Solvency ratio of the largest Russian manufacturers of packaging

Information agency Credinform has prepared a ranking of the largest Russian manufacturers of packaging. The companies with the largest annual revenue (TOP-10) have been selected for the ranking, according to the data from the Statistical Register for the latest available accounting periods (2016, 2015 and 2014). Then they have been ranked by solvency ratio (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Solvency ratio (x) is a ratio of shareholders’ equity to total assets, and it shows the dependence of the company on external loans. Its recommended value: > 0,5. A value less than a minimum one is indicative of dependence on external sources of funds, which may result in a liquidity crisis, unstable financial standing in the event of economic downturn.

The whole set of indicators and financial ratios is to be considered in order to get a full and comprehensive insight into a company’s financial standing.

| Name, INN, region | Revenue, million RUB | Net profit, million RUB | Solvency ratio (x), > 0,5 | Solvency index Globas | |||

| 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| National Enterprise Naberezhnochelninsky paperboard plant S.P.Titov NJSC INN 1650017638 Republic of Tatarstan |

8 268 | 9 418 | 1 283 | 1 262 | 0,89 | 0,89 | 148 Superior |

| AR Carton NJSC INN 2353017002 Krasnodar territory |

5 579 | 6 199 | 778 | 668 | 0,60 | 0,84 | 130 Superior |

| ALPLA LLC INN 5056000026 Moscow region |

6 695 | 7 679 | 787 | 1 180 | 0,54 | 0,76 | 136 Superior |

| Stora Enso Packaging BB LLC INN 4003014954 Kaluga region |

6 595 | 7 733 | 903 | 1 415 | 0,56 | 0,74 | 148 Superior |

| Smurfit Kappa Saint Petersburg NJSC INN 4703029321 Leningrad region |

5 451 | 6 347 | 250 | 481 | 0,66 | 0,70 | 144 Superior |

| ARKHBUM NJSC INN 2903003430 Arkhangelsk region |

6 169 | 7 650 | 217 | 817 | 0,47 | 0,57 | 176 High |

| Tetra Pak NJSC INN 7706017070 Moscow |

39 018 | 39 663 | 2 643 | 4 744 | 0,26 | 0,43 | 177 High |

| Huhtamaki CIS LLC INN 7724000760 Moscow region |

5 074 | 6 261 | 151 | 591 | 0,23 | 0,35 | 202 Strong |

| RETAL NJSC INN 7704521059 Moscow region |

16 073 | 15 118 | 705 | 657 | 0,30 | 0,26 | 203 Strong |

| GOTEK NJSC INN 4633000037 Kursk region |

5 789 | 6 695 | 159 | 77 | 0,00 | 0,01 | 232 Strong |

| Total for TOP-10 | 104 710 | 112 762 | 7 876 | 11 893 | |||

| Average value for TOP-10 | 10 471 | 11 276 | 788 | 1 189 | 0,45 | 0,56 | |

| Average value for TOP-1000 | 345 | 386 | 14 | 21 | |||

Average value of solvency ratio for TOP-10 companies in 2016 is above the recommended value. Six of TOP-10 companies increased their revenue and net profit in 2015 – 2016 2016 compared to prior period (highlighted green in columns 2 – 5 of Table 1). Other companies had a decrease in revenue or net profit (highlighted red in columns 2 – 5 of Table 1).

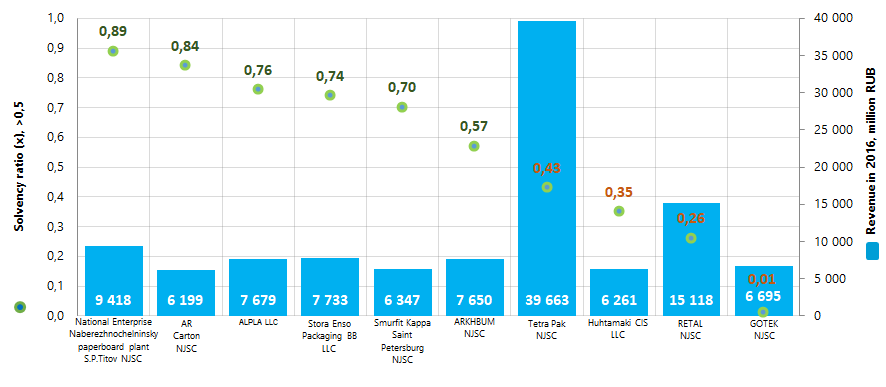

Picture 1. Solvency ratio and revenue of the largest Russian manufacturers of packaging (TOP-10)

Picture 1. Solvency ratio and revenue of the largest Russian manufacturers of packaging (TOP-10)Activity trends of information and communication hardware wholesalers

Information Agency Credinform has observed the trends in activity for information and communication hardware wholesalers.

The largest enterprises (TOP-10 and TOP-1000) in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2015 and 2016). The analysis was based on data of the Information and Analytical system Globas.

Net assets

Indicator of real cost of corporate assets, which is annually calculated as the difference between assets of the company and its debt liabilities. Net assets indicator is considered negative (insufficiency of property), if the company’s debts exceed net worth value.

| № in the TOP-1000 list | Name, INN, region | Net assets value, mln RUB* | Solvency index Globas | ||

| 2014 | 2015 | 2016 | |||

| 1 | 2 | 3 | 4 | 5 | 6 |

| 1. | LLC APPLE RUS INN 7707767220 Moscow |

1 428,4 | 9 154,5 | 15 606,6 | 196 High |

| 2. | OCS-CENTER LIMITED INN 7701341820 Moscow |

3 367,0 | 4 707,4 | 5 103,4 | 213 Strong |

| 3. | JSC CROC INCORPORATED INN 7701004101 Moscow |

3 253,8 | 3 285,2 | 3 367,7 | 188 High |

| 4. | COMPLETE COMPANY, LTD INN 7810793872 Saint-Petersburg |

1 206,8 | 2 349,3 | 2 556,4 | 175 High |

| 5. | JSC JET INFOSYSTEMS INN 7729058675 Moscow |

541,9 | 1 084,3 | 2 286,9 | 162 Superior |

| 996. | LLC D-LINK TRADE INN 6229040685 Ryazan region |

12,1 | -225,5 | -61,5 | 298 Medium |

| 997. | Technologies, systems and complexes Limited INN 7701922888 Moscow |

-101,0 | -100,9 | -61,7 | 302 Adequate |

| 998. | LLC KORDEIL INN 7811533531 Saint-Petersburg |

1,4 | -87,5 | -62,4 | 302 Adequate |

| 999. | JSC R-STYLE INN 7715037964 Moscow |

110,3 | 126,3 | -104,6 | 342 Adequate |

| 1000. | MARVEL COMPANY LIMITED INN 7811070820 Moscow |

315,2 | 324,6 | -757,1 | 600 Insufficient (Process of being wound up, 01.06.2017) |

*) – growth/decline indicators compared to previous period are marked with green and red filling in columns 4 and 5 respectively.

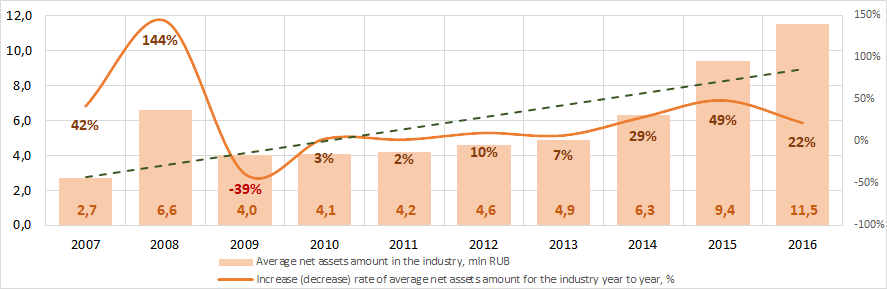

Picture 1. Change in average net assets value of information and communication hardware wholesalers in 2007 – 2016

Picture 1. Change in average net assets value of information and communication hardware wholesalers in 2007 – 2016Sales revenue

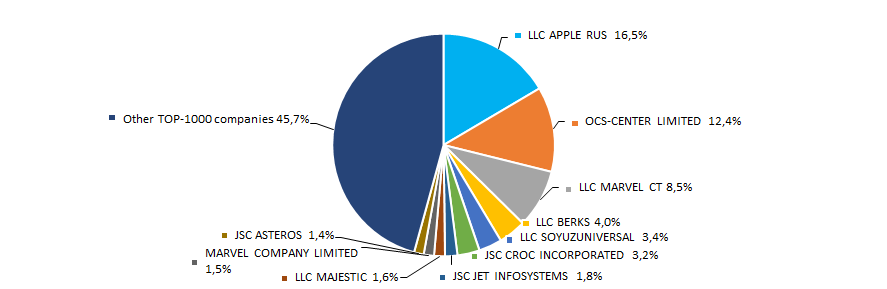

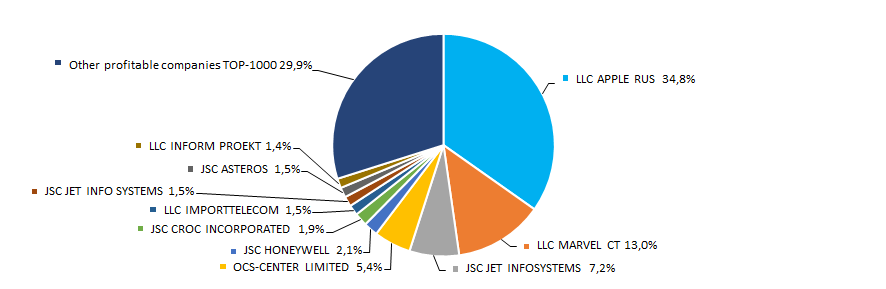

In 2016 total revenue of 10 leaders of the industry amounted to 54% from TOP-1000 total revenue. This fact shows relatively low level of competition among the industry (Picture 2).

Picture 2. Shares of TOP-10 companies in TOP-1000 total revenue for 2016

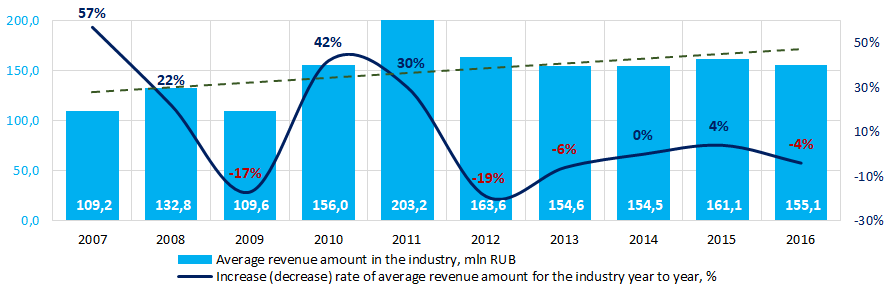

Picture 2. Shares of TOP-10 companies in TOP-1000 total revenue for 2016In general, the increasing tendency in sales revenue is observed (Picture 3).

Picture 3. Change in average revenue of information and communication hardware wholesalers in 2007 – 2016

Picture 3. Change in average revenue of information and communication hardware wholesalers in 2007 – 2016Profit and loss

Profit of 10 leading companies in the industry was 70% from TOP-1000 total profit in 2016 (Picture 4).

Picture 4. Shares of TOP-10 companies in TOP-1000 total profit for 2016

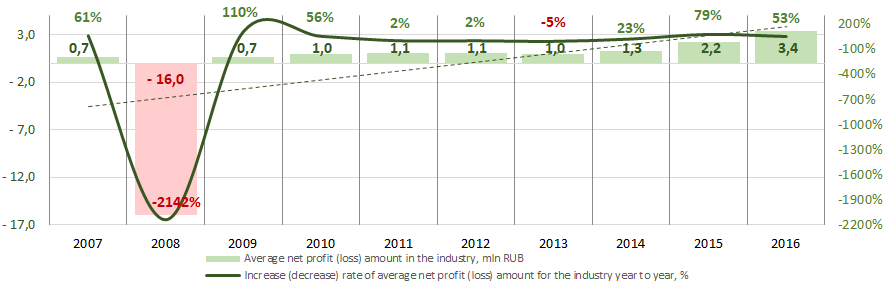

Picture 4. Shares of TOP-10 companies in TOP-1000 total profit for 2016For the ten-year period, the average industrial profit values have increasing tendency (Picture 5).

Picture 5. Change in average industrial profit values of the information and communication hardware wholesalers in 2007 – 2016

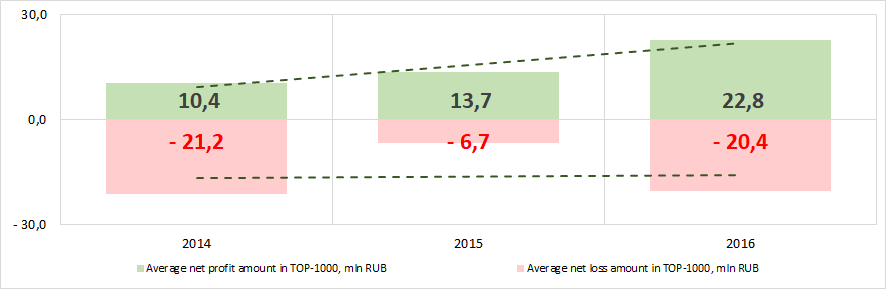

Picture 5. Change in average industrial profit values of the information and communication hardware wholesalers in 2007 – 2016For the three-year period, the average profit indicators of TOP-1000 companies show the growing tendency and the average net loss decreases (Picture 6).

Picture 6. Change in average profit/loss of the information and communication hardware wholesalers in 2007 – 2016

Picture 6. Change in average profit/loss of the information and communication hardware wholesalers in 2007 – 2016Key financial ratios

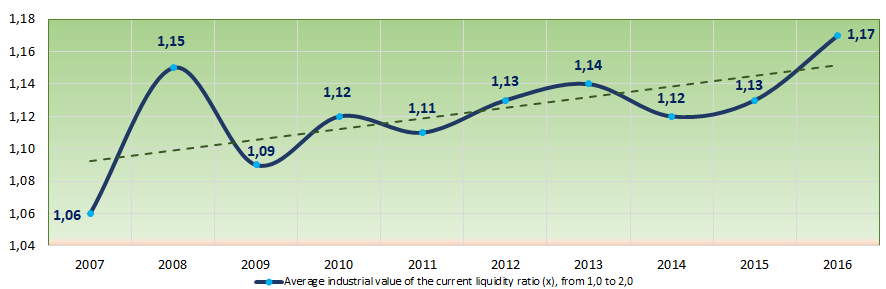

For ten years average indicators of the current liquidity ratio in the industry were within the interval of the recommended values – from 1,0 to 2,0 (Picture 7). In general, indicator of the ratio has increasing tendency.

Current liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

The experts of Information Agency Credinform, having taken into account the current situation in the economy as a whole and in the industries, has been developed and implemented in the Information and Analytical system Globas a calculation of practical values of financial ratios, which might be considered as normal for a certain industry. For the information and communication hardware wholesalers practical value of the current liquidity ratio was from 1,02 to 3,00 in 2016.

Picture 7. Change in average industrial values of current liquidity ratio of the information and communication hardware wholesalers in 2007 – 2016

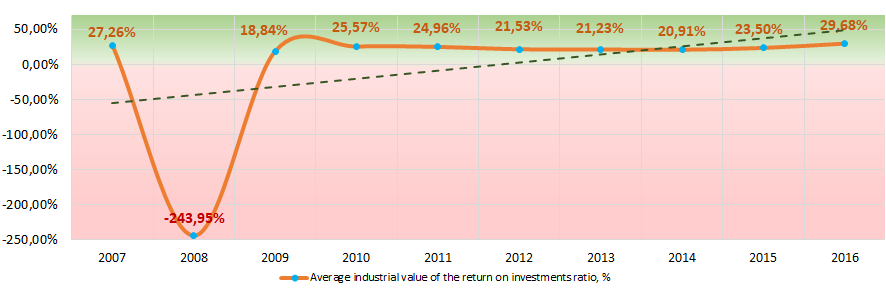

Picture 7. Change in average industrial values of current liquidity ratio of the information and communication hardware wholesalers in 2007 – 2016For the eight-year period, the instability of indicators of the return on investments ratio with increasing tendency is observed (Picture 8). The return on investments ratio ratio is calculated as a ratio of net profit to sum of equity and long-term liabilities and shows the return from equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average industrial values of the return on investments ratio of the information and communication hardware wholesalers in 2007 – 2016

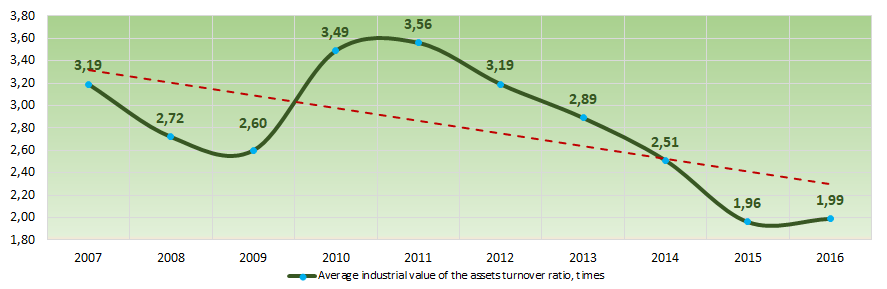

Picture 8. Change in average industrial values of the return on investments ratio of the information and communication hardware wholesalers in 2007 – 2016Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period and characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation, generating profit, is performed.

For the ten-year period, this business activity ratio demonstrated, in general, the decreasing trend (Picture 9).

Picture 9. Change in average industrial values of the assets turnover ratio of the information and communication hardware wholesalers in 2007 – 2016

Picture 9. Change in average industrial values of the assets turnover ratio of the information and communication hardware wholesalers in 2007 – 2016Production and services structure

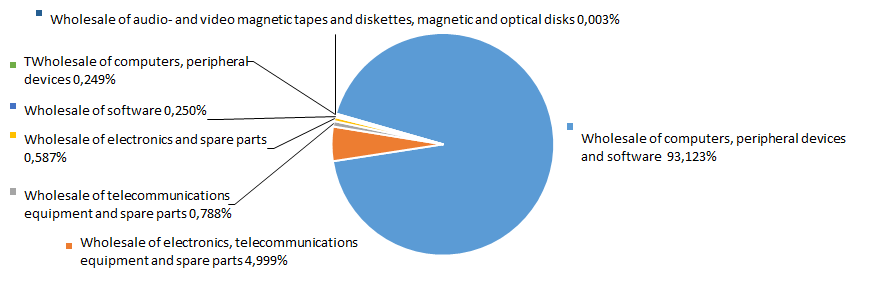

The largest share in TOP-1000 total revenue take companies engaged in wholesale of computers, peripheral devices and software (Picture 10).

Picture 10. Distribution of activity types in TOP-1000 total revenue, %

Picture 10. Distribution of activity types in TOP-1000 total revenue, %Main regions of activity

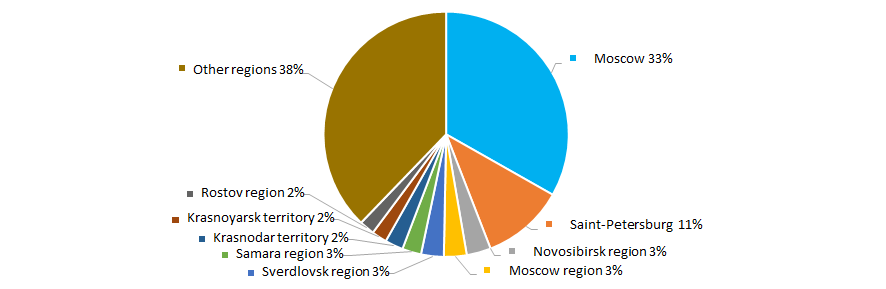

Companies TOP-1000 are distributed unequally on the territory of the country and registered in 64 regions (Picture 11).

Picture 11. Distribution of TOP-1000 companies throughout regions of Russia

Picture 11. Distribution of TOP-1000 companies throughout regions of RussiaFinancial position score

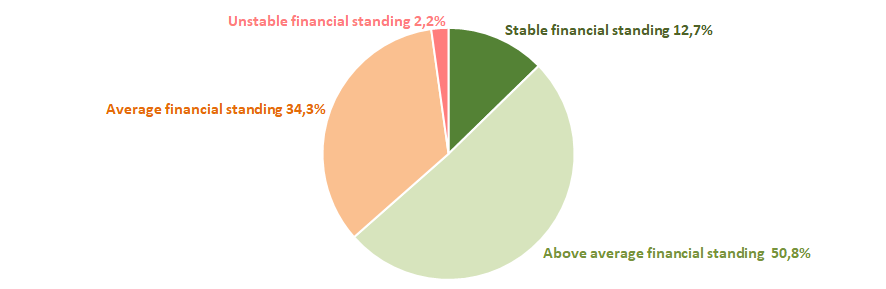

The assessment of TOP-1000 financial position shows that major part has stable or above average financial position (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

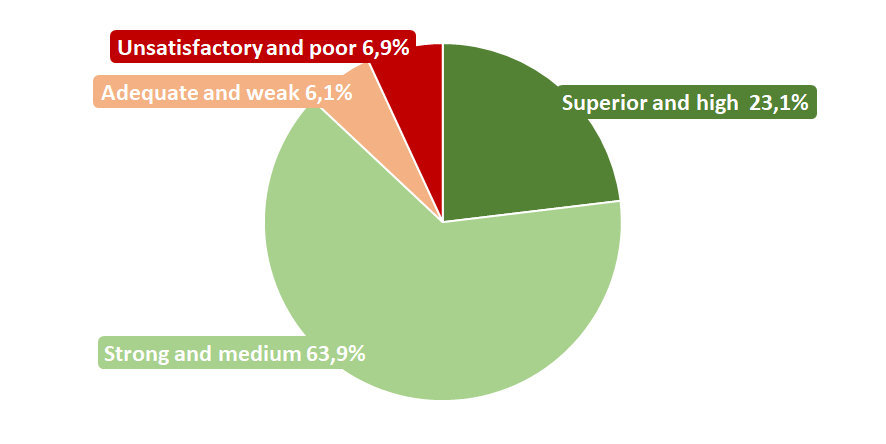

The majority of TOP-1000 companies have got from superior to medium solvency index Globas, this fact shows the ability of the companies to pay their debts in time and fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by solvency index Globas

Picture 13. Distribution of TOP-1000 companies by solvency index GlobasTherefore, the complex assessment of the information and communication hardware wholesalers, taking into account main indexes, financial indicators and ratios, demonstrates the domination of favorable trends in the industry.