Trends in activity of the largest companies of the Moscow region real economy

Information Agency Credinform presents a review of trends in activity of the largest companies of the Moscow region real economy.

The enterprises with the highest volume of annual revenue (TOP-10 and TOP-1000) within the non-financial sector of the Moscow region have been selected for the ranking, according to the data from the Statistical Register for the latest available accounting periods (2014-2016). the analysis was based on the data from the Information and Analytical system Globas.

Net assets

It is an indicator of fair value of corporate assets that is calculated annually as assets on balance less company’s liabilities. Net assets value is negative (insufficiency of property) if liabilities are larger than the assets.

| No. in TOP-1000 | Name | Net asset value, billion RUB* | Solvency index Globas | ||

| 2014 | 2015 | 2016 | |||

| 1. | GAZPROM INTERREGIONGAS LLC Wholesale of solid, liquid and gaseous fuel |

407,3 | 449,6 | 575,7 | 215 Strong |

| 2. | T PLUS PJSC Production of electric power |

122,8 | 125,5 | 145,6 | 205 Strong |

| 3. | MARS LLC Production of chocolate and sugar confectionery |

66,3 | 81,0 | 82,7 | 183 Superior |

| 4. | AUCHAN LLC Retail sale of mostly food products |

43,6 | 51,2 | 59,5 | 237 Strong |

| 5. | MACHINE-BUILDING PLANT PJSC Nuclear fuel production |

32,9 | 40,0 | 44,9 | 147 Superior |

| 996. | MULTIFLEX NJSC Production of plastic packaging |

-1,3 | -2,8 | -5,1 | 320 Adequate |

| 997. | EURASIA M4 JOINT VENTURE NJSC Leasing and management of own or rented non-residential real estate |

-5,4 | -9,2 | -9,0 | 256 Medium |

| 998. | KASHIRSKI MALL NJSC Leasing and management of own or rented non-residential real estate |

-7,6 | -14,0 | -10,1 | 267 Medium |

| 999. | CROCUS INTERNATIONAL NJSC Leasing and management of own or rented non-residential real estate |

-13,5 | -26,3 | -11,8 | 213 Strong |

| 1000. | FORD SOLLERS HOLDING LLC Production of motor vehicles |

5,5 | 4,0 | -19,2 | 334 Adequate |

*) – growth or decline values compared to prior period are highlighted green and red respectively in columns 4 and 5.

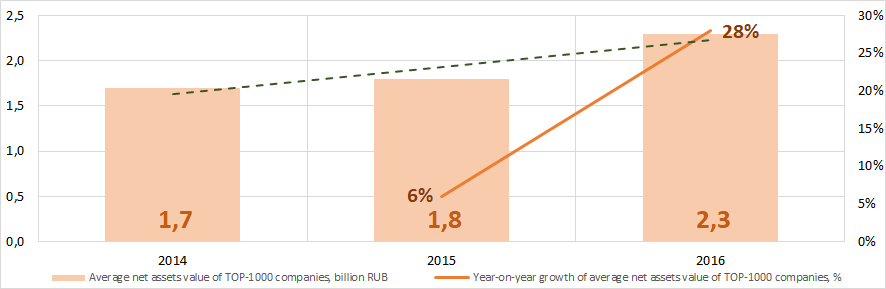

Picture 1. Change in average net asset value of the largest real economy companies of Moscow region in 2014 – 2016

Picture 1. Change in average net asset value of the largest real economy companies of Moscow region in 2014 – 2016Sales revenue

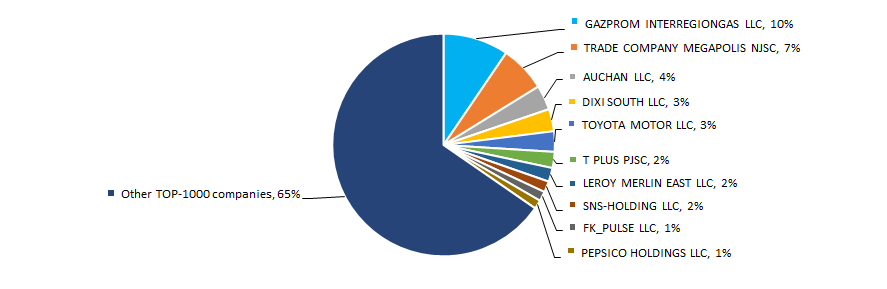

In 2016 sales revenue of 10 industry leaders within the real economy of Moscow region amounted to 35% of total revenue of TOP-1000 companies (Picture 2).

Picture 2. TOP-10 by their share in 2016 total revenue of TOP-1000 companies

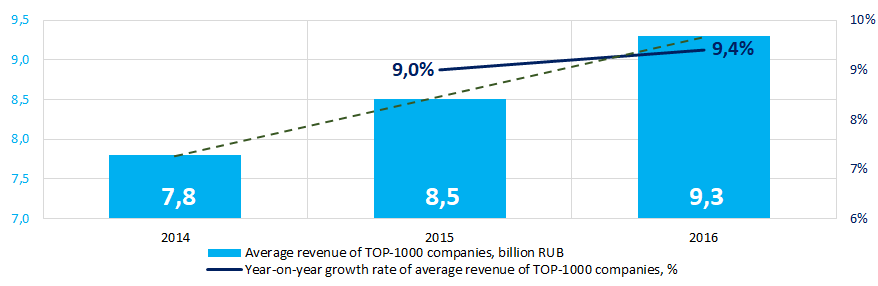

Picture 2. TOP-10 by their share in 2016 total revenue of TOP-1000 companiesRevenue volume tends to increase (Picture 3).

Picture 3. Change in average revenue of real economy companies of Moscow region in 2014– 2016

Picture 3. Change in average revenue of real economy companies of Moscow region in 2014– 2016Profit and loss

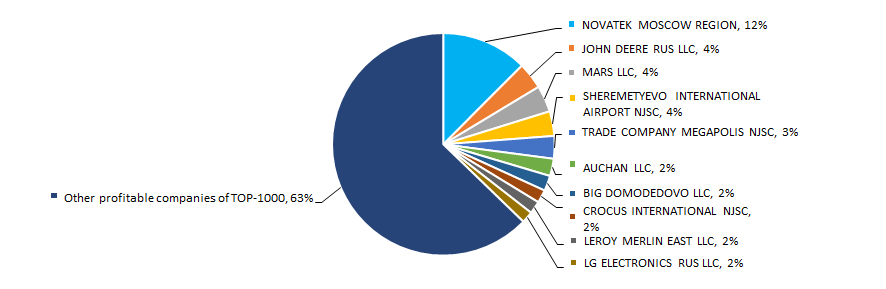

In 2016 profit of 10 industry leaders of real economy in Moscow region amounted to 37% of total profit of TOP-1000 companies (Picture 4).

Picture 4. TOP-10 companies by their share in 2016 total profit of TOP-1000 companies

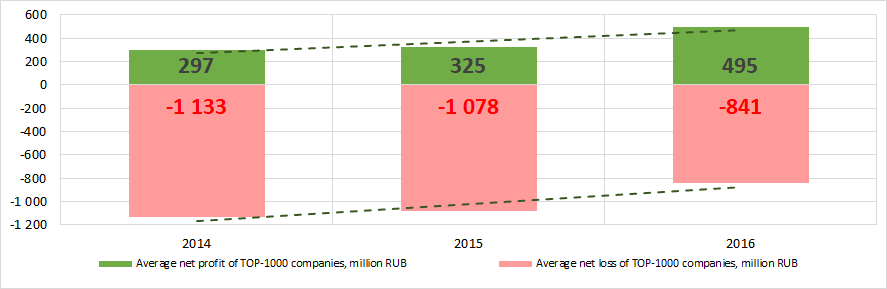

Picture 4. TOP-10 companies by their share in 2016 total profit of TOP-1000 companiesAverage profit values of TOP-1000 companies for three years tend to increase, and average loss value is decreasing (Picture 5).

Picture 5. Change in average profit and loss of the largest real economy companies of Moscow region in 2014 – 2016

Picture 5. Change in average profit and loss of the largest real economy companies of Moscow region in 2014 – 2016Key financial ratios

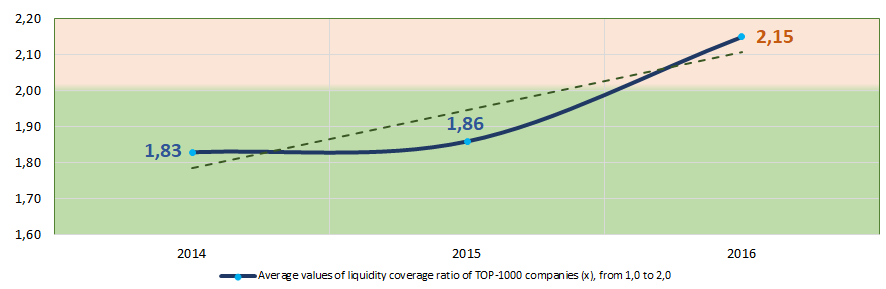

During 2014 – 2016 average values of liquidity coverage ratio of TOP-1000 companies were higher or within the recommended value – from 1,0 to 2,0 (Picture 6).

Liquidity coverage ratio (a ratio of current assets to current liabilities) reveals the sufficiency of a company’s funds for meeting its short-term liabilities.

Picture 6. Change in average values of liquidity coverage ratio of real economy companies of Moscow region in 2014 – 2016

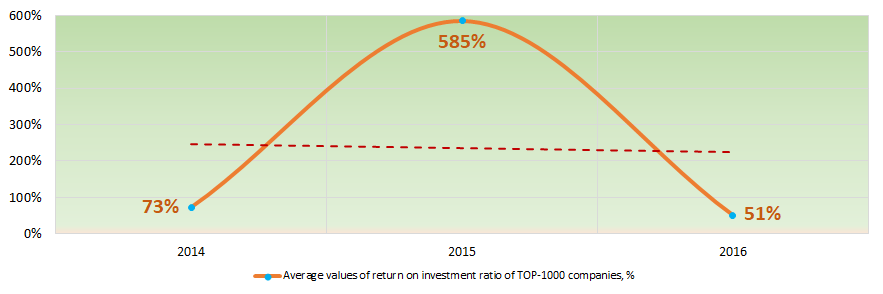

Picture 6. Change in average values of liquidity coverage ratio of real economy companies of Moscow region in 2014 – 2016The return on investment ratio was not stable during these three years, tending to decrease (Picture 7). It is a ratio of net profit to shareholders’ equity and noncurrent liabilities, and it demonstrates benefit from shareholders’ equity engaged in business activity and long-term raised funds of the company.

Picture 7. Change in average values of return on investment ratio of real economy companies of Moscow region in 2014 – 2016

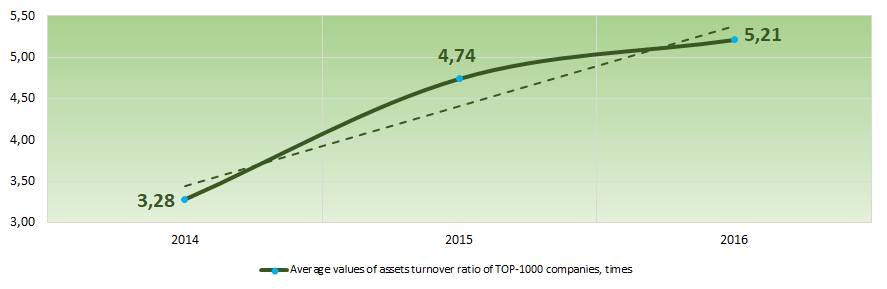

Picture 7. Change in average values of return on investment ratio of real economy companies of Moscow region in 2014 – 2016Assets turnover ratio is a ratio of sales revenue to average total assets for the period, and measures resource efficiency regardless of the sources. the ratio indicates the number of profit-bearing complete production and distribution cycles per annum.

During three years, this activity ratio tended to increase in general (Picture 8).

Picture 8. Change in average values of assets turnover ratio of the largest real economy companies of Moscow region in 2014 – 2016

Picture 8. Change in average values of assets turnover ratio of the largest real economy companies of Moscow region in 2014 – 2016Structure of production and services

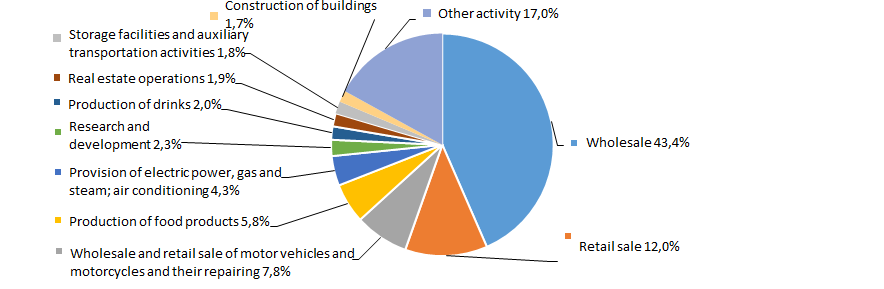

Wholesale and retail trade companies have the largest share in total revenue of TOP-1000 companies (Picture 9).

Picture 9. Types of activity by their share in total revenue of TOP-1000, %

Picture 9. Types of activity by their share in total revenue of TOP-1000, %Financial position score

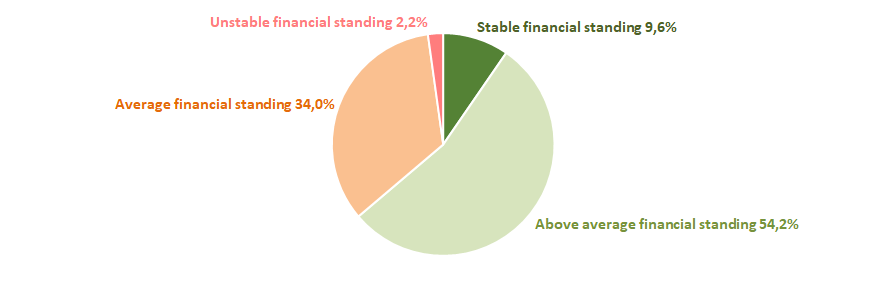

Assessment of financial state of TOP-1000 companies indicates that over a half of the companies have an above average financial standing (Picture 10).

Picture 10. TOP-1000 companies by their financial position score

Picture 10. TOP-1000 companies by their financial position scoreSolvency index Globas

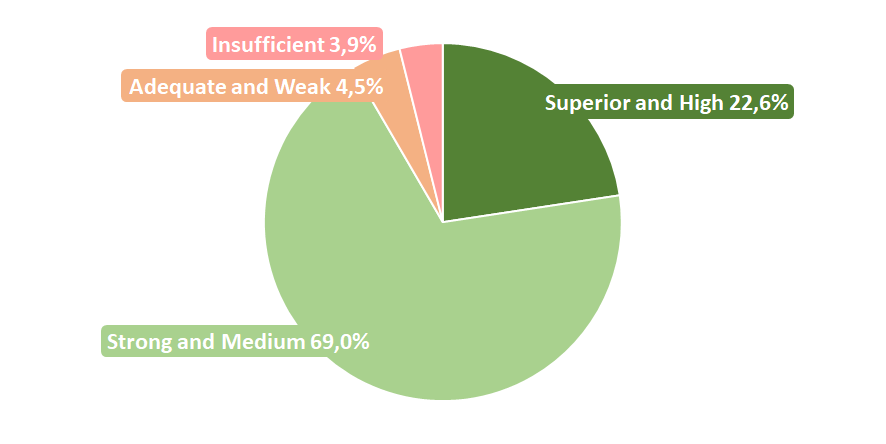

The most of TOP-1000 companies have got a superior, high, strong and medium Solvency index Globas, that indicates their capability to meet liabilities timely and in full (Picture 11).

Picture 11. TOP-1000 companies by Solvency index Globas

Picture 11. TOP-1000 companies by Solvency index GlobasTherefore, a comprehensive assessment of the largest real economy companies of Moscow region that considers key indexes, financial figures and ratios, is indicative of positive trends in the sector.

Updated procedure for maintaining EGRUL and EGRIP registers

New procedure for maintaining the Unified State Register of Legal Entities and the Unified State Register of Sole Entrepreneurs (EGRUL/EGRIP) approved by the order of the Ministry of Finance of the Russian Federation №165N of 30.10.2017 came into force on 1 March 2018. The order of the Ministry of Finance №25N of 18.02.2015 on approval of previous Procedure is declared invalid.

New procedure contains rules and periods of EGRUL/EGRIP data application, the technical error correction procedure and requirements for the content of the registers.

In case of differences in EGRUL/EGRIP data on electronic data carriers and paper documents, the priority should be given to hard copies.

In case of changes in EGRUL/EGRIP data, the previous data must be stored in the registries.

Technical errors in the registries should be corrected by making new records in EGRUL/EGRIP with the relevant links to erroneous recordings. The authorities of the Federal Tax Service of the Russian Federation, which corrected technical errors within 3 working days, should inform the relevant parties who reported about the errors in a written form.

New procedure does not contain rules on providing data or documents from the registries due to the changed procedure on obtaining the information above approved by the order of the Ministry of Finance of the Russian Federation №5N of 15.01.2015.