Filing of application procedure for insertion of software data to the Unified Register of the Russian programs for electronic computing machines (ECM) and databases is defined

Development of the register of the Russian programs for ECM and databases is provided by the RF Governmental Resolution of 16.11.2015 №1236 «On Establishing a Ban on Software Originating from Foreign Countries for the Purposes of Procurements for Federal and Municipal Needs».

The Unified Register of the Russian programs for electronic computing machines and databases (Register) contains information about all software (SW) with authorized origin from the RF.

In order to insert data about SW to the Register it is necessary to present:

- user account in the Unified System of Identification and Authentication (USIA);

- registered electronic signature certificate of a copyright holder;

- other information, documents and files, mentioned in the Rules for forming and administering the Unified Register of Russian programs for ECM and databases approved by the Resolution №1236.

Application and attached documents are filed to the Ministry of Communications and Mass Media of the RF (Minkomsvyaz) by means of electronic forms posted on the official site of the operator of the Register.

A copyright holder of SW or an individual empowered by copyright holders can file with an application. Authorities of executive power of the RF, subject of the RF, local self-government or organizations providing management or disposal of copyright can also file with an application in cases when SW exclusive rights reserved by the RF, subject of the RF, municipal entity.

After examination for compliance with the requirements of the Rules for forming and administering the Unified Register, Minkomsvyaz of the RF is obliged to take a decision on registration or denial of registration of SW during 10 work days from the date of application.

It should be reminded that programs for ECM and databases, originated from foreign countries, are forbidden by the Governmental Resolution of the RF №1236 during procurements for provisioning governmental and municipal needs. Contract type on SW realization and transmission form through communication channels do not matter.

Exceptions make cases of lack of information in the Register on SW, corresponding class of SW, planned for procurement or non-compliance of SW with the requirements specified by a customer.

Besides, this prohibition does not concern SW used by diplomatic and consular institutions of the RF in a foreign jurisdiction, trade representations of the RF of international organizations and SW or SW copyrights procurements, that information corresponding to state secret.

It is established that a customer is forbidden to replace the SW, information of that is included on the Register, with other SW in the course of civil law contract for delivery of SW or SW copyrights.

Minkomsvyaz of the RF is defined as empowered federal authority of executive power on forming and administering the Unified Register of the Russian programs for ECM and databases.

In general, realization of the RF Governmental Resolution № 1236 is aimed to support Russian SW manufacturers, spread its implementation and usage and provide Governmental assistance to SW copyright holders.

On October 10, 2016 the Register contains 2 046 names of software.

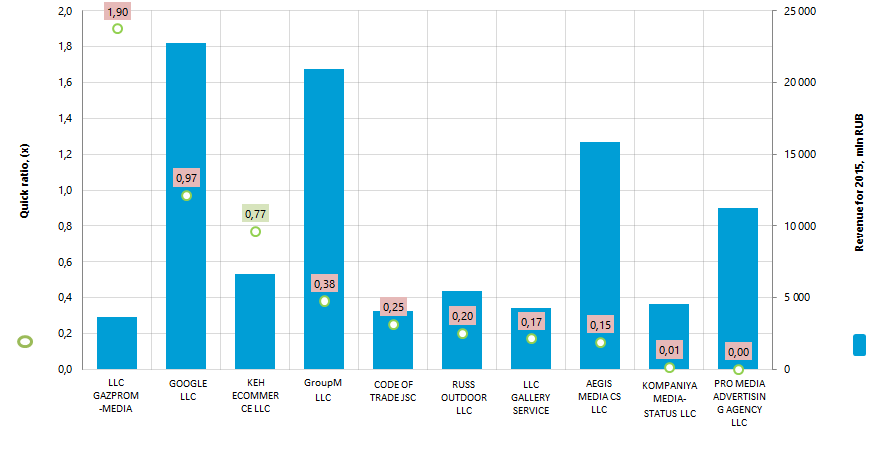

Quick ratio of the largest Russian advertising agencies

Information agency Credinform prepared a ranking of the largest Russian advertising agencies on the quick ratio.

The advertising agencies with the highest volume of revenue were selected for the ranking, according to the data from the Statistical Register for the latest available period - for 2015 (TOP-10). Then, the enterprises were ranked by decrease in quick ratio (Table 1).

Quick ratio characterizes company’s solvency in the short and medium term. The indicator is illustrative of the possibility of an enterprise to repay its short-term liabilities on account of the most liquid assets: cash, short-term receivables and short-term financial investment. Recommended value of the ratio is from 0,5 up to 0,8.

Too high ratio value may indicate irrational capital structure. It may be connected with a slow turnover of funds invested in stocks and an increase in accounts receivable. The low level of the indicator means that the funds and the upcoming income from current operations do not cover company’s current liabilities.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all available combination of ratios, financial and other indicators.

| Name, INN, Region | Net profit 2015, mln RUB | Revenue for 2015, in mln RUB | Revenue for 2015 by 2014, % | Quick ratio, (х) | Solvency index Globas-i |

|---|---|---|---|---|---|

| LLC GAZPROM-MEDIA INN 7728665444 Moscow |

1 371,4 | 3 671,8 | 84 | 1,90 | 216 High |

| GOOGLE LLC INN 7704582421 Moscow |

2 315,4 | 22 747,1 | 126 | 0,97 | 190 The highest |

| KEH ECOMMERCE LLC INN 7710668349 Moscow |

3 116,3 | 6 662,4 | 156 | 0,77 | 204 High |

| GroupM LLC INN 7731529770 Moscow |

769,2 | 20 957,8 | 122 | 0,38 | 181 The highest |

| CODE OF TRADE JSC INN 7710601954 Moscow |

785,8 | 4 061,9 | 377 | 0,25 | 215 High |

| RUSS OUTDOOR LLC INN 7731196087 Moscow region |

-744,4 | 5 436,8 | 95 | 0,20 | 301 Satisfactory |

| LLC GALLERY SERVICE INN 7714564333 Moscow |

-726,6 | 4 287,7 | 79 | 0,17 | 309 Satisfactory |

| AEGIS MEDIA CS LLC INN 7709583813 Moscow |

400,3 | 15 818,7 | 85 | 0,15 | 306 Satisfactory |

| KOMPANIYA MEDIA-STATUS LLC INN 7718840440 Moscow |

10,5 | 4 528,5 | 92 | 0,01 | 253 High |

| PRO MEDIA ADVERTISING AGENCY LLC INN 7701320731 Moscow |

6,4 | 11 256,9 | 290 | 0,00 | 219 High |

The average value of the quick ratio in the group of TOP-10 companies amounted to 0,48 in 2015. The same indicator in the group of TOP-100 companies averaged 0,41, by the industry average of 0,26.

The only company in the TOP-10, showing the recommended value of the ratio, is KEH ECOMMERCE LLC, which received also the highest net profit at the end of 2015.

There are 12 enterprises in the group of TOP-100 companies with the recommended value of the quick ratio. 15 organizations have the indicator above the recommended one in this group and 73 organizations have the indicator below the standard.

Seven companies from TOP-10 got the highest and high solvency index Globas-i, that indicates their ability to repay their debts in time and fully.

RUSS OUTDOOR LLC and GALLERY SERVICE LLC got satisfactory solvency index Globas-i, due to available information on their participation as defendants in arbitration court proceedings in terms of debt collection and due to losses in the balance sheet structure.

AEGIS MEDIA CS LLC got also satisfactory solvency index Globas-i, due to available information on cases of company’s late performance of its obligations and active enforcement orders.

The total revenue of the TOP-10 enterprises was 99,4 billion rubles in 2015, that is by 19% more than in 2014. At the same time the total net profit increased by 14%. Five companies of this group made in this period a decline in revenue and net profit, or loss. In the group of TOP-100 companies the increase in total revenue for the same period reached 22%, during the decrease in total net income by 7%.

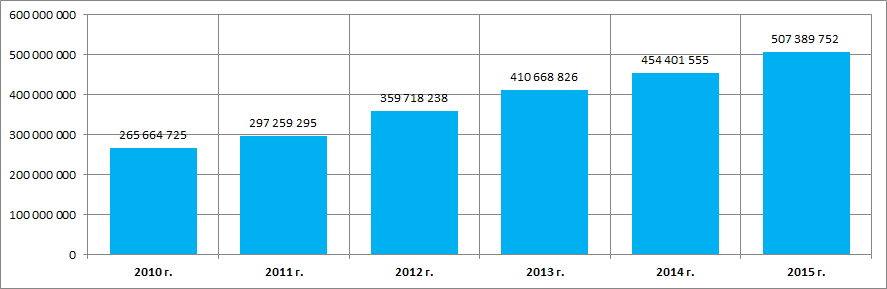

According to the Federal State Statistics Service (Rosstat), the amount of money spent by Russian organizations for the services of advertising agencies and audit companies is constantly increasing since 2010 (Picture 2).

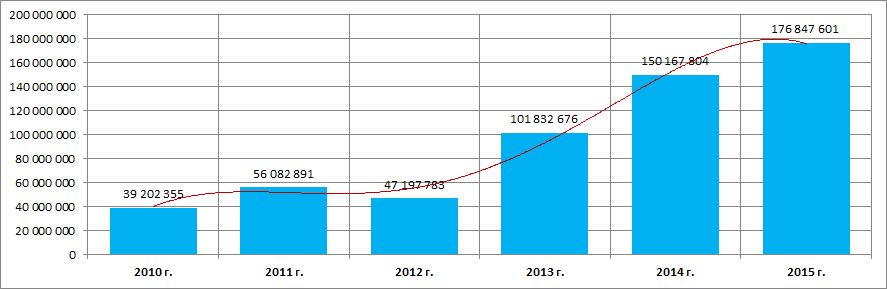

Such growth affects directly also the indicator of sales proceeds from the sale of advertising services, that is also confirmed by the data from Rosstat (Picture 3).

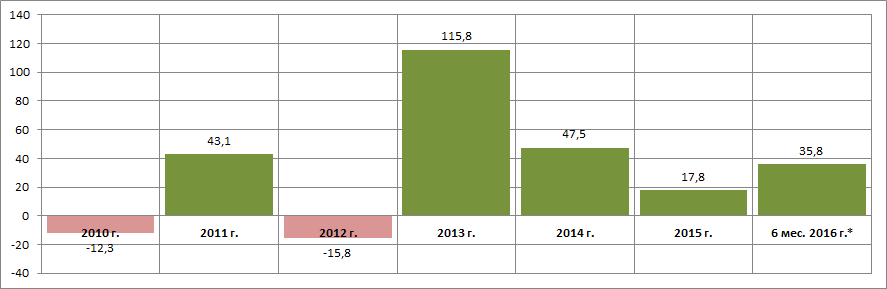

At the same time the revenue growth rate are instable from year to year (Picture 4).

*) - Data for 6 months 2016 are presented by the corresponding period of 2015

Thus, against the background of a growing volume of advertising services market, taken into account the significant number of companies with the quick ratio below standard, that is reflected in the industry average value of the ratio, the industry players in whole do not cover their current liabilities on account of own funds and income from current operations. This indicates an insufficiently high level of solvency of companies in the industry.

At the same time there is a significant concentration of advertising business observed in Moscow - the largest financial center in the country. This is testified by the data of the Information and analytical system Globas-i, according to which 100 the largest advertising agencies in terms of revenue for 2015 are focused only in five regions of Russia:

| Region | Amount of registered companies |

|---|---|

| Moscow | 85 |

| Moscow region | 7 |

| Saint-Petersburg | 5 |

| Nizhny Novgorod region | 2 |

| Krasnoyarsk territory | 1 |