Changes in laws in 2020

Financial statements in the Federal Tax Service (FTS), “regulatory guillotine”, fight against hybrid tax reduction schemes, the last year of the single tax on imputed income, new deductions, and goods traceability.

What changes in laws are awaiting the business in 2020?

I. FINANCIAL STATEMENTS

- Financial statements for 2019 have to be submitted to the FTS alone. The companies are no longer obliged to submit financial statements to the Federal State Statistics Service (Rosstat).

- Since January 1, it is allowed to keep e-accounts certified with digital signature. Paper form is not required, but may be necessary if it is submitted to the counterparty or a government agency.

- The following organizations are exempted from submitting a mandatory copy of financial statements to the FTS: budget-financed organizations, the Central bank of Russia, religious organizations, organizations submitting reports to the Central bank of Russia, organizations reports of which contain information classified as state secret; if there are cases established by the Government of Russia.

Source: Federal law No. 444-FL as of November 28, 2018 - A line on obligatory audit has been added to the forms of 2020 financial statements; income tax is divided into current and deferred; a new line “Income tax on operations result, not included in net profit (loss) of the period” has been added; changes were made to the financial results report form for small and medium-sized businesses.

Source: Order of the Ministry of Finance of Russia No. 61n as of April 19, 2019 - New forms of invoices and the universal transfer document (UPD) are fully applied. From January 1, the use of old forms is not allowed.

Source: Order of the FTS of Russia No. MMV-7-15/820@ as of December 12, 2018 - Since 2020, organizations hiring foreign workers must submit information to the Ministry of Internal Affairs in a new form.

Source: Order of the Ministry of Internal Affair No. 363 as of June 04, 2019 - Starting from the 1st quarter of 2020, organizations must provide the FTS with the calculations of Insurance premiums in a new form.

Source: Order of the FTS of Russia No. MMV-7-11/470@ as of September 18, 2019 - Since the new year, Rosstat has updated many forms of statistical accounting and reporting for the corporate sector.

Source: Orders of Rosstat No. 404 as of July 15, 2019, No. 410 as of July 18, 2019, and No. 421 as of July 24, 2019

II. ACTIVITY OF COMPANIES

- From 2020, the Russian companies should take into account the provisions of the International Convention, which prevents the erosion of the tax base and withdrawal of profits from taxation, for any payments to foreign counterparties or non-resident individuals. The Convention addresses issues related to hybrid tax reduction schemes. Since 2020, the rules of the Convention apply to double taxation avoidance agreements, and since 2021, for all other taxes.

Source: Federal law No. 79-FL as of May 01, 2019; “ ” 01.05.2019 No 79-ФЗ; "Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting" (concluded on November 24, 2016 in Paris) - At the end of 2020, as part of the development of AIS “TAX 3”, the FTS plans to introduce the “Climate Control” service, which will allow the taxpayer to evaluate the business or check the counterparty’s integrity.

"Passport of the Priority project "Development of the Automated Information System of the FTS of Russia (AIS "Tax-3") regarding the creation of an integrated analytical data warehouse and modernization of the information and analytical subsystem for the purposes of control work" ("Information and analytical subsystem for the purposes of the control work of the FTS of Russia")" (approved by the minutes of the meeting of the project committee No. 2 from March 27, 2018) - Small and medium-sized businesses will be able to receive payment under contracts concluded under the 223-FL within up to 15 days, instead of 30 days. The rule is effective from January 1, 2020. This will significantly improve the company's financial planning and increase the attractiveness of procurement for participants.

Source: RF Government Decree No. 1205 as of September 18, 2019 - By December 20, 2020, the FTS should create a Unified register of small and medium-sized enterprises - recipients of state and municipal support. The new register will be placed on the FTS of Russia official website.

Source: Federal law No. 279-FL as of August 02, 2019 - By the end of 2020, amendments to the legislation should be prepared, repealing the several thousand normative legal acts adopted in the USSR and the RSFSR and still in force in Russia - the “regulatory guillotine”. Instead of them many new by-laws are being developed, including those related to industry regulation.

Source: The action plan (“Road Map”) for the implementation of the mechanism of the “regulatory guillotine” (approved by the Government of the Russian Federation on May 29, 2019 No. 4714p-P36) - From June 1, 2020, with dairy products will be added to the list of goods subject to mandatory labeling. Mandatory labeling of goods should completely cover the “gray” imports into Russia. On December 31, 2019, the FTS experiment on introducing a “traceability” mechanism ended, within which tax specialists worked out a system for tracking the movement of each unit of marked goods.

Source: RF Government Decree No. 515 as of April 26, 2019 26.04.2019 N 515; "Agreement on the traceability mechanism of goods imported into the customs territory of the Eurasian Economic Union" (concluded on April 29,2019 in Nur-Sultan); RF Government Decree No. 792-r as of April 28, 2018

III. TAXATION

- Profit tax

From January 1, tax is payable on income paid by a foreign organization to its Russian shareholder, regardless of the taxation of such payment in a foreign jurisdiction.

Source: Federal law No. 325-FL as of September 29, 2019 - VAT

From January 1, companies will be able to receive VAT deductions from purchases to create trademarks, patents and other intangible assets. To get the deduction, organizations do not need to wait for the actual use of the asset.

Source: Federal law No. 325-FL as of September 29, 2019 - Corporate property tax

From January 1, organizations will pay real estate tax, regardless of whether the property is accounted for as fixed asset or not. The maximum rate amount is 2%.

Source: Federal law No. 325-FL as of September 29, 2019

From January 1, the list of objects of taxation on the cadastral value has been expanded: residential premises; garages; car parking spaces; construction in progress; residential buildings; garden houses.

Source: Federal law No. 379-FL as of November 28, 2019 - Single tax on imputed income

From January 1, a ban is imposed on the use of the single tax on imputed income by organizations and entrepreneurs engaged in retail sale of mandatory labeling goods: medicines, shoes, and fur products. Recall that from January 1, 2021 the single tax on imputed income is canceled for all organizations.

Source: Federal law No. 379-FL as of November 28, 2019; Order of the Ministry of Economic Development of Russia No. 684 as of October 21, 2019 - Investment

Organizations involved in the integrated development of the territory will be able to return up to 100% of the amount of expenses for the creation of transport and communal infrastructure objects, and up to 80% of the amount of expenses for the creation of social infrastructure objects from January 1. One can use the investment deduction until 2027.

Source: Federal law No. 210-FL as of July 26, 2019

In 2020, it is planned to develop important bills aimed at combating the artificial reduction of the tax base, which so far remains an urgent problem for the economy. Serious changes are being prepared related to inspections of the corporate sector, in connection with which the business community hopes to simplify audit procedures. The Federal Tax Service plans to begin to develop a mechanism to identify gray salaries in companies, for which it intends to use its experience in foreign exchange and financial control. We will continue to inform you about these and other innovations in the legislation and analyze the consequences of their application. We hope that the changes will have a positive effect on the business climate and the economy in the country.

Return on sales of household electric appliances

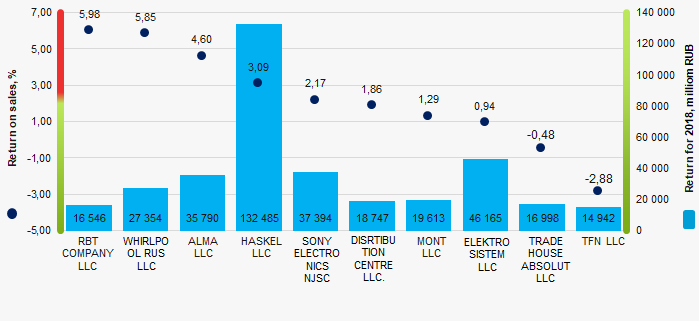

Information agency Credinform represents the ranking of the largest Russian wholesalers of household electric appliances. Trading companies with the largest volume of annual revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available periods (for 2016 - 2018). Then they were ranked by the return on sales ratio (Table 1). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Return on sales (%) is calculated as the share of operating profit in the total sales of a company. The ratio reflects the efficiency of industrial and commercial activity of an enterprise and shows the share of company’s funds obtained as a result of sale of products, after covering its cost of sales, paying taxes and interest payments on loans.

The spread in values of the return on sales in companies of the same industry is determined by differences in competitive strategies and product lines.

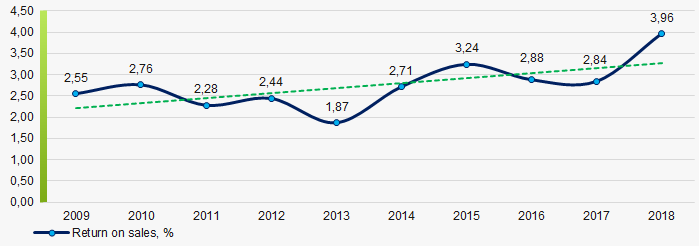

The experts of the Information agency Credinform, taking into account the actual situation both in the economy as a whole and in the sectors, has developed and implemented in the Information and Analytical system Globas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry. For wholesalers of household electric appliances the practical value of the return on sales ratio made from 3,96% in 2018.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all combination of indicators and financial ratios.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Return on sales, % | Solvency index Globas | |||

| 2017 | 2018 | 2017 | 2018 | 2017 | 2018 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| RBT COMPANY LLC INN 7452030451 Moscow |

12359,4 12359,4 |

16545,7 16545,7 |

11,9 11,9 |

69,7 69,7 |

2,32 2,32 |

5,98 5,98 |

180 High |

| WHIRLPOOL RUS LLC INN 7717654289 Moscow |

26351,9 26351,9 |

27354,3 27354,3 |

616,4 616,4 |

1268,6 1268,6 |

4,95 4,95 |

5,85 5,85 |

240 Strong |

| ALMA LLC INN 7701713130 Moscow, case on declaring the company bankrupt (insolvent) is proceeding bankruptcy proceedings since 20.11.2019 |

45271,1 45271,1 |

35790,5 35790,5 |

220,2 220,2 |

104,7 104,7 |

-0,45 -0,45 |

4,60 4,60 |

550 Insufficient |

| HASKEL LLC INN 7719269331 Moscow region |

124385,7 124385,7 |

132485,0 132485,0 |

732,3 732,3 |

2394,2 2394,2 |

1,13 1,13 |

3,09 3,09 |

187 High |

| SONY ELECTRONICS NJSC INN 7703001265 Moscow |

32198,8 32198,8 |

37393,8 37393,8 |

223,3 223,3 |

286,1 286,1 |

1,98 1,98 |

2,17 2,17 |

225 Strong |

| DISRTIBUTION CENTRE LLC INN 5047067909 Moscow region |

12867,0 12867,0 |

18746,6 18746,6 |

57,1 57,1 |

58,2 58,2 |

0,54 0,54 |

1,86 1,86 |

204 Strong |

| MONT LLC INN 7703313144 Moscow |

19896,3 19896,3 |

19612,9 19612,9 |

197,3 197,3 |

202,1 202,1 |

0,74 0,74 |

1,29 1,29 |

174 Superior |

| ELEKTROSISTEM LLC INN 7704844420 Moscow, In process of reorganization in the form of acquisition of other legal entities, 11.11.2019 |

43992,8 43992,8 |

46165,3 46165,3 |

232,1 232,1 |

614,7 614,7 |

0,62 0,62 |

0,94 0,94 |

249 Strong |

| TRADE HOUSE ABSOLUT LLC INN 7726600963 Moscow |

18463,2 18463,2 |

16998,2 16998,2 |

139,0 139,0 |

-183,4 -183,4 |

-0,16 -0,16 |

-0,48 -0,48 |

307 Adequate |

| TFN LLC INN 7727696432 Moscow |

18353,2 18353,2 |

14941,7 14941,7 |

262,6 262,6 |

285,4 285,4 |

-2,90 -2,90 |

-2,88 -2,88 |

225 Strong |

| Avearge value by TOP-10 companies |  35414,0 35414,0 |

36603,4 36603,4 |

269,2 269,2 |

510,0 510,0 |

0,88 0,88 |

2,24 2,24 |

|

| Industry average value |  111,4 111,4 |

119,7 119,7 |

1,8 1,8 |

-1,4 -1,4 |

2,84 2,84 |

3,96 3,96 |

|

improvement of the indicator to the previous period,

improvement of the indicator to the previous period,  decline in the indicator to the previous period.

decline in the indicator to the previous period.

The average value of the return on sales of TOP-10 enterprises is below industry average and practical values. Nine companies improved results in 2018.

Picture 1. Return on sales ratio and revenue of the largest Russian wholesalers of household electric appliances (TOP-10)

Picture 1. Return on sales ratio and revenue of the largest Russian wholesalers of household electric appliances (TOP-10)The industry average indicators of the return on sales trend to increase over the course of 10 years (Picture 2).

Picture 2. Change in the industry average values of the return on sales ratio of Russian wholesalers of household electric appliances in 2009 – 2018

Picture 2. Change in the industry average values of the return on sales ratio of Russian wholesalers of household electric appliances in 2009 – 2018