Are special economic zones a breakthrough for Russia?

The Special Economic Zone (SEZ) is a part of territory of the Russian Federation determining by the Government of the RF, where a special "privileged" mode of doing business exists and customs procedure of free customs zone may operates. As a rule, the validity of such zones is several decades and that is quite logical - high-tech innovations and new growth models are not created from scratch, it takes a long time and investor confidence in the return of their investments. There are also zero interest rates to investors on key taxes. Additionally, there are tax breaks for government bodies aimed to the development of SEZ infrastructure.

On the territory of the Russian Federation special economic zone of the following types can be created: industrial and manufacturing, technology development, tourist and recreational, port.

Funding of the creation of engineering, transport, social, innovation and other infrastructure of the special economic zone effects at the expense of the federal budget and the budgets of other levels.

Industrial and manufacturing zones are a vast territory, located in the major industrial regions of the country. The proximity to the resource base for production, access to finished infrastructure and main roads, create favorable conditions for doing business, creating new high-tech fields and industries. Today there are six industrial and manufacturing zones: "Alabuga" (Republic of Tatarstan), "Lipetsk", "Togliatti", "Titanium Valley" (Sverdlovsk region), "Moglino" (Pskov region), "Ljudinovo" (Kaluga region).

Technology development zones are located in the largest research and education centers with a rich academic tradition and recognized research schools. They offer great opportunities for innovative business development, hi-tech production and its output to the Russian and international markets. Today there are five technology development zones: "Dubna" (Moscow Region), "St. Petersburg", "Zelenograd» (Moscow), "Tomsk", "Innopolis" (Republic of Tatarstan).

Tourist and recreational zones are located in the most scenic and popular tourist regions of Russia. Special economic zone of tourist-type offer favorable conditions for the organization of tourism, sports, recreational and other types of businesses. Today there are four special economic zone of this type in Russia: "Altai Valley" (Altai region), "Baikal harbor" (Republic of Buryatia), "Gate of Baikal" (Irkutsk region), "Biryuzovaya Katun" (Buryatia).

Port zones are located in close proximity to major transportation routes, logistics SEZ can be a platform for the organization of the shipbuilding and ship repair activities, provision of logistics services, as well as a base for new routes. Currently there are two port SEZ: "Ulyanovsk", "Sovetskaya Gavan" (Khabarovsk Territory).

Thus it can be concluded that there are quite a great number of sites in Russia with preferential tax and customs regime, the infrastructure created by the state. However, it will take a large time period to SEZ to give our country new breakthrough technologies require, the stability of the legal framework and investor confidence that in spite of the preferential tax treatment and other incentives, their investment will bring them the planned return in the form of profits and participation in the management of generated business.

Profitability of enterprises engaged in forging, pressing, stamping and roll in Russia

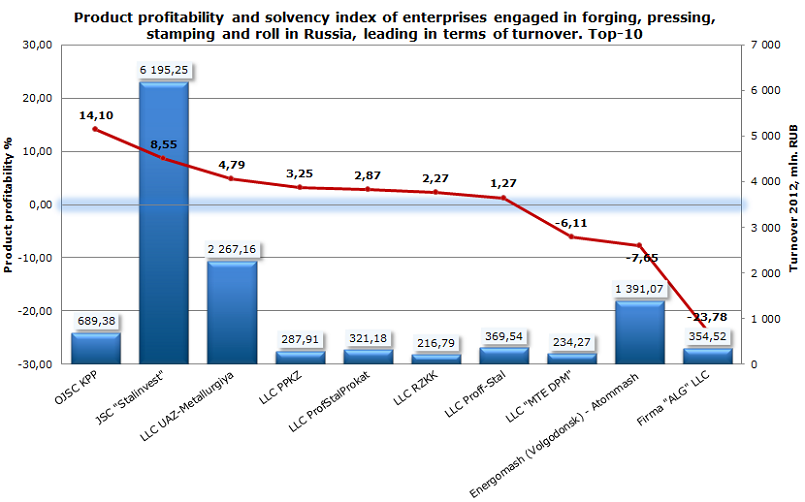

Information agency Crerdinform prepared a profitability ranking of enterprises engaged in forging, pressing, stamping and roll in Russia. The ranking list includes industry’s 10 largest Russian companies with mentioned activity type and is based on revenue as stated in the Statistics register, with the reference period of 2012. These companies were ranked first in terms of revenue, and then of product profitability decreasing.

Product profitability is rated as relation of sales profit to operating expenses. Economically, profitability shows allocated efficiency. Thuswise, product profitability makes it possible to conclude the practicability of one or another products release. Standard values for the parameters of this group are not provided, because they vary greatly depending on the industry.

| № | Name, INN | Region | Turnover 2012, mln. RUB | Product profitability % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | OJSC Kuznechno-pressovoe proizvodstvo,INN 6902006971 | Tver region | 689 | 14,10 | 233 (high) |

| 2 | JSC "Stalinvest",INN 5009034370 | Moscow region | 6195 | 8,55 | 249 (high) |

| 3 | LLC UAZ-Metallurgiya,INN 7327033007 | Ulyanovsk region | 2267 | 4,79 | 254 (high) |

| 4 | LLC Penzenskiy kuznechno-pressoviy zavod,INN 5835077108 | Penza region | 288 | 3,25 | 321 (satisfactory) |

| 5 | LLC ProfStalProkat,INN 7106504970 | Tula region | 321 | 2,87 | 299 (high) |

| 6 | LLC Ryazanskiy zavod kabelnikh konstruktsiy,INN 6230058119 | Ryazan region | 217 | 2,27 | 305 (satisfactory) |

| 7 | LLC Proff-Stal,INN 2339016896 | Krasnodar territory | 370 | 1,27 | 231 (high) |

| 8 | LLC "MTE DPM",INN 6140030630 | Rostov region | 234 | -6,11 | 303 (satisfactory) |

| 9 | Energomash (Volgodonsk) - Atommash Company Limited,INN 6143073311 | Rostov region | 1391 | -7,65 | 281 (high) |

| 10 | Firma "ALG" LLC,INN 7725075648 | Moscow | 355 | -23,78 | 332 (satisfactory) |

At an average index of 2,5% for the sector, OJSC Kuznechno-pressovoe proizvodstvo with its product profitability of 14,10% takes the leading position in the ranking. The company is 4th in the industry at year-end 2012. The high solvency index GLOBAS-i® confirms good results of business activity and marks the company as financially stable.

The second and third lines of the ranking are as follows: leaders in terms of 2012 turnover, JSC "Stalinvest" with 8,55% and LLC UAZ-Metallurgiya with 4,79% of product profitability, which is more than industry average value. Both companies got high solvency index GLOBAS-i®.

Three companies (LLC "MTE DPM", Energomash (Volgodonsk) - Atommash Company Limited and Firma "ALG" LLC) have product profitability value under zero because of sales profit negative quantity. It follows that they have to control expenses.

Industrywide, the plural situation can be stated. Some companies even with high turnover ratio cannot boast of high values of product profitability, and the industry average value is not very high, which reflects the high cost of producing products.

But it should be kept in mind that product profitability shows only the current situation and does not reflect the development prospects of the enterprise, i.e., does not account for long-term investments for the upgrading. That is why a set of indicators should be considered for the objective assessment of the company’s financial stability.