ТОP-1000 of North region companies

In order to reduce the interregional differences in the level and quality of life of the population, to accelerate economic growth and technological development and to ensure the national security of the country, in February 2019 the Russian Government approved the Strategy of Spatial Development of the Russian Federation until 2025. It consists of 12 macro-regions; one of them is North district, which includes: Arkhangelsk, Vologda and Murmansk regions, Nenets Autonomous Okrug, Republic of Karelia and Komi Republic.

Information agency Credinform has prepared a review of activity trends of the largest companies of the real economy sector in the Northern Economic Region of Russia.

The largest companies (ТОP-1000) in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2013 - 2018). The analysis was based on data of the Information and Analytical system Globas.

Net assets is a ratio reflecting the real value of company's property. It is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The ratio is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest company in terms of net assets is LLC LUKOIL-KOMI, INN 1106014140, Komi Republic. In 2018 net assets of the company amounted to almost 385 billion RUB.

The smallest size of net assets in TOP-1000 had LLC OIL COMPANY NORTHERN RADIANCE, INN 8300005580, Nenets Autonomous Okrug. The company is in liquidation since 27.07.2017. The lack of property of the company in 2018 was expressed in negative terms -20 billion RUB.

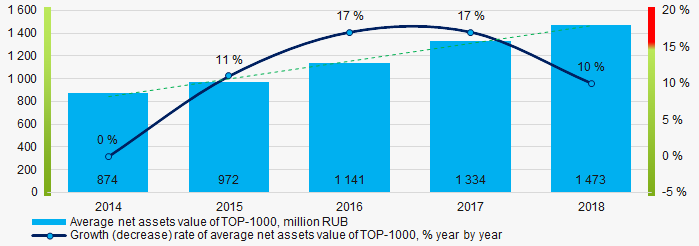

For the last five years, the average values of TOP-1000 net assets showed the growing tendency (Picture 1).

Picture 1. Change in average net assets value of ТОP-1000 companies in 2014 – 2018

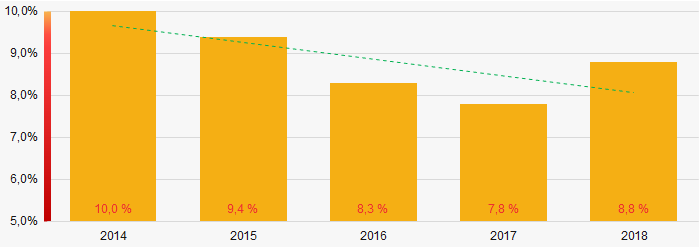

Picture 1. Change in average net assets value of ТОP-1000 companies in 2014 – 2018For the last five years, the share of ТОP-1000 enterprises with lack of property is decreasing (Picture 2).

Picture 2. The share of enterprises with negative net assets value in ТОP-1000

Picture 2. The share of enterprises with negative net assets value in ТОP-1000Sales revenue

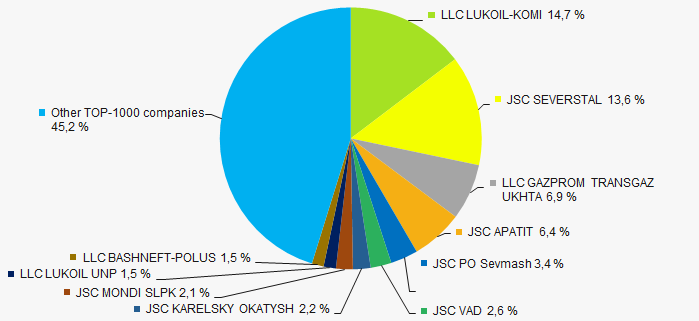

In 2018, the total revenue of 10 largest companies amounted to almost 55% from ТОP-1000 total revenue (Picture 3). This fact testifies the high level of capital concentration.

Picture 3. Shares of TOP-10 in TOP-1000 total revenue for 2018

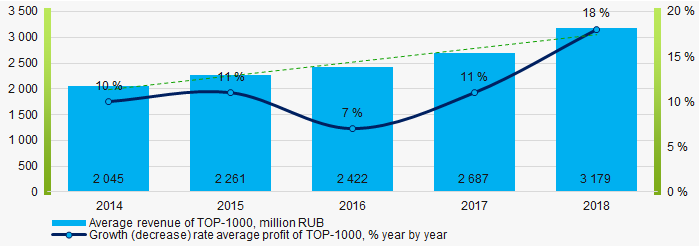

Picture 3. Shares of TOP-10 in TOP-1000 total revenue for 2018In general, the growing trend in sales revenue is observed (Picture 4).

Picture 4. Change in average revenue of TOP-1000 in 2014 – 2018

Picture 4. Change in average revenue of TOP-1000 in 2014 – 2018 Profit and loss

The largest company in terms of net profit is JSC SEVERSTAL, INN 3528000597, Vologda region. In 2018 the company’s profit amounted to 124 billion RUB.

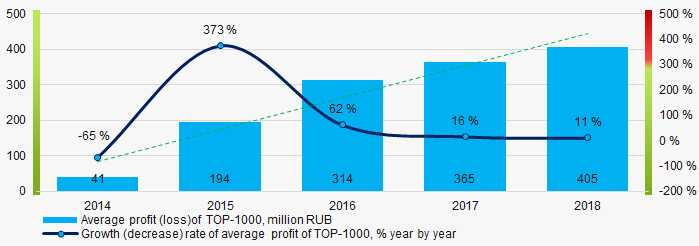

For the last five years, the average profit values of TOP-1000 show the growing tendency (Picture 5).

Picture 5. Change in average profit of TOP-1000 in 2014 – 2018

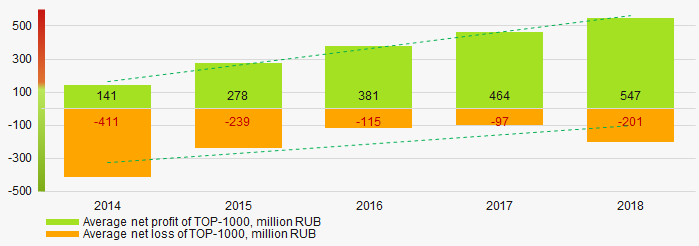

Picture 5. Change in average profit of TOP-1000 in 2014 – 2018 Over a five-year period, the average net profit values of ТОP-1000 show the growing tendency, along with this the average net loss is decreasing (Picture 6).

Picture 6. Change in average net profit/loss of ТОP-1000 companies in 2014 – 2018

Picture 6. Change in average net profit/loss of ТОP-1000 companies in 2014 – 2018Main financial ratios

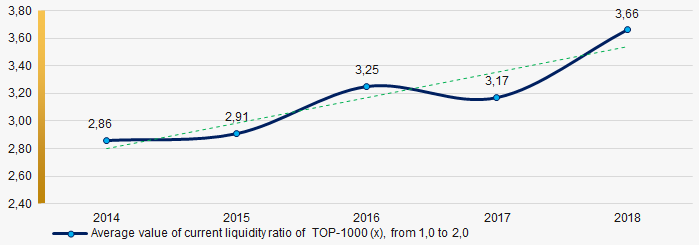

For the last five years, the average values of the current liquidity ratio were higher than the recommended values - from 1,0 to 2,0, with growing trend (Picture 7).

The current liquidity ratio (ratio of total working capital to short-term liabilities) shows the sufficiency of company’s assets to meet short-term obligations.

Picture 7. Change in average values of current liquidity ratio of TOP-1000 companies in 2014 – 2018

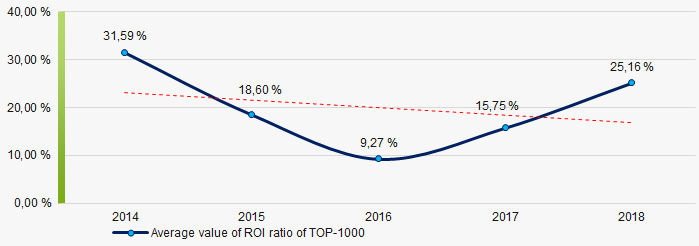

Picture 7. Change in average values of current liquidity ratio of TOP-1000 companies in 2014 – 2018For four years out of five, the high level of the average values of ROI ratio with downward trend is observed (Picture 8).

The ROI ratio is calculated as a ratio of net profit to sum of stockholder equity and long-term liabilities and shows the return from equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average values of ROI ratio in 2014 – 2018

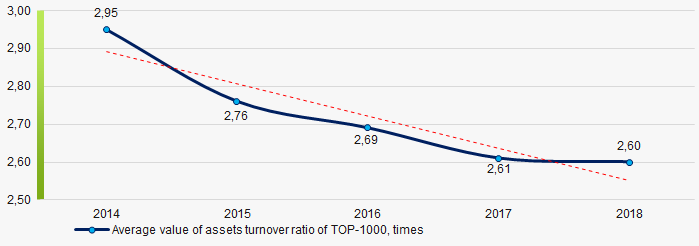

Picture 8. Change in average values of ROI ratio in 2014 – 2018 Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

For the last five years, this business activity ratio demonstrated the downward trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio of TOP-1000 companies in 2014 – 2018

Picture 9. Change in average values of assets turnover ratio of TOP-1000 companies in 2014 – 2018 Small businesses

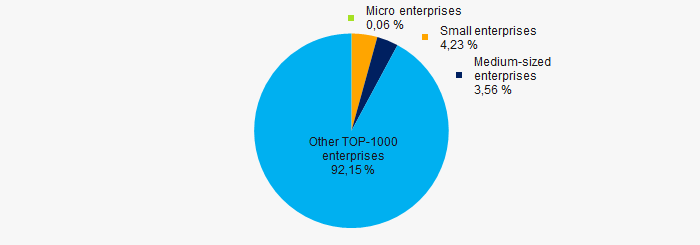

55% of ТОP-1000 companies are registered in the Unified register of small and medium-sized enterprises of the Russian Federal Tax Service. Herein, their share in TOP-1000 total revenue is about 9%, which is significantly lower than the national average value in 2018-2019 (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in ТОP-1000

Picture 10. Shares of small and medium-sized enterprises in ТОP-1000Main regions of activity

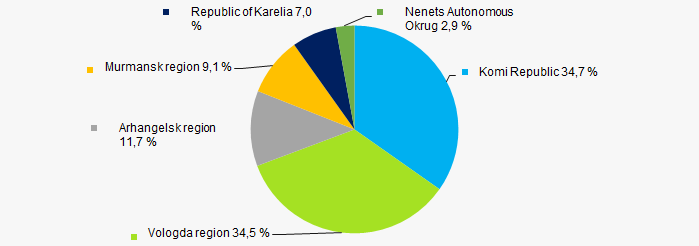

ТОP-1000 companies are unequally located across the country and registered in 6 regions of Russia. More than 69% of the largest enterprises in terms of revenue are located in the Komi Republic and Vologda region (Picture 11).

Picture 11. Distribution of TOP-1000 revenue over the territory of the Northern Economic Region of Russia

Picture 11. Distribution of TOP-1000 revenue over the territory of the Northern Economic Region of Russia Financial position score

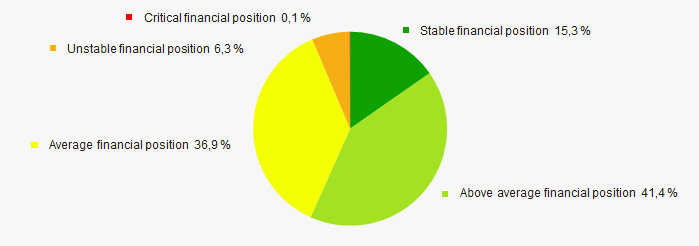

An assessment of the financial position of TOP-1000 companies shows that the largest part have above average financial position (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

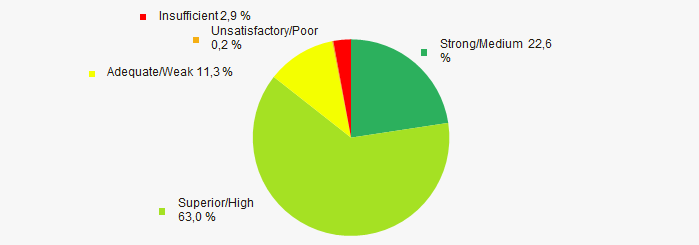

Most of TOP-1000 companies got superior/high or strong/medium Solvency index Globas, this fact shows the ability of the companies to meet their obligations in time and fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by Solvency index Globas

Picture 13. Distribution of TOP-1000 companies by Solvency index GlobasIndustrial production index

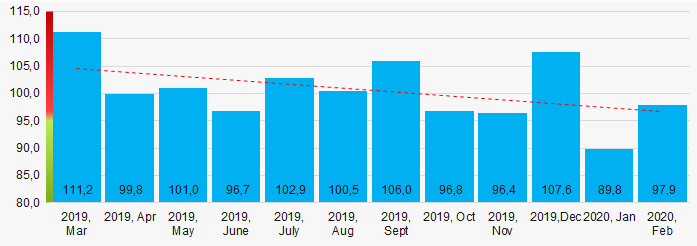

According to the Federal Service of State Statistics, there is a downward trend in the industrial production index in the Northern Economic Region of Russia during 12 months of 2019 – 2020 (Picture 14). Herewith the average index from month to month amounted to 100,6%.

Picture 14. Average industrial production index in the Northern Economic Region of Russia in 2019-2020, month by month (%)

Picture 14. Average industrial production index in the Northern Economic Region of Russia in 2019-2020, month by month (%)According to the same data, the share of enterprises of the Northern Economic Region of Russia in the amount of revenue from the sale of goods, works, services made 2,26% countrywide in 2019, that is higher than in 2018 (2,136%).

Conclusion

A complex assessment of activity of the largest companies of real economy sector in the Northern Economic Region of Russia, taking into account the main indexes, financial ratios and indicators, demonstrates the presence of positive trends (Table 1).

| Trends and assessment factors | Relative share, % |

| Growth/drawdown rate of average net assets value |  10 10 |

| Increase / decrease in the share of enterprises with negative net assets |  10 10 |

| The level of competition / monopolization |  -10 -10 |

| Growth/drawdown rate of average revenue |  10 10 |

| Growth/drawdown rate of average net profit (loss) |  10 10 |

| Increase / decrease in average net profit of companies |  10 10 |

| Increase / decrease in average net loss of companies |  10 10 |

| Increase / decrease in average values of current liquidity ratio |  5 5 |

| Increase / decrease in average values of ROI ratio |  -10 -10 |

| Increase / decrease in average values of assets turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses by revenue more than 22% |  -10 -10 |

| Regional concentration |  -5 -5 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Industrial production index |  -5 -5 |

| Dynamics of the share of enterprises in the total amount of revenue countrywide |  10 10 |

| Average value of factors |  2,8 2,8 |

favorable trend (factor),

favorable trend (factor),  unfavorable trend (factor).

unfavorable trend (factor).

Share of services in GDP of Top-20 economies of the world

The coronavirus COVID-19 pandemic has led to an unprecedented crisis in the global economy. To varying degrees, all regions of the world have been affected. The services sector is most affected: the tourism business is paralyzed, restaurants and hotels are closed, the mass entertainment and shopping industry suffers; air transportation decreased significantly.

There is a growing perception of the forthcoming problems size. According to the forecast of the American investment company Morgan Stanley, the US economy in the II quarter of 2020 will decline by an unprecedented 38%, and the real GDP will shrink 5,5% by the year end, the steepest drop since 1946.

Christine Lagarde, chairperson of the European Central Bank (ECB), believes that the restrictions introduced to combat the pandemic can lead to a reduction in the EU economy by 5%.

The International Monetary Fund (IMF) predicts a 5,5% drop in Russia's GDP this year. So far, this figure does not exceed the shock of the 2009 crisis, when the Russian GDP fell by 7,8%.

Existing estimates are likely to be reviewed more than once, since humanity has not yet reached the peak of the pandemic, therefore, the real damage will be understood later. Nevertheless, it may be concluded that countries with high share of services in GDP will suffer the most.

Among Top-20 countries with the largest economy, the US have the highest share of services in GDP exceeding 77%; it is 71% in the UK, and 70% in France (see Table 1).

The share of services in the GDP of Russia is less - 54%, in China - 52%, and in India - 49%.

| Rank | Country | Service in GDP, %* | National GDPs at PPP, trillion USD, 2019** | Position by GDP |

| 1 | USA | 77,4 | 21 439 | 2 |

| 2 | United Kingdom | 71,0 | 3 131 | 9 |

| 3 | France | 70,3 | 3 061 | 10 |

| 4 | Canada | 70,2 | 1 900 | 16 |

| 5 | Japan | 69,1 | 5 747 | 4 |

| 6 | Spain | 67,7 | 1 941 | 15 |

| 7 | Italy | 66,3 | 2 443 | 12 |

| 8 | Brazil | 62,6 | 3 456 | 8 |

| 9 | Germany | 61,8 | 4 444 | 5 |

| 10 | Mexico | 60,1 | 2 628 | 11 |

| 11 | Thailand | 56,9 | 1 383 | 20 |

| 12 | Iran | 54,4 | 1 471 | 18 |

| 13 | Turkey | 54,3 | 2 347 | 13 |

| 14 | Russia | 54,1 | 4 349 | 6 |

| 15 | Republic of Korea | 53,6 | 2 320 | 14 |

| 16 | China | 52,2 | 27 309 | 1 |

| 17 | Egypt | 51,4 | 1 391 | 19 |

| 18 | India | 49,1 | 11 326 | 3 |

| 19 | Saudi Arabia | 48,4 | 1 899 | 17 |

| 20 | Indonesia | 43,4 | 3 737 | 7 |

* Share of services in value added of GDP. Source: World Bank - World Development Indicators

** Source: INF - World Economic Outlook Database

Countries with their own industry and developed agriculture, independent of seasonal workers and foreign markets, will be less susceptible to the crisis. During the pandemic, industrial goods and food are of prime importance, and entertainment, leisure and shopping are transferred to the category of deferred demand.