Own resources of construction companies

Information agency Credinform presents ranking of the largest companies engaged in construction of buildings. Enterprises with the largest volume of annual revenue (TOP-10), were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2015-2017). Then they were ranked by working capital to current assets ratio (Table 1).The analysis was made on the basis of the data of the Information and Analytical system Globas.

Working capital to current assets ratio (x) is calculated as diminution of equity and intangible assets to current assets. The indicator shows ability of a company to finance current activities with the help of own working capital. Recommended value is > 0,1.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Working capital to current assets ratio (x), > 0,1 | Solvency Index Globas | |||

| 2016 | 2017 | 2016 | 2017 | 2016 | 2017 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| LLC LSR. Real Estate-SZ INN 7826090547 Saint-Petersburg |

33947,0 33947,0 |

37868,0 37868,0 |

6777,1 6777,1 |

8394,8 8394,8 |

0,12 0,12 |

0,14 0,14 |

199 High |

| JSC TEK MOSENERGO INN 7721604869 Moscow Bankruptcy claims |

24183,0 24183,0 |

34357,0 34357,0 |

783,1 783,1 |

920,9 920,9 |

-0,09 -0,09 |

0,07 0,07 |

400 Weak |

| JSC METROSTROY INN 7813046910 Saint-Petersburg Bankruptcy claims |

24449,4 24449,4 |

31919,7 31919,7 |

497,8 497,8 |

436,7 436,7 |

0,05 0,05 |

0,06 0,06 |

350 Adequate |

| LLC VELESSTROY INN 7709787790 Moscow |

88231,4 88231,4 |

73780,8 73780,8 |

2218,9 2218,9 |

1651,7 1651,7 |

0,05 0,05 |

0,05 0,05 |

209 Strong |

| JSC RENAISSANSE CONSTRUCTION INN 7814017341 Saint-Petersburg |

18124,2 18124,2 |

34862,3 34862,3 |

597,8 597,8 |

629,6 629,6 |

0,02 0,02 |

0,01 0,01 |

201 Strong |

| LLC MIP-STROI №1 INN 7701394860 Moscow |

28858,8 28858,8 |

46025,3 46025,3 |

284,5 284,5 |

424,7 424,7 |

-0,04 -0,04 |

-0,03 -0,03 |

296 Medium |

| JSC Armed forces infrastructure development directorate general INN 7703702341 Moscow Bankruptcy claims |

61923,8 61923,8 |

80570,3 80570,3 |

84,1 84,1 |

56,0 56,0 |

0,00 0,00 |

-0,05 -0,05 |

400 Weak |

| JSC STROYTRANSGAZ INN 5700000164 Moscow Bankruptcy claims |

25741,0 25741,0 |

36382,6 36382,6 |

643,1 643,1 |

717,6 717,6 |

-0,06 -0,06 |

-0,06 -0,06 |

189 High |

| LLC STROYGAZCONSULTING INN 7703266053 Saint-Petersburg Bankruptcy claims |

153019,2 153019,2 |

153789,1 153789,1 |

-6566,9 -6566,9 |

-7008,8 -7008,8 |

-0,05 -0,05 |

-0,13 -0,13 |

400 Weak |

| FGUP GVSU №14 INN 5047054473 Moscow Bankruptcy proceedings |

56977,7 56977,7 |

38089,7 38089,7 |

-905,7 -905,7 |

-4978,9 -4978,9 |

-0,05 -0,05 |

-0,22 -0,22 |

550 Insufficient |

| Total for TOP-10 |  515455,4 515455,4 |

567645,0 567645,0 |

4413,7 4413,7 |

1244,2 1244,2 |

|||

| Average for TOP-10 companies |  51545,5 51545,5 |

56764,5 56764,5 |

441,4 441,4 |

124,4 124,4 |

-0,01 -0,01 |

-0,02 -0,02 |

|

| Average industrial value |  58,36 58,36 |

58,0 58,0 |

0,2 0,2 |

-0,4 -0,4 |

-0,29 -0,29 |

-0,25 -0,25 |

|

— growth of indicator to the previous period,

— growth of indicator to the previous period,  — decrease of indicator to the previous period.

— decrease of indicator to the previous period.

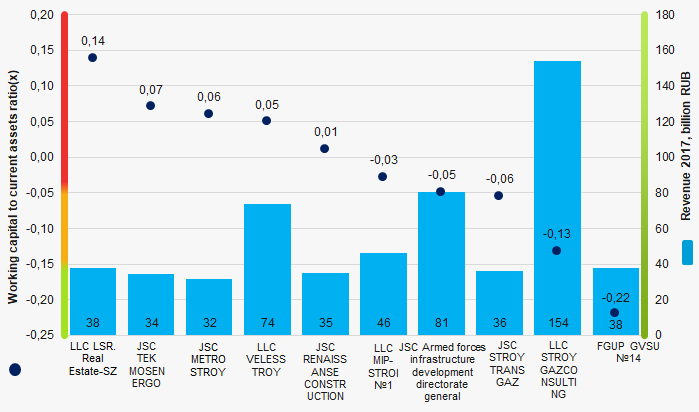

The average indicator of the working capital to current assets ratio of TOP-10 companies is characterized with negative value and above the average industrial value. Only one company of the group showed result above the recommended value in 2017.

Picture 1. Working capital to current assets ratio and revenue of the largest construction companies (TOP-10)

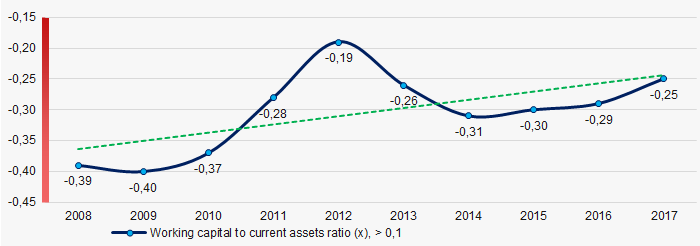

Picture 1. Working capital to current assets ratio and revenue of the largest construction companies (TOP-10) During 10 years average industrial indicators of the working capital to current assets ratio have negative values with increasing tendency. (Picture 2).

Picture 2. Change of average industrial indicators of the working capital to current assets ratio of the Russian construction companies in 2008 – 2017

Picture 2. Change of average industrial indicators of the working capital to current assets ratio of the Russian construction companies in 2008 – 2017 Capital amnesty has been extended

Since June 1, 2019 starts the prolongation of capital amnesty that provides relief from responsibility for currency and tax violations for Russian citizens who have returned their assets to the country voluntarily.

According to the Ministry of Finance, during the previous stages about 19,000 returns have been filed, and assets of several billions dollars have been returned.

Amnesty extension will last until February 29, 2020. In the course of this period Russian citizens can declare their foreign property and accounts, receive an exemption for personal income tax and corporate profit tax of foreign companies under their control, if registered as tax residents of Russia.

Relief from criminal responsibility is guaranteed by amendments to Article 761 of the Criminal Code of the Russian Federation.

Cash assets are to be returned to Russian banks, and companies are to be re-registered in special administrative districts of the Kaliningrad region and Primorye territory. In these regions budget taxes are set at zero rate. Zero rate is also set for dividends paid by holding companies to majority shareholders that own over 15% of the company’s capital for at least a year before the decision to pay dividends. Income of foreign persons from shares of public holding companies are taxed at 5% rate.

The advantages of this amnesty scheme are beyond question. The issue of assets preservation for business becomes more and more urgent under the conditions of increasing sanctions pressure.