Wood processing industry trends

Information agency Credinform presents a review of activity trends of the largest Russian companies in the wood processing industry.

The largest companies in terms of annual revenue for the last reporting periods available in the state statistics bodies and the Federal Tax Service (2011 – 2020) engaged in wooden products manufacture (lumber, plywood, veneer, wooden containers and decking, prefabricated wooden constructions) (TOP 1000) were selected for the analysis. Selection and analysis of companies were carried out based on data from the Information and Analytical system Globas.

Net assets – is a ratio that reflects the real value of the company's property that is calculated annually as the difference between the assets on the company's balance sheet and its debt obligations. The net asset ratio is negative (insufficient property) if the company's debt exceeds the value of its property.

The largest company in the TOP 1000 in terms of net assets is EGGER DREVPRODUKT GAGARIN LLC, INN 6723019741, Smolensk Region, production of plywood, wooden veneered panels and similar layered materials, wood slabs and other lignified materials. In 2020, net assets amounted to almost 25 billion rubles.

The smallest net asset value in the TOP 1000 is RIMBUNAN HIJAU MDF LLC, INN 2721143979, Khabarovsk Territory, logging. Property insufficiency in 2020 was expressed by a negative value of -16 billion RUB.

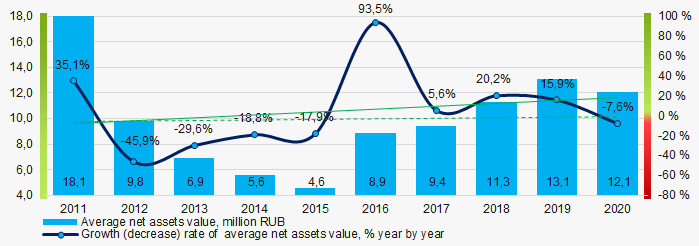

Covering the ten-year period, average net assets of the industry and their growth rates have an upward trend (Picture 1).

Picture 1. Change in average industry net assets ratios of in 2011-2020

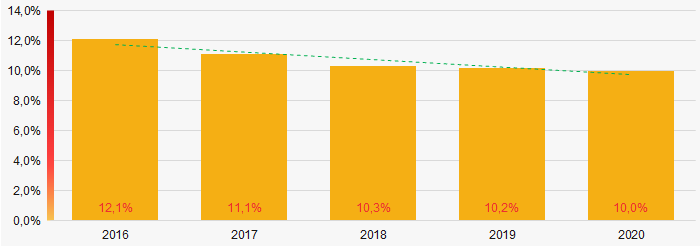

Picture 1. Change in average industry net assets ratios of in 2011-2020Shares of companies with property insufficiency in the TOP 1000 had a positive downward trend over the past five years (Picture 2).

Picture 2. Shares of the TOP 1000 companies with negative net assets in 2016-2020

Picture 2. Shares of the TOP 1000 companies with negative net assets in 2016-2020Sales revenue

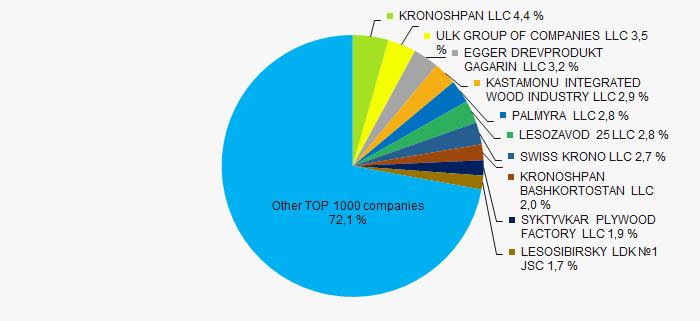

The revenue of the top ten companies in 2020 amounted to 28% of the total revenue of the TOP 1000 companies. (Picture 3). This indicates a high level of competition in the industry.

Picture 3. Доли участия компаний ТОП-10 в суммарной выручке 2020 г. ТОП-1000

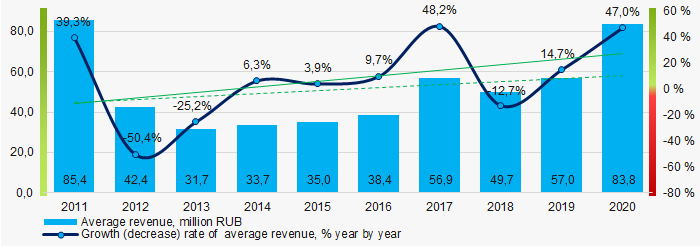

Picture 3. Доли участия компаний ТОП-10 в суммарной выручке 2020 г. ТОП-1000During the ten-year period, average industry revenue values and their growth rates have been increasing year by year. (Picture 4).

Picture 4. Changes in average industry revenue ratios in 2011-2020

Picture 4. Changes in average industry revenue ratios in 2011-2020Profit and loss

The largest company in the TOP 1000 in terms of net profit in 2020 is PALMIRA LLC, INN 7811085819, Saint Petersburg, production of wooden containers. The profit amounted to over 6 billion rubles.

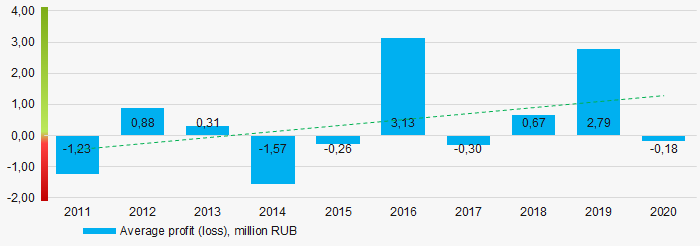

Covering the ten-year period, average industry profit values tend to increase. (Picture 5).

Picture 5. Change in average profit (loss) ratios of the TOP 1000 in 2011-2020

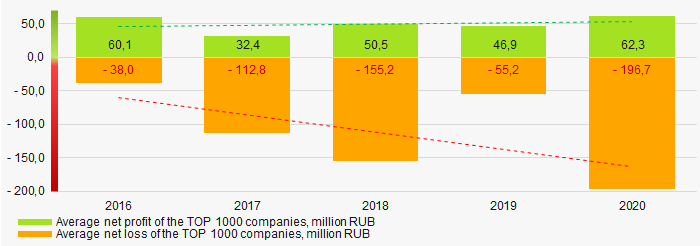

Picture 5. Change in average profit (loss) ratios of the TOP 1000 in 2011-2020Covering the five-year period, average values of net profit and net loss ratios of TOP 1000 companies tend to increase (Picture 6).

Picture 6. Changes in average values of net profit and net loss ratios of the TOP 1000 companies in 2016-2020

Picture 6. Changes in average values of net profit and net loss ratios of the TOP 1000 companies in 2016-2020Key financial ratios

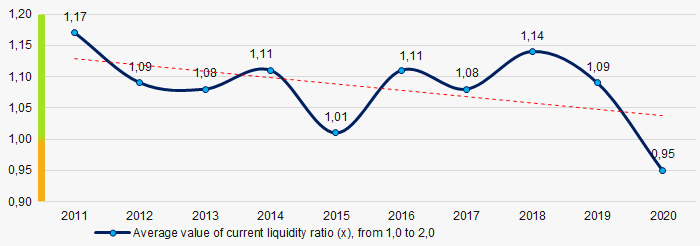

Covering the ten-year period, current liquidity ratio average values were in the range of recommended values - from 1.0 to 2.0, with a trend to decrease. (Picture 7).

Current liquidity ratio (current assets to short-term liabilities) shows sufficiency of a company’s assets to settle short-term liabilities.

Picture 7. Changes in current liquidity ratio average industry values in 2011-2020

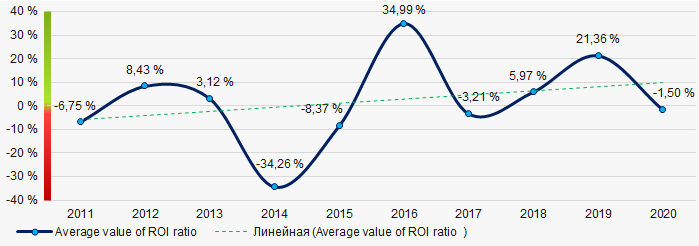

Picture 7. Changes in current liquidity ratio average industry values in 2011-2020For ten years, average industry indicators of the ROI showed an upward trend. (Picture 8).

This ratio is calculated as ratio of net profit to amount of equity and long-term liabilities and demonstrates return on equity involved in commercial activities and long-term funds raised by organization.

Picture 8. Change in return on investment ratio average values in 2011-2020

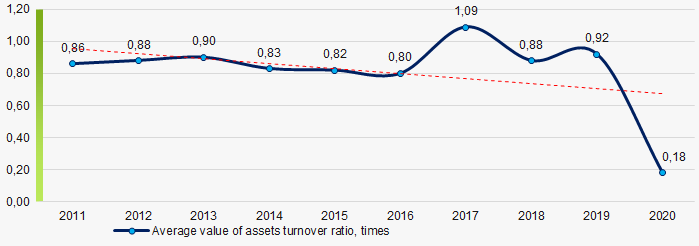

Picture 8. Change in return on investment ratio average values in 2011-2020Asset turnover ratio is calculated as ratio of sales revenue to average value of total assets for a period and implicates the efficiency of use of all available resources; regardless of the sources, they were raised. The ratio shows how many times per year the full cycle of production and turnover is performed generating the corresponding effect in the form of profit.

Covering the ten years period, values of the said business activity ratio showed a trend to decrease (Picture 9).

Picture 9. Change in average asset turnover ratio values in 2011-2020

Picture 9. Change in average asset turnover ratio values in 2011-2020Small enterprises

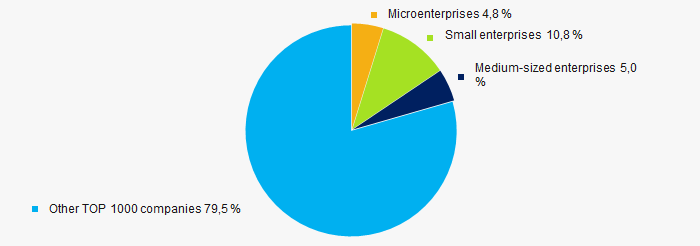

84% of the TOP 1000 companies are registered in the Unified Register of Small and Medium-Sized Enterprises of the Federal Tax Service of the Russian Federation. At the same time, the share of their revenue in the total revenue of the TOP 1000 in 2020 is over 20%, which is the average for the country in 2018-2019. (Picture 10).

Picture 10. Revenue shares of small and medium-sized enterprises in the TOP-1000

Picture 10. Revenue shares of small and medium-sized enterprises in the TOP-1000Main regions of activity

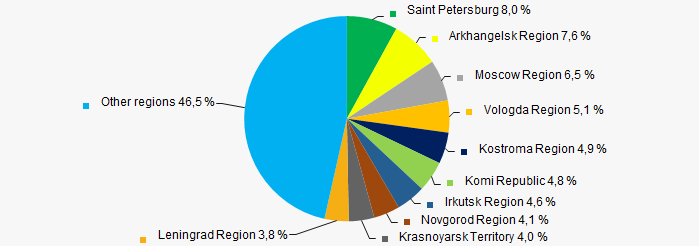

The TOP-1000 companies are registered in 69 regions (81% of the subjects of the Russian Federation) and are distributed unevenly across the country. Over 53% of the total revenue of the TOP 1000 companies in 2020 is concentrated in ten regions (Picture 11).

Picture 11. Distribution of the TOP 1000 companies' revenue by Russian regions

Picture 11. Distribution of the TOP 1000 companies' revenue by Russian regionsFinancial position score

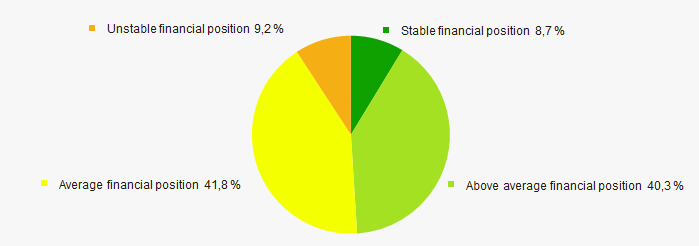

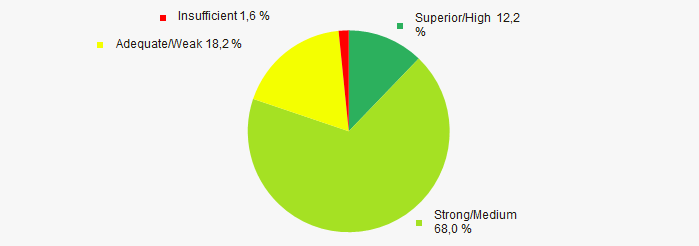

Financial position assessment of the TOP 1000 companies shows that the largest part of them is in average financial position. (Picture 12).

Picture 12. Distribution of TOP-100 companies by financial position score

Picture 12. Distribution of TOP-100 companies by financial position scoreGlobas Solvency Globas

The largest part of the TOP 1000 companies has been assigned superior and high Globas Solvency Index. This indicates their ability to fully meet their debt obligations (Picture 13).

Picture 13. Distribution of the TOP 1000 companies according to the Globas Solvency Index

Picture 13. Distribution of the TOP 1000 companies according to the Globas Solvency Index Conclusion

A comprehensive assessment of activities of the largest companies in the wood processing industry indicates the predominance of positive trends in their activities in the period from 2011 to 2020. (Table 1).

| Trends and evaluation factors | Share of factor, % |

| Dynamics of average net assets value |  10 10 |

| Growth (decline) rate in average size of net assets |  10 10 |

| Increase / decrease in share of enterprises with negative values of net assets |  10 10 |

| Level of monopolization / competition |  5 5 |

| Dynamics of average revenue |  10 10 |

| Growth (decline) rate in average size of revenue |  10 10 |

| Dynamics of average profit (loss) |  5 5 |

| Increase / decline in average values of net profit |  10 10 |

| Increase / decline in average values of net loss |  -10 -10 |

| Increase / decrease in average values of current liquidity ratio |  -5 -5 |

| Increase / decrease in average values of return on investment ratio |  10 10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| The share of small and medium-sized enterprises in revenue is more than 20% |  10 10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  5 5 |

| Globas Solvency Index (the largest share) |  10 10 |

| Average value of factors share |  4,4 4,4 |

positive trend (factor),

positive trend (factor),  negative trend (factor)

negative trend (factor)

TOP 10 wood processing enterprises

Information agency Credinform presents the ranking of the largest Russian primary wood processing enterprises. The largest companies in the industry (TOP 10 and TOP 1000) in terms of annual revenue for the last reporting periods available in the state statistics bodies and the Federal Tax Service (2018-2020) were selected for the ranking. Then they were ranked by product profitability ratio (Table 1). Selection of companies and analysis were carried out on the basis of data from the Information and Analytical system Globas.

Product profitability is calculated as a ratio of profit from sales to ordinary activities expenses. In general, profitability reflects the economic efficiency of production. Analysis of product profitability allows us to assess efficiency and feasibility of manufacturing goods.

There are no standard values for indicators of this group, since they vary greatly depending on industry.

It is necessary to pay attention to the entire set of indicators and financial ratios to get the most complete and objective picture of enterprise's financial condition.

| Name, INN, region | Revenue, million rubles | Net profit (loss), million rubles. | Product profitability, % | Globas Solvency Index | |||

| 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| MAYER-MELNHOF HOLZ EFIMOVSKY LLC INN 4715778325 Leningrad Region |

6 906,2 6 906,2 |

6 690,7 6 690,7 |

1 916,4 1 916,4 |

972,9 972,9 |

34,85 34,85 |

24,91 24,91 |

192 Superior |

| KALEVALA WOODWORKING PLANT LLC INN 7807311832 Republic of Karelia |

4 102,8 4 102,8 |

4 339,1 4 339,1 |

152,6 152,6 |

207,7 207,7 |

18,30 18,30 |

18,04 18,04 |

229 Strong |

| LESRESURS LLC INN 3808156861 Irkutsk Region |

4 072,4 4 072,4 |

4 399,5 4 399,5 |

460,1 460,1 |

867,6 867,6 |

15,75 15,75 |

17,56 17,56 |

168 Superior |

| ILIM TIMBER INDUSTRY LLC INN 7838407799 Saint Petersburg |

8 416,1 8 416,1 |

10 110,8 10 110,8 |

30,5 30,5 |

117,7 117,7 |

2,63 2,63 |

16,57 16,57 |

191 Superior |

| LESOZAVOD 25 JSC INN 2928001265 Arkhangelsk Region |

12 730,9 12 730,9 |

16 986,5 16 986,5 |

269,4 269,4 |

2 046,6 2 046,6 |

4,60 4,60 |

14,29 14,29 |

171 Superior |

| YUGORSKY TIMBER INDUSTRY HOLDING LLC INN 8601022074 Khanty-Mansi Autonomous Area - Yugra |

4 862,9 4 862,9 |

5 432,2 5 432,2 |

172,0 172,0 |

427,0 427,0 |

6,25 6,25 |

11,68 11,68 |

149 Superior |

| ULK GROUP OF COMPANIES LLC INN 2922008546 Arkhangelsk Region |

18 089,0 18 089,0 |

20 863,0 20 863,0 |

-77,1 -77,1 |

-7 368,7 -7 368,7 |

9,42 9,42 |

10,40 10,40 |

321 Adequate |

| LESOSIBIRSKY LDK №1 JSC INN 2454003302 Krasnoyarsk Territory |

8 960,9 8 960,9 |

10 268,1 10 268,1 |

224,2 224,2 |

-397,9 -397,9 |

-2,10 -2,10 |

9,50 9,50 |

281 Medium |

| AMUR TIMBER INDUSTRY COMPANY LLC INN 2721162072 Khabarovsk Territory |

4 338,3 4 338,3 |

4 252,3 4 252,3 |

167,3 167,3 |

-2 230,0 -2 230,0 |

-5,70 -5,70 |

-0,28 -0,28 |

321 Adequate |

| RUSSIAN FOREST 3000 LLC INN 6711012340 Smolensk Region |

20 695,0 20 695,0 |

11 858,3 11 858,3 |

15 655,4 15 655,4 |

-1 070,4 -1 070,4 |

310,65 310,65 |

-8,28 -8,28 |

275 Medium |

| TOP 10 average value |  9 317,4 9 317,4 |

9 520,1 9 520,1 |

1 897,1 1 897,1 |

-642,8 -642,8 |

39,47 39,47 |

11,44 11,44 |

|

| TOP 1000 average value |  273,2 273,2 |

284,2 284,2 |

24,4 24,4 |

0,8 0,8 |

12,90 12,90 |

12,17 12,17 |

|

| Industry average value |  50,4 50,4 |

50,0 50,0 |

2,4 2,4 |

-0,1 -0,1 |

10,46 10,46 |

8,61 8,61 |

|

improvement of the indicator to the previous period,

improvement of the indicator to the previous period,  deterioration of the indicator to the previous period

deterioration of the indicator to the previous period

In 2020, average indicators of the product profitability coefficient of the TOP 10 and TOP 1000 are higher than the industry average. Two companies from the TOP 10 had negative indicators in both 2019 and 2020. The decline in indicators in 2020 was observed in three TOP 10 companies, while in 2019 there were six such companies.

At the same time, in 2020, seven companies increased their revenue and five companies increased their net profit.

The increase in average revenue in the TOP 10 amounted to 2%, in the TOP 1000 - 4%, and the average industry indicator decreased by almost 1%.

The average profit in the TOP 10 decreased by almost 4 times, in the TOP 1000 - by 30 times, and the average drop in the industry was 25 times.

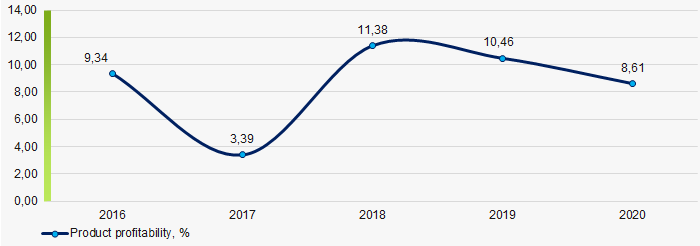

Over the past 5 years, average industry indicators of product profitability coefficient have been growing only in 2018. The best value of indicator was achieved in the same year, and the worst result was shown in 2017. (Picture 1).

Picture 1. Changes in average industry values of product profitability coefficient of primary wood processing enterprises in 2016-2020.

Picture 1. Changes in average industry values of product profitability coefficient of primary wood processing enterprises in 2016-2020.