. (0,1 times) is a uranium production company with projects currently in Australia and two mines in Africa located in Western Australia. The company’s shares are listed in the Australian Securities Exchange (ASX) and Toronto Securities Exchange (TSX). Since 1998, during a period of sustained downturn in global uranium markets, Paladin accumulated a quality portfolio of advanced uranium projects each having production potential. The Langer Heinrich Mine in Namibia is Paladin’s flagship project. The Kayelekera Mine in Malawi, the Company’s second mine, provided an excellent follow-up to Langer Heinrich. A Development Agreement with the Government of Malawi was executed in February 2007, which provides fiscal stability for the project for ten years. Unfortunately, despite improvements to both processing recoveries and costs, the extended downturn in uranium price has resulted in Kayelekera Mine being placed on 'care and maintenance' until there is a significant improvement in the uranium price outlook. Regional exploration is currently focused on identifying additional resources to extend the expected life of the project when processing at the Kayelekera Mine resumes.

Uranium One Inc. (0,1 time) is one of the world’s largest uranium producers with a globally diversified portfolio of assets located in Kazakhstan, the United States, Australia and Tanzania. ROSATOM State Atomic Energy Corporation, through its affiliates, owns 100% of the outstanding common shares of Uranium One.

Today 50% of total extracted uranium in the world account for Australia, Kazakhstan and Russia.

| Country | U, tons | %, of global reserves |

|---|---|---|

| Australia | 1 706 100 | 28,9 |

| Kazakhstan | 679 300 | 11,5 |

| Russia | 505 900 | 8,6 |

| Canada | 493 900 | 8,4 |

| Niger | 404 900 | 6,9 |

| Namibia | 382 800 | 6,5 |

| SAR | 338 100 | 5,7 |

| Brazil | 276 100 | 4,7 |

| USA | 207 400 | 3,5 |

| PRC | 199 100 | 3,4 |

| Mongolia | 141 500 | 2,4 |

| Ukraine | 117 700 | 2,0 |

| Uzbekistan | 91 300 | 1,5 |

| Botswana | 68 800 | 1,2 |

| Tanzania | 58 500 | 1,0 |

| Jordan | 40 000 | 0,7 |

| Other countries | 191 500 | 3,2 |

| Total in the world | 5 902 900 |

Capital turnover has a direct impact on the solvency of the company. In addition, the increase in the capital turnover rate ceteris paribus indicates an increase in production and technical capacity of the organization.

Self-regulation in the financial market of Russia

The financial market, as a combination of economic relations between sellers and buyers of cash resources and investment properties, consists of securities and gold markets, money and foreign exchange markets. Money and securities are the main subjects of trading in the financial market.

Figural comparison of finances with the circulatory system of the economy indicates the key importance of the financial market for the functioning of the state. This thesis has a remarkable confirmation by the indexes of capitalization of the Russian stock market (in December 2014 they made 338.5 billion USD), as well as the indexes of GVA volume in the financial activity for 2014 (3,2 trillion RUB). The Moscow stock exchange, the largest in Russia, taking the lead in trading volume of trading in all segments of the exchange market in FSU countries and in Eastern Europe, is among the TOP-20 world's largest stock exchanges on the trading volume on the stock market, and on the trading volume in the time market - among the TOP-10.

The dynamic development of the Russian financial market, its constant segmentation, growing variety and complication of instruments has led gradually to the occurrence of many regulators, formalization of their activities, weakening of stimulating levers of regulation compared with prohibitive.

The measures prescribed by the Federal Law of July 13, 2015 №223-FZ «On self-regulatory organizations in the financial market area and on introducing amendments to Articles 2 and 6 of the Federal Law «On introducing amendments to certain legislative acts of the Russian Federation», which becomes into force on the 11th of January 2016 (except certain provisions), are intended to overcome these problems.

The law assumes the creation of self-regulatory organizations (SRO) in all segments of the financial market, except the banking sector, i.e. it will extend to brokers, dealers and managers, depositories and specialized depositories, registrars, non-governmental pension funds, joint-stock and mutual funds, management companies of investment funds, insurance companies, insurance brokers, mutual insurance companies, microfinance institutions, credit housing and savings consumers’ co-operatives, agricultural consumer credit co-operatives, pawnbroker's offices.

The membership in SRO will be obligatory. Each segment may have two SRO, but a financial institution can be a member only of one SRO in its segment. It is possible also to establish SRO, which join financial institutions from different segments, but when certain requirements are satisfied. Supervision over the activity of SRO will be provided by the Central Bank of the RF, which will have the right to impose fines, to send a demand of the replacement of the management of SRO, to assign and revoke the status of these organizations. At the same time the Central Bank is allowed to give self-regulatory organizations a number of powers of regulation and supervision.

Self-regulatory organizations in the field of financial market are given the right to protect and represent the interests of their members in the Central Bank of the RF, federal executive bodies, local executive bodies, courts, international organizations. The development and adoption of a code of professional ethics, performance standards fall also within the scope of their activities.

Obligatory National associations of self-regulatory organizations in the field of financial market are not prescribed by the law.

The world experience in the field of self-regulation is very contradictory. In the USA, for example, there are two types of it: compulsory and voluntary, by that the joint-stock market is a matter of compulsory self-regulation. All its participants are required to be register at the Financial Industry Regulatory Authority (FINRA). Great Britain, in its turn, which former took the lead in terms of financial markets’ regulation worldwide, has refused to self-regulation in this area as far back as 1997 because of massive violations of the rights of investors. At the moment the activity of financial markets is controlled by the Financial Services Authority (FSA) there - a non-governmental organization with the liability limited by guarantee.

How will the self-regulation of the financial market in Russia operate - the time will tell. According to experts, already by the middle of 2016 it will be possible to assess how the measures, introduced by the new law, would influence on the efficiency of work of financial institutions.

According to the «All-Russian portal about self-regulation» in the financial sector, 22 SRO have been already registered by now. To get acquainted with their activities, as well as with performance indicators of organizations of financial and other markets is possible by subscription to the information and analytical system Globas-i®.