Profit level of fuel wholesale

Information agency Credinform represents the ranking of the largest wholesalers of motor fuel, including aviation gasoline. The enterprises with the largest volume of annual revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available periods (for 2015 – 2017). Then they were ranked by the net profit ratio (Table 1). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net profit ratio (%) is calculated as a relation of net profit (loss) to sales revenue and characterizes the level of sales profit.

There is no normative value for the indicator. It is recommended to compare enterprises of one industry, or change of the ratio in the course of time of a certain company. A negative value of the ratio indicates a net loss. A high value shows an efficient operation of an enterprise.

The experts of the Information agency Credinform, taking into account the actual situation both in the economy as a whole and in the sectors, has developed and implemented in the Information and Analytical systemGlobas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry. For wholesalers of motor fuel the practical value of the net profit ratio made from 1,59 % in 2017.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all combination of indicators and financial ratios.

| Name, INN, region | Sales revenue, billion rubles | Net profit (loss), billion rubles | Net profit ratio, % | Solvency index Globas | |||

| 2016 | 2017 | 2016 | 2017 | 2016 | 2017 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| RN-AERO LLC INN 7705843041 Moscow |

75,48 75,48 |

97,73 97,73 |

20,52 20,52 |

14,38 14,38 |

20,30 20,30 |

15,18 15,18 |

241 Strong |

| RN-SMAZOCHNYE MATERIALY LLC INN 6227007682 Ryazan region |

28,69 28,69 |

43,13 43,13 |

1,27 1,27 |

4,85 4,85 |

17,49 17,49 |

11,24 11,24 |

153 Superior |

| KOMPANIYA ADAMAS NJSC INN 7704747779 Moscow |

39,03 39,03 |

43,61 43,61 |

-0,35 -0,35 |

1,71 1,71 |

3,66 3,66 |

3,92 3,92 |

239 Strong |

| GAZENERGOSET ST. PETERSBURG LLC INN 1515919573 Saint-Petersburg |

17,99 17,99 |

31,73 31,73 |

-0,14 -0,14 |

0,86 0,86 |

1,74 1,74 |

2,72 2,72 |

192 High |

| GAZPROMNEFT-REGIONAL SALES LLC INN 4703105075 Saint-Petersburg |

486,96 486,96 |

572,81 572,81 |

20,18 20,18 |

8,96 8,96 |

3,10 3,10 |

1,56 1,56 |

241 Strong |

| TATNEFT-AZS CENTER LLC INN 1644040195 Republic of Tatarstan |

39,07 39,07 |

45,37 45,37 |

0,42 0,42 |

0,44 0,44 |

1,94 1,94 |

0,98 0,98 |

178 High |

| NC ROSNEFT – KUBANNEFTEPRODUCT PJSC INN 2309003018 Krasnodar territory |

37,04 37,04 |

38,45 38,45 |

0,59 0,59 |

0,36 0,36 |

1,86 1,86 |

0,95 0,95 |

277 Medium |

| PTK-TERMINAL LLC INN 7806055343 Saint-Petersburg |

25,02 25,02 |

25,05 25,05 |

0,22 0,22 |

0,07 0,07 |

0,50 0,50 |

0,26 0,26 |

238 Strong |

| RN-VOSTOKNEFTEPRODUKT LLC INN 2723049957 Khabarovsk territory |

50,89 50,89 |

55,58 55,58 |

0,43 0,43 |

0,08 0,08 |

1,93 1,93 |

0,14 0,14 |

254 Medium |

| FORTEINVEST NJSC INN 7707743204 Moscow |

100,13 100,13 |

134,14 134,14 |

-9,82 -9,82 |

-1,42 -1,42 |

-3,19 -3,19 |

-1,06 -1,06 |

297 Medium |

| Total by TOP-10 companies |  900,31 900,31 |

1084,60 1084,60 |

33,33 33,33 |

30,28 30,28 |

|||

| Average value by TOP-10 companies |  90,03 90,03 |

108,46 108,46 |

3,33 3,33 |

3,03 3,03 |

4,93 4,93 |

3,59 3,59 |

|

| Industry average value |  0,64 0,64 |

0,72 0,72 |

0,014 0,014 |

0,011 0,011 |

2,17 2,17 |

1,59 1,59 |

|

improvement of the indicator to the previous period,

improvement of the indicator to the previous period,  decline in the indicator to the previous period.

decline in the indicator to the previous period.

The average value of the net profit ratio of TOP-10 enterprises is above the industry average and practical values. Three companies improved their results in 2017.

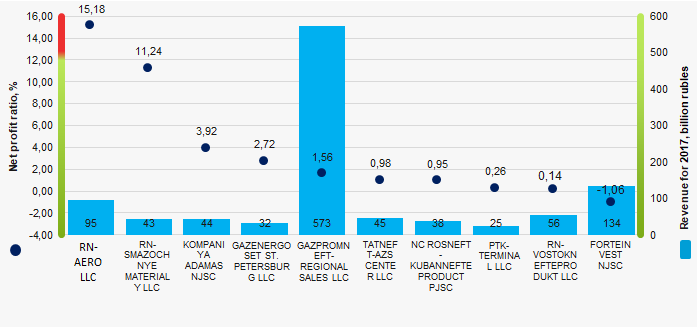

Picture 1. Net profit ratio and revenue of the largest Russian wholesalers of motor fuel (TOP-10)

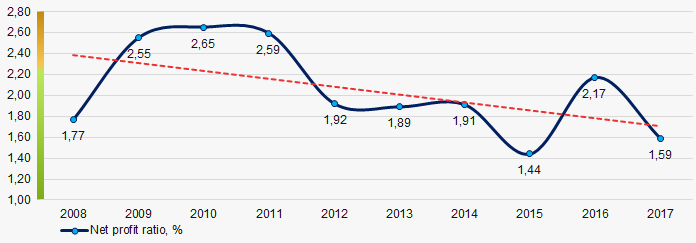

Picture 1. Net profit ratio and revenue of the largest Russian wholesalers of motor fuel (TOP-10)For ten years, the industry average indicators of the net profit ratio tend to decrease. (Picture 2).

Picture 2. Change in industry average values of the net profit ratio of Russian wholesalers of motor fuel in 2008 – 2017

Picture 2. Change in industry average values of the net profit ratio of Russian wholesalers of motor fuel in 2008 – 2017Tax optimization abroad will become more complicated

From October 1, 2019 the «Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting», which was concluded in Paris on November 24, 2016 and signed in 68 countries of the world, will enter into force in Russia. The Convention was ratified by the Federal Law №79-FZ of May 1, 2019.

The Convention was developed within the frame of the Action Plan on Base Erosion and Profit Shifting (BEPS plan), the main purpose of which is to ensure profit taxation in those country where business is actually carried out, and to counter the artificial transfer of profit to low-tax jurisdictions with the aim of tax evasion.

The measures specified by the Convention relate primarily to hybrid schemes for reducing of the tax burden, abuses of the provisions of agreements, and artificially avoiding of the status of a permanent establishment.

The countries, which have signed the Convention and carried out the procedures that it provides for, are given the opportunity to toughen simultaneously all current intergovernmental agreements on the avoidance of double taxation, without holding bilateral negotiations on each agreement.

The application of the Convention to specific agreements is subject to the signing of a multilateral Convention by the partner countries and the inclusion of Russia in the list of jurisdictions, in respect of which the Convention applies.

The convention is to be applied to 71 agreements between Russia and other states. As of July 3, 2019, the Convention has already been ratified by 20 states: Austria, Belgium, Great Britain, Ireland, Lithuania, Luxembourg, Malta, the Netherlands, Poland, Serbia, Slovakia, Slovenia, Finland, France, Israel, the United Arab Emirates, India, Singapore, Australia and New Zealand.