Profitability of enterprises engaged in forging, pressing, stamping and roll in Russia

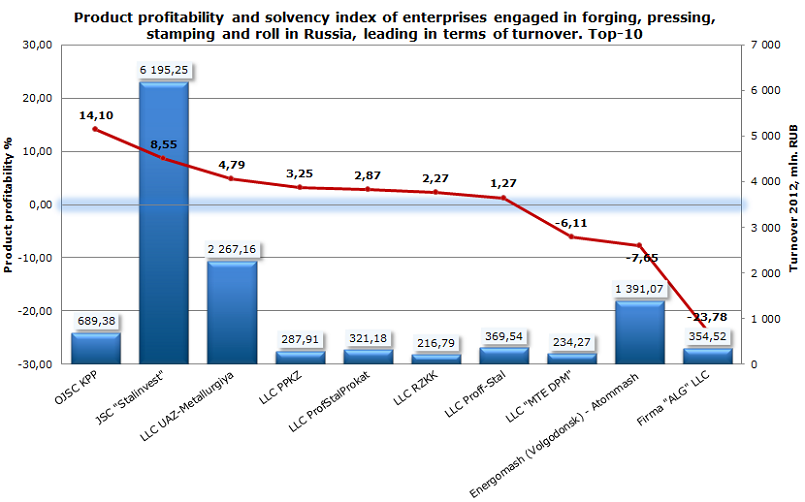

Information agency Crerdinform prepared a profitability ranking of enterprises engaged in forging, pressing, stamping and roll in Russia. The ranking list includes industry’s 10 largest Russian companies with mentioned activity type and is based on revenue as stated in the Statistics register, with the reference period of 2012. These companies were ranked first in terms of revenue, and then of product profitability decreasing.

Product profitability is rated as relation of sales profit to operating expenses. Economically, profitability shows allocated efficiency. Thuswise, product profitability makes it possible to conclude the practicability of one or another products release. Standard values for the parameters of this group are not provided, because they vary greatly depending on the industry.

| № | Name, INN | Region | Turnover 2012, mln. RUB | Product profitability % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | OJSC Kuznechno-pressovoe proizvodstvo,INN 6902006971 | Tver region | 689 | 14,10 | 233 (high) |

| 2 | JSC "Stalinvest",INN 5009034370 | Moscow region | 6195 | 8,55 | 249 (high) |

| 3 | LLC UAZ-Metallurgiya,INN 7327033007 | Ulyanovsk region | 2267 | 4,79 | 254 (high) |

| 4 | LLC Penzenskiy kuznechno-pressoviy zavod,INN 5835077108 | Penza region | 288 | 3,25 | 321 (satisfactory) |

| 5 | LLC ProfStalProkat,INN 7106504970 | Tula region | 321 | 2,87 | 299 (high) |

| 6 | LLC Ryazanskiy zavod kabelnikh konstruktsiy,INN 6230058119 | Ryazan region | 217 | 2,27 | 305 (satisfactory) |

| 7 | LLC Proff-Stal,INN 2339016896 | Krasnodar territory | 370 | 1,27 | 231 (high) |

| 8 | LLC "MTE DPM",INN 6140030630 | Rostov region | 234 | -6,11 | 303 (satisfactory) |

| 9 | Energomash (Volgodonsk) - Atommash Company Limited,INN 6143073311 | Rostov region | 1391 | -7,65 | 281 (high) |

| 10 | Firma "ALG" LLC,INN 7725075648 | Moscow | 355 | -23,78 | 332 (satisfactory) |

At an average index of 2,5% for the sector, OJSC Kuznechno-pressovoe proizvodstvo with its product profitability of 14,10% takes the leading position in the ranking. The company is 4th in the industry at year-end 2012. The high solvency index GLOBAS-i® confirms good results of business activity and marks the company as financially stable.

The second and third lines of the ranking are as follows: leaders in terms of 2012 turnover, JSC "Stalinvest" with 8,55% and LLC UAZ-Metallurgiya with 4,79% of product profitability, which is more than industry average value. Both companies got high solvency index GLOBAS-i®.

Three companies (LLC "MTE DPM", Energomash (Volgodonsk) - Atommash Company Limited and Firma "ALG" LLC) have product profitability value under zero because of sales profit negative quantity. It follows that they have to control expenses.

Industrywide, the plural situation can be stated. Some companies even with high turnover ratio cannot boast of high values of product profitability, and the industry average value is not very high, which reflects the high cost of producing products.

But it should be kept in mind that product profitability shows only the current situation and does not reflect the development prospects of the enterprise, i.e., does not account for long-term investments for the upgrading. That is why a set of indicators should be considered for the objective assessment of the company’s financial stability.

The Central Bank of Russia increases control over high-street banks

The Central Bank of Russia establishes a new department, aimed to control the most important credit organizations, in order to prevent possible shocks in the financial system of the country, where a problem in the one of high-street banks may spur a chain reaction and bring on a crisis. The new institution begins to work from October 1st, 2013. It was the case of late meeting of the board of directors of the Bank of Russia.

Definitely, the Central Bank, as a financial super moderator, having concentrated on itself not only supervisory role over credit system of the country, but also since recently over organized securities market, doesn’t divest itself of power to have control over other banks. However, the Central Bank will keep a wary eye on the most important institutions.

As expected, the list will include about twenty credit organizations. It will be certified in the beginning of the next year, and one of the main criterion to qualify a bank as a key one is obviously the number of its assets and borrowings, including private deposits. These banks, in case of force-majeur, may claim for government support and financial recovery, which is generally speaking, has become a common practice in the EU and the USA, as a result of financial crisis in 2008. Following the international experience, this policy of the Central Bank of Russia seems to be reasonable. It is destined to give positive signal not only to the citizens, but also to the business, and to enhance confidence to all the banking system of the country.

The CredInform information agency is preparing to implement an independent index of banks, which will reflect the degree of their financial capacity and reliability, and also let the concerned persons estimate the risks of partnership with banking institutions.