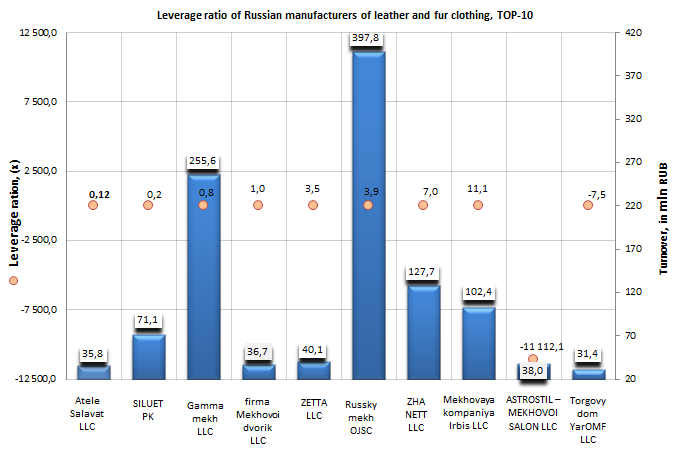

Leverage ratio of Russian manufacturers of leather and fur clothing

Information agency Credinform prepared а ranking on leverage ratio of Russian manufacturers of leather and fur clothing. The companies with highest volume of revenue were selected for this ranking according to data from the Statistical Register for the latest available period (for the year 2012). Then, the first 10 enterprises selected by turnover were ranked by decrease in the value of the leverage ratio.

Leverage ratio refers to the group of financial stability indexes. Indicators of this group are interesting first of all for long-term credits, because they characterize the company’s ability to satisfy its long-term obligations. So that, the leverage ratio is calculated as the relation of total borrowed assets to amount of internal capital and shows, how many units of borrowed funds were added by an enterprise to each unit of its own funding sources.

Recommended value for the considered indicator is less than 1. At the same time, the relation of borrowed and own funds cannot be negative, that is why the value of the ratio within the interval from 0 to 1 is one of the indicators of high ability of an enterprise to repay its liabilities.

| № | Name, INN | Region | Turnover for 2012, in mln RUB | Leverage ratio, (х) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | AteleSalavat LLC ИНН 274002257 |

Republic of Bashkortostan | 36 | 0,12 | 212 (high) |

| 2 | SILUET PK ИНН 1435025108 |

Republic of Sakha (Yakutia) | 71 | 0,18 | 262 (high) |

| 3 | Gammamekh LLC ИНН 7704725239 |

Moscow | 256 | 0,8 | 199 (the highest) |

| 4 | firma Mekhovoi dvorik LLC ИНН 4329014519 |

Kirov region | 37 | 0,95 | 220 (high) |

| 5 | ZETTA LLC ИНН 5003026214 |

Moscow | 40 | 3,47 | 244 (high) |

| 6 | Russky mekh OJSC ИНН 7716080225 |

Moscow | 398 | 3,85 | 200 (high) |

| 7 | ZHANETT LLC ИНН 7723332829 |

Moscow | 128 | 7,03 | 242 (high) |

| 8 | Mekhovaya kompaniya Irbis LLC ИНН 2630801733 |

Stavropol territory | 102 | 11,05 | 279 (high) |

| 9 | ASTROSTIL – MEKHOVOI SALON LLC ИНН 7801227038 |

Saint-Petersburg | 38 | -11 112,11 | 273 (high) |

| 10 | Torgovy dom YarOMF LLC ИНН 7602053242 |

Yaroslavl region | 31 | -7,54 | 329 (satisfactory) |

The analysis of obtained results showed, that the leverage ratio of four from TOP-10 companies met specified standards: Atele Salavat LLC (0,12), SILUET PK (0,18), Gammamekh LLC (0,8) and firma Mekhovoi dvorik LLC. All companies got a high and the highest solvency index GLOBAS-i®, that characterizes them as financially stable.

The enterprises ZETTA LLC, Russky mekh OJSC, ZHANETT LLC and Mekhovaya kompaniya Irbis LLC showed, by contrast, the values of the leverage ratio exceeding 1, i.e. above the recommended values. Such result can testify to excess borrowing, what can have an adverse effect on the solvency of organizations in the future. However, considering the combination of both financial and non-financial indicators all companies got a high solvency index GLOBAS-i®.

The enterprises ASTROSTIL – MEKHOVOI SALON LLC and Torgovy dom YarOMF LLC showed negative values of the leverage ratio (-11 112,11 and -7,54 respectively), that can testify to negative values in the structure of own capital of these firms. Even so, considering the combination of both financial and non-financial indicators the company ASTROSTIL – MEKHOVOI SALON LLC got a high solvency index GLOBAS-i®, reflecting the solvency level, which is characterized by the ability to pay off the liabilities in time and fully.

In summary, it could be noted, that for the objective assessment of a company it should be considered not only recommended values of those or other indicators, but also industry-average indicators.

Economic boom of the consumer crediting increased tax levies flow to the state treasury

Following the 2013 results the total return of duties for land and property has increased by 12%. According to experts, such results were achieved mostly thanks to close cooperation of the Federal Tax Service (FTS) and the Federal Service for State Registration, Cadastre and Cartography (Roseestr).

During current year both departments are planning to continue the effective cooperation. In such a way, the total data comparison about property units of Roseestr and FTS is in the works.

The possible ways of the informational collaboration were discussed on the last meeting of these departments. The returns of duties for the property by 2013 were also summed up.

According to the Head of FTS, Mikhail Mishustin, by 2013 results, the total tax revenue to the consolidated budget without the transport tax amounted to 790 bln rubles. At the same time the tax revenue growth was evidenced under the following items: property tax – by 26% (22.3 bln rubles), corporate property tax – by 15% (615.1 bln rubles), land tax – by 11% (156.5 bln rubles).

In expert’s judgement, the tax revenue growth can be explained by the improvement of the examiners’ administration processes. They started to pay more attention to the registration of property units by the due date. Moreover, there was a change over from the taxation base to trading multiples, in other words the property items estimation according to the cadastral value.

Economic boom of the consumer crediting in 2012-2013 also resulted in the tax revenue growth. Individuals started to purchase sufficiently expensive property items.

The total administrative and economical actions for the tax base accession have already had its positive results. The effective cooperation of both departments is the minimal term for the tax base accession and tax collection in full for the estimation by examiners.