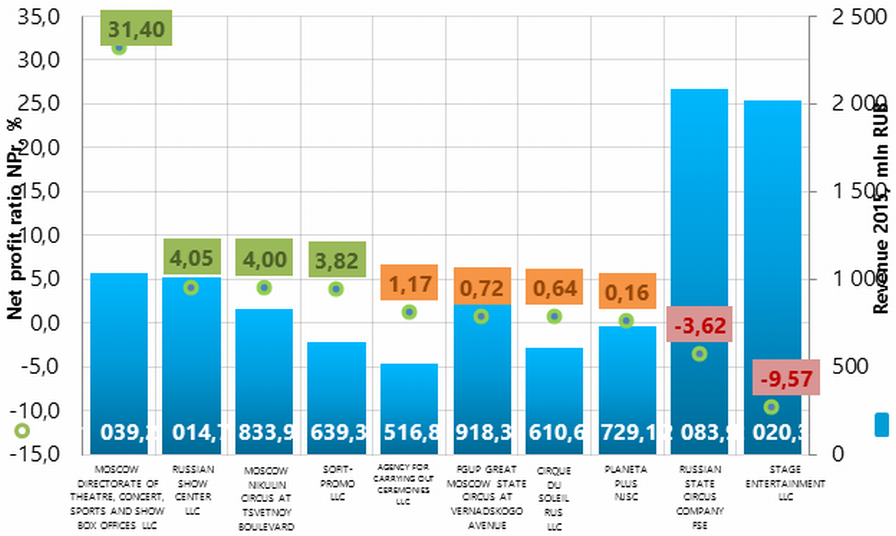

Net profit ratio of the largest Russian creative enterprises in the sphere of art and entertainment

Information agency Credinform has performed a ranking of the largest Russian creative enterprises in the sphere of art and entertainment. Enterprises with the largest annual revenue (TOP-10) for the latest accounting periods available in the State statistical authorities (2015 and 2014) have been selected for the ranking. Then they have been ranked by net profit ratio (Table 1). The analysis was based on data of the Information and Analytical system Globas.

Net profit ratio is calculated as a relation of net profit (loss) to sales revenue, and indicates sales profit rate. There is no standard value for this ratio. It is recommended to compare enterprises within one sector, or change of the ratio in the course of time of a certain company. A negative value of the ratio signals about net loss. A high value shows an efficient operation of the enterprise.

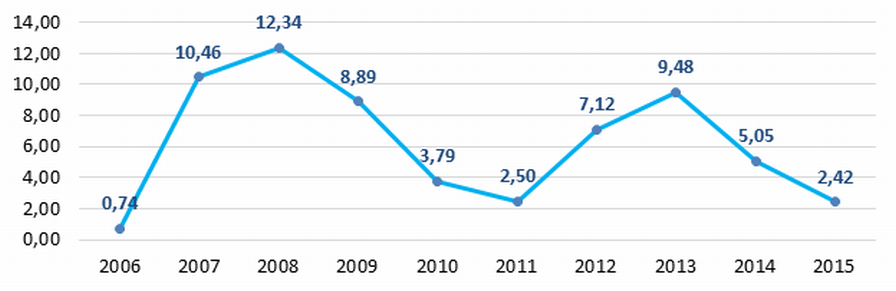

A calculation of practical values of financial ratios, which might be considered as normal for a certain industry, has been developed and implemented in the Information and Analytical system Globas by the experts of Information Agency Credinform, having taken into account the current situation in the economy as a whole and in the industries. The practical value of net profit ratio for creative enterprises in the sphere of art and entertainment in 2015 amounted to 2,42%.

The whole set of financial indicators and ratios of a company is to be considered to get the fullest and fairest opinion about the company’s financial standing.

| Name, INN, region | Net profit, mln RUB | Revenue, mln RUB | NPr, % |

Solvency index Globas® | ||||

| 2014 | 2015 | 2016 | 2014 | 2015 | 2016 | |||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| MOSCOW DIRECTORATE OF THEATRE, CONCERT, SPORTS AND SHOW BOX OFFICES LLC INN 7710944197 Moscow |

198,1 | 326,3 | 264,2 | 868,1 | 1 039,2 | 1 026,5 | 31,40 | 212 High |

| RUSSIAN SHOW CENTER LLC INN 7710666750 Moscow |

37,7 | 41,0 | 17,8 | 1 088,4 | 1 014,7 | 440,3 | 4,05 | 239 High |

| MOSCOW NIKULIN CIRCUS AT TSVETNOY BOULEVARD NJSC INN 7707284367 Moscow |

31,4 | 33,4 | 70,7 | 648,3 | 833,9 | 925,6 | 4,00 | 143 The highest |

| SOFIT-PROMO LLC INN 7839503590 Saint Petersburg |

32,4 | 24,4 | 163,1 | 639,3 | 3,82 | 172 The highest | ||

| AGENCY FOR CARRYING OUT CEREMONIES LLC INN 7725269594 Moscow |

15,4 | 6,1 | 308,3 | 516,8 | 1,17 | 305 Satisfactory | ||

| FGUP GREAT MOSCOW STATE CIRCUS AT VERNADSKOGO AVENUE INN 7736039722 Moscow |

123,9 | 6,6 | 88,9 | 996,0 | 918,3 | 1 125,7 | 0,72 | 165 The highest |

| CIRQUE DU SOLEIL RUS LLC INN 7704704694 Moscow |

-33,8 | 3,9 | -49,8 | 818,6 | 610,6 | 705,2 | 0,64 | 318 Satisfactory |

| PLANETA PLUS NJSC INN 7801140316 Saint Petersburg |

-26,1 | 1,2 | 786,8 | 729,1 | 0,16 | 229 High | ||

| RUSSIAN STATE CIRCUS COMPANY FSE INN 7702060003 Moscow |

43,6 | -75,5 | 49,4 | 1 871,3 | 2 083,9 | 2 116,6 | -3,62 | 263 High |

| STAGE ENTERTAINMENT LLC INN 7704536785 Moscow |

-162,9 | -75,5 | -151,1 | 1 635,8 | 2 020,3 | 1 211,4 | -9,57 | 297 High |

| Total for TOP-10 companies | 259,6 | 174,1 | 9 184,6 | 10 405,9 | ||||

| Average value of TOP-10 companies | 26,0 | 17,4 | 918,5 | 1 040,6 | 3,28 | |||

| Industry average value | 0,4 | 0,1 | 9,5 | 9,6 | 2,42 | |||

*Data for 2016 is given for reference.

The average value of 2015 net profit ratio in TOP-10 companies is higher than the practical value. Four companies of TOP-10 have an index value that is lower than the practical one. Two companies have a negative value, and at the same time, they have the biggest revenue of TOP-10 companies.

Eight of TOP-10 companies have a decrease in revenue or net profit as compared to the prior period, or have loss.

Picture 1. Net profit ratio and revenue of the largest Russian creative enterprises in the sphere of art and entertainment (TOP-10)

Picture 1. Net profit ratio and revenue of the largest Russian creative enterprises in the sphere of art and entertainment (TOP-10)Industry average values of net profit ratio in 2006-2015 (Picture 2) mirror the general macroeconomic situation in the country. Net profit increases during crisis periods.

Picture 2. Change of industry average values of net profit ratio of the largest Russian creative enterprises in the sphere of art and entertainment in 2006 – 2015

Picture 2. Change of industry average values of net profit ratio of the largest Russian creative enterprises in the sphere of art and entertainment in 2006 – 2015 Eight of TOP-10 companies got the highest or a high solvency index Globas, that demonstrates their ability to pay their debts in time and fully.

AGENCY FOR CARRYING OUT CEREMONIES LLC and CIRQUE DU SOLEIL RUS LLC got a satisfactory solvency index Globas, due to information concerning the companies being defendants in debt collection arbitration proceedings, untimely fulfillment of their obligations and unclosed writs of execution. Index development trends are stable.

Business entity should know its counterparty

On July 18, 2017, the President of the RF has signed the Federal Law «On amendments to Part One of the Russian Tax Code» (№163-FZ). This statutory instrument is also called the «law on tax abuses». According to the developers, the main objectives of this law are the identifying of common and understandable signs that testify to the facts of abuse, the uniform application of the developed law-enforcement approaches and thereby the creation of fair business environment and exclusion of unfair competition.

According to the law, the signs, which testify to the facts of abuse:

- distortion of information about facts of business life (a combination of such facts), about objects of taxation that are to be recorded in tax accounting and/or bookkeeping or in tax reporting of a taxpayer;

- non-payment (partial payment) and/or set-off (refund) of a tax amount considered as the main objectives of the transaction (operation);

- fulfillment of the obligation for a transaction (operation) by the person, who is not the party to the contract concluded with a taxpayer and/or a person, to whom the obligation to execute the transaction (operation) under the contract or the law has not been transferred.

In addition, the law determines that the following facts should not be considered as illegal as the ground for recognizing the fact that the taxpayer decreases the tax base and/or the amount of tax payable:

- signing of primary accounting documents by an unidentified or unauthorized person;

- violation by a counterparty of a taxpayer of the legislation on taxes and fees;

- possibility of a taxpayer to receive the same result of economic activity when making other transactions (operations) that are not prohibited by the law.

All mentioned above is equally applicable to payers of fees, insurance payments and tax agents. It is crucially that the law imposes the duty on tax authorities to prove facts of abuse by a taxpayer.

The developers believe that the law requires to proceed only from the reality of transactions (operations) carried out by a taxpayer. It makes possible to avoid the use of vague notions such as «business purpose», «impossibility of real performance of transactions», «lack of necessary conditions», «non-exercise of due diligence».

Experts of the Information agency Credinform believe that the notion of «due diligence and caution» will not disappear from the practice of the business. This concept is much broader than it is considered and used by tax authorities, assessing a taxpayer for the existence of facts of unjustified tax benefit.

«Due diligence and caution» from the point of view of doing business means, first of all, a comprehensive check of a counterparty by business entity and proceeds from an assessment of possible risks from cooperation with him, his experience, understanding of the ability to perform the contract by the contractor. As the ultimate goal of such inspection is considered the necessity to avoid signing a contract with a fly-by-night company or with a firm that has problems with solvency, or an organization that undergoes bankruptcy proceedings or uses fraudulent schemes etc.

In its letter from March 23, 2017 (№ED-5-9/547@) the tax service pays attention to this in the course of inspection by requesting documents from the taxpayer that record the results of the search, monitoring and selection of a counterparty; results of market monitoring of the relevant goods (works, services); study and evaluation of potential counterparties, their business reputation, solvency, availability of necessary resources, experience; including documented rationale for choosing a particular counterparty and other aspects.

The Information and Analytical system Globas will make it possible to report to the tax service on all the positions mentioned in the letter. The system has an intellectual search for information on business entities both in Russia and abroad, the corresponding analytical capabilities for the diagnostics of the business of a counterparty, assessment of the state of industries, of the competitive environment, solution of business problems, making managerial decisions to prevent (reduce) entrepreneurial risks and factors of their influence.