Equity turnover of IT-companies

Information agency Credinform represents the ranking of the largest Russian IT-companies. The enterprises with the largest volume of annual revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available periods (for 2016 - 2018). Then they were ranked by the equity turnover ratio (Table 1). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Equity turnover ratio (times) is defined as a relation of revenue to annual average sum of equity and shows the company’s usage rate of all available assets.

Equity turnover ratio reflects the turnover rate of own capital. The high value of this ratio indicates the effectiveness of use of own funds. Accordingly, the low ratio value indicates about inaction of the part of own funds.

The experts of the Information agency Credinform, taking into account the actual situation both in the economy as a whole and in the sectors, has developed and implemented in the Information and Analytical system Globas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry. For IT-companies the practical value of the equity turnover ratio made from 1,96 times in 2018.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all combination of indicators and financial ratios.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Equity turnover, times | Solvency index Globas | |||

| 2017 | 2018 | 2017 | 2018 | 2017 | 2018 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| CENTRE OF LOYALTY PROGRAMMES NJSC INN 7702770003 Moscow |

16962,1 16962,1 |

25628,2 25628,2 |

303,4 303,4 |

1341,6 1341,6 |

37,72 37,72 |

26,04 26,04 |

211 Strong |

| SIBERIAN INTERNET COMPANY LLC INN 7708119944 Moscow |

32586,8 32586,8 |

49297,7 49297,7 |

2090,7 2090,7 |

2003,0 2003,0 |

20,82 20,82 |

15,65 15,65 |

194 High |

| VISA PAYMENT SYSTEM LLC INN 7710759236 Moscow |

9666,2 9666,2 |

11958,7 11958,7 |

371,6 371,6 |

550,3 550,3 |

7,43 7,43 |

11,01 11,01 |

251 Medium |

| GAZPROM INFORM LLC INN 7727696104 Moscow |

10575,0 10575,0 |

11387,0 11387,0 |

6,4 6,4 |

53,5 53,5 |

9,49 9,49 |

9,98 9,98 |

220 Strong |

| INLINE TELECOM SOLUTIONS LLC INN 7715612935 Moscow |

6848,0 6848,0 |

6595,9 6595,9 |

86,0 86,0 |

106,0 106,0 |

9,10 9,10 |

8,51 8,51 |

235 Strong |

| NETCRACKER LLC INN 7713511177 Moscow |

6715,9 6715,9 |

7604,6 7604,6 |

263,9 263,9 |

537,2 537,2 |

7,56 7,56 |

5,90 5,90 |

159 Superior |

| RN-CARD LLC INN 7743529527 Moscow |

10267,4 10267,4 |

9716,3 9716,3 |

637,9 637,9 |

329,6 329,6 |

2,63 2,63 |

4,56 4,56 |

220 Strong |

| LUKOIL-INFORM LLC INN 7705514400 Moscow |

24104,5 24104,5 |

17038,3 17038,3 |

1213,8 1213,8 |

1434,8 1434,8 |

4,24 4,24 |

4,14 4,14 |

223 Strong |

| MASTERCARD LLC INN 7707724547 Moscow |

5878,3 5878,3 |

8315,4 8315,4 |

1880,9 1880,9 |

3069,4 3069,4 |

2,44 2,44 |

1,70 1,70 |

190 High |

| MAIL.RU LLC INN 7743001840 Moscow |

39306,3 39306,3 |

43519,6 43519,6 |

4130,9 4130,9 |

5838,9 5838,9 |

0,38 0,38 |

0,33 0,33 |

190 High |

| Average value by TOP-10 companies |  16291,0 16291,0 |

19106,2 19106,2 |

1098,5 1098,5 |

1526,4 1526,4 |

10,18 10,18 |

8,78 8,78 |

|

| Industry average value |  37,5 37,5 |

42,1 42,1 |

2,9 2,9 |

3,1 3,1 |

2,14 2,14 |

2,00 2,00 |

|

improvement of the indicator to the previous period,

improvement of the indicator to the previous period,  decline in the indicator to the previous period

decline in the indicator to the previous period

The average value of equity turnover ratio of TOP-10 enterprises is above industry average and practical values. Three companies improved the result in 2018.

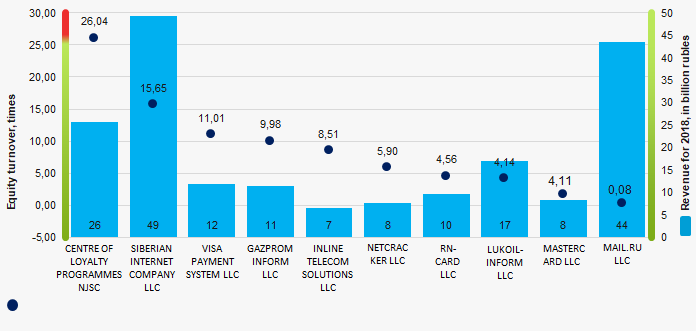

Picture 1. Equity turnover ratio and revenue of the largest Russian IT-companies (TOP-10)

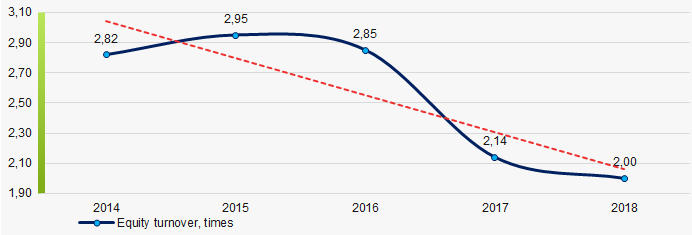

Picture 1. Equity turnover ratio and revenue of the largest Russian IT-companies (TOP-10)The industry average indicators of equity turnover ratio have a downward trend over the course of five years. (Picture 2).

Picture 2. Change in the industry average values of equity turnover ratio of Russian IT-companies in 2014 – 2018

Picture 2. Change in the industry average values of equity turnover ratio of Russian IT-companies in 2014 – 2018Trends in Moscow’s real economy

Information agency Credinform has prepared a review of activity trends of the largest companies of the Moscow’s real economy.

The largest companies (ТОP-10000) in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2013 - 2018). The analysis was based on data of the Information and Analytical system Globas.

Net assets is a ratio reflecting the real value of company's property. It is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The ratio is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest company in terms of net assets is JSC GAZPROM, INN 7736050003. In 2018 net assets of the company amounted to 11067 billion RUB.

The smallest size of net assets in ТОP-10000 had Otkritie Holding JSC, INN 7708730590. The lack of property of the company in 2018 was expressed in negative terms -454 billion RUB.

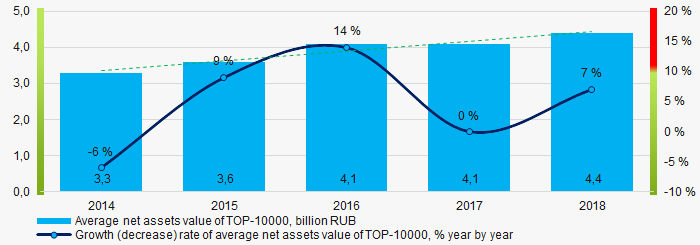

For the last five years, the average values of net assets showed the growing tendency (Picture 1).

Picture 1. Change in TOP-10000 average net assets value in 2014 – 2018

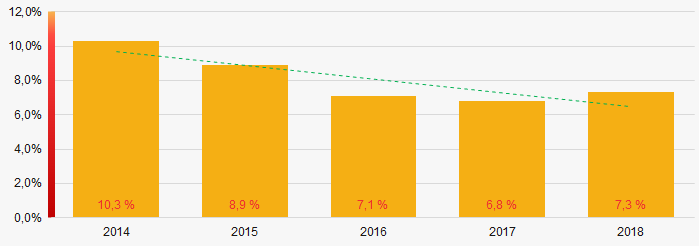

Picture 1. Change in TOP-10000 average net assets value in 2014 – 2018For the last five years, the share of ТОP-10000 enterprises with lack of property showed the decreasing tendency (Picture 2).

Picture 2. The share of enterprises with negative net assets value in ТОP-10000

Picture 2. The share of enterprises with negative net assets value in ТОP-10000Sales revenue

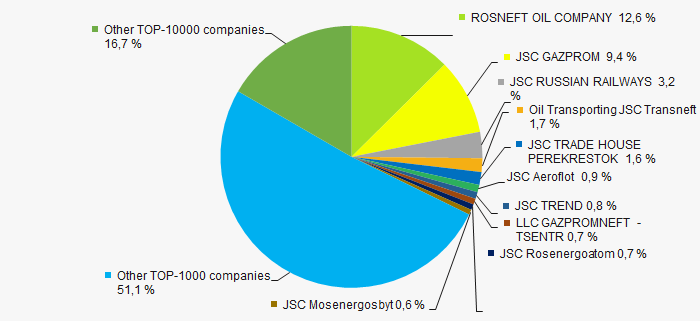

In 2018, the total revenue of 1000 largest companies amounted to more than 83% from ТОP-10000 total revenue. (Picture 3).This fact testifies the high level of capital concentration.

Picture 3. Shares of TOP-10 and TOP-1000 in TOP-10000 total revenue for 2018

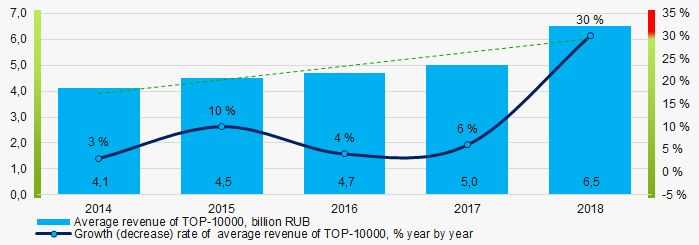

Picture 3. Shares of TOP-10 and TOP-1000 in TOP-10000 total revenue for 2018In general, the growing trend in sales revenue is observed (Picture 4).

Picture 4. Change in average revenue of TOP-10000 in 2014 – 2018

Picture 4. Change in average revenue of TOP-10000 in 2014 – 2018Profit and loss

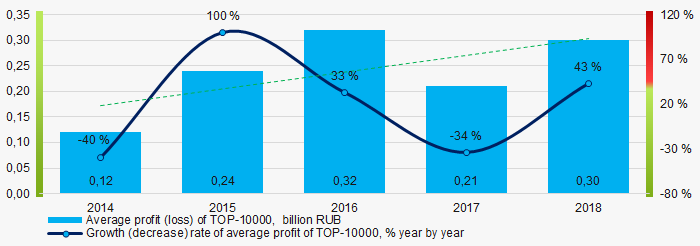

The largest company in terms of net profit is also JSC GAZPROM, INN 7736050003. In 2018, the company’s profit amounted to 933 billion RUB.

For the last five years, the profit values of ТОP-10000 companies showed the increasing tendency (Picture 5).

Picture 5. Change in average profit (loss) of TOP-10000 in 2014 – 2018

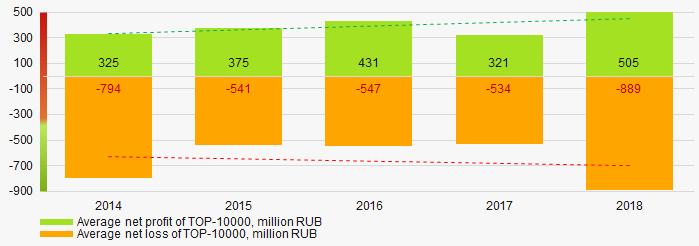

Picture 5. Change in average profit (loss) of TOP-10000 in 2014 – 2018Over a five-year period, the average net profit values of ТОP-10000 show the increasing tendency, along with this the average net loss is increasing too (Picture 6).

Picture 6. Change in average net profit/loss of ТОP-10000 companies in 2014 – 2018

Picture 6. Change in average net profit/loss of ТОP-10000 companies in 2014 – 2018Main financial ratios

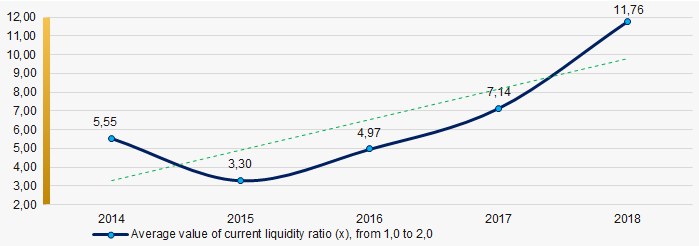

For the last five years, the average values of the current liquidity ratio were higher than the recommended values - from 1,0 to 2,0, with increasing tendency (Picture 7).

The current liquidity ratio (ratio of total working capital to short-term liabilities) shows the sufficiency of company’s assets to meet short-term obligations.

Picture 7. Change in average values of current liquidity ratio in 2014 – 2018

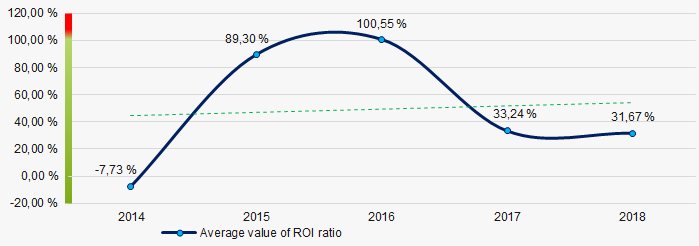

Picture 7. Change in average values of current liquidity ratio in 2014 – 2018For the last five years, the growing tendency of ROI ratio is observed (Picture 8).

The ROI ratio is calculated as a ratio of net profit to sum of stockholder equity and long-term liabilities and shows the return from equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average values of ROI ratio in 2014 – 2018

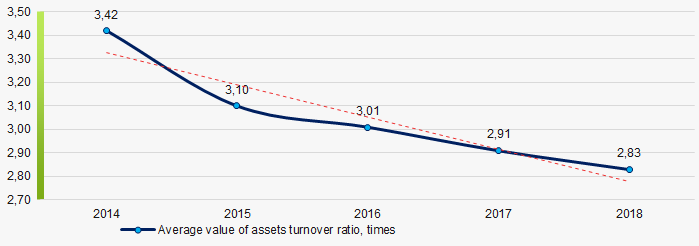

Picture 8. Change in average values of ROI ratio in 2014 – 2018Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

For the last five years, this business activity ratio demonstrated the downward trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio in 2014 – 2018

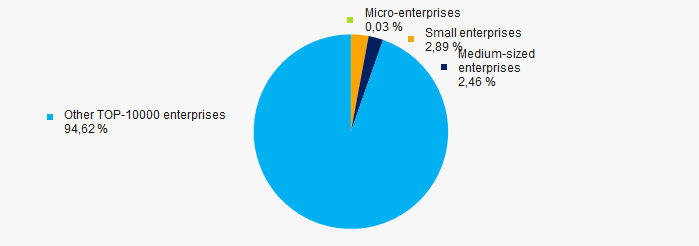

Picture 9. Change in average values of assets turnover ratio in 2014 – 2018 Small businesses

51% of ТОP-10000 companies are registered in the Unified register of small and medium-sized enterprises of the Russian Federal Tax Service. Herein, their share in TOP-10000 total revenue amounted to 5,4%, which is significantly lower than national average value (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in ТОP-10000

Picture 10. Shares of small and medium-sized enterprises in ТОP-10000Main regions of activity

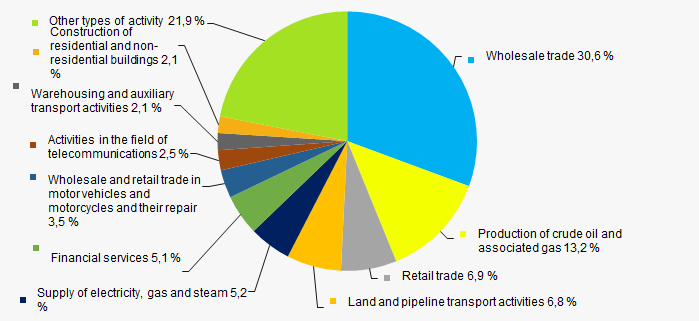

The wholesale companies have the largest share (almost 31%) in ТОP-10000 total revenue (Picture 11).

Picture 11. Distribution of TOP-10000 revenue by types of activity

Picture 11. Distribution of TOP-10000 revenue by types of activityFinancial position score

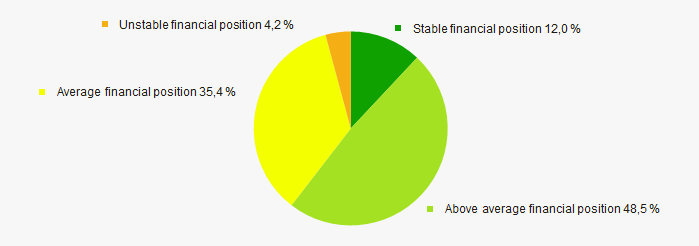

An assessment of the financial position of TOP-10000 companies shows that the largest part have the above average financial position (Picture 12).

Picture 12. Distribution of TOP-10000 companies by financial position score

Picture 12. Distribution of TOP-10000 companies by financial position scoreSolvency index Globas

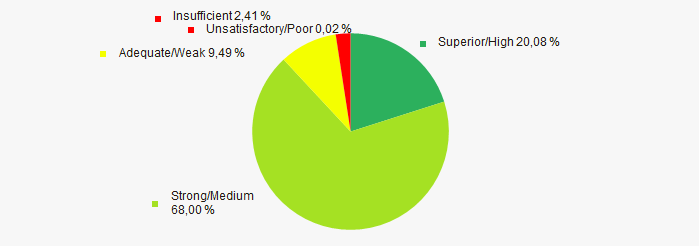

Most of TOP-10000 companies got superior/high or strong/medium Solvency index Globas, this fact shows the ability of the companies to meet their obligations in time and fully (Picture 13).

Picture 13. Distribution of TOP-10000 companies by Solvency index Globas

Picture 13. Distribution of TOP-10000 companies by Solvency index GlobasIndustrial production index

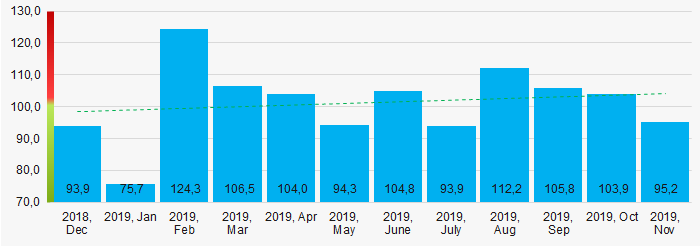

According to the Federal Service of State Statistics, the growing tendency of industrial production index is observed in Moscow during 12 months of 2018 – 2019 (Picture 14). Herewith the average index from month to month amounted to 101,2%.

Picture 14. Industrial production index in Moscow in 2018-2019, month by month (%)

Picture 14. Industrial production index in Moscow in 2018-2019, month by month (%)According to the same data, the share of Moscow enterprises in total revenue from sale of goods, products, works and services within country amounted to 25,083% in 2018 and 24,959% for 9 months of 2019, which is higher than the figure for the same period in 2018 (24.780%).

Conclusion

A complex assessment of the largest companies of the Moscow’s real economy, taking into account the main indexes, financial ratios and indicators, demonstrates the presence of positive trends (Table 1).

| Trends and assessment factors | Relative share, % |

| Growth/drawdown rate of average net assets value |  10 10 |

| Increase / decrease in the share of enterprises with negative net assets |  10 10 |

| The level of competition / monopolization |  -10 -10 |

| Growth/drawdown rate of average revenue |  10 10 |

| Growth/drawdown rate of average net profit (loss) |  10 10 |

| Increase / decrease in average net profit |  10 10 |

| Increase / decrease in average net loss |  -10 -10 |

| Increase / decrease in average values of current liquidity ratio |  5 5 |

| Increase / decrease in average values of ROI ratio |  10 10 |

| Increase / decrease in average values of assets turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses by revenue more than 22% |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Industrial production index |  10 10 |

| Dynamics of the share of the region's revenue in the total revenue of the Russian Federation |  5 5 |

| Average value of factors |  4,0 4,0 |

favorable trend (factor),

favorable trend (factor),  unfavorable trend (factor).

unfavorable trend (factor).