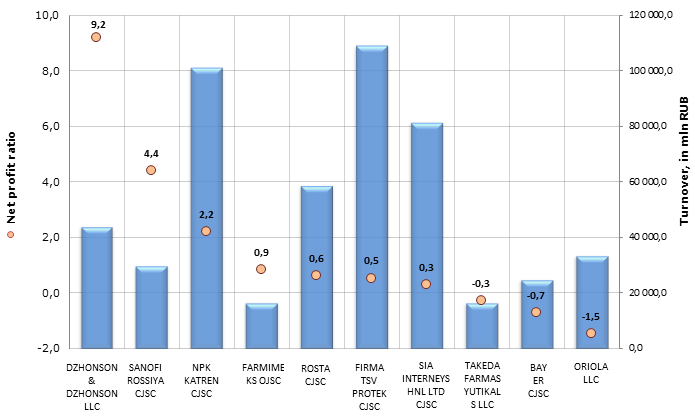

Net profit ratio of distributors of pharmaceutical products

Information agency Credinform prepared a ranking of distributors of pharmaceutical products.

The companies with the highest volume of revenue were selected for this ranking according to data from the Statistical Register for the latest available period (for the year 2012). These enterprises were ranked by decrease in net profit ratio.

Net profit ratio (%) is the relation of net profit (loss) of a company to sales revenue. It shows how profitable were sales of a company.

There is no specified value, that’s way it is recommended to compare companies of the same branch or ratio's change with time in one specific organization. If the indicators are negative, it means that company has a net loss. The higher is the net profit ratio, the more effective is finally company’s activity.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to industry-average indicators in the branch, but also to all presented combination of financial data.

| № | Name | Region | Turnover, in mln RUB, for 2012 | Net profit ratio, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | DZHONSON & DZHONSON LLC INN: 7725216105 |

Moscow | 43 910,1 | 9,2 | 223 high |

| 2 | SANOFI ROSSIYA CJSC INN: 7705018169 |

Moscow | 29 734,3 | 4,4 | 223 high |

| 3 | NAUCHNO-PROIZVODSTVENNAYA KOMPANIYA KATREN CJSC INN: 5408130693 |

Novosibirsk region | 101 206,7 | 2,2 | 201 high |

| 4 | FARMATSEVTICHESKY IMPORT, EKSPORT OJSC INN: 7710106212 |

Moscow | 16 594,2 | 0,9 | 261 high |

| 5 | ROSTA CJSC INN: 7726320638 |

Moscow region | 58 880,0 | 0,6 | 226 high |

| 6 | FIRMA TSENTR VNEDRENIYA PROTEK CJSC INN: 7724053916 |

Moscow | 109 120,5 | 0,5 | 245 high |

| 7 | SIA INTERNEYSHNL LTD CJSC /(SIA INTERNATIONAL Ltd) INN: 7714030099 |

Moscow | 81 537,6 | 0,3 | 255 high |

| 8 | TAKEDA FARMASYUTIKALS LLC INN: 7711067140 |

Moscow | 16 423,2 | -0,3 | 287 high |

| 9 | BAYER CJSC INN: 7704017596 |

Moscow | 24 806,9 | -0,7 | 294 high |

| 10 | ORIOLA LLC INN: 7704150140 |

Moscow region | 33 506,1 | -1,5 | 302 satisfactory |

Picture. Net profit ratio, turnover of the largest distributors of pharmaceutical products (TOP-10)

The ranking includes enterprises involved mainly in distribution (and not in own production) of pharmaceuticals to retail networks of the country.

Turnover of the largest distributers of pharmaceutical products (TOP-10) made 515 719,6 bln RUB, according to the latest published financial statement. The leaders accumulate up to 35% of sales revenue of all participants of the branch. The average net profit ratio of TOP-10 companies is 1,6%.

NPK KATREN CJSC and PROTEK CJSC have the revenue above 100 bln RUB and are the main players in Russian pharmaceutical market. The net profit ratio by these enterprises is respectively - 2,2% and 0,5%. By comparable turnover of both organizations, NPK KATREN CJSC yields more net profit to its founders after deduction of all expenses, i.e. the business is more effective.

NPK KATREN CJSC takes the first place in the overall ranking of pharmaceutical distributors on the share of direct supplies of medical products and the gross sales.

Tsentr vnedreniya PROTEK is one of the largest national distributors of pharmaceutical products and goods for beauty and health in Russia. The company carries out its activity in 83 territorial entities of the RF. The regional network includes 6 interregional logistic centers, 28 branches with full-service warehouses, 9 branches with storage depots and 43 regional trade representations.

According to the independent estimation of the Information agency Credinform, the organizations of the TOP-10 list got a high solvency index (except ORIOLA LLC), what can signal to an potential investor, that the largest market players can pay off their debts in time and fully, while risk of default is minimal.

See also: Net profit ratio of the largest publishers of newspapers and magazines in Russia

The Ministry of Economic Development worsened the blueprint of economic development on 2015

The Ministry of Economic Development of the Russian Federation lowered the estimates of the country’s economic growth on 2015. If a new forecast is approved by the government, there will be a necessity to revise the next-year draft budget. However, the authorities are not going to decline the budget rule.

According to the updated forecast, almost all the key indicators are lowered. Thus, the main economic indicator, GDP growth rate, is twice lowered – from 2% to 1%. However, due to the sharp deterioration in the investment climate, even the 1% growth may be considered as a quite optimistic development scenario.

The ministry lowered the estimate of retail sale growth to 0,6% from the earlier forecasted 2,1%, actual personal income – to 0,4% from 1,3% and actual earnings to 0,2 from 1,9%.

Inflation forecast on 2015 was by contrast increased. As for the ministry’s estimates, this indicator will amount to 6,5% in the next year, whereas it was forecasted to reach 5%.

At the same time the governmental agency saved the forecast for such indicators as the oil price and the ruble’s rate to dollar. Thus, the Ministry of Economic Development is still expecting the oil price to dip not lower than USD 100 per barrel and the ruble’s rate to dollar -not lower than 37 rubles per dollar. Nevertheless, Alexey Moiseyev, deputy Minister of Finance, stated that this oil price forecast is quiet overestimated. According to officer, in 2015-2017 it might be noticeably lower than USD 100 per barrel.

The decrease of the main forecast is related to the heightening of geopolitical tension owing to the situation in Ukraine. At the same time the news concerning the liberalization of sanctions on the part of the Western countries have appeared this week. But even under the most favorable outcome for Russia, the sanctions, unlike the way they were imposed, will be called off gradually. In addition, it will take more than a year to the recover the investment climate. According to different forecasts, the capital outflow at the end of current year might reach USD 100 – 200.

Alexey Ulyukayev, the Head of the Ministry, stated that the Russian economy has entered a negative stage of the economic cycle. At the same time he pointed that under existing quality of the institutes, it is impossible to improve the entrepreneurial climate and to entice investors. Significant infrastructure solutions on the part of the state are necessary and more than never effective at the moment.