Net profit ratio of the largest Russian coal mining companies

Information agency Credinform represents the ranking of Russian coal mining companies. Coal mining enterprises with the largest volume of annual revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available periods (for 2015 - 2017). Then they were ranked by the revenue volume (Table 1). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Proceeds from the sale of goods, products, works, services – these are monetary amounts or material values in monetary terms, obtained as a result of business activities after the sale of goods and services.

Net profit ratio is a relation of net profit (loss) of a company to sales revenue.

The revenue and ratio show the scale of an enterprise and the effectiveness of its business activities. As a rule, the larger is company's revenue, the higher is its resistance to the effects of negative factors that could be crushing for small and micro enterprises. Revenue also indicates the production capacity of an organization, especially if you look at this indicator in dynamics. By adding to the analysis of the net profit ratio, it is possible to assess realistically the competitiveness of the company in the market. A high value of the net profit ratio (above the industry average) characterizes a more successful position of the enterprise in relation to its competitors.

In 2016, about 30% of coal mining companies had the net profit ratio higher than the industry average one, and in 2017 - only 23.8%. This suggests that, in general, the coal industry is not sufficiently effective in terms of the ability of the majority of companies to compete on an equal footing. To a some extent, this is due to a certain concentration: the TOP-10 companies cover 40% of the entire coal mining industry, and the TOP-25 - already more than 65%.

For getting of the most comprehensive and fair picture of the financial standing of enterprises of this sector it is necessary to pay attention to combination of the two considered indicators and take into account the dynamics of their change. The ranking of TOP-10 companies is presented below (Table 1).

| Name, INN, region | Sales revenue, mln RUB | Net profit (loss), mln RUB | Net profit ratio, in % | Solvency index Globas | |||

| 2016 | 2017 | 2016 | 2017 | 2016 | 2017 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| NJSC SUEK-KUZBASS INN 4212024138 Kemerovo region |

105508 105508 |

134255 134255 |

22171 22171 |

30262 30262 |

21 21 |

22,5 22,5 |

204 Strong |

| NJSC COAL COMPANY KUZBASSRAZREZUGOL INN 4205049090 Kemerovo region |

69130 69130 |

85884 85884 |

2690 2690 |

9611 9611 |

3,8 3,8 |

11,1 11,1 |

218 Strong |

| JSC HC YAKUTUGOL INN 1434026980 Republic of Sakha (Yakutia) |

40006 40006 |

41423 41423 |

14051 14051 |

15834 15834 |

35,1 35,1 |

38,2 38,2 |

231 Strong |

| NJSC PREPARATION PLANT RASPADSKAYA INN 4214018690 Kemerovo region |

17527 17527 |

37470 37470 |

843 843 |

503 503 |

4,8 4,8 |

1,3 1,3 |

225 Strong |

| NJSC SIBERIAN ANTHRACITE INN 5406192366 Novosibirsk region |

21485 21485 |

35996 35996 |

2860 2860 |

7795 7795 |

13,3 13,3 |

21,6 21,6 |

205 Strong |

| NJSC RAZREZ TUGNUISKY INN 0314002305 Republic of Buryatia |

32093 32093 |

35049 35049 |

5346 5346 |

5761 5761 |

16,6 16,6 |

16,4 16,4 |

213 Strong |

| NJSC TSENTRALNAYA OBOGATITELNAYA FABRIKA KUZNETSKAYA INN 4218000253 Kemerovo region |

24996 24996 |

34358 34358 |

609 609 |

910 910 |

2,4 2,4 |

2,6 2,6 |

184 High |

| PJSC UGOLNAYA KOMPANIYA YUZHNY KUZBASS INN 4214000608 Kemerovo region |

27758 27758 |

32636 32636 |

7814 7814 |

17926 17926 |

28,1 28,1 |

54,9 54,9 |

233 Strong |

| PJSC KUZBASSKAYA TOPLIVNAYA COMPANY INN 4205003440 Kemerovo region |

21823 21823 |

30237 30237 |

600 600 |

1705 1705 |

2,7 2,7 |

5,64 5,64 |

171 Superior |

| NJSC MEZHDURECHIE INN 4214000252 Kemerovo region |

18907 18907 |

29712 29712 |

11149 11149 |

18026 18026 |

58,9 58,9 |

60,6 60,6 |

197 High |

| Total by TOP-10 companies |  379233 379233 |

497020 497020 |

68132 68132 |

108344 108344 |

|||

| Average value by TOP-10 companies |  37923 37923 |

49702 49702 |

6813 6813 |

10833 10833 |

18,7 18,7 |

23,5 23,5 |

|

| Industry average value |  1652 1652 |

2379 2379 |

203 203 |

386 386 |

12,3 12,3 |

16,2 16,2 |

|

— improvement of the indicator to the previous period,

— improvement of the indicator to the previous period,  — decline in the indicator to the previous period.

— decline in the indicator to the previous period.

The average value of the net profit ratio of TOP-10 companies is above the industry average one. In 2017, all TOP-10 companies improved sales revenue, and in terms of the net profit ratio eight companies increased their efficiency. Moreover, all average values of companies’ indicators improved.

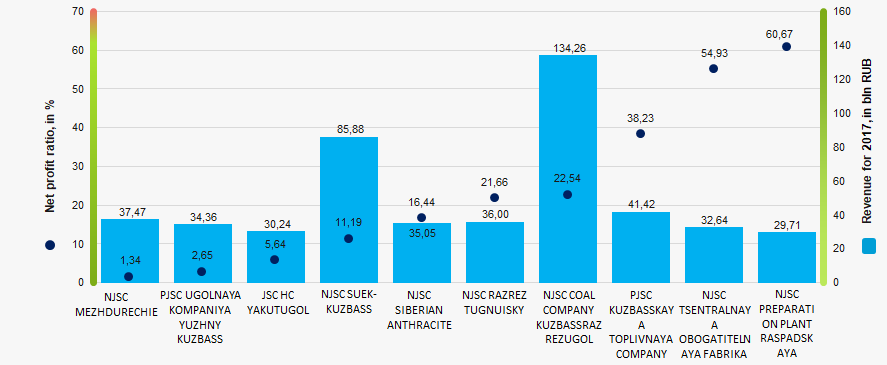

Picture 1. Net profit ratio and revenue of the largest Russian coal mining companies (TOP-10)

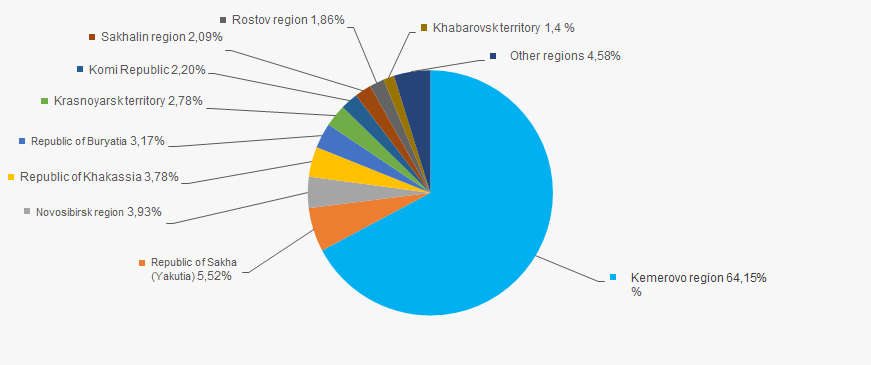

Picture 1. Net profit ratio and revenue of the largest Russian coal mining companies (TOP-10)67,2% of the total revenue of the industry in 2017 was generated by enterprises located in Kemerovo region (Picture 2). At the same time, only 34% of coal mining companies operate in this region. This indicates that namely Kemerovo region is the locomotive of the coal industry. The second place in terms of revenue takes the Republic of Sakha (Yakutia). It accounts for 5,8% of total consolidated revenue and 3,6% of companies.

Picture 2. Distribution of regions by share in total revenue in 2017

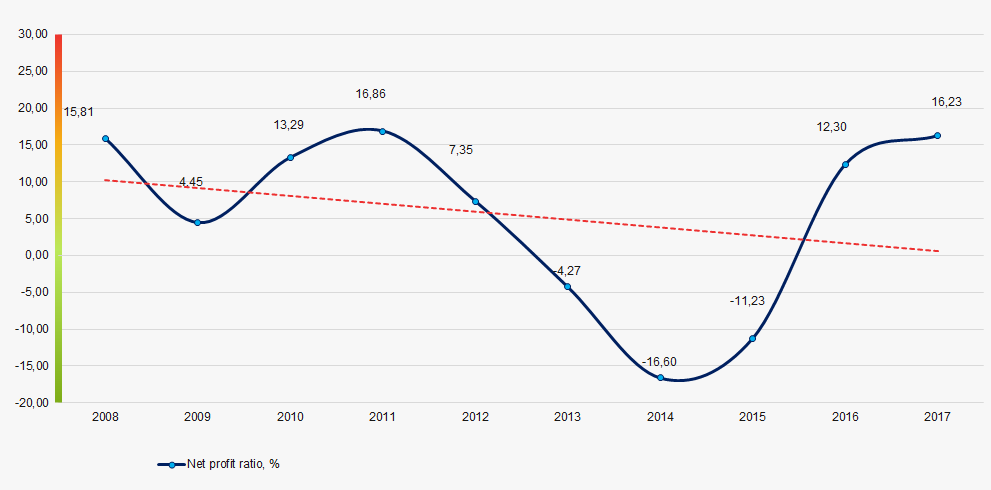

Picture 2. Distribution of regions by share in total revenue in 2017For 10 years, industry average values of the net profit ratio have a certain stability, except for the crisis years (picture 3). In general, the industry was able to cope with the recession of 2013-2015 and reach the pre-crisis level of the net profit ratio.

Picture 3. Change in industry average values of the net profit ratio of Russian coal mining companies in 2008–2017

Picture 3. Change in industry average values of the net profit ratio of Russian coal mining companies in 2008–2017Trends in tourism

Information agency Credinform has prepared a review of trends in tourism. The largest Russian travel agencies (TOP-10 and TOP-1000) in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2015 - 2017). The analysis was based on data of the Information and Analytical system Globas.

Net assets is a ratio reflecting the real value of company's property. It is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The ratio is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

| № | Name, INN, region | Net assets value, bln RUB | Solvency index Globas | ||

| 2015 | 2016 | 2017 | |||

| 1 | 2 | 3 | 4 | 5 | 6 |

| 1 | JSC TOURIST COMPLEX KLJASMA LAKE INN 5029026466 Moscow region |

5,48 |  5,33 5,33 |

5,08 5,08 |

212 Strong |

| 2 | ПVAO INTOURIST INN 7703016416 Moscow |

4,62 |  3,99 3,99 |

3,39 3,39 |

310 Adequate |

| 3 | LLC VODOHOD INN 7707511820 Moscow |

1,83 |  2,25 2,25 |

2,11 2,11 |

192 High |

| 4 | LLC LITEINYI 5 INN 7838397950 Saint Petersburg |

1,06 |  1,10 1,10 |

1,17 1,17 |

175 High |

| 5 | LLC KEYSUSTEMS TOUR INN 2130119586 Chuvash Republic |

1,06 |  1,10 1,10 |

1,17 1,17 |

241 Strong |

| 996 | LLC SVOY TOUR AND TRAVEL INN 7730633954 Moscow |

-0,14 |  -0,12 -0,12 |

-0,12 -0,12 |

290 Medium |

| 997 | LLC VEGA INN 0256021810 Republic of Bashkortostan |

-0,11 |  -0,11 -0,11 |

-0,12 -0,12 |

367 Adequate |

| 998 | LLC HOTEL AND TOURIST COMPLEX LADOGA ESTATE INN 1007021940 Republic of Karelia |

-0,10 |  -0,11 -0,11 |

-0,14 -0,14 |

349 Adequate |

| 999 | LLC NTC INTOURIST INN 7717678890 Moscow |

-0,08 |  -0,02 -0,02 |

-0,21 -0,21 |

315 Adequate |

| 1000 | LLC TT-TRAVEL INN 7714775020 Moscow |

-4,34 |  -3,75 -3,75 |

-4,96 -4,96 |

306 Adequate |

— growth indicator in comparison with prior period,

— growth indicator in comparison with prior period,  — decline indicator in comparison with prior period.

— decline indicator in comparison with prior period.

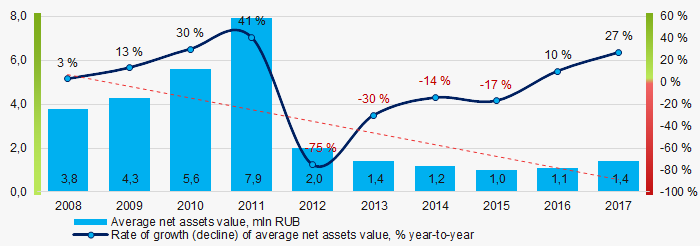

For the last ten years, the average values of TOP-1000 net assets showed the decreasing tendency (Picture 1).

Picture 1. Change in average net assets value of travel agencies in 2008 – 2017

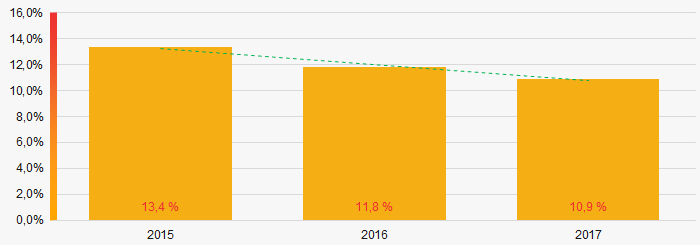

Picture 1. Change in average net assets value of travel agencies in 2008 – 2017For the last three years, the share of enterprises with lack of property is decreasing (Picture 2).

Picture 2. The share of enterprises with negative net assets value in ТОP-1000 in 2015 – 2017

Picture 2. The share of enterprises with negative net assets value in ТОP-1000 in 2015 – 2017 Sales revenue

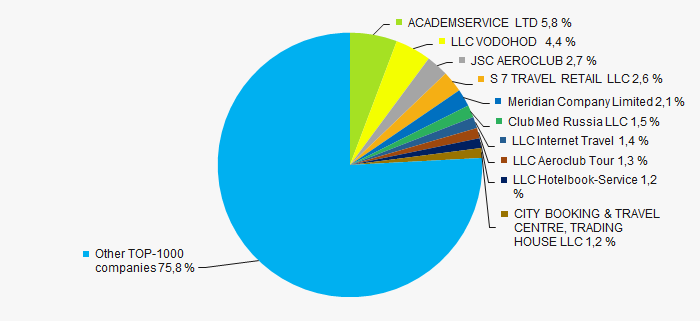

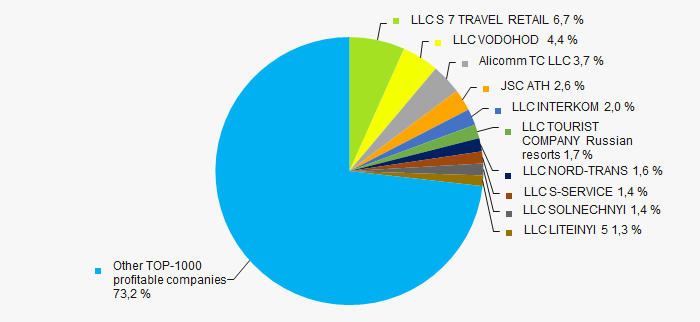

In 2017, the total revenue of 10 largest companies amounted to 24% from ТОP-1000 total revenue (Picture 3). This fact testifies high level of competition within the industry.

Picture 3. Shares of TOP-10 in TOP-1000 total revenue for 2017

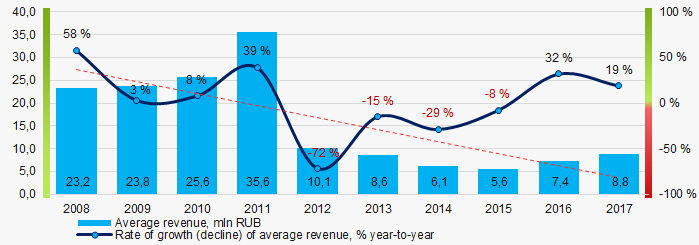

Picture 3. Shares of TOP-10 in TOP-1000 total revenue for 2017In general, over a ten-year period the decrease in average sales revenue is observed (Picture 4).

Picture 4. Change in average revenue of travel agencies in 2008 – 2017

Picture 4. Change in average revenue of travel agencies in 2008 – 2017Profit and loss

In 2017 profit of 10 largest companies amounted to 27% from TOP-1000 total profit (Picture 5).

Picture 5. Shares of TOP-10 companies in TOP-1000 total profit for 2017

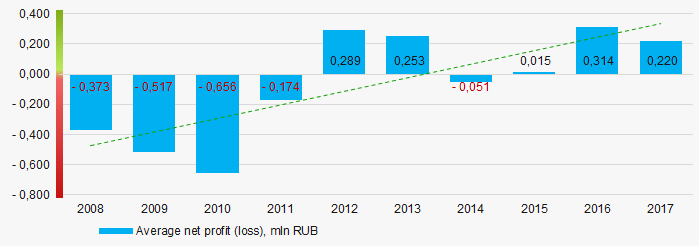

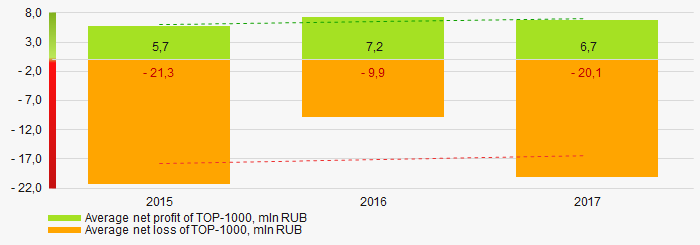

Picture 5. Shares of TOP-10 companies in TOP-1000 total profit for 2017For the last ten years, the average net profit values show the growing tendency (Picture 6).

Picture 6. Change in average net profit of travel agencies in 2008 – 2017

Picture 6. Change in average net profit of travel agencies in 2008 – 2017Over a three-year period, the average net profit values of ТОP-1000 show the growing tendency, along with this the average net loss decreases (Picture 6).

Picture 7. Change in average profit/loss of ТОP-1000 companies in 2015 – 2017

Picture 7. Change in average profit/loss of ТОP-1000 companies in 2015 – 2017 Main financial ratios

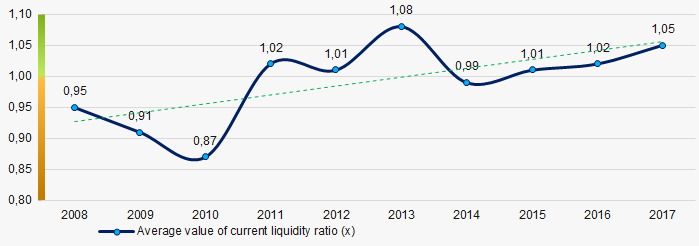

For the last ten years, the average values of the current liquidity ratio were within the recommended values - from 1,0 to 2,0, with growing tendency (Picture 8).

The current liquidity ratio (ratio of total working capital to short-term liabilities) shows the sufficiency of company’s assets to meet short-term obligations.

Picture 8. Change in average values of current liquidity ratio of travel agencies in 2008 – 2017

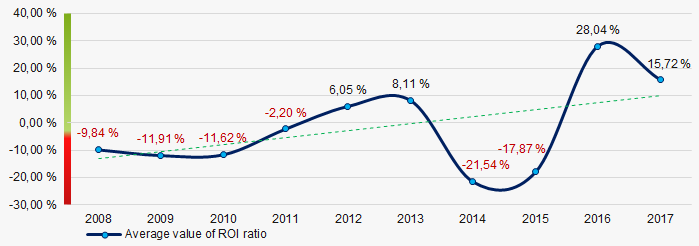

Picture 8. Change in average values of current liquidity ratio of travel agencies in 2008 – 2017 For the last ten years, the average values of ROI ratiowere mostly negative with growing tendency (Picture 9).

The ROI ratio is calculated as a ratio of net profit to sum of stockholder equity and long-term liabilities and shows the return from equity involved in commercial activities and long-term borrowed funds.

Picture 9. Change in average values of ROI ratio in 2008 – 2017

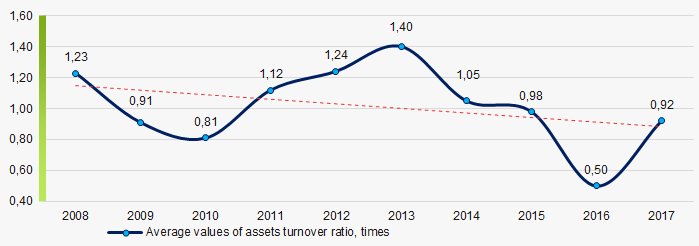

Picture 9. Change in average values of ROI ratio in 2008 – 2017Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

For the last ten years, this business activity ratio demonstrated the downward trend (Picture 10).

Picture 10. Change in average values of assets turnover ratio of travel agencies in 2008 – 2017

Picture 10. Change in average values of assets turnover ratio of travel agencies in 2008 – 2017 Production structure

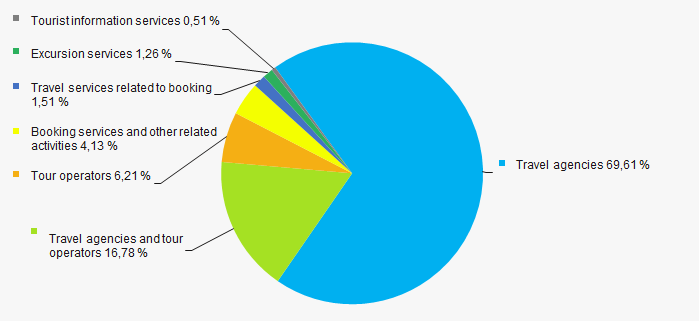

The largest share of ТОP-1000 total revenue is occupied by the enterprises engaged in travel agency services (Picture 11).

Picture 11. Distribution of activities in ТОP-1000 total revenue

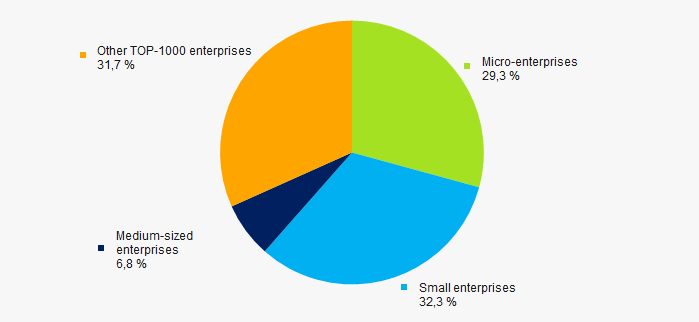

Picture 11. Distribution of activities in ТОP-1000 total revenue94% of ТОP-1000 companies are registered in the Unified register of small and medium-sized enterprises of the Russian Federal Tax Service. Herein, in 2017 their share in TOP-1000 total revenue amounted to 68%, it is significantly higher than indicator for the economy as a whole (Picture 12).

Picture 12. Shares of small and medium-sized enterprises in ТОP-1000, %

Picture 12. Shares of small and medium-sized enterprises in ТОP-1000, %Main regions of activity

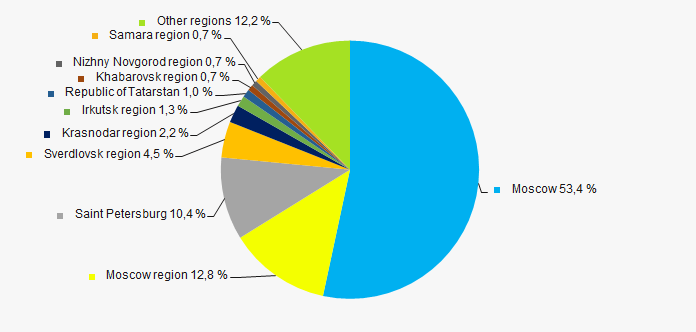

ТОP-1000 companies are unequally located across the country and registered in 70 regions of Russia. More than 76% of the largest enterprises in terms of revenue are located in Moscow, Moscow region and Saint Petersburg Picture 13).

Picture 13. Distribution of TOP-1000 revenue by the regions of Russia

Picture 13. Distribution of TOP-1000 revenue by the regions of RussiaFinancial position score

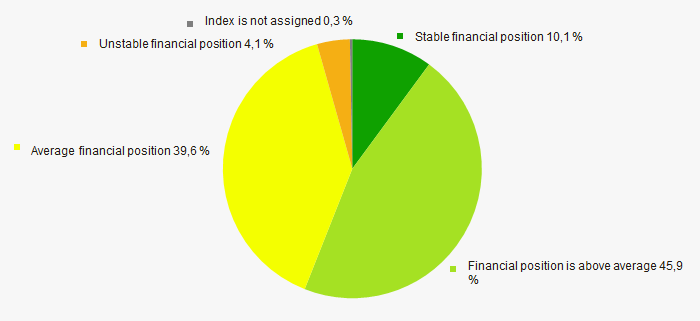

An assessment of the financial position of TOP-1000 companies shows that more than a half of them have stable or above average financial position (Picture 14).

Picture 14. Distribution of TOP-1000 companies by financial position score

Picture 14. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

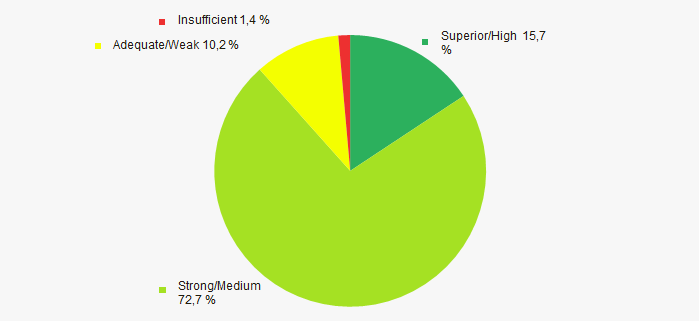

Most of TOP-1000 companies got superior/high or strong/medium Solvency index Globas, this fact shows the ability of the companies to meet their obligations in time and fully (Picture 15).

Picture 15. Distribution of TOP-1000 companies by Solvency index Globas

Picture 15. Distribution of TOP-1000 companies by Solvency index Globas Conclusion

A complex assessment of activity of the largest Russian travel agencies, taking into account the main indexes, financial ratios and indicators, demonstrates the presence of favorable trends (Table 2).

| Trends and assessment factors | Relative share, % |

| Growth/drawdown rate of average net assets value |  -10 -10 |

| Increase / decrease in the share of enterprises with negative net assets |  10 10 |

| Growth/drawdown rate of average revenue |  -10 -10 |

| Competition/ monopolization level |  10 10 |

| Growth/drawdown rate of average net profit (loss) |  10 10 |

| Increase / decrease in average net profit of TOP-1000 companies |  10 10 |

| Increase / decrease in average net loss of TOP-1000 companies |  10 10 |

| Increase / decrease in average values of current liquidity ratio |  10 10 |

| Increase / decrease in average values of ROI ratio |  10 10 |

| Increase / decrease in average values of assets turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses in the industry by revenue more than 30% |  10 10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of factors |  4,3 4,3 |

— favorable trend (factor),

— favorable trend (factor),  — unfavorable trend (factor).

— unfavorable trend (factor).