Investment in hostels

Information agency Credinform represents the ranking of the largest Russian hostels. Hostels – legal entities with the largest volume of annual revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available periods (for 2016 - 2018). Then they were ranked by the return on equity ratio (Table 1). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Return on equity (%) is calculated as a relation of company’s net profit to its equity. The ratio determines the efficiency of use of capital invested by the owners of the enterprise and shows how many monetary units of net profit were earned by each unit invested by owners.

This indicator is used by investors and company’s owners to measure their own investment. The higher the ratio value, the more profitable the investment. By the return on equity with a negative or zero value it is necessary to analyze the advisability and efficiency of investment in the enterprise in the future. In such cases, the ratio value should be compared with other investment.

Too high value of the indicator, in its turn, can negatively affect the financial stability of a company. High profitability implies also higher risks.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all combination of company’s financial indicators and ratios.

| Name, INN, region | Sales revenue, mln RUB | Net profit (loss), mln RUB | Return on equity, % | Solvency index Globas | |||

| 2017 | 2018 | 2017 | 2018 | 2017 | 2018 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| DRUZYA-OTELI I KHOSTELY LLC INN 7842074140 Saint-Petersburg |

22,85 22,85 |

22,57 22,57 |

5,47 5,47 |

3,94 3,94 |

-153,23 -153,23 |

998,98 998,98 |

274 Medium |

| OKEI KHOSTELGRUPP LLC INN 7713389343 Moscow |

21,66 21,66 |

26,94 26,94 |

0,89 0,89 |

2,48 2,48 |

82,08 82,08 |

69,49 69,49 |

243 Strong |

| SET UYUTNYKH KVARTIR,OBSHCHEZHITII I KHOSTELOV UYUT LLC INN 7841491060 Saint-Petersburg |

18,82 18,82 |

22,06 22,06 |

-1,60 -1,60 |

-3,08 -3,08 |

25,60 25,60 |

33,01 33,01 |

346 Adequate |

| PLANETA KHOSTEL LLC INN 7705557749 Moscow |

27,33 27,33 |

37,94 37,94 |

3,22 3,22 |

1,01 1,01 |

124,72 124,72 |

28,16 28,16 |

262 Medium |

| HOSTEL-S LLC INN 7702375797 Moscow |

26,71 26,71 |

28,28 28,28 |

2,11 2,11 |

1,60 1,60 |

28,56 28,56 |

18,14 18,14 |

272 Medium |

| HOSTEL-A NJSC INN 7720791790, Moscow is in the process of reorganization in the form of transformation, since 09.06.2017 |

10,15 10,15 |

17,81 17,81 |

-5,83 -5,83 |

0,29 0,29 |

33,39 33,39 |

-1,66 -1,66 |

306 Adequate |

| SET KHOSTELOV ZAKHODI LLC INN 7743111955 Moscow |

17,63 17,63 |

20,45 20,45 |

-2,85 -2,85 |

0,84 0,84 |

8,36 8,36 |

-2,52 -2,52 |

307 Adequate |

| KHOSTELSERVIS LLC INN 7726053654 Moscow |

20,63 20,63 |

30,26 30,26 |

-0,64 -0,64 |

0,89 0,89 |

3,73 3,73 |

-5,57 -5,57 |

298 Medium |

| SUPERHOSTEL LLC INN 7842504932 Saint-Petersburg |

137,53 137,53 |

118,65 118,65 |

7,53 7,53 |

-1,03 -1,03 |

118,02 118,02 |

-18,95 -18,95 |

253 Medium |

| SWEET VILLADGE HOSTEL LLC INN 7840033501 Saint-Petersburg |

16,03 16,03 |

19,14 19,14 |

1,57 1,57 |

-0,63 -0,63 |

83,97 83,97 |

-50,77 -50,77 |

300 Adequate |

| Total by TOP-10 companies |  319,34 319,34 |

350,08 350,08 |

9,88 9,88 |

6,31 6,31 |

|||

| Average value by TOP-10 companies |  31,93 31,93 |

35,01 35,01 |

0,99 0,99 |

0,63 0,63 |

35,52 35,52 |

106,83 106,83 |

|

| Industry average value |  33,17 33,17 |

38,79 38,79 |

-12,74 -12,74 |

-4,65 -4,65 |

3 388,74 3 388,74 |

1 229,76 1 229,76 |

|

improvement of the indicator to the previous period,

improvement of the indicator to the previous period,  decline in the indicator to the previous period.

decline in the indicator to the previous period.

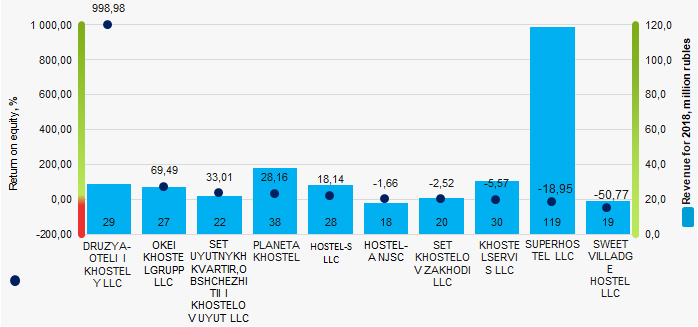

The average value of the return on equity ratio of TOP-10 companies in 2018 is significantly lower than the average value for the hotel services industry. Two companies improved results in 2018.

Picture 1. Return on equity ratio and revenue of the largest hostels (TOP-10)

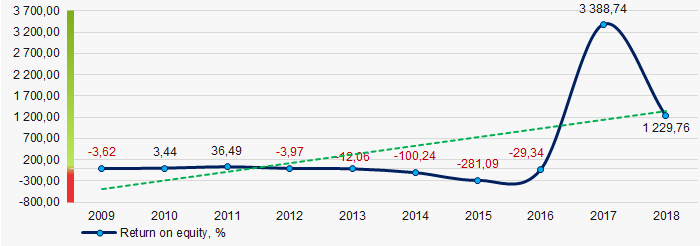

Picture 1. Return on equity ratio and revenue of the largest hostels (TOP-10)Over 10 years, the average values of the return on equity ratio in the hotel services industry have a tendency to increase. (Picture 2).

Picture 2. Change in industry average values of the return on equity ratio of hotel facilities in 2009 – 2018

Picture 2. Change in industry average values of the return on equity ratio of hotel facilities in 2009 – 2018TOP-10 of regions by the share of small business

In the countries with the modern economic structure, over 50% of work force is employed in small and medium-sized enterprises. In Russia, this figure is 22%. In 2018, the share of small business in total revenue of companies (including large) was 27,9%.

Contribution of small companies to the GDP is obviously insufficient. Russia is still the country of large corporations and monopoly, and therefore there are artificially high prices and lack of fair competition.

The Government is seeking to bring the GDP share in the economy to the level of developed countries up to 2025. However, there are already regions in Russia with the regional GDP financing mainly by small and medium-sized business.

The Republic of Dagestan with small business’ total share of 75,7% is ranked the first. This fact is due to the traditional economy of the region, where the population is involved in personal subsidiary economy and handicraft industry. Large business is slightly spread because of unavailability of rich natural recourses and effective demand. The similar situation prevails in neighboring North Caucasus republics (see Table 1).

TOP-10 also includes Ivanovo region (72,5%), Sevastopol (65,3%), Kirov region (56%) and Zabaikalye territory (55,5%).

Despite the high share of small business in the leading regions, the absolute contribution of small business is minimal: 1,7 trillion RUB compared to 59,9 trillion RUB for the whole country.

| № | Region | Small business’ share in total turnover of companies, % | Small business’ turnover, billion RUB | Total turnover of companies, billion RUB |

| 1 | Republic of Dagestan | 75,7 | 308 | 406 |

| 2 | Ivanovo region | 72,5 | 425 | 586 |

| 3 | Sevastopol | 65,3 | 81 | 125 |

| 4 | Kabardino-Balkarian Republic | 62,2 | 75 | 121 |

| 5 | Chechen Republic | 61,5 | 109 | 177 |

| 6 | Republic of Ingushetia | 61,0 | 16 | 26 |

| 7 | Republic of North Ossetia-Alania | 58,9 | 64 | 108 |

| 8 | Kirov region | 56,0 | 333 | 595 |

| 9 | Republic of Adygea | 55,5 | 90 | 162 |

| 10 | Zabaikalye territory | 55,5 | 211 | 381 |

| Russian Federation | 27,9 | 59 936 | 214 562 |

Source: ЕМИСС, Unified interdepartmental statistical information system, Rosstat, calculations of Credinform based on the System Globas

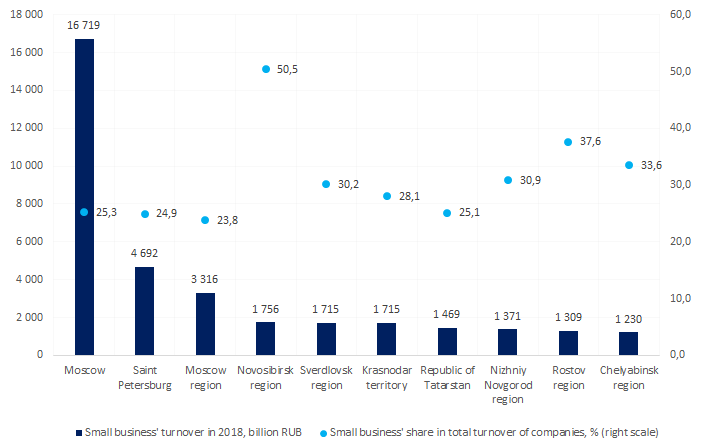

The highest turnover of small business in absolute figures is recorded for Moscow - 16,7 trillion in 2018. However, the share of small business in total turnover of companies slightly exceeded 25%.

Novosibirsk region is ranked the fourth with the highest share of small business in the regional economy – 50,5% (see Picture 1).

Рисунок 1. Small business’ share in the regions with the highest turnover of small and medium-sized business

Рисунок 1. Small business’ share in the regions with the highest turnover of small and medium-sized businessThe priority is to increase the contribution of small business to the GDP, and it is involved stable and continued development of the economy, fair competition and entering new selling markets. However, lack of plans to reduce the tax burden, cancellation of single tax on imputed income from 2021, huge fiscal injections to the large state-owned companies to the detriment of small companies – all these call into question the achievement of the goal.