TOP 10 road construction companies in Moscow

Information agency Credinform represents a ranking of the largest Russian road construction companies in Moscow. Companies with the largest volume of annual revenue (TOP 10 and TOP 50) were selected for the ranking, according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2018 - 2020). They were ranked by the return on the authorized capital (Table 1). The selection and analysis were based on the data of the Information and Analytical system Globas.

Return on the authorized capital (%) indicates the efficiency of the authorized capital use and shows the amount of net profit accounting for one rouble of the authorized capital.

The higher is the indicator, the more efficient is the usage of capital contributed to the authorized fund. However, it is necessary to consider that too high values, exceeding in several times the average values for economy or sector may indicate low authorized capital at higher net profit.

For the most complete and objective view of the financial condition of the enterprise, it is necessary to pay attention to the complex of indicators and financial ratios of the company.

| Name, INN | Revenue, billion RUB | Net profit (loss), billion RUB | Return on the authorized capital, % | Solvency index Globas | |||

| 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| JSC DSK AVTOBAN INN 7725104641 |

47,17 47,17 |

32,60 32,60 |

2,26 2,26 |

7,73 7,73 |

2 257 093 2 257 093 |

7 732 376 7 732 376 |

208 Strong |

| LLC CONCESSION CONSTRUCTION COMPANY No. 1 INN 9729021990 |

25,24 25,24 |

43,04 43,04 |

4,46 4,46 |

6,15 6,15 |

4 456 489 4 456 489 |

6 148 273 6 148 273 |

264 Medium |

| JSC FOR CONSTRUCTION AND RECONSTRUCTION OF ROADS AND AERODROMES INN 6163002069 |

7,49 7,49 |

11,61 11,61 |

0,92 0,92 |

1,22 1,22 |

3 679 804 3 679 804 |

4 886 008 4 886 008 |

195 High |

| LLC DORTEKH INN 7728346960 |

2,55 2,55 |

6,04 6,04 |

0,04 0,04 |

0,25 0,25 |

415 500 415 500 |

2 465 110 2 465 110 |

222 Strong |

| JSC TSENTRDORSTROI INN 7702059544 |

13,10 13,10 |

13,68 13,68 |

0,04 0,04 |

0,23 0,23 |

192 217 192 217 |

999 643 999 643 |

205 Strong |

| LLC KOLTSEVAYA MAGISTRAL INN 5032273017 |

4,52 4,52 |

8,70 8,70 |

0,04 0,04 |

0,05 0,05 |

400 720 400 720 |

532 370 532 370 |

295 Medium |

| LLC IBT INN 7704818388 |

8,86 8,86 |

14,13 14,13 |

0,25 0,25 |

0,78 0,78 |

2 497 2 497 |

7 842 7 842 |

228 Strong |

| LLC RUS-STROI INN 7707766346 |

3,72 3,72 |

5,46 5,46 |

0,04 0,04 |

0,06 0,06 |

129 129 |

412 412 |

239 Strong |

| JSC MOSTOTREST INN 7701045732 |

77,30 77,30 |

65,74 65,74 |

1,73 1,73 |

-1,99 -1,99 |

4 384 4 384 |

-5 027 -5 027 |

297 Medium |

| LLC TRANSSTROIMEKHANIZATSIYA INN 7715568411 |

63,06 63,06 |

56,86 56,86 |

0,70 0,70 |

-4,47 -4,47 |

7 045 370 7 045 370 |

-44 709 540 -44 709 540 |

299 Medium |

| Average value for TOP 10 |  25,30 25,30 |

25,79 25,79 |

1,05 1,05 |

1,00 1,00 |

1 845 420 1 845 420 |

-2 194 253 -2 194 253 |

|

| Average value for TOP 50 |  6,83 6,83 |

6,61 6,61 |

0,27 0,27 |

0,16 0,16 |

588 451 588 451 |

-261 222 -261 222 |

|

| Average industry value |  0,19 0,19 |

0,20 0,20 |

0,001 0,001 |

4 4 |

44 44 |

||

growth of indicator to the previous period,

growth of indicator to the previous period,  fall of indicator to the previous period

fall of indicator to the previous period

The industry average values of the return on the authorized capital is significantly above the industry average ones of TOP 10 and TOP 50. Two companies of TOP 10 had negative values of the indicator and reduced their figures in 2020. In 2019, the fall was recorded for five companies.

In 2020, seven companies included in TOP 10 gained revenue and five legal entities gained net profit. In general, the revenue of TOP 10 climbed at average 2%, and a 3% decrease was recorded in TOP 50. There was a 5% increase in the industry average indicator.

There was a 5% and 41% decrease in profit of TOP 10 and TOP 50 respectively. The industry average profit climbed 3 times.

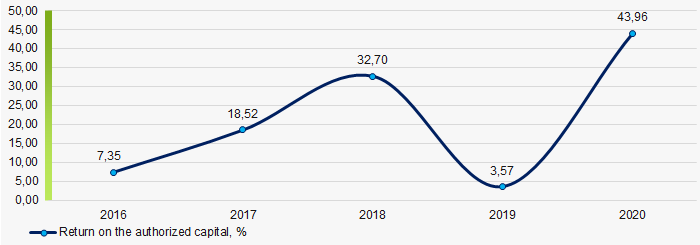

Over the past five years, the industry average values of the return on the authorized capital have increased over three periods. The highest value was recorded in 2020 and the lowest one was in 2019 (Picture 1).

Picture 1. Change in the industry average values of the return on the authorized capital in 2016 - 2020

Picture 1. Change in the industry average values of the return on the authorized capital in 2016 - 2020Redomicilation to Russia

The law on termination of the double tax treaty between Russia and the Netherlands was signed on May 26, 2021 due to the refusal of the Netherlands government to rise tax rate to 15% for dividends and interest transferred from the Russian subsidiaries to foreign accounts. The treaty will be no longer in force from January 1, 2022, if the notice of denunciation is sent before the end of June 2021.

Cyprus, Malta and Luxembourg have agreed to change the doubly tax treaty on such conditions as Russia established.

Russian companies controlled by the foreign residents

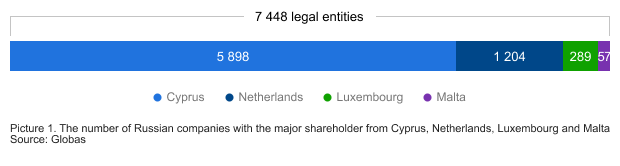

The residents of four countries, the treaty is revised with, control 7 448 Russian legal entities including 337 the largest taxpayers with the annual revenue exceeding 10 billion RUB.

The Cyprus residents control 5 898 companies including 218 the largest taxpayers, and 1 204 entities with 104 the largest taxpayers count for the Netherlands.

Consequences of termination of the double tax treaty with the Netherlands

The double tax treaty with the Netherlands made it possible to withdraw profit from Russia in the form of dividends at the 5% rate, and interest on debenture at the 0% rate. In 2019, 339,9 billion RUB were transferred to the Netherlands in this way. According to the Central bank of Russia, the volume of foreign direct investment in the reinvestment of income from the Netherlands to Russia amounted to 118,6 billion RUB, i.e. 2,9 times less than the withdrawn capital.

Now the rate will be risen to 15% for dividends and to 20% for interest. If a legal entity operates without a permanent establishment, it will be obliged to pay the income tax in two jurisdictions. Moreover, such kind of companies cannot count on the reduction of rates in Netherlands at the distribution of interest and dividends in Russia. Taxes paid in the Netherlands will not be counted for individuals either.

It will be a milestone for the Russian business: it is head for the foreign corporations obtaining profit in Russia to pay taxes at the full rates especially in light of the fact that many of them are of the Russian origin.

The largest taxpayers controlled by the Dutch legal entities:

JSC VIMPEL-COMMUNICATIONS, JSC AVTOVAZ, LLC YANDEX,

JSC FORTUM, LLC CORPORATE CENTER X 5,

JSC TRANSMASHHOLDING, LLC URAL LOCOMOTIVES

Consequences of changes of the double tax treaty with Cyprus

Formally not considered as an offshore zone, Cyprus with its very loyal tax legislation was the most attractive country for large companies of the Russian origin until recently. Over 1,9 trillion RUB were transferred to Cyprus in 2019, while the foreign direct investment in the reinvestment of income from Cyprus to Russia were 3,7 times less and amounted to 512 billion RUB.

A new treaty with Cyprus is already in force since January 1, 2021. The tax rate for dividends was increased form 5% to 15% and for interest – from 0% to 15%. After applied changes, there is the first case of redomicilation. On March 2021, LENTA INTERNATIONAL PUBLIC JOINT-STOCK COMPANY was redomiciled from Cyprus to the special administrative region in Kaliningrad, the major shareholder of LLC LENTA-2, owner of Lenta hypermarket chain.

Special administrative regions or SAR are regions with preferential tax regime located in the islands Russky (Vladivostok) and Oktyabrsky (Kaliningrad). The main purpose of SAR establishment is the repatriation of capital and protection of legal entities from sanctions.

The largest taxpayers controlled by the Cyprus residents are engaged in the metallurgical industry:

JSC NOVOLIPETSK STEEL MILL, JSC MAGNITOGORSK IRON & STEEL WORKS,

JSC PIPE METALLURGICAL COMPANY

Harbors for the Russian business

The Ministry of Finance of Russia plans to start negotiations with Singapore, Switzerland and Hong Kong for changes in double tax treaty. The possible strategy for the holding companies is to have no foreign residents as shareholders, which will lead to reorganization of their corporate structure. Special administrative regions in Vladivostok and Kaliningrad may provide an alternative where there is a 5% tax rate for dividends for public international holding companies (“public IHC”). Moreover, there is a bill on application of this regime for non-public IHC.

The following shareholders of large corporations were established in SAR:

LENTA INTERNATIONAL PUBLIC JOINT-STOCK COMPANY,

OK RUSAL INTERNATIONAL PUBLIC JOINT-STOCK COMPANY,

EN+ GROUP INTERNATIONAL PUBLIC JOINT-STOCK COMPANY,

ROSENERGO INVESTMENTS INTERNATIONAL PUBLIC JOINT-STOCK COMPANY,

INTERNATIONAL COMPANY AKTIVUM shareholder of JSC MMC NORILSK NICKEL)

The creation of special administrative regions is the transfer of international practices of offshore administration to Russia. In the future, this will make it possible not only to re-domicile Russian companies, but also to attract foreign ones. Subject to the revision of the treaties under the terms of Russia, the rate on dividends and interest in foreign jurisdictions will be increased to 15%, and it will be 0-5% in domestic offshores.