Problems of anti-crisis plan implementation

After long discussions, disputes and agreements, the 2016 anti-crisis plan was formed in the first quarter of the current year. The plan contained the measures in different sectors of the economy, the aim of which was to stimulate the economic growth. In the plan development process the rational approach was used; taking into account the high level of uncertainty, the approach implied the detailed calculation of costs, proving the feasibility of each measure, introduction of scenario assessment elements.

The first part of the plan included high priority measures focused on stabilization of economic situation using distribution and redistribution of budget funds, facilities allocated from the Government anti-crisis fund and the balances, which were not used by the departments in the past year. The second part of the plan didn’t require financing as it contained the structural measures related to creation of positive environment for business with the focus on ensuring freedom, assistance and support of small and medium-sized business.

The total sum of funds on realization of 2016 anti-crisis measures amounted approximately to 684,8 bln RUB. It was supposed to use different sources of financing: almost 468,32 bln RUB from the budget of the Russian Federation, 176,0 bln RUB from the anti-crisis fund. The volume and source of financing of the last sum had to be defined till the end of half-year period by revenue results.

Among the arranged measures, the following steps were expeditious:

- allocation of budget credits and subsidies to regions for refinancing of their debts to banks, promotion of employment of population in order to prevent the growth of unemployment, social payments to unemployed: the largest item of expenditure is 310 bln RUB, already 208,2 bln RUB are transferred as of the end of first half of the year;

- allocation of funds for the development of single-industry cities, including the co-financing of infrastructure facilities, which promote the realization of investment projects, creation of priority development areas in some regions (7,2 bln RUB);

- recapitalization of the largest banks: 100 bln RUB from the budget of the Russian Federation were transferred for the financial recovery of the State Corporation "Bank for Development and Foreign Economic Affairs (Vnesheconombank)", subsidies in the form of asset contribution on foreign borrowings amounted to 109,5 bln RUB;

- support of promising scientific and technical industries and important for the chain related industries, for example: motor industry (137,69 bln RUB planned), transport engineering (to 10 bln RUB), agricultural machine building (10,5 bln RUB), consumer goods manufacturing (1,4 bln RUB), housing construction, agriculture, the turnover of medicines, besides it is planned to transfer 39,8 bln RUB from the National Wellbeing Fund to RUSSIAN RAILWAYS for the purchase of locomotives;

- it is supposed to allocate 11,1 bln RUB from the budget of the Russian Federation for the support of small and medium-sized enterprises, creation of new enterprises and modernization of existing businesses.

At the July meeting of the Government of the Russian Federation it was noted, that according to the results of the first half of the year only 70 out of 120 anti-crisis measures were applied. Among the reasons of non-fulfillment were: non-allocation of the planned funds, non-receipt of them by the recipients (only the sixth part of its already distributed part was transferred from the anti-crisis fund) or non-use of them by the companies, as a result, the money stay at the bank accounts, bringing only the interest on deposits.

Besides, the Government didn’t define the source of financing for targeted support of single-industry cities (5,1 bln RUB required), stimulating the creation of new small and medium-sized enterprises (10 bln RUB), the expansion of grant program for small innovative enterprises (3 bln RUB), medical supply of certain categories of citizens (36,7 bln RUB), and also the second indexation of non-contributory pension. According to leading experts, the postponement of a decision on the source of financing may lead to enhancement in measures cost by more than 10% and amounted to 62,8 bln RUB.

Against the background of cost reduction the Government didn’t allocate the promised 38,9 bln RUB for RUSSIAN RAILWAYS, the program of state guarantees for loans attracted within the framework of project financing wasn’t renewed, the funds for high-tech export support wasn’t allocated although the Government has agreed to allocate only 7,5 bln RUB out of specified 13 bln RUB. It could be that the postponement of a decision on sources of financing for anti-crisis measures is connected with the opened discussion on the sources and volumes of financing for budget expenditure within 2017-2019.

The Central Bank of Russia will estimate pledges upon credit activities

In order to improve the bank supervision, protection of creditors and depositors’ interests, to get more reliable information on financial situation of the borrower and item value of the bank pledge, the Federal Law as of 03.07.2016 №362-FZ “On Introducing Amendments to articles 72 and 73 of the Federal Law “On the Central Bank of the Russian Federation (the Bank of Russia)” and article 33 of the Federal Law “On Banks and Banking Activities” was enacted.

The law determines the verification procedure of property availability and estimation by the Central Bank of Russia, being the pledged item upon receipt of a credit. The procedure of familiarization with activities of the borrower and pledger is also determined.

The Central Bank of Russia is entitled a right to carry out an expert examination of the pledged item, accepted as loan collateral, in order to determine the adequacy of credit organization reserves, created for risks. The corresponding examination involves implementation of measures for recognition of the pledged item existence, its inspection and assessment of its value.

Credit organizations are obliged to set up their reserves, taking into account the results of such examination. The ways of assistance with getting information on the pledged item and the borrower’s activity should be described in the internal documents of the credit organizations.

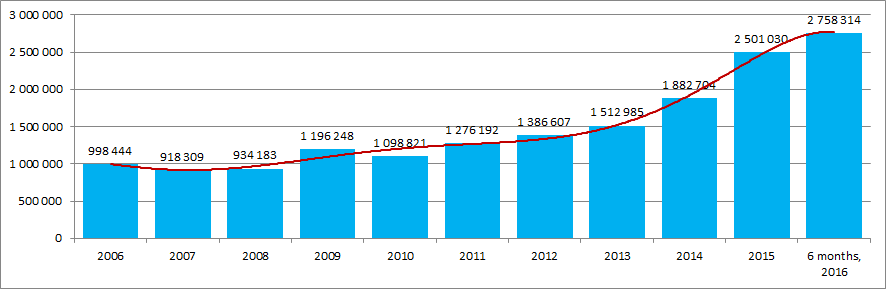

Growing volumes of loan debts of the Russian enterprises in recent years, including debt under bank credits and loan indebtedness, indicate the relevance of the measures taken for increase of pledgers and borrower’s responsibility to the credit organizations (Figure 1).

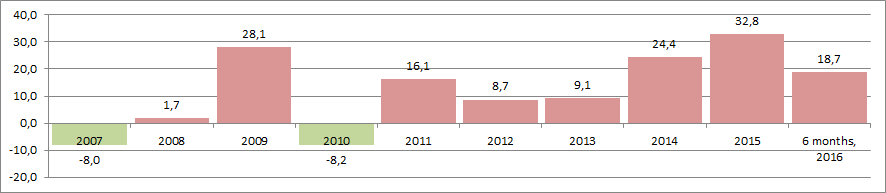

The growth rates of loan debts since 2007 are presented on the Figure 2.