The Central Bank of Russia puts in a black-list the companies making shady transactions.

Starting 2013 the number of shady financial transactions in the foreign trade activity exceeded last years index practically by half and according to experts reached 1. 5 trillion rubles. Such deplorable results forced the Central Bank (CB) to create a “black list” of Russian companies, members of foreign trade activity, suspected in illegal withdrawal of money abroad and money laundering. The black list will contain next indices, helping to identify the organization: name, state registration number and tax reference number. The list will be sent to banks by local branches of the CB.

In the letter to banks the CB puts forward some features, which can represent illegal withdrawal of money abroad. For instance, the CB recommends to draw attention to cases when Russian companies close transaction passports on foreign trade contracts and loan agreements due to change of authorized bank. But at the same time they do not appeal to any of the credit organizations. And during the closure of the transaction passport, liabilities to counterparties on the part of non-residents occur to be partly/fully undrawn. According to the CB, in majority of cases corresponding activities of organization show original intentions of the company to withdraw money abroad illegally.

Organizations, put on the black-list, would be divided into two groups. The first group will contain the companies with debts on the part of foreign residents of 80% of total payments under contract. Credit organizations are entitled to refuse to conclude a bank account agreement and to conduct operations with companies from this group. The second group will contain organizations with debts from 20% to 80%. It is recommended to take companies from the second group for the special control. The data about operations of these companies are to be sent to the Federal Service for Fiscal Monitoring.

According to the CB, during 1994-2012 years 11 trillion rubles were withdrawn from Russia. In these operations a key role is played by fly-by-night companies.

The Credinform information agency has worked out its own scheme of revealing fly-by-night companies. With the help of Reliability index, which uses more than 30 various financial and non-financial factors, it is possible to exactly identify a shady company.

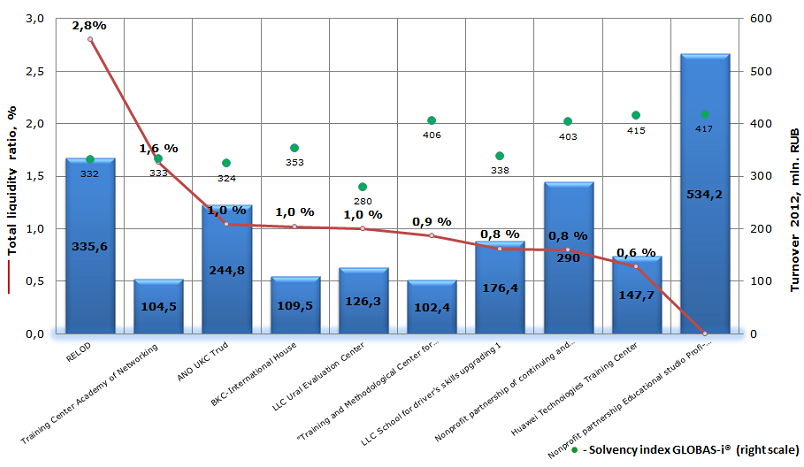

Total liquidity ratio of educational institutions for adults

Information agency Credinform has prepared a ranking of Russian organizations specialized to the provision of educational services - training centers, foreign language schools, design, driving schools, etc. The ranking list includes the largest educational institutions and is based on revenue as stated in the Statistics register, with the reference period of 2012. These companies were ranked then in terms of total liquidity ratio.

Total liquidity ratio (x) is the ratio of current assets to current liabilities of the company. It shows capital adequacy of the enterprise to repay current liabilities. Recommended value varies from 2% to 3%, but should be at least 1%. This ratio describes the ability of the company to provide for its short-term liabilities on the most marketable (liquid) share of assets - current assets. It also provides an overall assessment of the assets liquidity.

If the ratio is much higher than 1, it can be concluded that the organization has a sufficiently large amount of free resources, which were formed through owned sources. This alternative of working capital formation is the most appropriate from the opinion of enterprise creditors. However, from the perspective of management it shows a lack of efficiency in the assets management (money "does not work").

The ratio value 1 implies the equality of the current assets and liabilities. Missing ratio value indicates that the company had no short-term liabilities as of year-end 2012.

| № | Name | INN | Region | Turnover 2012,mln. RUB | Total liquidity ratio, (%) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|---|

| 1 | RELOD | 7706010268 | Moscow | 335,6 | 2,80 | 332 (satisfactory) |

| 2 | Training Center Academy of Networking | 7701110607 | Moscow | 104,5 | 1,63 | 333(satisfactory) |

| 2 | ANO UKC Trud | 7709335271 | Moscow | 244,8 | 1,04 | 324 (satisfactory) |

| 4 | BKC-International House | 7731244534 | Moscow | 109,5 | 1,02 | 353 (satisfactory) |

| 5 | LLC Ural Evaluation Center | 6664069610 | Sverdlovsk region | 126,3 | 1,00 | 280 (high) |

| 6 | "Training and Methodological Center for Nuclear and Radiation Safety" | 7719287002 | Moscow | 102,4 | 0,93 | 406 (satisfactory) |

| 7 | LLC School for driver’s skills upgrading 1 | 7714554656 | Moscow | 176,4 | 0,81 | 338 (satisfactory) |

| 8 | Nonprofit partnership of continuing and continuing professional education "British Higher School of Art and Design" | 7719236569 | Moscow | 290,0 | 0,80 | 403 (satisfactory) |

| 9 | Huawei Techno logies Training Center | 7734227375 | Moscow | 147,7 | 0,64 | 415 (satisfactory) |

| 10 | Nonprofit partnership Educational studio Profi-style | 5256079545 | Nizhny Novgorod region | 534,2 | - | 417 (satisfactory) |

Diagram. Total liquidity ratio of the largest Russian educational institutions for adults

The largest educational institutions for adults (further education) in terms of 2012 turnover are expectedly located in Moscow - eight out of ten of the Top-10.

The total turnover of the top-10 companies for the year 2012 amounted to 2 billion 170.5 million RUB. The average calculated value of the leaders’ total liquidity ratio is 1.2% (higher than 1). This indicates the positive balance. From the point of view of the creditors, the mentioned situation may be considered as sufficiently positive signal. However, each case needs more detailed analysis of the company’s financial situation.

The following companies from the top-10 showed the value of total liquidity ratio higher than 1: RELOD (English language courses, training literature) - 2.8%; Training Center Academy of Networking ("Lanit", authorized training center of Microsoft, Novell, Intel, SCO, Informix, programs Certified Internet Webmaster, Security Certified Program) - 1,63%; ANO UKC Trud (certification of employment, work safety training, organization of work safety service) - 1.04 %; BKC-International House (English course) - 1.02 %. LLC Ural Evaluation Center (training of NDT and Welding specialists) has the ratio equal to 1, which indicates the equality of current assets and liabilities.

The rest of the list showed the total liquidity ratio less than 1: "Training and Methodological Center for Nuclear and Radiation Safety" (training for regulatory agencies of safety in the use of nuclear energy and utilities); LLC School for driver’s skills upgrading 1 (driving school); Nonprofit partnership of continuing and continuing professional education "British Higher School of Art and Design" (training in the field of design); Huawei Technologies Training Center (implements programs of additional professional education for specialists working in the Russian research market). Current liabilities of the mentioned organizations exceed current assets, which can be negatively viewed. Supposing that investors (creditors) will request their investments in the business together, the company will not be able to pay it.

The value of the ratio for Nonprofit partnership Educational studio Profi-style (basic education, further training, training for hairdressers) is not calculated, which indicates the lack of short-term liabilities.

It should also be mentioned that all top-10 educational institutions, except LLC Ural Evaluation Center with its high index, received satisfactory solvency index GLOBAS -i ® at an independent credit rating of Credinform. This indicates the lack of stability to the change of economic situation; companies do not guarantee the full and timely repayment of its liabilities. This can be explained by demanding of supplemental educational services from clients - not all companies can afford to send staff to training. Individual training also involves not only the availability of funds, but also a high degree of motivation, focus on results. In times of economic instability this services transfer to the so-called "pent-up demand" area.