Payback for a tiny text

Many people came across the situation when the main eye-catching offer of the advertisement of the credit organizations’ financial services is followed by the tiny text. Usually, this text carries the special terms of the provision of services and other limitations. As a rule, nobody reads this information, though it hides the important legal meaning. As a result, the different cases take place to the disfavour of the customer, leading to additional scarcely voidable financial expenses.

In order to avoid such confusions, the State Duma of the Russian Federation passed in the first reading a bill concerning strengthening of responsibility in this field: the bank employers will pay up to RUB 1 million fee for the breach of requirements to advertisement of financial services.

Many credit organizations lure the clients using forbidden methods. They invite the famous people to act in promotional video, saying nothing about the additional services. At the same time, the borrowers don’t get the full and reliable information. The tiny blind text on the billboards hiding the most important credit terms and the indicating in the advertisement only the minimum interest rate without reffering to other terms, which leads to significant expenses of the borrower, are among the violations.

The goal of the new law is to provide the citizens with the completeness of information, while advertising particular financial products in order to make people be informed about its final cost.

Up to date the maximum penalty for banks for the breaching of the advertisement amounts to RUB 300 thousand. According to law draftsmen, the law is not obeyed in the current form due to the fact that it doesn’t cause difficulties for the violators.

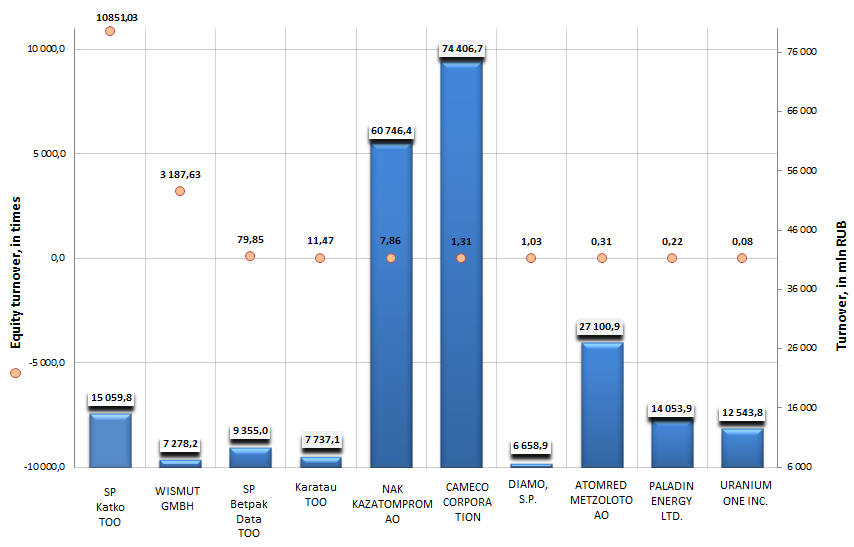

Equity turnover of the world's largest enterprises engaged in mining and processing of uranium ore

Information agency Credinform prepared a ranking on equity turnover of world's largest enterprises engaged in mining and processing of uranium ore. The companies with the highest volume of revenue for 2013 were selected for the investigation. Then, the enterprises were ranked by number of equity turnover per annum.

Equity turnover reflects the equity turnover rate, that means - in particular, for joint stock companies – activity of money, which are ventured by company’s owners. Low value of this indicator testifies to inactivity of a part of equity. Increase in turnover means that company’s equity is put into turnover.

| № | Company name | Country | Turnover for 2013, in mln RUB | Equity turnover, times |

|---|---|---|---|---|

| 1 | SP Katko TOO | Kazakhstan | 15 060 | 10 851,03 |

| 2 | WISMUT GMBH | Germany | 7278 | 3187,63 |

| 3 | SP Betpak Dala TOO | Kazakhstan | 9355 | 79,85 |

| 4 | KaratauTOO | Kazakhstan | 7737 | 11,47 |

| 5 | NAK KAZATOMPROM AO | Kazakhstan | 60 746 | 7,86 |

| 6 | CAMECO CORPORATION | Canada | 74 407 | 1,31 |

| 7 | DIAMO, S.P. | Czech Republic | 6659 | 1,03 |

| 8 | ATOMREDMETZOLOTO AO | Russia | 27 101 | 0,31 |

| 9 | PALADIN ENERGY LTD. | Australia | 14 054 | 0,22 |

| 10 | URANIUM ONE INC. | Canada | 12 544 | 0,08 |

Uranium is the main energy source of nuclear power, which accounts for about 20% of the world's electricity. The uranium industry covers all stages of uranium production, including exploration, mining and ore processing. Russia owns 9% of the world's uranium reserves, being behind Australia (31% of world reserves) and Kazakhstan (12% of world reserves) on this indicator.

In Russia uranium is mined by the Uranium Holding Atomredmetzoloto, which is a part of Atomenergoprom OJSC. The Holding manages all uranium mining companies in Russia, and also controls over 20% of Kazakhstan's uranium reserves.

At the year-end 2013 Atomredmetzoloto JSC became the 3rd company on turnover in the world, given way to CAMECO CORPORATION (Canada) and NAK Kazatomprom JSC (Kazakhstan). However, on equity turnover the enterprise takes just only the 8th place among the top-10 largest companies in the world.

The Kazakh-French joint venture SP Katko TOO took the 1st place in the presented ranking, with the value of equity turnover 10 851,03 times, that testifies to an active use of equity of the enterprise in its operations. The firm is the 4th company on turnover in the world. SP Katko TOO was founded in 1996 and mines uranium by drillhole in situ leaching in the field Moiynkum located in South-Kazakhstan region. Company’s shareholders are «NAK «Kazatomprom» OJSC and the French company AREVA.

Equity turnover of the world's largest enterprises engaged in mining and processing of uranium ore, TOP-10

The Canadian company Uranium One Inc. rounds out the ranking with the equity turnover 0,08 times. Note, that in 2013 the Russian Uranium Holding Atomredmetzoloto made a deal on the consolidation of 100% of shares of Uranium One Inc. In accordance with the terms of the agreement, all ordinary shares of the Canadian company were acquired, which at that time did not belong to Atomredmetzoloto JSC and affiliated persons. The management of foreign assets was transferred to the company Uranium One Holding N.V.

Equity turnover directly influences the company’s solvency. Moreover, the increase in equity turnover rate reflects under otherwise equal conditions the growth of production and technical potential of organization.