Current liquidity ratio of the largest Russian enterprises for growing perennial crops

Information agency Credinform prepared a ranking of the largest Russian enterprises growing perennial crops (grapes, citrus fruits and berries). Companies with the highest volume of revenue (TOP-10) were selected for this ranking according to the data from the Statistical Register for the latest available periods (2015 and 2014). The enterprises were ranked by current liquidity ratio in 2015 (Table 1). The analysis was based on data from the Information and Analytical system Globas®

Current liquidity ratio (x) is calculated as current assets to short-term liabilities of the company and shows the adequacy of the enterprise's funds to pay off its short-term obligations.

The recommended value is from 1.0 to 2.0. The value of the indicator less than 1.0 indicates the excess of current liabilities over current working capital. Thus, the lower interval limit is determined by the need to ensure the adequacy of working capital for the full repayment of short-term obligations. Otherwise, the enterprise faces bankruptcy. However, a significant excess of short-term funds over liabilities may indicate a violation of the capital structure and inefficient or non-rational investment of funds.

Taking into account the actual situation both in economy in general and in sectors, the experts of the Information Agency Credinform have developed and implemented in the Information and Analytical System Globas® the calculation of practical values of financial ratios that can be recognized as normal for a particular industry. The practical value of return on sales ratio for enterprises growing perennial crops in 2015 was from 0,36 to 2,45.

For the most complete and objective view of the financial condition of the enterprise it is necessary to pay attention to the complex of presented ratios, financial and other indicators of the company.

| Name, INN, region | Net profit, 2014, bln RUB | Net profit, 2015, bln RUB | Revenue, 2014, bln RUB | Revenue, 2015, bln RUB | R (х) | Solvency index Globas® |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| JSC COLLECTIVE AGRICULTURAL ENTERPRISE SVETLOGORSKOE INN 2323018810 Krasnodar territory | 51,1 | 136,7 | 356,0 | 476,7 | 7,88 | 156 The highest |

| JSC "Agrofirma Imeny 15 Let Oktyabrya" INN 4811004620 Lipetsk region | 224,7 | 377,0 | 717,8 | 956,0 | 7,59 | 285 High |

| ПPJSC AGRONOM INN 2330018225 Krasnodar territory | 84,5 | 248,6 | 481,8 | 703,0 | 6,36 | 134 The highest |

| OOO AGROFIRMA YUBILEINAYA INN 2352039564 Krasnodar territory | 168,0 | 291,6 | 338,2 | 516,9 | 4,96 | 243 High |

| ООО FANAGORIYA-AGRO INN 2352034020 Krasnodar territory | 92,2 | 165,0 | 348,2 | 396,4 | 4,67 | 195 The highest |

| PJSC SAD-GIGANT INN 2349008492 Krasnodar territory | -209,2 | 453,6 | 1 551,1 | 1 891,4 | 1,52 | 1199 The highest |

| JSC TSENTRALNO-CHERNOZEMNAYA PLODOVO-YAGODNAYA KOMPANIYA INN 3662070125 Voronezh region | 56,3 | 159,4 | 476,4 | 626,3 | 1,15 | 234 High |

| JSC AGROFIRMA YUZHNAYA INN 2352000493 Krasnodar territory | 525,3 | 830,2 | 1 321,3 | 1 924,9 | 0,90 | 199 The highest |

| JSC SOVKHOZ IMENI LENINA INN 5003009032 Moscow region | 391,3 | 1 401,3 | 1 415,8 | 958,5 | 0,90 | 210 High |

| JSC SHP VINOGRADNOE INN 2624022231 Stavropol territory | 0,4 | 1,3 | 610,4 | 598,4 | 0,72 | 245 High |

| Total for the group of companies TOP-10 | 1 384,5 | 4 064,5 | 7 617,0 | 9 048,5 | ||

| Average for the group of companies TOP-10 | 138,4 | 406,5 | 761,7 | 904,8 | 3,67 | |

| Industry average value | 1,2 | 3,3 | 15,9 | 17,2 | 1,24 |

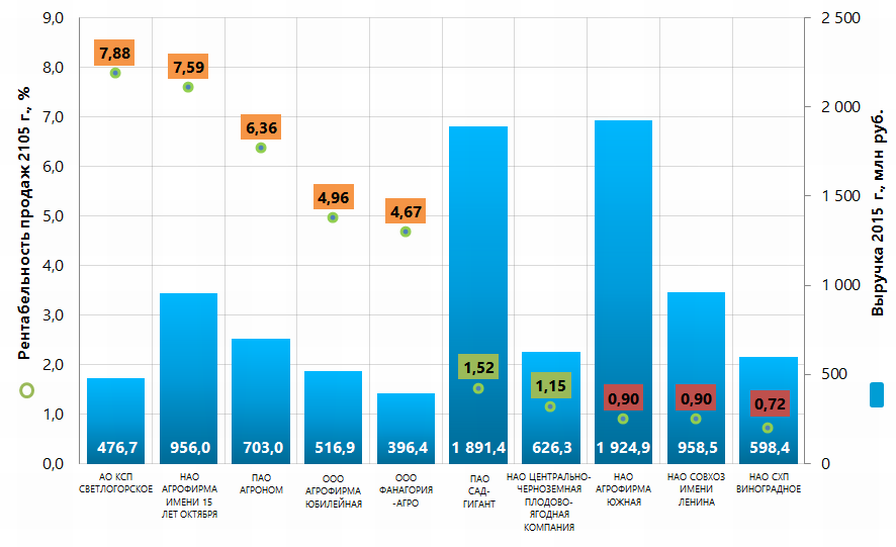

The average value of current liquidity ratio of TOP-10 in 2015 companies is higher than the recommended, practical and average values. Five companies of the TOP-10 have indicators above the upper interval limit of the recommended value, two companies - within the interval and three companies - below the interval values (marked in column 6 of Table 1 and on Picture 1 with yellow, green and red respectively). At the same time, the indicators of the last three companies are within practical limits.

In 2015 all companies of the TOP-10 increased net profit and two companies reduced revenue compared to the previous period (marked with red in column 5 of Table 1).

Picture 1. Current liquidity ratio and revenue of the largest Russian enterprises engaged in growing of perennial crops (TOP-10)

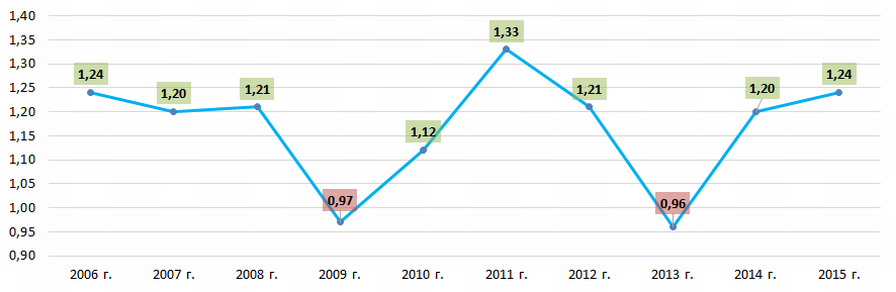

Picture 1. Current liquidity ratio and revenue of the largest Russian enterprises engaged in growing of perennial crops (TOP-10)The average sectoral indicators of current liquidity ratio (Picture 2) are quite stable and within the recommended range, except 2009 and 2013.

Picture 2. Change in the average sectoral values of profitability of sales ratio of the Russian enterprises engaged in growing of perennial crops in 2006 - 2015

Picture 2. Change in the average sectoral values of profitability of sales ratio of the Russian enterprises engaged in growing of perennial crops in 2006 - 2015All TOP-10 companies hot high and the highest Solvency index Globas®, which indicates their ability to timely and fully repay their debt obligations.

Return on sales ratio of the largest Russian pharmaceutical wholesale distributors

Information agency Credinform has prepared a ranking of the largest Russian pharmaceutical wholesale distributors. The enterprises with the highest volume of revenue (TOP-10) have been selected for the ranking, according to the data from the Statistical Register for the latest available accounting periods (2015 and 2014) (TOP-10). Then they have been ranked by the 2015 return on sales ratio (Table 1).

Return on sales (%) is the share of operating profit in the total sales volume of the company. The return on sales ratio represents the efficiency of the company’s industrial and commercial activity and shows its funds that remained after having covered the cost of production, loan interest and tax payments.

The variety of values of return on sales of companies within one sector is determined by the difference in competitive strategies and product lines. Thus, having the same value of revenue, operation costs and earnings before tax, two different companies may have different return on sales due to the ratio of interest to the net profit.

The calculation of practical values of financial ratios, which might be considered as normal for a certain industry, has been developed and implemented in the Information and Analytical system Globas® by the experts of Information Agency Credinform, having taken into account the current situation in the economy as a whole and in the industries. The practical value of the return on sales ratio for pharmaceuticals wholesalers starts from 4,87.

For the most comprehensive and objective opinion on the company’s financial position, the whole set of financial indicators and ratios should be taken into account.

| Name, INN, region | 2015 net profit, mln RUB | 2015 revenue, mln RUB | 2015/ 2014 revenue,% | 2015 return on sales, % | Solvency index Globas® |

| NJSC SANOFI RUSSIA INN 7705018169 Moscow | 2 936,4 | 47 476,6 | 2,8 | 17,87 | 181 The highest |

| JOHNSON & JOHNSON LIMITED LIABILITY COMPANY a159-c4e0f0d3187f INN 7725216105 Moscow | 3 277,7 | 46 715,1 | 7,2 | 13,93 | 191 The highest |

| NJSC BAYER INN 7704017596 Moscow | 508,0 | 41 126,2 | 21,6 | 6,19 | 229 High |

| JOINT STOCK COMPANY SCIENTIFIC PRODUCTION COMPANY KATREN INN 5408130693 Novosibirsk Region | 5 790,7 | 182 301,6 | 26,7 | 4,17 | 187 The highest |

| FARMPERSPEKTIVA LLC INN 6312050583 Kaluga region | 174,4 | 31 422,1 | 51,4 | 3,17 | 223 High |

| NJSC ROSTA INN 7726320638 Moscow region | 415,3 | 63 384,6 | -12,8 | 2,76 | 201 High |

| НNJSC CV PROTEK FIRM INN 7724053916 Moscow | 5 419,7 | 166 578,3 | 25,8 | 1,55 | 197 The highest |

| FK PULS LLC INN 5047045359 Moscow region | 2 150,9 | 92 038,1 | 67,3 | -0,60 | 188 The highest |

| PHARM-LOGISTIC LLC INN 7727692420 Moscow | -683,9 | 35 408,8 | -12,2 | -0,68 | 400 Low |

| NJSC SIA INTERNATIONAL LTD INN 7714030099 Moscow | -3 111,1 | 59 438,2 | -39,7 | -4,10 | 300 Satisfactory |

| Total for TOP-10 group of companies | 16 878,1 | 765 889,5 | |||

| Average value within TOP-10 group of companies | 1 687,8 | 76 588,9 | 11,5 | 4,43 | |

| Industry average value | 6,1 | 187,6 | 2,0 | 4,87 |

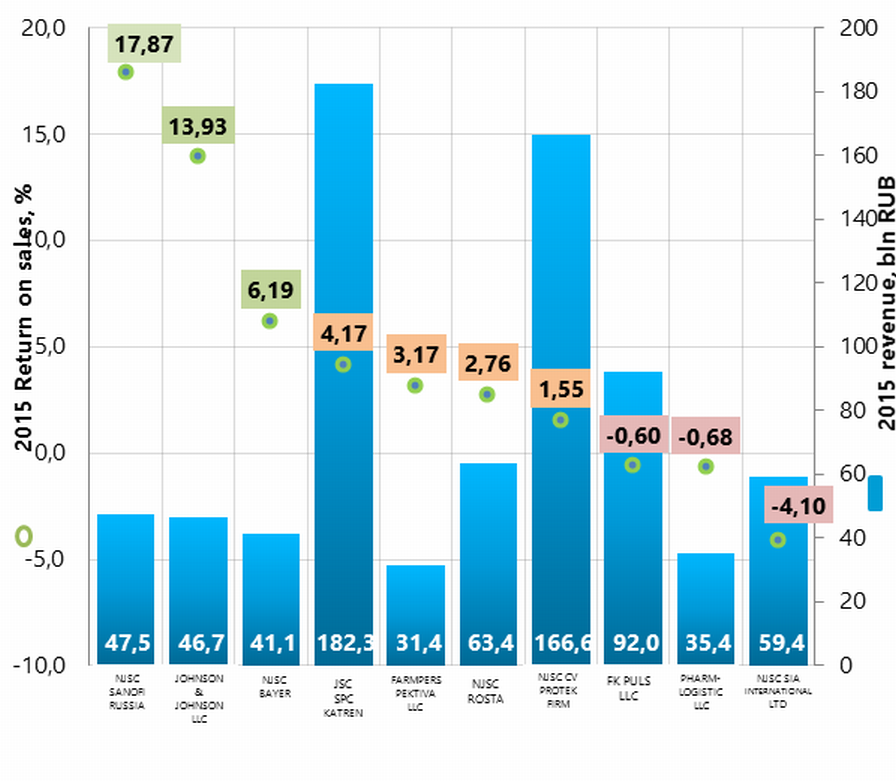

The average value of the 2015 return on sales ratio in TOP-10 group of companies is lower than practical value. Three companies of TOP-10 group of companies have a negative value of the ratio, four companies have a lower value, and three have a value that is higher than the practical one (red, yellow and green highlight respectively, in Table 1 and Picture 1).

Four companies of TOP-10 group decreased their revenue and net profit indicators (having loss) in 2015 as compared to the prior period (red highlight in Table 1).

Picture 1. Return on sales ratio and revenue of the largest Russian pharmaceuticals wholesalers (TOP-10)

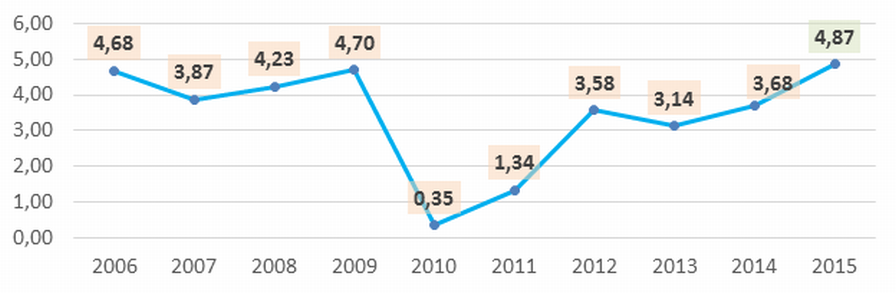

Picture 1. Return on sales ratio and revenue of the largest Russian pharmaceuticals wholesalers (TOP-10) Industry average values of the return on sales ratio (Picture 2) represent the macroeconomic situation in general, with declines during crisis periods.

Picture 2. Industry average values of the return on sales ratio of the largest Russian pharmaceuticals wholesalers in 2006 – 2015

Picture 2. Industry average values of the return on sales ratio of the largest Russian pharmaceuticals wholesalers in 2006 – 2015 Eight of TOP-10 companies got the highest or high solvency index Globas® that demonstrates their ability to pay their debts in time and fully.

PHARM-LOGISTIC LLC got a low solvency index Globas®, due to information concerning a bankruptcy claim against the company. In this regard, one is to expect the results of the case hearing. In addition to this, there are cases of late debt performance, unclosed writs of execution and loss within the balance sheet structure. Index development trends are negative.

NJSC SIA INTERNATIONAL LTD got a satisfactory solvency index Globas®, due to information concerning the company being a defendant in debt collection arbitration proceedings, untimely fulfillment of obligations and unclosed writs of execution. Index development trends are stable.