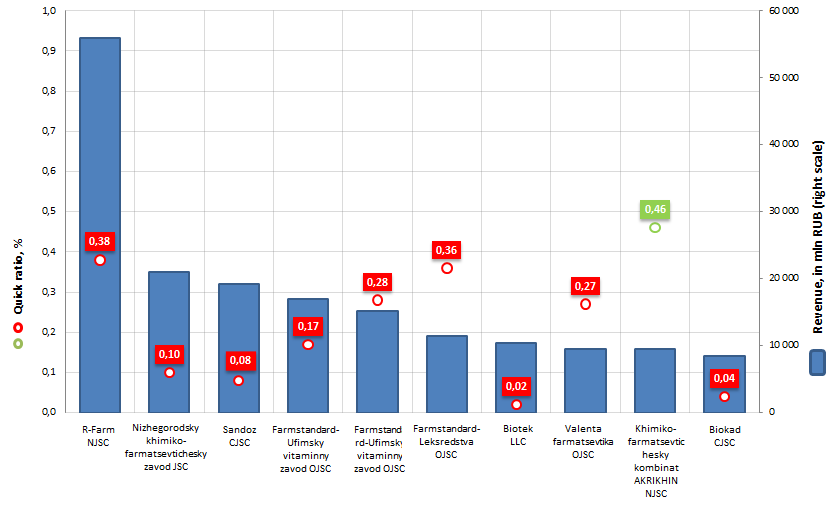

Quick ratio of the largest pharmaceutical companies of Russia

Information agency Credinform prepared a ranking of the largest pharmaceutical companies of Russia.

The TOP-10 list of enterprises was drawn up for the ranking on the volume of revenue, according to the data from the Statistical Register for the latest available period (for the year 2014). These enterprises were ranked by decrease in turnover; the data on the dynamic of revenue related to the previous period, quick ratio and solvency index GLOBAS-i® are represented (see the Table 1).

Quick ratio is an indicator, which characterizes the solvency of a company in the short/medium term; the ratio makes it possible to determine whether an enterprise will be able to repay its short-term liabilities due to the most liquid assets: cash, short-term receivables, short-term investments.

Recommended value is from 0,5 up to 0,8.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to the average value of indicators in the industry, but also to all presented combination of financial indicators and company’s ratios.

| № | Name | Region | Revenue, in mln RUB, for 2014 | Increase of revenue,% | Quick ratio, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|---|

| 1 | R-Farm NJSC INN 7726311464 |

Moscow | 55 918,8 | 21,2 | 0,4 below standard | 208 high |

| 2 | Nizhegorodsky khimiko-farmatsevtichesky zavod JSC INN 5260900010 |

Nizhny Novgorod region | 20 925,3 | 13,2 | 0,1 below standard | 219 high |

| 3 | Sandoz CJSC INN 7717011640 |

Moscow | 19 158,8 | 7,5 | 0,1 below standard | 285 high |

| 4 | Farmstandard-Ufimsky vitaminny zavod OJSC INN 0274036993 |

Republic of Bashkortostan | 16 925,0 | -32,9 | 0,2 below standard | 193 the highest |

| 5 | FarmstandardPJSC INN 0274110679 |

Moscow region | 15 216,6 | -32,5 | 0,3 below standard | 255 high |

| 6 | Farmstandard-Leksredstva OJSC INN 4631002737 |

Kursk region | 11 477,3 | -27,7 | 0,4 below standard | 208 high |

| 7 | Biotek LLC INN 7713053544 |

Moscow | 10 340,1 | -10,4 | 0,0 below standard | 307 satisfactory |

| 8 | Valenta farmatsevtika OJSC INN 5050008117 |

Moscow region | 9 534,0 | 38,4 | 0,3 below standard | 174 the highest |

| 9 | Khimiko- farmatsevtichesky kombinat AKRIKHIN NJSC INN 5031013320 |

Moscow region | 9 440,9 | 16,4 | 0,5 standard | 196 the highest |

| 10 | Biokad CJSC INN 5024048000 |

Saint Petersburg | 8 387,8 | 180,3 | 0,0 below standard | 214 high |

The quick ratio of the largest pharmaceutical manufacturers (except Khimiko- farmatsevtichesky kombinat AKRIKHIN NJSC) does not stay within the recommended lower limit interval: current liabilities of companies exceed the most liquid part of the balance, that, under certain conditions, could lead them to a non-payments crisis.

Picture 1. Quick ratio and revenue of the largest pharmaceutical companies of Russia (TOP-10)

The annual revenue of the participants of the TOP-10 list amounted to 177,3 bln RUB at the end of 2014, that is higher by the symbolic 1,0% than the consolidated figure of the same enterprises in the previous reporting period (mainly this is due to a drop in revenue of the group of companies Pharmstandard). Taking into account the inflation, the industry is stagnating. The policy of import substitution, which is realized via imitative «shake-out» from the market of foreign players, has to change the trend of the development of the pharmaceutical industry.

Since the 10th of December the restrictions on the public procurement of imported drugs come into force. The new rules will affect purchases «for provisioning governmental and municipal needs with drugs included in the list of vital and essential medicines». If an imported drug can be replaced by Russian equivalent (generic) or analogs from the member countries of the Eurasian Economic Union, a customer shall reject all applications, containing proposals for the supply of drugs, which come from foreign countries. The list includes 608 medicines.

It is said also in the document, that before the end of 2016 the restrictions do not apply to medicines, for which the package is made in the territories of the states - members of the Eurasian Economic Union.

Earlier, it was pointed out in the Cabinet of Ministers, that the measure «is aimed at the development of domestic production of drugs». According to the officials, two-thirds of essential medicines have already been produced in Russia.

However, any restrictions are of problematic nature: it is noticed, that the Russian equivalents have more side effects and less quality than original imported drugs. Moreover, there is a risk that during public procurement our suppliers will split the difference and dictate the prices. And the «elimination» of unnecessary competitors will not contribute to investments in developments.

SRO should enter the financial market in 2016

Currently, there are several definitions of the concept of «self-regulatory organization». The following one is among the most precise definitions:

Self-regulatory organization (SRO) is a non-profit organization that joins business entities based on the unity of production branch of goods, works and services or the market of produced goods and services, or that joins the subjects of professional activity of a certain kind.

The basic document, which regulates relations, arising in connection with the acquisition and termination of the status of self-regulatory organizations, the activity of SROs, cooperation between SROs and their members, consumers of goods, works and services produced by them, is the federal law №315-FZ "On self-regulatory organizations» dated 01.12.2007, in force as of 24.11.2014.

The functions of SROs include:

1) development and establishment of conditions for the membership in SRO;

2) disciplinary action;

3) resolution of disputes between members;

4) analysis of the activity of its members;

5) representation of interests of members of SRO;

6) professional training;

7) insurance of transparency;

8) supervision of compliance with standards and rules of SRO;

9) examination of complaints;

10) maintenance of the register of members.

By 2015, the analysis of organizations and the situation in the financial market has shown the necessity of the establishment of SRO in it. In July 2015 the Federal Law №223-FZ «On self-regulatory organizations in field of the financial market and on amendments to Articles 2 and 6 of the Federal Law «On introducing amendments to certain legislative acts of the Russian Federation» has been adopted. The effect of this law extends to SROs, joining financial institutions engaged in certain types of activity (brokers, dealers, depositaries, insurance companies, microfinance institutions, pawnshops etc).

Currently, analysts assess positively the creation of SRO in the financial market. The following arguments are declared among others:

- self-regulation is a convenient mechanism for cooperation between the Central Bank and market participants;

- SRO may apply the standards, regulatory rules by direct participation of its members;

- separation of the regulation between the Central Bank and SRO will help not limit creative developments of market participants etc.

Moreover, the developed standards and rules of SRO in the financial market may be more stringent, than by the mega-regulator. Participation in SRO can be also considered as a sign of quality for a customer.

Perhaps this is why the Central Bank considers the development of SRO in the financial market as a «mega-ambitious goal». The law will come into force since the 1st of January 2016. The Central Bank will regulate depending on the scope of financial institution and specific of its activity. However, SRO express readiness for oversight functions already today.