Activity trends of companies with UTII

Information agency Credinform presents a review of the activity trends of the companies with unified tax on imputed income.

The largest enterprises having ever paid the unified tax on imputed income in the period of its activity (TOP-1000) in terms of annual revenue were selected for the analysis according to the data from the Statistical Register and the Federal Tax Service for the period of 2014 – 2019 years. The analysis was based on the data from the Information and Analytical system Globas.

Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

The largest company with UTII in term of net assets was JSC BASHINFORMSVYAZ, INN 0274018377, Republic of Bashkortostan. In 2019, net assets value of the company amounted to more than 17,2 billion RUB.

The lowest net assets value among TOP-1000 was recorded for OOO LABIRINT, INN 7451241509, Penza region. The company is a part of retail chain under the trademark “KRASNOE, &, BELOE”. In 2019, insufficiency of property of the company was indicated in negative value of -1,4 billion RUB.

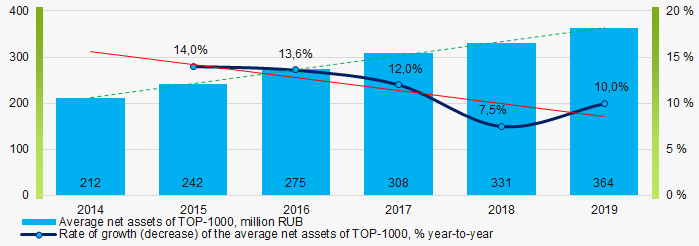

During six-year period, the average net assets values of TOP-1000 have a trend to increase, with decreasing growth rates (Picture 1).

Picture 1. Change in average net assets value of TOP-1000 in 2014 – 2019

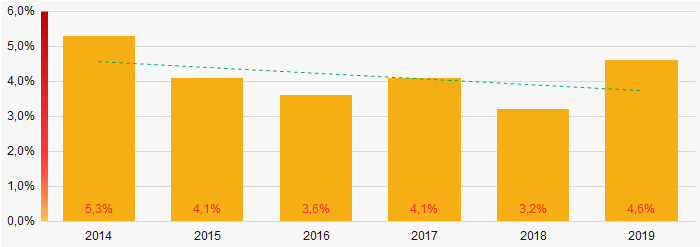

Picture 1. Change in average net assets value of TOP-1000 in 2014 – 2019The shares of TOP-1000 companies with insufficient property had positive trend to for the past six years (Picture 2).

Picture 2. Shares of companies with negative net assets value in TOP-1000 in 2014 – 2019

Picture 2. Shares of companies with negative net assets value in TOP-1000 in 2014 – 2019Sales revenue

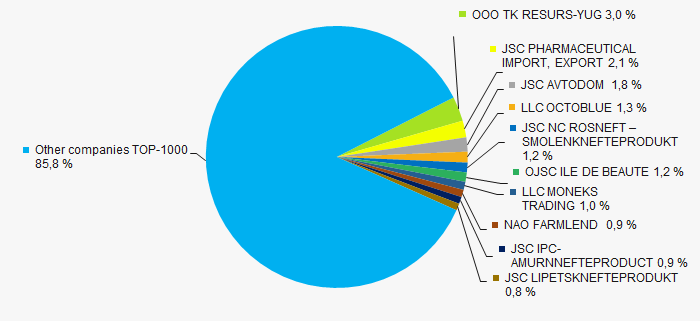

The revenue volume of the ten leading companies amounted to 14% of the total revenue of TOP-1000 companies in 2019 (Picture 3). It gives evidence to relatively low level of the capital concentration among companies with UTII.

Picture 3. Shares of TOP-10 companies in the total revenue of TOP-1000 in 2019

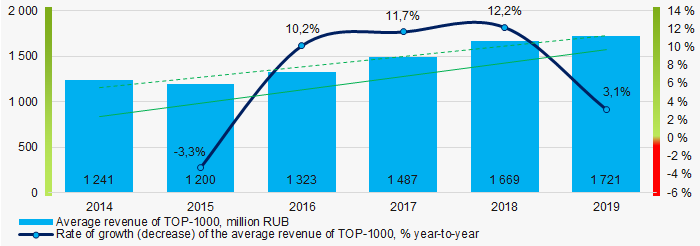

Picture 3. Shares of TOP-10 companies in the total revenue of TOP-1000 in 2019In general, there is a trend to increase in revenue with increasing growth rates (Picture 4).

Picture 4. Change in average revenue in 2014– 2019

Picture 4. Change in average revenue in 2014– 2019Profit and loss

The largest company in term of net profit is JSC BASHINFORMSVYAZ, INN 0274018377, Republic of Bashkortostan. The company’s profit exceeded 1,9 billion RUB in 2019.

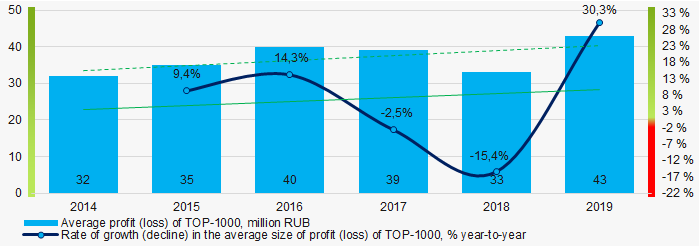

During six-year period, the average profit figures of TOP-1000 companies have a trend to increase with increasing growth rates (Picture 5).

Picture 5. Change in average profit (loss) of TOP-1000 companies in 2014- 2019

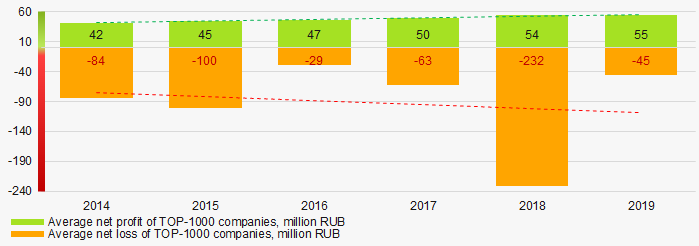

Picture 5. Change in average profit (loss) of TOP-1000 companies in 2014- 2019During six-year period, the average net profit figures of TOP-1000 companies have a trend to increase with the increasing average net loss (Picture 6).

Picture 6. Change in average net profit and net loss of ТОP-1000 companies in 2014 – 2019

Picture 6. Change in average net profit and net loss of ТОP-1000 companies in 2014 – 2019Key financial ratios

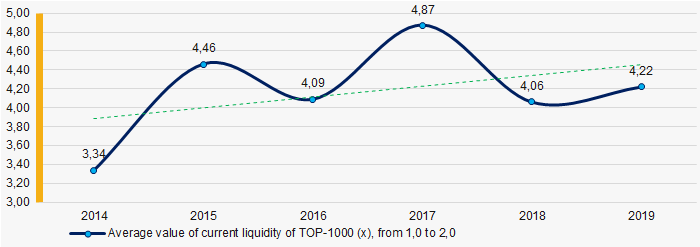

During six-year period, the average values of the current liquidity ratio of TOP-1000 companies were above the recommended one – from 1,0 to 2,0, with a trend to increase. (Picture 7).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of company’s assets to repay on short-term liabilities.

Picture 7. Change in average values of current liquidity ratio of TOP-1000 in 2014 – 2019

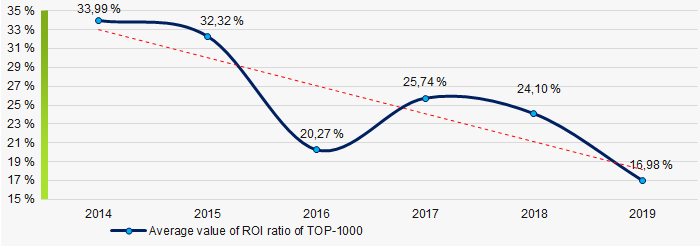

Picture 7. Change in average values of current liquidity ratio of TOP-1000 in 2014 – 2019During six years, there was a general trend to decrease in the average ROI values (Picture 8).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average values of ROI ratio of TOP-1000 in 2006 – 2011

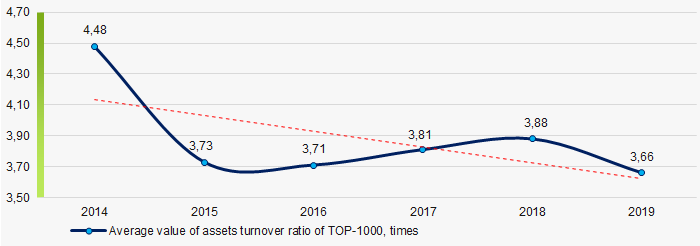

Picture 8. Change in average values of ROI ratio of TOP-1000 in 2006 – 2011Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

During the six-year period, there was a trend to decrease of this ratio (Picture 9).

Picture 9. Change in average values of assets turnover ratio of TOP-1000 companies in 2014 – 2019

Picture 9. Change in average values of assets turnover ratio of TOP-1000 companies in 2014 – 2019Small enterprises

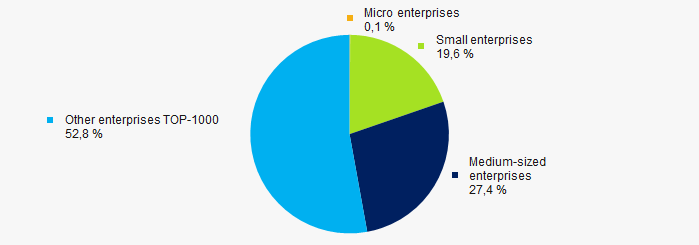

77% companies of TOP-1000 are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. However, their share in total revenue of TOP-1000 amounted 47%, which is twice lower than the average country values in 2018 - 2019 (Picture 10).

Picture 10. Shares of small and medium-sized enterprises inTOP-1000

Picture 10. Shares of small and medium-sized enterprises inTOP-1000Main regions of activity

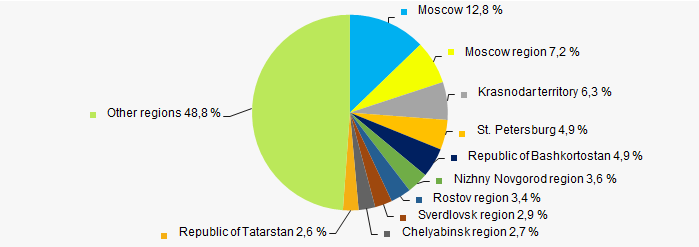

Companies of TOP-1000 are registered in 78 regions of Russia, and unequally located across the country. More than 26% of companies largest by revenue consolidate in Moscow, Moscow region and Krasnodar territory (Picture 11).

Picture 11. Distribution of TOP-1000 revenue by the regions of Russia

Picture 11. Distribution of TOP-1000 revenue by the regions of RussiaFinancial position score

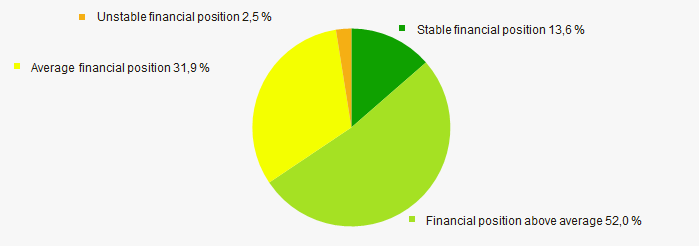

According to the assessment, the financial position of most of TOP-1000 companies is above average (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

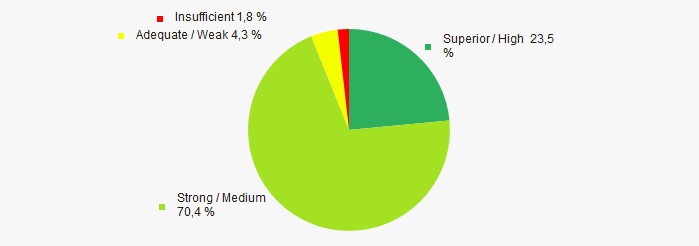

Most of TOP-1000 companies got Superior / High and Strong / Medium index Globas. This fact shows their ability to meet their obligations fully and by the due date (Picture 13).

Picture 13. Distribution of TOP-1000 companies by solvency index Globas

Picture 13. Distribution of TOP-1000 companies by solvency index GlobasConclusion

Complex assessment of activity of the largest companies with UTII, taking into account the main indexes, financial ratios and indicators, demonstrates the prevalence of positive trends in their activity in 2014- 2019 (Table 1).

| Trends and evaluation factors | Relative share of factors, % |

| Dynamics of the average net assets value |  10 10 |

| Rate of growth (decline) in the average size of net assets |  -10 -10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  10 10 |

| Level of capital concentration |  5 5 |

| Dynamics of the average revenue |  10 10 |

| Rate of growth (decline) in the average size of revenue |  10 10 |

| Dynamics of the average profit (loss) |  10 10 |

| Rate of growth (decline) in the average size of profit (loss) |  10 10 |

| Growth / decline in average values of net profit |  10 10 |

| Growth / decline in average values of net loss |  -10 -10 |

| Increase / decrease in average values of current liquidity ratio |  5 5 |

| Increase / decrease in average values of return on investment ratio |  -10 -10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses in terms of revenue being more than 22% |  10 10 |

| Regional concentration |  -5 -5 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of relative share of factors |  3,8 3,8 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).

The largest chain restaurants in Russia

Information agency Credinform represents a ranking of the largest chain restaurants in Russia. Using the Information and Analytical system Globas, the experts of the Agency have selected TOP-10 restaurant companies and analyzed their 2019 revenues.

The ranking includes only brand owners of the largest restaurants in Russia.

McDonalds is presented by two legal entities, that is why it is mentioned in the ranking twice, and its revenues are consolidated.

| № | Name | Revenues for 2019, billion RUB |

| 1 | MCDONALDS |

81,8 |

MCDONALDS-MOSCOW |

||

| 2 | BURGER RUS |

44,9 |

| 3 | YUM RESTAURANT RUSSIA |

16,2 |

| 4 | AMREST |

12,4 |

| 5 | GALEREYA ALEKS |

8,8 |

| 6 | ROSINTER RESTAURANTS   |

6,5 |

| 7 | PIZZA-RESTAURANTS |

5,1 |

| 8 | TEREMOK-INVEST |

4,9 |

| 9 | FASTLAND |

4,1 |

| 10 | PRIMESTAR RESTAURANTS GROUP |

3,2 |

All but one of companies belong to the fast food business.

The first company is McDonalds (81,8 billion RUB). It is the largest fast food chain in the world having all grounds to be at the top of the ranking. Over 30 thousand people have visited the opening of the first McDonalds in Russia on January 31, 1990.

The format of ROSINTER RESTAURANTS (6,5 billion RUB) differs from the others of the ranking. The company develops family restaurants with Italian, Japanese and American cuisines. The legal entity owns IL Patio, Planeta Sushi, T.G.I. Friday’s and Costa Coffee chains.

PRIMESTAR RESTAURANTS GROUP (3,2billion RUB) closes the ranking. It is a part of “Novikov Group of Companies1 ”. “Fast is not bad” is the main concept of this fast casual restaurant. There are over 100 locations in Moscow.

The results of the ranking shows the fast food chains lead the ranking. Tasty, fast and affordable food is their key to success.

1 International chain of restaurants owned by Arkadiy Anatolievich Novikov, the Russian entrepreneur