Trends in trade of electronic goods

Information agency Credinform has observed trends in the activity of the largest wholesalers of household electronics.

Enterprises with the largest volume of annual revenue (TOP-1000) were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2013-2018). The analysis was made on the basis of the data of the Information and Analytical system Globas.

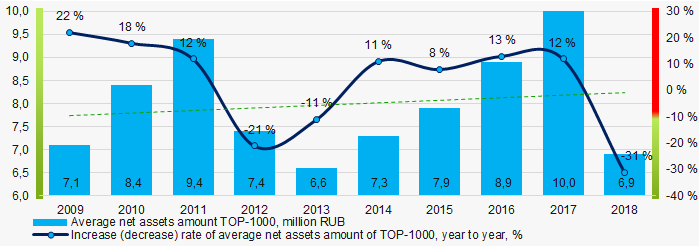

Net assets is an indicator, reflecting the real value of company's property, is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest company in the NCFD in terms of net assets amount is LLC KHASKEL, INN 7719269331, Moscow region. In 2018 net assets of the enterprise amounted to 15,7 billion RUB.

LLC OURSSON , INN 7743830082, Moscow had the smallest amount of net assets in the TOP-1000 group. Insufficiency of property of the company in 2018 was expressed in negative value -622 billion RUB.

For a ten-year period average amount of net assets of TOP-1000 companies has increasing tendency (Picture 1).

Picture 1. Change in average indicators of the net asset amount in 2009 – 2018

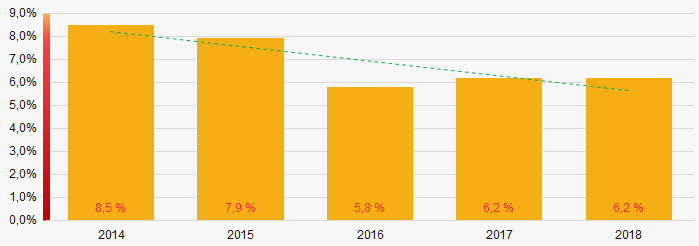

Picture 1. Change in average indicators of the net asset amount in 2009 – 2018Share of companies with insufficiency of property in the TOP-1000 has decreasing tendency for the last five years (Picture 2).

Picture 2. Shares of companies with negative values of net assets in TOP-1000 companies

Picture 2. Shares of companies with negative values of net assets in TOP-1000 companies Sales revenue

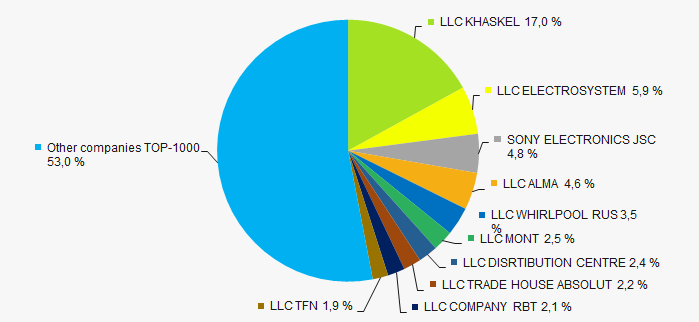

The revenue volume of 10 leaders of the industry made 47% of the total revenue of TOP-1000 companies in 2018 (Picture 3). It demonstrates relatively high level of monopolization.

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 companies for 2018

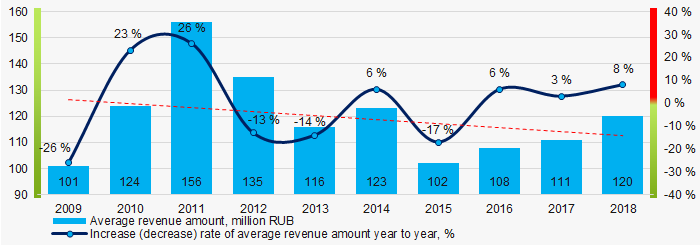

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 companies for 2018In general, an increasing tendency in revenue volume is observed (Picture 4).

Picture 4. Change in the average revenue in 2009 – 2018

Picture 4. Change in the average revenue in 2009 – 2018Profit and losses

The largest company in terms of net profit amount is also LLC KHASKEL, INN 7719269331, Московская область. The profit in 2018 amounted to 2,4 billion RUB.

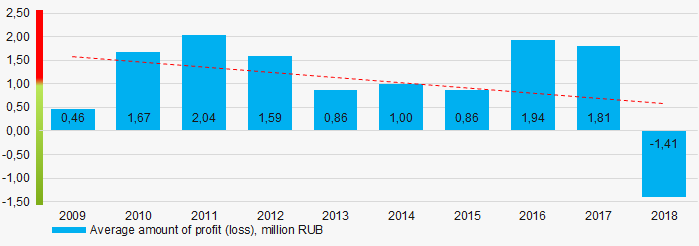

Over a ten-year period average indicators of net profit for TOP-1000 group have a decreasing tendency (Picture 5).

Picture 5. Change in the average indicators of net profit of TOP-1000 companies in 2009 – 2018

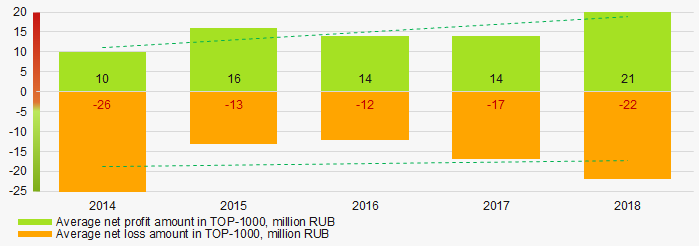

Picture 5. Change in the average indicators of net profit of TOP-1000 companies in 2009 – 2018Over a five-year period, the average values of net profit indicators of TOP-1000 companies tend to increase. Besides, the average value of net loss decreases (Picture 6).

Picture 6. Change in the average indicators of net profit and loss of TOP-1000 companies in 2014 – 2018

Picture 6. Change in the average indicators of net profit and loss of TOP-1000 companies in 2014 – 2018Key financial ratios

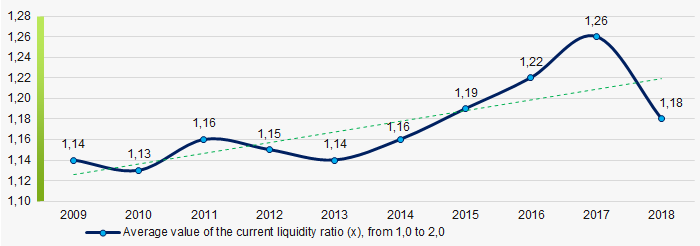

Over the five-year period the average indicators of the current liquidity ratio of TOP-1000 in general were within the range of recommended values – from 1,0 up to 2,0 with increasing tendency (Picture 7).

The current liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 7. Change in the average values of the current liquidity ratio of TOP-1000 companies in 2009 – 2018

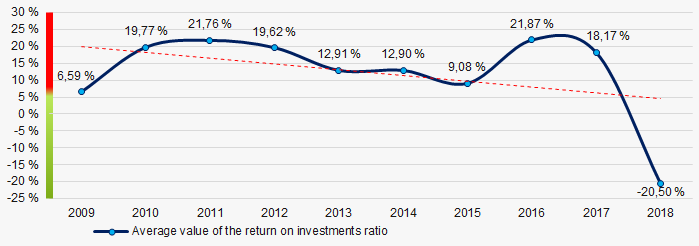

Picture 7. Change in the average values of the current liquidity ratio of TOP-1000 companies in 2009 – 2018A decreasing tendency of the average values of the indicators of the return on investment ratio has been observed for ten years (Picture 8).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity of own capital and the long-term borrowed funds of an organization.

Picture 8. Change in the average values of the return on investment ratio of TOP-1000 companies in 2009 – 2018

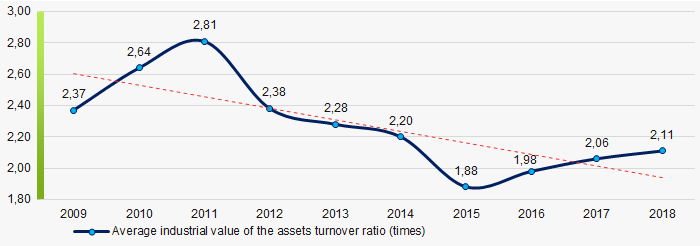

Picture 8. Change in the average values of the return on investment ratio of TOP-1000 companies in 2009 – 2018Asset turnover ratio is calculated as the relation of sales revenue to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

This business activity ratio showed a tendency to decrease for a ten-year period (Picture 9).

Picture 9. Change in the average values of the assets turnover ratio of TOP-1000 companies in 2009 – 2018

Picture 9. Change in the average values of the assets turnover ratio of TOP-1000 companies in 2009 – 2018Small business

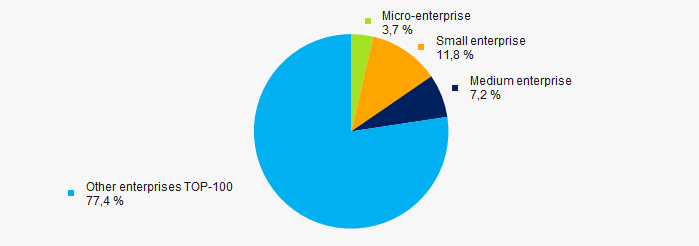

90% of the TOP-1000 companies are registered in the Register of small and medium enterprises of the Federal Tax Service of Russia. Besides, share of revenue in the total volume is 22,6%, that is higher than the average indicator countrywide (Picture 10).

Picture 10. Shares of small and medium enterprises in TOP-1000 companies

Picture 10. Shares of small and medium enterprises in TOP-1000 companiesMain regions of activity

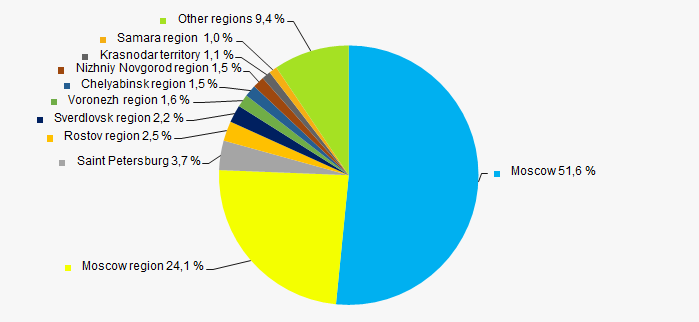

TOP-1000 enterprises that registered in 70 regions and are unequally distributed along the country. Almost 76% are located in Moscow and Moscow region (Picture 11).

Picture 11. Distribution of revenue TOP-1000 companies by regions of Russia

Picture 11. Distribution of revenue TOP-1000 companies by regions of Russia Financial position score

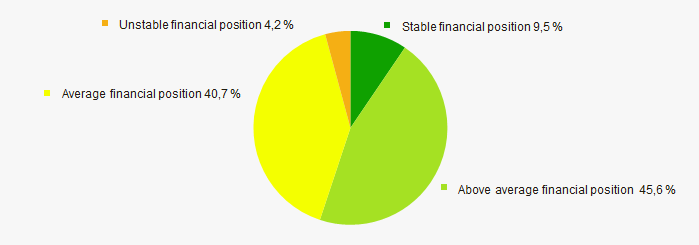

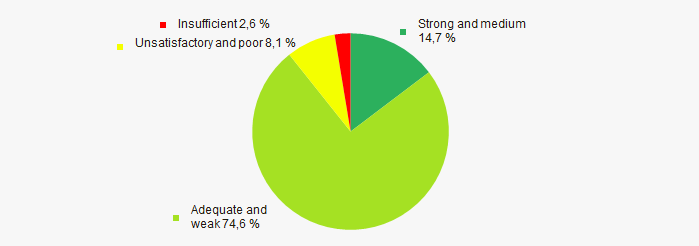

An assessment of the financial position of TOP-1000 companies shows that the largest number is in an above average financial position. (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

Most of TOP-1000 companies have got from Medium to Superior Solvency index Globas, that points to their ability to repay their debts in time and fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by solvency index Globas

Picture 13. Distribution of TOP-1000 companies by solvency index GlobasAccording to the data from the Federal State Statistics Service, share of enterprises of wholesale of household electronics in the total revenue volume from sale of goods, products, works, services countrywide for 2018 amounted to 0,474%, and 0,436% - for 9 months of 2019, that is higher that the indicator for 9 months of 2018, amounted to 0,360%.

Conclusion

Comprehensive assessment of the activity of the largest enterprises of wholesale of household electronics, taking into account the main indexes, financial indicators and ratios, demonstrates the presence of favorable trends (Table 1)

| Trends and assessment factors | Share of factor, % |

| Rate of increase (decrease) of average amount of net assets |  10 10 |

| Increase / decrease of share of companies with negative values of net assets |  10 10 |

| Level of competition/monopolization |  -10 -10 |

| Increase (decrease) rate of average revenue amount |  -10 -10 |

| Increase (decrease) rate of average net profit (loss) amount |  -10 -10 |

| Increase / decrease of average net profit amount of TOP-1000 companies |  10 10 |

| Increase / decrease of average net loss amount of TOP-1000 companies |  10 10 |

| Increase / decrease of average industrial values of the current liquidity ratio |  10 10 |

| Increase / decrease of average industrial values of the return on investments ratio |  -10 -10 |

| Increase / decrease of average industrial values of the assets turnover ratio, times |  -10 -10 |

| Share of small and medium enterprises in the industry in terms of revenue volume more than 22% |  10 10 |

| Regional concentration |  -10 -10 |

| Financial position (major share) |  10 10 |

| Solvency index Globas (major share) |  10 10 |

| Dynamics of shares of companies of the industry in the total revenue volume from sale of goods, products, works, services countrywide |  10 10 |

| Average value of factors |  2,0 2,0 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).

2019 legislative acts

Provisions of Federal Law «On Customs Regulation in the Russian Federation and on Introduction of Amendments to Certain Legislative Acts of the Russian Federation» concerning electronic interaction of customs authorities and payers came into effect on January 1, 2019. Provisions of law concerning electronic consulting provisions will come into effect on January 1, 2020, provisions on filing complaints in electronic form against decisions, actions or omissions of customs authorities – on January 1, 2022.

From January 1, 2019, in accordance with the Federal Law No. 231-FZ from July 29, 2018, auditors are obliged to submit information to the Federal Tax Service (FTS of the RF) at the first request within a ten-day period based on the decision of the head of the FTS of the RF or his deputy. Upon receipt of such request, auditors have the right to inform the person in respect of whom the request was received.

Since January 31, 2019 the amendments to the Federal Law No. 218-FZ «On credit histories» ated December 30, 2004 came into force. Following these amendments, the borrowers, including natural persons, can make a free-cost query twice a year or unlimited number of chargeable queries on credit reports through credit institutions having agreements for information services with credit bureaus. This can be carried out in the form of electronic documents signed with ordinary or enhanced unqualified electronic signature.

In accordance with the Federal Law No. 444-FZ from November 28, 2018 «On Amendments to the Federal Law «On financial accounts», beginning from the financial accounts for 2019, all companies are obliged to file accounts only in electronic form. Small business entities will file accounts in electronic form since 2020.

The Federal Law No. 322-FZ dated August 03, 2018 amended the Federal Law “On insurance of deposits of individuals in banks of the Russian Federation” and extended the system of insurance of bank deposits to small business funds. That is, entrepreneurs, having funds in the accounts of bankrupt credit institutions can return them in the amount of not more than 1 400 000 rubles.

In addition, amendments were made to the Federal Law No. 127-FZ «On Insolvency (Bankruptcy)» dated October 26, 2002. Now, the deposit agreement requirements of small business companies transferred to the Deposit Insurance Agency included in the number of claims of third-priority creditors.

By the Federal Law No. 480-FZ from December 25, 2018 amendments were made to the Federal Law «On protecting rights of legal entities and individual entrepreneurs during the execution of the public control (supervision) and municipal control». The moratorium on scheduled inspections of legal entities– small business entities and individual entrepreneurs was extended to 2019 – 2020.

The Federal Law No. 533-FZ from December 27, 2018 with the amendments to articles 76.1 and 145.1 of the Criminal Code the Russian Federation and amendments to the Criminal Procedural Code of the Russian Federation entered into force on January 8, 2019. The Law expanded the list of crimes, criminal cases of which should be terminated upon condition of reparation for damages. In addition, the amendments established the conditions that allow the head of organization to avoid the criminal liability for non-payment of wages.

The Federal Law No. 335-FZ from November 27, 2017 “On amendments to the Part One and Part Two of the Tax Code of the Russian Federation and certain legislative acts of the Russian Federation” established that since January 1, 2019, foreign providers of electronic services for legal entities and individual entrepreneurs in Russia are obliged to pay value added tax (VAT). ). In this regard, all foreign providers are required to register for tax purposes until February 15, 2019.

The Federal Law No. 327-FZ from August 03, 2018 «On the amendments to the Federal Law «On credit histories» came into effect on January 31, 2019.

According to the adopted amendments, a personal credit score is now assigned to Russian consumers and each Russian individual is now authorized to request two free credit history reports annually.

The Russian President’s Decree No. 8 from January 14, 2019 established the Russian Ecological Operator, a public nonprofit entity for creation of a comprehensive municipal solid waste management system. 69 regions have switched over to the new MSW treatment system since January 1, 2019.

From June 1, 2019, the Federal Law No. 527-FZ «On the amendments to Articles 46 and 54 of the Federal Law On communications» dated 27.12.2018 came into force. According to the Law, domestic national roaming is canceled, i.e. operators of mobile radio-telephone communication are obliged to establish equal terms in their networks for the provision of services to each subscriber, regardless of the region of his/her/its location.

The Government of the RF adopted the Order No. 158 «On Approval of the Regulation on the Classification of Hotels» dated 16.02.2019. According to the Regulation, all types of hotels are classified according to the system of stars, which provides for 6 categories: from five stars - to no stars.

In the beginning of 2019 amendments regarding state registration of LLC and Individual Entrepreneurs came into force.

Concept of digital rights is determined by the legislation as an object of civil rights. The Federal Law No. 34-FZ from March 18, 2019 «On Amendments to the First, Second and Article 1124 of the Third Parts of the Civil Code of the RF» came into force on October 1, 2019.

The international Convention to prevent base erosion and profit shifting was ratified.

In order to reduce external sanctions pressure, a list of information that listed companies have the right not to disclose has been determined by the Resolution of the Government of the Russian Federation dated 04.04.2019 No. 400.

The significant changes in the Tax Code of the Russian Federation were made in accordance with the Federal Law No. 63-FZ from April 15, 2019.

The amendments improve the procedure of income and property tax collection, granting benefits on transport and land taxes as well as simplify fiscal management, reduce tax return and the administrative burden on taxpayers.

Since June 1, 2019 starts the prolongation of capital amnesty that provides relief from responsibility for currency and tax violations for Russian citizens who have returned their assets to the country voluntarily.

On July 1, 2019, the Federal Law No. 71-FZ from May 01, 2019 with amendments that improve the contract system of public procurement, entered into force.

Data from the Unified State Register of Legal Entities (EGRUL) on companies under sanctions and Crimean legal entities will be closed. The Resolution of the Government of Russia No. 729 from June 06, 2019 entitles not to disclose shareholders, management and licenses of mentioned legal entities in EGRUL.

According to the amendments, made by the Federal Law No. 105-FZ from May 29, 2019 to the Articles 11.1 and 20 of the Federal Law «On Banks and Banking Activities» and to the Article 189.64 of the Federal Law «On Insolvency (Bankruptcy)», the amount of creditor`s claim is defined without reference to minimum wage. In case of claim`s nonfulfillment the Central Bank of the RF is obliged to revoke license of a credit institution.

On October 1, 2019 the «Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting» entered into force in Russia.

A new chapter 22.2 «Investigation of cases on Protection of Rights and Legal Interests of group of people», was entered to the Civil Procedural Code of the RF by the Federal Law No. 191-FZ from July 18, 2019. That makes it possible for individuals and companies to apply to the court for protection of rights and legal interests of group of persons. Amendments came into force on October 1, 2019.

The amendments to the Law On development of small and medium-sized businesses were introduced in accordance with the Federal Law №245-FZ from July 26, 2019. The changes approved the concept of social enterprise and social entrepreneurship.

Assignment of the right or demand on the collection of overdue debts on payment of residential premises and for utility services to third parties is prohibited in Russia from the moment of publication of the Federal Law №214-FZ dated 26.07.2019, which amended the Housing Code of the RF, the laws «On the protection of rights and legal interests of natural persons in cases of debts collection» and «On microfinance activities and microfinance organizations».

New settlement arrangements were set within the legal proceedings in general jurisdiction and arbitration courts. The changes came into force on October 25, 2019. The relevant changes were made to the Code of Administrative Judicial Procedure, Arbitral and Civil Procedural Codes of the Russian Federation by the Federal Law No.197-FZ from July 26, 2019.

On July 26, 2019, the Federal Law No. 47-FZ from July 26, 2019 entered into force with amendments to the law «On financial accounts» and other legislative acts related to regulation of accounting.

Since August 13, 2019, the purchase from citizens of products made from precious metals and stones, the processing of scrap from them are subject to obligatory licensing. This provision is contained in the Federal law No. 282-FZ dated 02.08.2019.

The minimum size of equity of microcredit organizations was changed. It is regulated by the Federal Law No. 271-FZ from August 2, 2019.

In order to create the Unified register of small and medium-sized supported enterprises, the Federal Law No. 279-FZ from August 2, 2019 amended the Law "On development of small and medium-sized enterprises in the Russian Federation".

The Federal Law No. 59-FZ from April 15, 2019, that made amendments to the Article 17 of the Housing Code of the RF, came into force on October 1, 2019. Therefore, according to the amendments, activities of hostels on providing hotel services in residential houses are forbidden.

The amendments to the Arbitration Procedure Code began to act since October 1, 2019. Now only persons with higher legal education or degree in legal profile could be representatives of the parties during trial of civil and arbitration cases. The provision is included in the Federal Law No. 451-FZ from November 28, 2018.

By Resolution of the RF Government No. 1216, the amendments to the fire prevention rules were made. These amendments are mainly concern the buildings wherein trading companies, medical, cultural and educational institutions are based.

Amendments were made by the Order of the Federal Tax Service of Russia (FTS) as of September 27, 2019 № ММВ-7-22/487@ to the corresponding formerly published orders, regarding criteria for being qualified as the largest taxpayers and subjected to tax administration in the specified interregional inspectorates of the FTS.

The Federal LawNo. 377-FZ from November 12, 2019 FZ adopted amendments to legislative acts relating to the entry of information into the Unified State Register of Legal Entities (EGRUL), the Unified State Register of Sole Entrepreneurs (EGRIP), the Unified Federal Register of Information on the Facts of the Activities of Legal Entities (Fedresurs). From November 12, 2019, legal entities are obliged to disclose information in Fedresurs concerning sale and transfer of the company for rent, liquidation, reorganization and reduction of the amount of the authorized capital.