On the national payment card system

According to the approved Strategy of Development of the National Payment System (NSPK), the 3rd stage of its development is being implemented now by the decision of the Supervisory board of NSPK JSC of February 6, 2015. The strategy envisages that the 3rd stage (2016-2018) is to focus on the NSPK product line enhancement by offering up-to-date payment products and services, their promotion and expansion on the territory of the Russian Federation. A multifunctional product line of payment products and services of NSPK is to be the key result of this stage, and it will allow NSPK to become competitive against international payment systems.

At the moment the development of NSPK shows the following results:

- 380 banks have joined NSPK, 100 of them issue Mir payment cards. Over 10 mln cards are being held by citizens within Russia. 67 largest trade and service companies (hypermarket chains, gas filling stations and restaurants) accept the national card.

- Since July 1, 2017 Mir cards have been available for use in departments and ATMs of all Russian banks. New employees of budgetary enterprises and old-age pensioners, that are to start receiving their pension benefit, have also begun getting the cards since July 1. Geolocation launched at locator.mironline.ru allows looking up the closest service points of Mir cards.

- The Mir payment system has entered co-badging agreements with Maestro (a MasterCard brand, has limited functions compared to the main one), Japan’s JCB, and has signed corresponding contracts with American Express and Union Pay, China.

- There are ongoing works on certification, adjustment of processing systems, calculation schemes and mechanisms under the pilot project of NSPK and the Armenian payment system ArCa, that provides for a mutual acceptance of national payment cards within both countries’ infrastructure: of ArCa cards in Russia, and Mir cards in Armenia.

However, a survey by the Russia Public Opinion Research Center (VCIOM) has revealed that the population is not ready for the reform. According to the results, about 70% of Russians are not going to get a Mir card at the moment. 3% are holders of the card, and 20% are going to get the card. 78% of Russian citizens are holders of at least one card.

In order to improve the development of NSPK, in future the obligation to accept Mir card is going to be included in the Consumer right protection code. The launch of a cashback service program is expected in autumn 2017. According to the program, every cardholder, regardless of the issuing bank, can get a bonus reward of a certain percent of the purchase by paying with the new Mir card in Russia (for food, fuel, tourism, etc.). Geolocation connected with the loyalty program is to be implemented as the 2nd – 3rd step of 2018, for it requires a rather complicated mechanism.

In addition to this, the first joint project of the international system Visa and national system Mir (possibly the first one within the framework of the Visa – Mir co-badging) is planned to be performed in the form of the VTB’s new Moscow social card, as well as promotion of business relations with Vietnam, United Arab Emirates, the CIS countries, and search for common grounds with a number of European Mediterranean and Central European countries – in order to make it possible to use Mir cards abroad.

After a successful realization of the mutual acceptance of ArCa and Mir cards, similar projects will be implemented in other Eurasian Economic Union countries, Belarus (Belkart payment system) and Kazakhstan (Tengri-card) in particular. Pilot projects in Belarus and Kazakhstan are to start before the end of 2018.

Evidence suggests that NSPK’s development goes in strict adherence to the Strategy. Experts recommend you to check a bank’s reliability in the Information and Analytical system Globas® before getting a Mir payment card.

Current liquidity ratio of the largest Russian enterprises for growing perennial crops

Information agency Credinform prepared a ranking of the largest Russian enterprises growing perennial crops (grapes, citrus fruits and berries). Companies with the highest volume of revenue (TOP-10) were selected for this ranking according to the data from the Statistical Register for the latest available periods (2015 and 2014). The enterprises were ranked by current liquidity ratio in 2015 (Table 1). The analysis was based on data from the Information and Analytical system Globas®

Current liquidity ratio (x) is calculated as current assets to short-term liabilities of the company and shows the adequacy of the enterprise's funds to pay off its short-term obligations.

The recommended value is from 1.0 to 2.0. The value of the indicator less than 1.0 indicates the excess of current liabilities over current working capital. Thus, the lower interval limit is determined by the need to ensure the adequacy of working capital for the full repayment of short-term obligations. Otherwise, the enterprise faces bankruptcy. However, a significant excess of short-term funds over liabilities may indicate a violation of the capital structure and inefficient or non-rational investment of funds.

Taking into account the actual situation both in economy in general and in sectors, the experts of the Information Agency Credinform have developed and implemented in the Information and Analytical System Globas® the calculation of practical values of financial ratios that can be recognized as normal for a particular industry. The practical value of return on sales ratio for enterprises growing perennial crops in 2015 was from 0,36 to 2,45.

For the most complete and objective view of the financial condition of the enterprise it is necessary to pay attention to the complex of presented ratios, financial and other indicators of the company.

| Name, INN, region | Net profit, 2014, bln RUB | Net profit, 2015, bln RUB | Revenue, 2014, bln RUB | Revenue, 2015, bln RUB | R (х) | Solvency index Globas® |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| JSC COLLECTIVE AGRICULTURAL ENTERPRISE SVETLOGORSKOE INN 2323018810 Krasnodar territory | 51,1 | 136,7 | 356,0 | 476,7 | 7,88 | 156 The highest |

| JSC "Agrofirma Imeny 15 Let Oktyabrya" INN 4811004620 Lipetsk region | 224,7 | 377,0 | 717,8 | 956,0 | 7,59 | 285 High |

| ПPJSC AGRONOM INN 2330018225 Krasnodar territory | 84,5 | 248,6 | 481,8 | 703,0 | 6,36 | 134 The highest |

| OOO AGROFIRMA YUBILEINAYA INN 2352039564 Krasnodar territory | 168,0 | 291,6 | 338,2 | 516,9 | 4,96 | 243 High |

| ООО FANAGORIYA-AGRO INN 2352034020 Krasnodar territory | 92,2 | 165,0 | 348,2 | 396,4 | 4,67 | 195 The highest |

| PJSC SAD-GIGANT INN 2349008492 Krasnodar territory | -209,2 | 453,6 | 1 551,1 | 1 891,4 | 1,52 | 1199 The highest |

| JSC TSENTRALNO-CHERNOZEMNAYA PLODOVO-YAGODNAYA KOMPANIYA INN 3662070125 Voronezh region | 56,3 | 159,4 | 476,4 | 626,3 | 1,15 | 234 High |

| JSC AGROFIRMA YUZHNAYA INN 2352000493 Krasnodar territory | 525,3 | 830,2 | 1 321,3 | 1 924,9 | 0,90 | 199 The highest |

| JSC SOVKHOZ IMENI LENINA INN 5003009032 Moscow region | 391,3 | 1 401,3 | 1 415,8 | 958,5 | 0,90 | 210 High |

| JSC SHP VINOGRADNOE INN 2624022231 Stavropol territory | 0,4 | 1,3 | 610,4 | 598,4 | 0,72 | 245 High |

| Total for the group of companies TOP-10 | 1 384,5 | 4 064,5 | 7 617,0 | 9 048,5 | ||

| Average for the group of companies TOP-10 | 138,4 | 406,5 | 761,7 | 904,8 | 3,67 | |

| Industry average value | 1,2 | 3,3 | 15,9 | 17,2 | 1,24 |

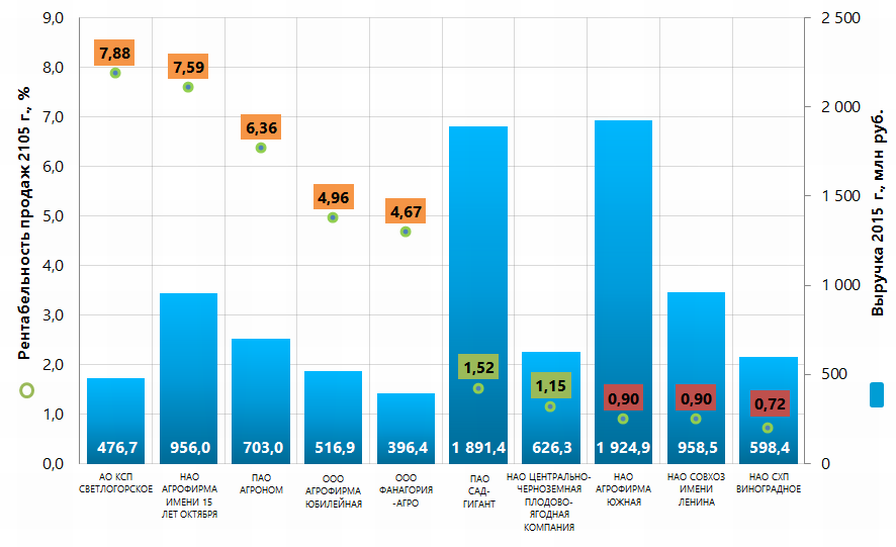

The average value of current liquidity ratio of TOP-10 in 2015 companies is higher than the recommended, practical and average values. Five companies of the TOP-10 have indicators above the upper interval limit of the recommended value, two companies - within the interval and three companies - below the interval values (marked in column 6 of Table 1 and on Picture 1 with yellow, green and red respectively). At the same time, the indicators of the last three companies are within practical limits.

In 2015 all companies of the TOP-10 increased net profit and two companies reduced revenue compared to the previous period (marked with red in column 5 of Table 1).

Picture 1. Current liquidity ratio and revenue of the largest Russian enterprises engaged in growing of perennial crops (TOP-10)

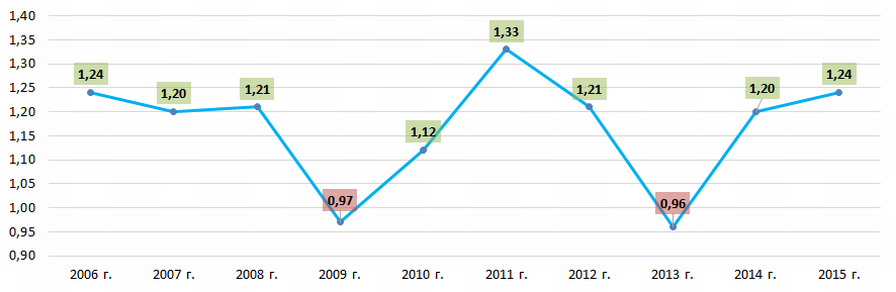

Picture 1. Current liquidity ratio and revenue of the largest Russian enterprises engaged in growing of perennial crops (TOP-10)The average sectoral indicators of current liquidity ratio (Picture 2) are quite stable and within the recommended range, except 2009 and 2013.

Picture 2. Change in the average sectoral values of profitability of sales ratio of the Russian enterprises engaged in growing of perennial crops in 2006 - 2015

Picture 2. Change in the average sectoral values of profitability of sales ratio of the Russian enterprises engaged in growing of perennial crops in 2006 - 2015All TOP-10 companies hot high and the highest Solvency index Globas®, which indicates their ability to timely and fully repay their debt obligations.