Trends in the activity of Dagestani companies

Information agency Credinform represents an overview of activity trends of the largest companies in the real sector of the economy of the Republic of Dagestan.

The enterprises with the largest volume of annual revenue in the real sector of the economy of the Republic of Dagestan (TOP-10 and TOP-1000) were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2012 - 2017). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net assets are an indicator, reflecting the real value of company’s property, is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

| № | Name, INN, type of activity |

Net assets value, bln RUB |

Solvency index Globas | ||||

| 2013 | 2014 | 2015 | 2016 | 2017 | |||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 1 | KIZLYARSKII KONYACHNYI ZAVOD PJSC INN 0547011052 Production of distilled drinking alcoholic beverages: vodka, whiskey, brandy, gin, liqueurs, etc. |

4.42 4.42 |

4.69 4.69 |

5.00 5.00 |

5.37 5.37 |

5.52 5.52 |

231 Strong |

| 2 | GAZPOM TRANSGAZ MAKHACHKALA LLC INN 0500000136 Transportation of gas and products of its processing through pipelines |

5.32 5.32 |

4.64 4.64 |

4.66 4.66 |

4.39 4.39 |

н/д | 208 Strong |

| 3 | DERBENT COGNAC PLANT NJSC INN 0542003065 Production of food alcohol |

3.73 3.73 |

4.04 4.04 |

4.14 4.14 |

4.35 4.35 |

4.45 4.45 |

218 Strong |

| 4 | MAKHACHKALINSKII MORSKOI TORGOVYI PORT NJSC INN 0573008521 Cargo handling |

1.85 1.85 |

1.79 1.79 |

1.91 1.91 |

1.89 1.89 |

0.60 0.60 |

268 Medium |

| 5 | DAGNEFTEGAS NJSC INN 0515012247 Extraction of natural gas and gas condensate |

1.34 1.34 |

1.53 1.53 |

1.66 1.66 |

1.61 1.61 |

1.47 1.47 |

289 Medium |

| 996 | MAKHACHKALAVODOKANAL PJSC INN 0560037035 Distribution of water for drinking and industrial needs |

-0.14 -0.14 |

-0.36 -0.36 |

-0.60 -0.60 |

-0.83 -0.83 |

-1.06 -1.06 |

317 Adequate |

| 997 | GAZPROM GAZORASPREDELENIE DAGESTAN INN 0561049072 Transportation of gas through pipelines |

-1.98 -1.98 |

-2.65 -2.65 |

-3.42 -3.42 |

-3.89 -3.89 |

-4.58 -4.58 |

340 Adequate |

| 998 | DAGESTANSKAYA SETEVAYA KOMPANIYA NJSC INN 2632800485 Transmission of electricity and technological connection to distribution networks |

0.03 0.03 |

0.00 0.00 |

-1.15 -1.15 |

-4.49 -4.49 |

-8.85 -8.85 |

350 Adequate |

| 999 | CASPIAN FLAT GLASS NJSC INN 0522016027 Production of flat glass Case on declaring the company bankrupt (insolvent) is proceeding |

-0.57 -0.57 |

-3.00 -3.00 |

-6.06 -6.06 |

-6.90 -6.90 |

-10.24 -10.24 |

550 Insufficient |

| 1000 | DAGESTANSKAYA ENERGOSBYTOVAYA KOMPANIYA PJSC INN 0541031172 Sale of electric power |

-8.91 -8.91 |

-10.87 -10.87 |

-14.92 -14.92 |

-18.47 -18.47 |

-24.23 -24.23 |

309 Adequate |

— increase in the indicator to the previous period,

— increase in the indicator to the previous period,  — decrease in the indicator to the previous period.

— decrease in the indicator to the previous period.

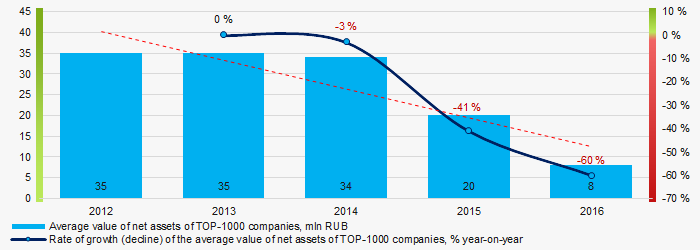

The average values of net assets of TOP-1000 enterprises tend to decrease over the five-year period (Picture 1).

Picture 1. Change in average indicators of the net asset value of TOP-1000 companies in 2012 – 2016

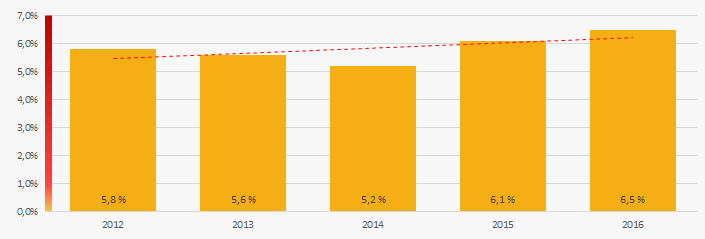

Picture 1. Change in average indicators of the net asset value of TOP-1000 companies in 2012 – 2016The share of enterprises with insufficiency of assets tend to grow over the five-year period (Picture 2).

Picture 2. Share of enterprises with negative values of net assets in TOP-1000

Picture 2. Share of enterprises with negative values of net assets in TOP-1000Sales revenue

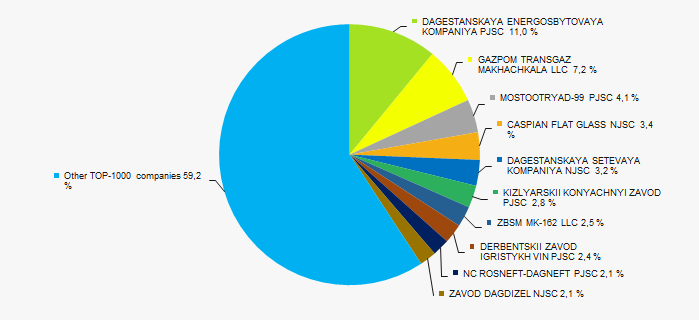

The revenue volume of 10 industry leaders made 41% of the total revenue of TOP-1000 companies in 2016. (Picture 3). It points to a relatively high level of capital concentration in the Republic of Dagestan.

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 enterprises for 2016

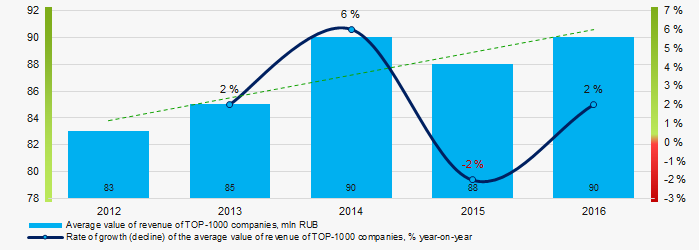

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 enterprises for 2016In general, there is a trend towards an increase in revenue volume (Picture 4).

Picture 4. Change in the average revenue of TOP-1000 companies in 2012 – 2016 годах

Picture 4. Change in the average revenue of TOP-1000 companies in 2012 – 2016 годахProfit and losses

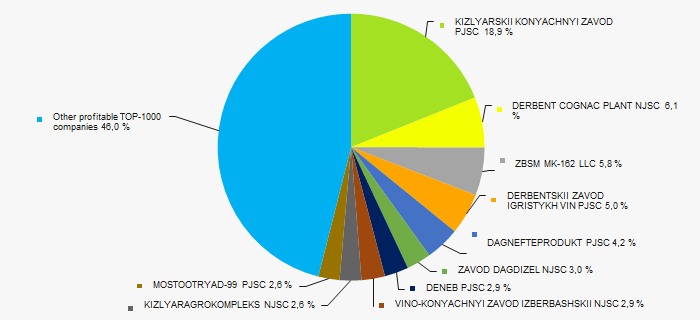

The profit volume of 10 industry leaders made 54% of the total profit of TOP-1000 companies in 2016 (Picture 5).

Picture 5. Shares of participation of TOP-10 companies in the total volume of profit of TOP-1000

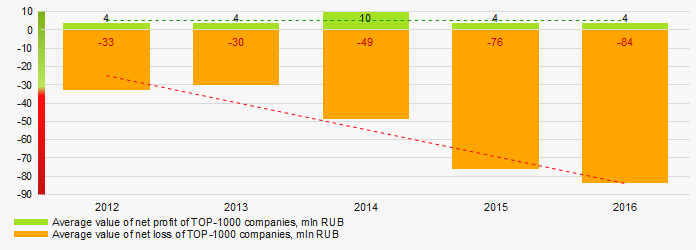

Picture 5. Shares of participation of TOP-10 companies in the total volume of profit of TOP-1000Average values of net profit’s indicators of TOP-1000 companies do not to increase over the five-year, while the average size of net loss increases (Picture 6).

Picture 6. Change in the average values of indicators of profit and loss of TOP-1000 companies in 2012 – 2016

Picture 6. Change in the average values of indicators of profit and loss of TOP-1000 companies in 2012 – 2016Key financial ratios

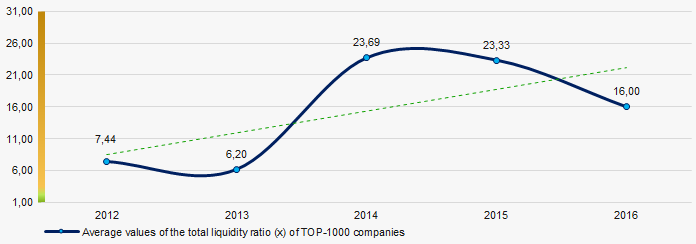

Over the five-year period the industry average indicators of the total liquidity ratio were much higher than the interval of recommended values - from 1.0 up to 2.0, with a tendency to increase (Picture 7).

The total liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 7. Change in average values of the total liquidity ratio of TOP-1000 companies in 2012 – 2016

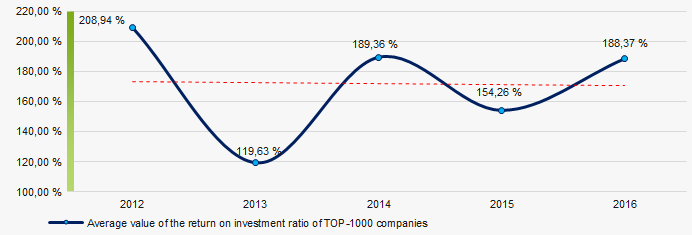

Picture 7. Change in average values of the total liquidity ratio of TOP-1000 companies in 2012 – 2016There is a high level of average values of the return on investment ratio within five years, with a tendency to some decrease return on investment ratio within five years, with a tendency to some decrease (Picture 8).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity of own capital and the long-term borrowed funds of an organization.

Picture 8. Change in average values of the return on investment ratio of TOP-1000 companies in 2012 – 2016

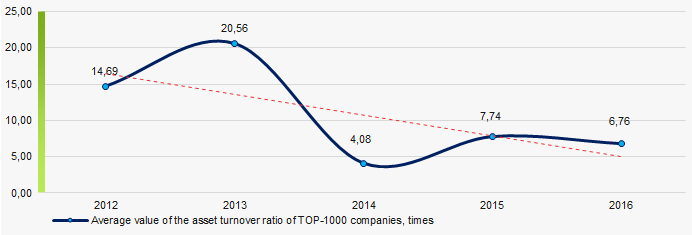

Picture 8. Change in average values of the return on investment ratio of TOP-1000 companies in 2012 – 2016Asset turnover ratio is calculated as the relation of sales proceeds to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

This ratio of business activity showed a tendency to decrease over the five-year period (Picture 9).

Picture 9. Change in average values of the asset turnover ratio of TOP-1000 companies in 2012 – 2016

Picture 9. Change in average values of the asset turnover ratio of TOP-1000 companies in 2012 – 2016Production structure

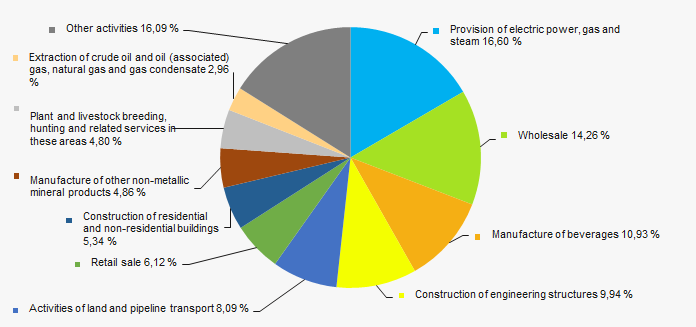

The largest share in the total revenue of TOP-1000 is owned by companies, specializing in provision of electric power, gas and steam, as well as wholesale (Picture 10).

Picture 10. Distribution of types of activity in the total revenue of TOP-1000 companies

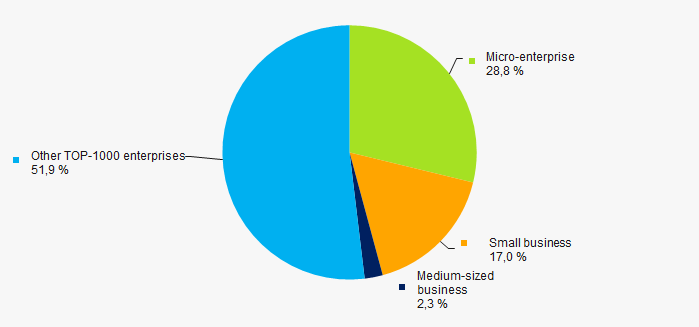

Picture 10. Distribution of types of activity in the total revenue of TOP-1000 companies48% of TOP-1000 companies are registered in the Register of small and medium-sized businesses of the Federal Tax Service of the RF (Picture 11).

Picture 11. Shares of small and medium-sized businesses in TOP-1000 companies

Picture 11. Shares of small and medium-sized businesses in TOP-1000 companiesFinancial position score

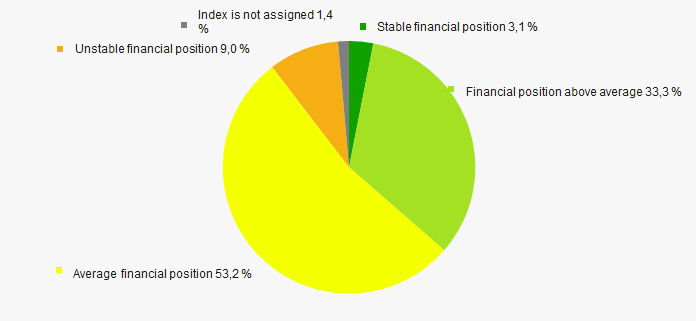

An assessment of the financial position of TOP-1000 companies shows that their the largest number are in the average financial position (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

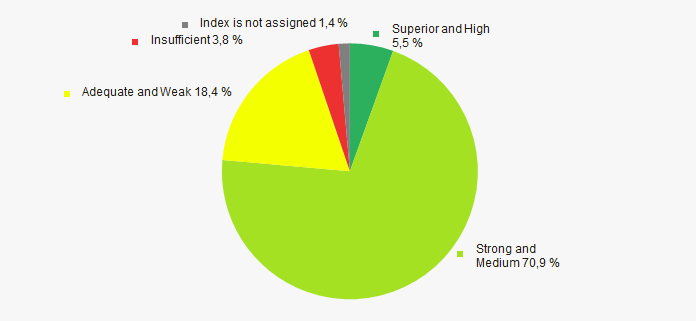

Most of TOP-1000 companies got Strong or Medium Solvency index Globas, that points to their ability to pay off their debts in time and fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by solvency index Globas

Picture 13. Distribution of TOP-1000 companies by solvency index Globas Conclusion

A comprehensive assessment of activity of the largest companies in the real sector of the economy of the Republic of Dagestan, taking into account the main indices, financial indicators and ratios, points to favorable trends, such as revenue growth, a high level of total liquidity and return on investment ratios. However, alarming and negative factors are: decrease in the average size of net assets and an increase in the share of companies with insufficiency of property, growing net losses, trends in the decline in the return on investment and asset turnover ratios

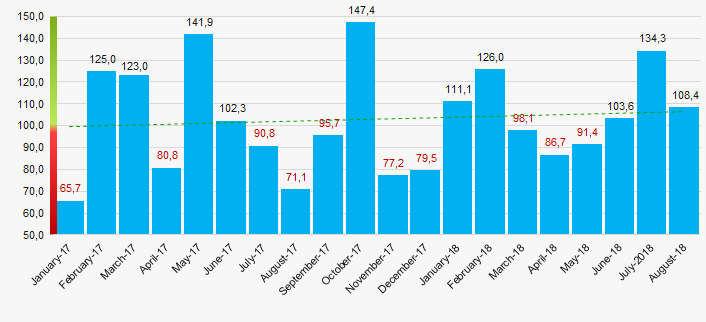

According to the Federal Service of State Statistics, there is a tendency to increase the industrial production index in the Republic of Dagestan in 2017 – 2018, higher than Russia average. Thus, for 8 months of 2018 the industrial production index increased on average by 7,5%, and in general for the period 2017 - 2018 - by 3% (Picture 14).

Picture 14. Industrial production index in the Republic of Dagestan in 2017 – 2018, month-over-month (%)

Picture 14. Industrial production index in the Republic of Dagestan in 2017 – 2018, month-over-month (%)According to the same information, the share of the Republic of Dagestan in the amount of proceeds from the sale of goods, products, works, services countrywide made 0,06% for 8 months of 2018.

Get out of debts

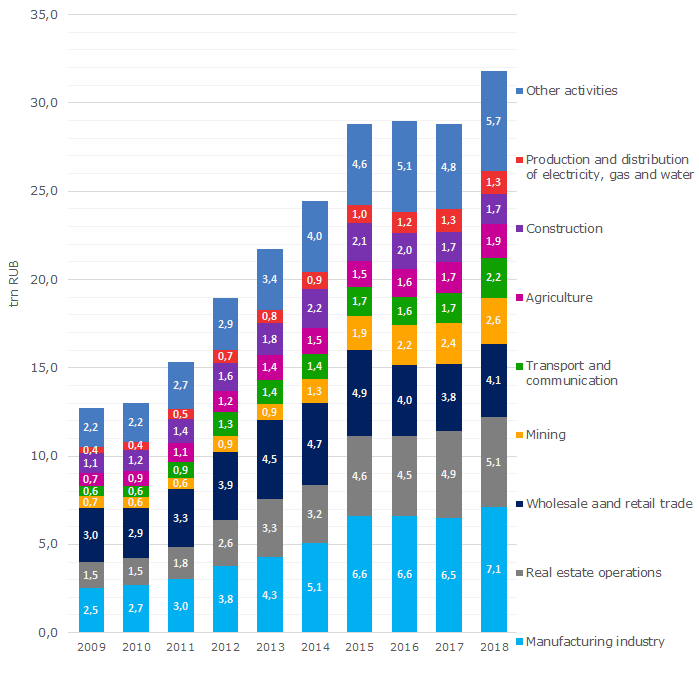

According to the Bank of Russia, loan debt of the Russian corporate sector by September has reached historical peak of 31,8 trn RUB or 35% of the GDP. Compared to the same period of 2017, debts have increased by 10,5%.

To get funding is one of the key challenges hindering the development of business in Russia. The problem of business funding remains relevant throughout the company’s life.

According to the survey by Rosstat, 35% of executives brought insufficient funds to notice, 27% pointed at high interest rate, and 50% of respondents mentioned low demand on products.

The situation is that companies take credits while insufficient demand negatively affects the revenue. As a result, there is a need in additional financial resources, which are increasingly difficult to be serviced.

Following the reduction of the key rate to 7,25% by the Bank of Russia this year, loan debt growth has quicken noticeably. Companies began active borrowing of money after the period of 2015-2017 when the average debt was at the level of 28,8 trn RUB (see Picture 1). Processing enterprises have the highest size of indebtedness – 7,1 trn RUB.

For the past 4 years credit indebtedness in manufacturing industry increased by 40% at the industrial-production growth by about 6.8% for the same period.

In general, companies of all sectors of domestic economy accumulate debts at a fast pace. However due to historically low mortgage rates and deferred housing demand, the construction sector has noticeable increase in the number of real estate buyers, and credit indebtedness is gradually going down.

Picture 1. Dynamics of credit indebtedness by sectors, according to the Bank of Russia on September 1 of each year

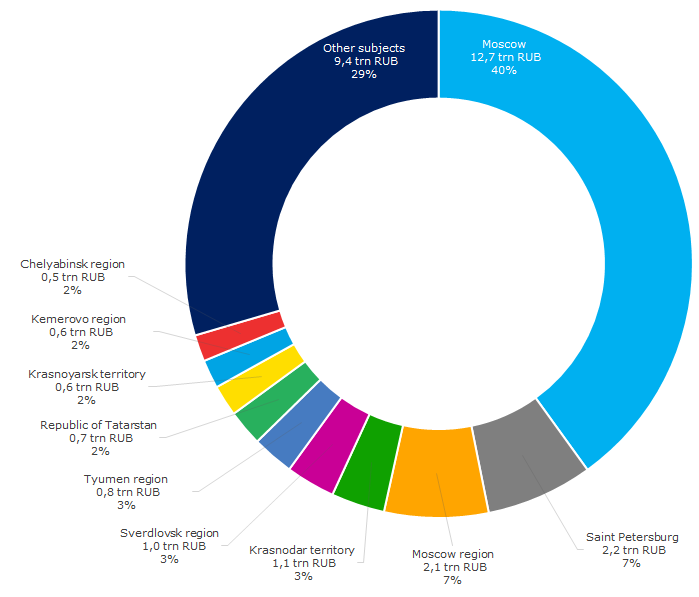

Picture 1. Dynamics of credit indebtedness by sectors, according to the Bank of Russia on September 1 of each yearThe highest credit indebtedness is accumulated by companies in Moscow – 12,4 trn RUB or over 40% of total debt. It bears mentioning that only 21% of all active legal entities in Russia are registered in Moscow, that speaks for disproportion in allocation of business. The bulk of business leaders are located in the capital. Significantly less investment, credit and debt in raw numbers fall for the share of regions. Saint Petersburg with loan debts of 2,1 trn RUB is ranked the second.

According to the Information and Analytical system Globas, total debt to banks and counterparties of Moscow companies for 2017 reached 44,2 trn RUB, and 5,8 trn RUB – of companies in Saint Petersburg.

Picture 2. Credit indebtedness by regions as of 01.09.2018

Picture 2. Credit indebtedness by regions as of 01.09.2018The highest average amount of credit indebtedness per 1 company is in Yamal-Nenets autonomous district – 35 mln RUB, Tyumen region – 19 mln RUB, and Chukotka autonomous district – 15 mln RUB (see Table 1).

As of 01.09.2018, the average credit indebtedness of legal entities throughout Russia amounted to 8 mln RUB, 15 mln RUB in Moscow, and 7 mln RUB in Saint Petersburg.

Table 1. Average credit indebtedness per 1 company, as of 01.09.2018

| Rank | Subject | Average amount of credit indebtedness per 1 company, mln RUB |

| 1 | Yamal-Nenets autonomous district | 35 |

| 2 | Tyumen region | 19 |

| 3 | Chukotka autonomous district | 15 |

| 4 | Moscow | 15 |

| 5 | Kemerovo region | 13 |

| 6 | Leningrad region | 10 |

| 7 | Kursk region | 10 |

| 8 | Moscow region | 9 |

| 9 | Bryansk region | 9 |

| 10 | Tula region | 9 |

The highest increase in loan debts was recorded for companies of the Republic of Crimea, Tambov and Voronezh regions: by 44%, 41% and 37% respectively. The Republic of Khakassia leads by the rate of debt drawdown – by 45% (see Table 2).

From 01.09.2017 to 01.09.2018 credit indebtedness of companies in Moscow and Saint Petersburg increased by 13% and 9% respectively.

Table 2. The highest increase and decrease in corporate credit indebtedness by regions, according to the Bank of Russia

| Rank | Subject | Increase rate of credit indebtedness, % as of 01.09.2018 to 01.09.2017 | Subject | Decrease rate of credit indebtedness, % as of 01.09.2018 to 01.09.2017 |

| 1 | Republic of Crimea | 44 | Republic of Khakassia | -45 |

| 2 | Tambov region | 41 | Zabaikalye Territory | -38 |

| 3 | Voronezh region | 37 | Republic of Sakha (Yakutia) | -19 |

| 4 | Chukotka autonomous district | 35 | Smolensk region | -18 |

| 5 | Republic of Udmurtia | 33 | Kabardino-Balkarian Republic | -16 |

| 6 | Tyumen region | 32 | Arkhangelsk region | -14 |

| 7 | Tula region | 31 | Kostroma region | -11 |

| 8 | Magadan region | 30 | Ivanovo region | -11 |

| 9 | Novgorod region | 29 | Novosibirsk region | -11 |

| 10 | Lipetsk region | 27 | Samara region | -9 |

For the relatively short period not only business community based on market relations was formed in Russia, but also money-and-credit mechanism. Loans help companies to attract additional funds for increase in profits and sales, development of fixed assets and output. However, under adverse circumstances, loans could be crushing burden and one of the reasons of bankruptcy.

Loan growth should be followed by accelerated dynamics in economy, which is unfortunately not observed nowadays. Credits are used for accrued expenses and old debts covering, as well as for sustaining capital.

On September 14, 2018, the Bank of Russia raised the key rate up to 7,5% for the first time since 2014. According to Credinform experts, this will lead to some drawdown of corporate debt growth rate, but not eliminate the debt overburden risk. Balance between own and attracted funds, and reasonable estimate of sectoral macroeconomic indicators by the company’s management are indispensable conditions for sound business and economy in general.