Return on investment of the largest Russian manufacturers of electrical equipment

Information agency Credinform represents the ranking of the largest Russian manufacturers of electrical equipment. The enterprises with the largest volume of annual revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available periods (for 2014 and 2015). Then they were ranked by the return on investments (Table 1). The analysis was made based on data of the Information and analytical system Globas.

Return on investment (ROI ratio, %) is calculated as a ratio of net profit (loss) to the value of net assets. The indicator characterizes the level of profitability from investments, i.e. the amount of monetary units required by an enterprise for receiving one monetary unit of net profit. With the help of this indicator it is possible to assess the advisability of raising of borrowed funds at a certain percent.

Normative values for profitability indicators are not provided, because they vary, depending on the industry, in which an enterprise operates. The indicators of each particular company should be considered in comparison with industry indicators.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all combination of company’s indicators and financial ratios.

| Name, INN, region | Net profit, mln RUB. * | Revenue, mln RUB * | ROI ratio, % | Solvency index Globas | ||||

| 2014 | 2015 | 2016 | 2014 | 2015 | 2016 | |||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| BEKO LIMITED LIABILITY COMPANY INN 7804157910 Vladimir region |

944 | 1 191 | 1 041 | 9 344 | 9 577 | 10 989 | 24,68 | 213 High |

| KAMSKII KABEL LLC INN 5904184047 Perm territory |

10 | 465 | 115 | 19 325 | 21 422 | 23 517 | 20,14 | 263 High |

| NAO ELEKTROKABEL KOLCHUGINSKII ZAVOD INN 3306007697 Vladimir region |

49 | 526 | 345 | 8 473 | 10 518 | 11 064 | 18,96 | 206 High |

| LIMITED LIABILITY COMPANY ELKAT INN 7722018271 Moscow |

352 | 206 | 135 | 8 472 | 8 505 | 7 628 | 14,93 | 226 High |

| LIMITED LIABILITY COMPANY LG ELECTRONICS RUS INN 5075018950 Moscow region |

2 096 | 2 471 | 7 330 | 97 690 | 80 695 | 82 415 | 13,97 | 186 The highest |

| PAO PROIZVODSTVENNOE OByEDINENIE ZAVOD IMENI SERGO INN 1648032420 Republic of Tatarstan |

-44 | 416 | н/д | 5 886 | 9 942 | н/д | 6,86 | 173 The highest |

| NAO INDESIT INTERNATIONAL INN 4823005682 Lipetsk region |

-101 | 280 | 963 | 16 277 | 16 473 | 18 737 | 2,75 | 223 High |

| PAO THE INCORPARATED ELECTROTECHNICAL PLANTS INN 7716523950 Moscow |

3 | 5 | -261 | 9 002 | 8 917 | 10 594 | 0,17 | 242 High |

| NAO GRUPPA KOMPANII ELEKTROSHCHIT -TM SAMARA INN 6313009980 Samara region |

-110 | -673 | -3 037 | 18 718 | 15 541 | 13 807 | -6,79 | 293 High |

| BSH BYTOWIJE PRIBORY LLC INN 7819301797 St. Petersburg |

-926 | -531 | 426 | 8 005 | 10 118 | 30 964 | -42,22 | 293 High |

| Total by TOP-10 companies | 2 272 | 4 355 | 201 193 | 191 709 | ||||

| Average value by TOP-10 companies | 227 | 436 | 20 119 | 19 171 | 5,35 | |||

| Industry average value | 2 | 16 | 192 | 179 | 6,82 | |||

*)Data for 2016 are provided for reference.

The average indicator of the return on investment of TOP-10 companies is below the industry average. Two firms have a negative value of the indicator. Eight from the TOP-10 companies reduced revenue or net profit in 2015 - 2016 in comparison with the previous period or have losses (are marked with red filling in columns 3, 4, 6 and 7 in Table 1).

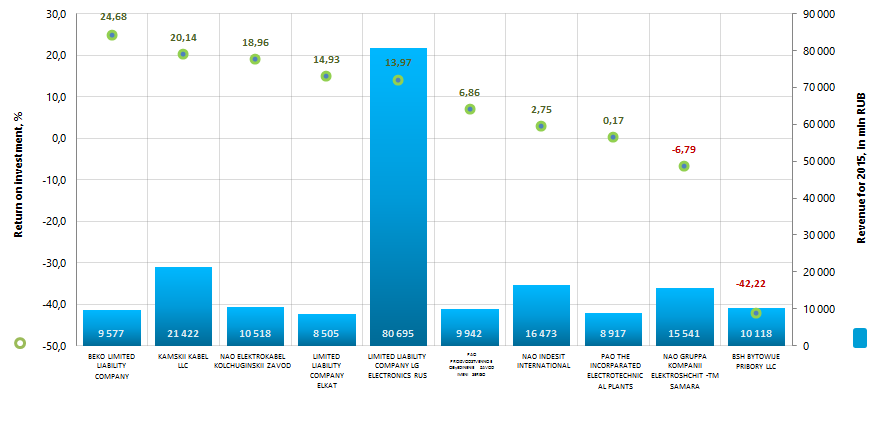

Picture 1. Return on investment ratio (ROI ratio,%) and revenue of the largest Russian manufacturers of electrical equipment (TOP-10)

Picture 1. Return on investment ratio (ROI ratio,%) and revenue of the largest Russian manufacturers of electrical equipment (TOP-10)The industry average values of the ROI ratio in the period 2006 - 2015 reflect macroeconomic trends, decreasing during crisis developments (Picture 2).

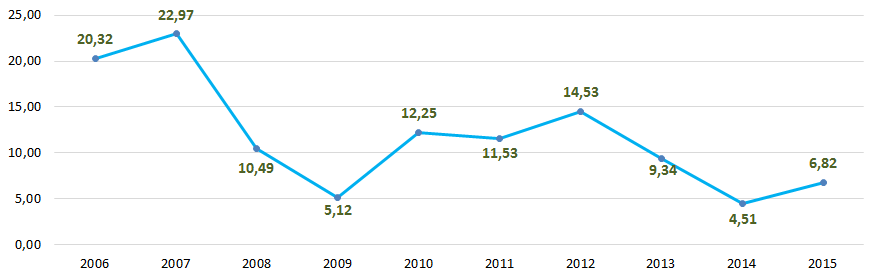

Picture 2. Change in the average industry values of the return on investment ratio of Russian manufacturers of electrical equipment in 2006 - 2015

Picture 2. Change in the average industry values of the return on investment ratio of Russian manufacturers of electrical equipment in 2006 - 2015All TOP-10 companies got the highest or high solvency index Globas, that testifies to their ability to repay their debt obligations timely and fully.

The old familiar

The advertising market has preserved the status quo

A recently finished tender, which had been put on hold since 2013, has made no significant change in the balance of power in Saint Petersburg outdoor advertising market.

Less advertisement, the same players. A competitive tender for the right for outdoor advertisement installation for a 10 years period has been held four years past the originally set date. The contracts for using of 14,500 structures expired in 2013, but the tender has been postponed several times due to discussion of introduction of an outdoor advertisement state standard (GOST, effective from March 2016), and due to litigation between the city and the operators. The results of the tender that will boost the city budget by 1.13 billion rubles are hardly unexpected: the market leaders have kept their position. However, the largest operators, namely Russ Outdoor, Poster and Reklama-Center, will have to pay 80% more for placement, but the amount of advertisement is to reduce by 40%: advertising above the roadways will disappear, and its amount in the historical center of the city will plummet. The number of tender’s competitors totaled 17.

The last stand. An order of the Federal Antimonopoly Service (FAS) to set the tender aside was the result of complaints of several companies against the terms and conditions of the tender. It may become the only obstacle for contracts conclusion following the tender’s results. City authorities have refused to follow the FAS’s order, so the parties are to meet at court, the first hearing is to be held at the end of September. However, St. Petersburg authorities are not going to wait for the court’s decision, and intend to execute contracts with the operators before the hearings. For that purpose, the tender winners will transfer to the treasury 100% of the annual payment and a 5% payment security for every subsequent year.

A refreshed market. The most of experts agree that the tender was successful both for the operators in the advertising market and for St. Petersburg in general. The status quo preserved in the market provides vast opportunities for business development, and the Northern Capital becomes one of the most attractive advertising spaces in the country. At the same time, the city has managed to save jobs and, despite the reduction of the amount of structures, to get a substantial growth in the treasury’s revenue. Nevertheless, if the litigation between the Smolny and the FAS caused by the unsuccessful operators’ discontent drags on, the process may involve other operators that have concluded contracts, and their interests will be violated if the tender is cancelled. The annulment of tender results may become devastating for the market, and analysts suppose this scenario to be unlikely. However, we are about to find out the look of the refreshed outdoor advertisement market of St. Petersburg.

A well-known idea that advertising drives sales has never been so relevant. When you enter into a contract for advertising services, make sure that the operator you have chosen is credible, is not a fraudster or a fly-by-night company. You will get help in the Information and Analytical system Globas® of the Information Agency Credinform, that contains data concerning over 24 mln legal entities and individual entrepreneurs of Russia and all over the world, and a wide range of analytical tools that help to find the best-performing business partners promptly and efficiently.