Product profitability of meat products manufacturers

Information agency Credinform prepared a ranking of Russian meat products manufacturers.

The companies with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2012). These enterprises were ranked by decrease in product profitability ratio.

Product profitability (%) is the relation of sales profit (loss) to its total value (amount of expenses for production, business and administrative expenses). It shows the results of current expenditures. If the ratio is negative, it testifies that a company has sales loss, what, surely, can be considered from a negative point of view.

There are no recommended or specified values prescribed for the mentioned ratio, because it varies strongly depending on the branch, where each concrete enterprise conducts business, that is why it should be assessed relying on industry-average indicator of the sector, as well as on indexes of other enterprises of the same industry.

| № | Name | Region | Turnover,in mln RUB, for the year 2012 | Turnover gain by the year 2011, % | Product profitability, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|---|

| 1 | STARODVORSKIE KOLBASY CJSC INN: 3328426780 |

Vladimir region | 8 171,7 | 12,0 | 16,1 | 227 high |

| 2 | ROSTOVSKY KOLBASNY ZAVOD – TAVR LLC INN: 6165079035 |

Rostov region | 7 970,6 | 8,9 | 13,4 | 235 high |

| 3 | AGRO INVEST CJSC INN: 7710445247 |

Moscow region | 7 576,0 | 12,3 | 7,6 | 229 high |

| 4 | CHERKIZOVSKY MYASOPERERABATYVAYUSHCHY ZAVOD OJSC INN: 7718013714 |

Moscow | 11 472,8 | 7,4 | 7,5 | 197 the highest |

| 5 | Mikoyanovsky masokombinat CJSC INN: 7722169626 |

Moscow | 10 625,6 | 16,7 | 5,2 | 245 high |

| 6 | Myasokombinat Dubki LLC INN: 6432013128 |

Saratov region | 9 021,8 | 22,0 | 4,9 | 220 high |

|

7 |

TSARITSYNO OJSC INN: 7724017435 |

Moscow | 7 517,2 | 4,0 | 3,6 | 209 high |

| 8 | Ostankinsky myasopererabatyvayushchy kombinat OJSC INN:7715034360 |

Moscow | 25 795,2 | 15,8 | 2,7 | 191 the highest |

| 9 | Ptitsekombinat LLC INN: 2631029799 |

Stavropol territory | 9 305,9 | 71,5 | 2,3 | 263 high |

| 10 | VELIKOLUKSKY MYASOKOMBINAT OJSC INN: 6025009824 |

Pskov region | 8 375,8 | -7,4 | 1,3 | 241 high |

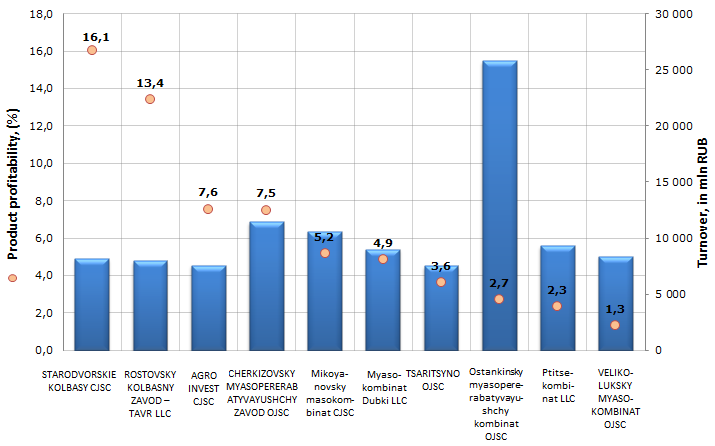

Picture 1. Product profitability, turnover of the largest meat products manufacturer of Russia (TOP-10)

According to the data available in the database GLOBAS-i® of the Information agency Credinform, about 1330 companies act in the market of meat products manufacturers, with the revenue above zero and cumulative turnover 552,7 bln RUB. This points to a high degree of fragmentation of the market. Enterprises from Moscow are in the lead on cumulative turnover.

Judging from the data of the table, Ostankinsky myasopererabatyvayushchy kombinat OJSC was the largest manufacturer with the highest volume of revenue in the market of meat products. Company’s revenue has increased almost by 16% per annum. According to the independent estimation of solvency GLOBAS-i® the company has the index - 191 points, what characterizes the organization as creditworthy, guaranteeing that its credit debts will be pay off in time and fully with minimal risk of default. With the assumption that the index value can be in the range from 100 points – the best value, up to 600 – the worst one.

Also among TOP-10 companies are following Moscow enterprises, having their history and unique technology: Cherkizovsky myasopererabatyvayushchy zavod OJSC, ЗАО Mikoyanovsky masokombinat CJSC, Tsaritsyno OJSC, Dymovskoe kolbasnoe proizvodstvo LLC.

All TOP-10 enterprises got a high and the highest solvency index GLOBAS-i®, what points to sound enough financial standing of the branch.

Cumulative turnover of TOP-10 companies-manufacturers of meat products made 103,4 bln RUB (18,7% of the market) in 2012, went up by 11,8% per annum. From investment point of view, business cooperation with these organizations seems to be the most attractive.

Industry-average product profitability – 3,6%. Thereby the first 6 companies from TOP-10 were able to reach higher value among the largest manufacturers: STARODVORSKIE KOLBASY CJSC (16,1%); ROSTOVSKY KOLBASNY ZAVOD – TAVR LLC (13,4%); AGRO INVEST CJSC (7,6%); CHERKIZOVSKY MYASOPERERABATYVAYUSHCHY ZAVOD OJSC (7,5%); Mikoyanovsky masokombinat CJSC (5,2%); Masokombinat Dubki LLC (4,9%).

Russian venture market has fallen practically by one half

Following the results of the 1st quarter 2014 Russian venture market fell practically by one half. The total volume of transactions decreased by 42%, and their amount declined by 38% in comparison with the similar period of the previous year.

For the 1st quarter of the current year 79 transactions were closed, for a total amount of 109 mln USD. At that 49 mln USD is accounted for the exit of investors from projects and only 60 mln USD – for new financing. Such results have become minimal since 2012.

The experts note that softening of the venture market may be still more significant, if not for the activity of Internet Initiatives Development Fund (IIDF). The Fund was founded at the discretion of the President in July of the previous year. The Director of the Fund Kirill Varlamov announced then his intention to invest 6 bln RUB in different Russian startups during the coming three years.

The experts note the brisk growth of the volume of transactions in the sector of information technologies (IT). Following the results of the 1st quarter 2014 the share of IT sector made 44% from the total volume of transactions.

The most significant transactions of Russian venture market in the 1st quarter 2014 became the investments of the Fund iTech Capital into the service for the search of airline tickets Aviasales and into the provider of cloud communication services Mango Telecom. 10 mln USD were accounted for each transaction.

One of the main changes of Russian venture market is focusing of corporations on computer technologies and equipment. We remind that back in the previous quarter 89% of assets were invested in software and internet. Private funds, apart from investments into computer technologies, pay their attention increasingly to the development of biotechnologies. So called business angels or private investors take more and more interest in projects on the development of industrial engineering in recent times.

Today it can be stated that Russian venture market is in the search of a catalyst of growth. Surely, deterioration in economic and political environment impaired the volume of foreign venture investments. However, such exacerbation of economic relations with the West can be of benefit to Russian investors. In case of the decrease in capital supply it is possible to make arrangements with entrepreneurs on more favorable terms.