The Central Bank claims to lower the credit risks by thorough examination of the borrower

The Central Bank of the Russian Federation (CB RF) claims credit organizations to identify the entities (clients), being under their customers, and beneficiaries. These requirements are determined by the Central Bank in the “Clause on identification of clients and beneficiaries by credit organizations for purposes of countermeasure to income legalization (laundering) obtained by illegal means and terrorism financing” as of August 19th, 2004 №262C (from there Clause). This Clause is implemented by the Regulator in accordance with the requirements of the federal law “Concerning the Combating of income legalization (laundering) obtained by illegal means and terrorism financing” as of 07.08.2001 №115-FL.

According to the Clause, the corresponding program should be developed in the credit organization. The program is to have the procedure of clients’ identification, beneficiaries’ determination and identification, including procedure of risk level estimation of transaction performed by the client in order to legalize (launder) income obtained by illegal means or to finance the terrorism and the arguments of the risk estimation.

The credit organization ought to collect information, mentioned in the appendixes of the listed Clause, documents being the evidence of banking transactions or other operations’ performance, in order to fulfil the program. The credit organization is also entitled a right to use other data (documents), which is definable in its internal documents. Moreover, it should use the information from the open databases of the federal executive authorities posted in the information and telecommunication network Internet and other information sources, available for the credit organization legitimately.

The regulator of the federal law and the Clause implementation practice set that the largest credit organizations fulfil the requirements of the law documents incompletely. Thus, the banks for instance, take the check of the legal entity as a mere formality. In particular, they doesn’t examine whether the company is situated at the stated operational address by visiting the office. As a result, the banks have more than 100 legal entities, the operational address of which doesn’t correspond with the office address.

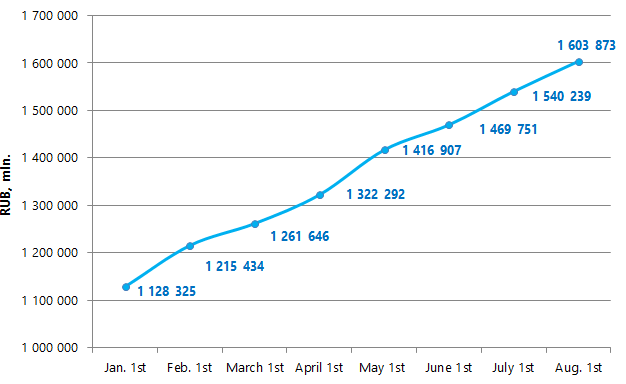

Disregarding of the actions on the legal entities’ inspection leads subsequently to high credit risks: payments delay, slight credit default or common default on monetary means. According to the Statistics of the Central Bank of Russia, the total sum of the delayed credit indebtedness of the resident legal entities or individual entrepreneurs as of August 1st, 2015 amounts to more than RUB 1,6 trillion. Comparing with the situation on January 1st, 2015 this indicator increased by a factor of 1,42. The growth dynamics of the delayed credit indebtedness during 2015 is represented on the figure 1.

Figure 1. Total sum of the delayed credit indebtedness of the resident legal entities or individual entrepreneurs in Russian from January 1st to August 1st, 2015.

The existing situation cannot but concern the Regulator. In this regard the 262C Clause (“Concerning identification of clients…”) of the Central bank is being prepared in the new version. It is expected that the effect to the Clause will be given in the IV quarter of 2015. According to the Clause, it is required for banks to check the originality of the received data, including visiting of the prospective borrower in order to make sure that the legal entity is situated at the listed address; that it carries on operation activity and has the stated charges. According to the Central Bank, this action will not only provide an opportunity to identify the corporate clients together with other actions, but also to determine its credit risk level and the sum of the required reserves on the issued loans.

Besides, market experts state that the services of checking “fly-by-nights” companies on the web-sites of the Central Bank and the Federal Tax Service doesn’t help the banks in a proper way, due to their rare updating.

Nowadays, the significant assistance in solving the corresponding problems might be rendered by Information and Analytical System Globas-i®. This resource within a very short time makes it possible to identify beneficiaries both of Russian and international legal entity; to determine whether the Russian firms has attributes of a “fly-by-night” company; to analyze the ability to meet debt obligations and practicability of credit granting, its maximum amount on short-term and long-term periods.

Auditing activities will become more transparent

As of September, 2015, there are 5 self-regulated organizations (SRO) of auditors registered in Russia. According to its own data, they include a little more than 9,5 thousand organizations.

| SRO | Auditing organizations | Auditors, Individual entrepreneurs | Total |

|---|---|---|---|

| Audit Chamber of Russia | 880 | 5858 | 6738 |

| Institute of Professional Auditors (NP IPA) | 263 | 2316 | 2579 |

| Moscow Audit Chamber | 1157 | 5502 | 6659 |

| Russian Collegium of Auditors | 841 | 3490 | 4331 |

| Audit AssociationSodruzhestvo | 6400 | 6340 | 12740 |

| Total: | 9541 | 23506 | 33047 |

In spite of the fact the quantity of auditors is small, the importance of the auditing activity for the economy in the whole and for specific organizations cannot be overestimated.

The Federal law as of December 1st, 2014 №403-FL “On introducing amendments to legislative acts of the Russian Federation” might be confirmation to it.

In the new version the Article 42 “Accounts audit of credit organizations, banking group, banking holding” of the Federal Law “On Banks and Banking Activities” is stated fully. Editorial corrections have respect to Art. 9, para. 1, second sub-paragraph of the Federal Law as of July 24th, 2002 №111-FL “Concerning the Investment of Resources for the Financing of the Funded Component of a Retirement Pension in the Russian Federation”.

The most significant changes which came into effect since January 1st, 2015 deal with the Federal Law as of December 30th, 2008 №307-FL “Concerning Auditing Activities”. The amendments are made to the overwhelming majority of the law articles. Briefly it might be represented in the following manner:

- the list of enterprises which accounts are subject to statutory audit is corrected. Currently these are accounts of: each and all joint stock companies, as well as all credit organizations, credit bureaus, professional securities traders, insurance and clearance companies, non-state pension and other funds, management companies of investment and pension funds, organizations, dealing with preparation of consolidated financial accounts, accounts on securities admitted to trading;

- the audit is statutory when the following economic criteria take place: revenue amounts to more than RUB 400 million or the amount of balance sheet assets exceeds RUB 60 million;

- both accounts in the whole and their parts are subject to audit;

- at present only auditing organizations are entitled the right to carry out audit of companies which securities are admitted to trading, state corporations, as well as companies with a government stake exceeding 25%;

- contest on selection of auditing organization might be held once every five years. The participation of the auditing organization, being a representative of the small and medium business, is compulsory, providing the revenue of the company, holding the contest, doesn’t exceed RUB 1 billion;

- requirements to audit documentation are now imposed not by the federal standards but by the international standards of auditing activity. The documentation is to be stored within 5 years after a year of its receipt or implementation;

- the limit in the number of the members of SRO auditors is increased: from 700 to 10 000 natural entities and from 500 to 2000 organizations;

- only the authorized auditor might be a general director of the auditing organization, having no right to transfer the management to individual entrepreneur or to administrator;

- in case of the statutory audit, the absence of the audit report on the meeting of shareholders, company participants, holders of equity interests might be qualified as non-compliance of the legislation on preparatory set and holding of the corresponding meetings and is punished in the form of penalty from 500 to RUB 700 thousand.

According to experts, such significant changes in the auditing law might have positive and negative effects. On the one hand, the unification of the Russian law with the international standards of auditing activity will certainly have a positive effect on the quality and transparency of the domestic auditors. On the other – it may lead in the foreseeable future (till 2017) to essential repartition of the audit market, as well as to reduction in number of few and far between self-regulated organizations of auditors.