Introduction of responsibility for Russian and foreign legal entities for bribery of public officials abroad

In March 2016 the Federal law of Russian Federation as of 09.03.2016 №64-FZ “Concerning the Introduction of Amendments to Code of the Russian Federation on Administrative Violations” came into force.

The amendments refer to the clauses concerning illegal gratification on behalf of the legal entity. The dispositions of the statute are now practiced in cases when the transfer or promise of money and valuables took place abroad. The responsibility occurs if these actions were stacked against interests of Russia as well as in cases contemplated by the international treaty of Russia if the violator wasn’t brought to criminal or administrative responsibility in the foreign country.

The lawbreakers might be fined under administrative procedures. The penalties amount to:

- in case of small bribery (less than 1 million RUB) – up to three-fold amount of remuneration but no fewer than 1 million RUB;

- in case of major bribery (from 1 to 20 million RUB) – up to thirty-fold amount of remuneration but no fewer than 20 million RUB;

- in case of grand bribery (more than 20 million RUB) – up to hundred-fold amount of remuneration but no fewer than 100 million RUB;

The fine sanctions are as well extended to foreign legal entities.

The law introduces the administrative responsibility for violation of contracts concluded on unorganized tenders such as: repurchase agreements, contracts being derivative financial instruments or other contracts provided by the statutory acts of the Central Bank of Russia or federal laws. The responsibility is also contemplated for filing of incomplete or unreliable information, violation of procedure and terms of filing of such information on aforementioned contracts or general agreement to repository or the Bank of Russia. The violation is punishable by an administrative fine for public officials ranging from 20 to 30 th RUB, and for legal entities – from 300 to 500 th RUB.

The administrative responsibility of repositories is significantly strengthened. This is relevant to such actions as improper refusal or avoidance of making entry on the aforementioned agreements; making of such entry without causes contemplated by federal laws or statutory acts of the Central Bank of Russia; non-fulfilment or improper fulfilment of the duty to file information from the list of agreements, including to the Central Bank of Russia; illegal acquisition, use or disclosure of information or data from the list of agreements. Such violations are fraught with fines – for public officials ranging from 30 to 50 th RUB, for legal entities – from 700 th to 1 million RUB.

Net profit ratio of the largest Russian law consulting firms

Information agency Credinform has prepared the ranking of the largest law consulting firms in Russia.

The largest companies by revenue volume for the last available in the Statistical register period (2014) were taken for the ranking. They were ranked in the descending order of net profit ratio.

Net profit ratio (%) is calculated as a ratio of net profit (loss) to revenue from sale. The ratio shows to what extent company’s sales were profitable.

There is no standard indicator value, therefore it is recommended to compare companies belonging to one industry or the change of ratio in the course of time by a specific enterprise. The negative value of indicator gives evidence to availability of the net profit. The bigger indicator value shows the bigger operating efficiency of an enterprise.

In order to get the fullest and fairest view of the company’s situation, it is necessary to pay attention not only to the values of financial ratios, but also to all the submitted financial and nonfinancial data.

| Name, tax number, region | Revenue 2014, th RUB | Revenue 2014 to 2013, % | Net profit 2014, th RUB | Net profit ratio 2013, % | Net profit ratio 2014, % | Solvency index Globas-i® |

|---|---|---|---|---|---|---|

|

CHAMBER OF COMMERCE AND INDUSTRY OF THE RUSSIAN FEDERATION, CCI OF RUSSIA Tax number 7710026920 Moscow |

833 444 |

163 |

712 762 |

192,58 |

85,52 |

210 High |

|

LAW FIRM GORODISSKY & PARTNERS LTD Tax number 7702195561 Moscow |

3 060 012 |

118 |

1 442 581 |

16,60 |

47,14 |

154 Prime |

|

JOINT STOCK COMPANY MIKHAILOV & PARTNERS.STRATEGIC COMMUNICATION MANAGEMENT Tax number 7702131247 Moscow |

1 076 820 |

100 |

252 306 |

23,67 |

23,43 |

236 High |

|

Limited Liability Company McKinsey & Company CIS Tax number 7710708760 Moscow |

6 718 388 |

110 |

545 128 |

14,00 |

8,11 |

203 High |

|

NEO CENTRE Joint Stock COMPANY Tax number 7706793139 Moscow |

883 967 |

121 |

39 539 |

16,65 |

4,47 |

260 High |

|

JOINT STOCK COMPANY BDO UNICON BUSINESS SOLUTIONS Tax number 7728641612 Moscow |

2 022 606 |

187 |

90 092 |

1,91 |

4,45 |

232 High |

|

Oliver Wyman LLCTax number 7709802744 Moscow |

974 569 |

78 |

23 500 |

23,47 |

2,41 |

241 High |

|

OOO DOLGOVOI TSENTR Tax number 7708597482 Moscow |

505 113 |

77 |

3 148 |

2,50 |

0,62 |

288 High |

|

Strategy Partners Group JSC Tax number 7736612855 Moscow |

882 912 |

118 |

4 770 |

5,35 |

0,54 |

228 High |

|

IFC Asset Management Company Tax number 7706250679 Ulyanovsk region |

479 745 |

93 |

-554 258 |

2,89 |

-115,53 |

306 Satisfactory |

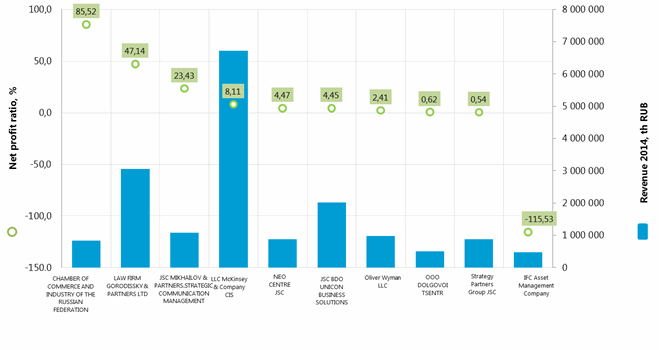

Limited Liability Company McKinsey & Company CIS, the Top-10 leader by revenue for 2014, is placed on the fourth spot of the ranking. Share of this company in Top-10 total revenue volume amounted to 39 %. CHAMBER OF COMMERCE AND INDUSTRY OF THE RUSSIAN FEDERATION has the highest net profit ratio 85,52%. The lowest and the most negative value -115,53% belongs to IFC Asset Management Company, which corresponds to the significant loss of the company for 2014. This is the only company in the Top-10 having satisfactory solvency index Globas-i®. It means that the solvency level of the company doesn’t guarantee full and timely repayment of debt obligations. The rest nine companies were given the prime and high solvency index Globas-i®, which gives evidence to their ability to meet debt obligations timely and full.

Figure 1. Net profit ratio, revenue from sale of the largest law consulting firms (Top-10)

Figure 1. Net profit ratio, revenue from sale of the largest law consulting firms (Top-10)

The total revenue volume of the Top-10 companies for 2014 amounted to 17,4 billion RUB, which is by 14% greater than the same indicator for 2013. At the same time the revenue of three companies decreased in comparison with the previous year. Only two companies - LAW FIRM GORODISSKY & PARTNERS LTD and JOINT STOCK COMPANY BDO UNICON BUSINESS SOLUTIONS showed the increase of net profit ratio value in 2014 in relation to 2013. The average indicator value in the Top-10 in 2013-2014 amounted to 19,85% and 14,68% respectively. It reflects the trend of efficiency decline of conducting this business due to total economic situation in the country.

Nine companies from the Top-10 are registered in Moscow. It bears evidence to the high centralization of law consulting services business in one region of the country. It is confirmed by the Federal State Statistics Service of Russia (Rosstat) data by the related type of activity – provision of auditing services (Table 2).

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | |

|---|---|---|---|---|---|---|

| Russian Federation | 23 055 363 | 23 879 631 | 23 376 519 | 25 698 381 | 27 174 094 | 27 301 423 |

| Central Federal District (CFD) | 16 975 505 | 18 133 217 | 18 193 189 | 20 778 198 | 22 309 382 | 22 579 036 |

| Share of CFD in the total volume across Russian Federation, % | 74 | 76 | 78 | 81 | 82 | 83 |