Customs office will be vested with a right to initiate administrative cases

At the present time customs authorities, detected violations by motor vehicle search, crossing the border of Russia, have no right to initiate by themselves an administrative case and give a ticket. A bill, introduced to the State Duma by the Government of the RF, should straight such things out.

Border security is the necessary condition of domestic tranquility. Customs office suppresses illegal entry of migrants, arms and narcotics smuggling. If the customs office finds violations by transport control, then materials for an administrative case are submitted to the bodies of the Ministry of Internal Affairs (MVD) or Federal Service for Supervision of Transport (Rostransnadzor). It will take a certain amount of time before appropriate structures will try a case, also the search of violators is connected with extra expenditures, and considering that the border is crossed by foreign carriers – it seems to be a yet harder task to impose responsibility on them. As the result the budget receives less funds in the form of penalties, and violators get the illusion about the impunity of law infringement, because by such system the base of an punishment - its unavoidability – breaks down.

Furthermore, in case there are nonconformities of weight and overall parameters to statutory standards, found out by a vehicle, leaving Russia, customs officer gives notice of detected violations to a carrier and the necessity of arriving at the nearest control point of Rostransnadzor. In a fact it turns out that parties in good faith have to spend time for the completion of a violation in place, which could be long-distance from the point of apprehension, and others just circumvent received regulations.

Now therefore, the introduced initiative should fill this lacuna in the legislation.

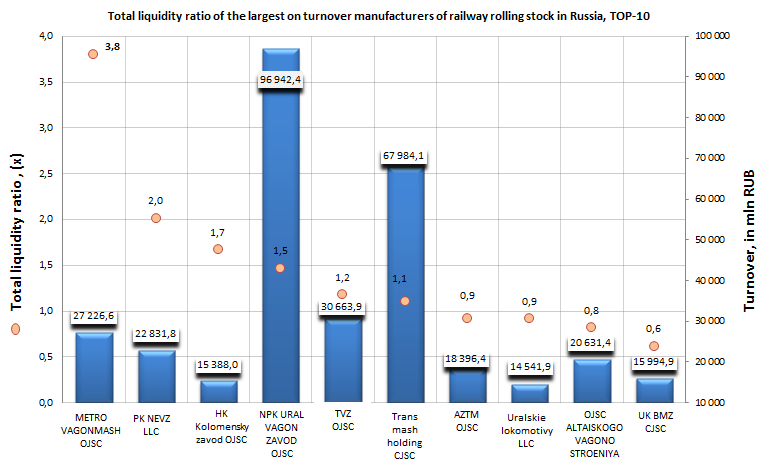

Total liquidity ratio of manufacturers of railway rolling stock

Information agency Credinform prepared a ranking of manufacturers of railway rolling stock on total liquidity ratio. The companies with the highest volume of revenue were selected for this ranking according to data from the Statistical Register for the latest available period (for the year 2012). Then, the first 10 enterprises selected by turnover were ranked by decrease in total liquidity ratio.

Total liquidity ratio (х) is calculated as the relation of the sum of company’s current assets to short-term liabilities and shows the sufficiency of its funds for repayment of short-terms liabilities. The higher is the indicator value, the better is the solvency of an organization, however, the ratio value higher than 2 can testify to an irrational capital structure, what can be connected with a slowdown in the turnover of funds, invested into inventory, or unreasonable growth of accounts receivable. Recommended values of the indicator: from 1 to 2.

It should be reminded that current assets include following indicators: inventory, value added tax on acquired assets, accounts receivable, financial investments (except monetary equivalents), cash and cash equivalents and other current assets.

Under short-term liabilities are considered: borrowers' liabilities, accounts payable, deferred income, estimated liabilities and other short-term liabilities.

| № | Name, INN | Region | Turnover for 2012, in mln RUB | Total liquidity ratio, (х) | Solvency indexGLOBAS-i® |

|---|---|---|---|---|---|

| 1 | METROVAGONMASH OJSC INN 5029006702 |

Moscow region | 27 227 | 3,8 | 140 (the highest) |

| 2 | PROIZVODSTVENNAYAKOMPANIYANOVOCHERKASSKYELEKTROVOZOSTROITELNYZAVODLLC INN 6150040250 |

Rostov region | 22 832 | 2,01 | 222 (high) |

| 3 | Holdingovaya kompaniya Kolomensky zavod OJSC INN 5022013517 |

Moscow region | 15 388 | 1,67 | 172 (the highest) |

| 4 | OJSC NAUCHNO-PROIZVODSTVENNAYAKORPORATSIYAURALVAGONZAVODIMENIF.E. DZERZHINSKOGO INN 6623029538 |

Sverdlovsk region | 96 942 | 1,47 | 169 (the highest) |

| 5 | TVERSKOI VAGONOSTROITELNY ZAVOD OJSC INN 6902008908 |

Tver region | 30 664 | 1,18 | 239 (high) |

| 6 | TransmashholdingCJSC INN 7723199790 |

Moscow | 67 984 | 1,11 | 173 (the highest) |

| 7 | ARMAVIRSKY ZAVOD TYAZHOLOGO MASHINOSTROENIYA OJSC INN 2302044590 |

Krasnodar territory | 18 396 | 0,92 | 244 (high) |

| 8 | UralskielokomotivyLLC INN 6606033929 |

Sverdlovsk region | 14 542 | 0,92 | 251 (high) |

| 9 | OJSC ALTAISKOGOVAGONOSTROENIYA INN 2208000010 |

Altaiterritory | 20 631 | 0,82 | 249 (high) |

| 10 | UPRAVLYAYUSHCHAYAKOMPANIYABRYANSKYMASHINOSTROITELNYZAVODCJSC INN 3232035432 |

Bryansk region | 15 995 | 0,61 | 247 (high) |

The first place of the ranking list belongs to METROVAGONMASH OJSC with the value of the total liquidity ratio 3,8, that is higher, than recommended values, and can testify to an irrational capital structure. However, the company got the highest solvency index GLOBAS-i®, that characterizes it as financially stable.

Five companies from TOP-10 Russian manufacturers of railway rolling stock have the values of total liquidity ratio, which correspond to recommended values: PROIZVODSTVENNAYA KOMPANIYA NOVOCHERKASSKY ELEKTROVOZOSTROITELNY ZAVOD LLC (2,01), Holdingovaya kompaniya Kolomensky zavod OJSC (1,67), OJSC NAUCHNO-PROIZVODSTVENNAYA KORPORATSIYA URALVAGONZAVOD IMENY F.E. DZERZHINSKOGO (1,47), TVERSKOI VAGONOSTROITELNY ZAVOD OJSC (1,18) and Transmashholding CJSC (1,11). Similar results testify to optimal capital structure and companies’ ability to repay short-terms liabilities asap. In support of good results the companies got the highest and a high solvency index GLOBAS -i®.

The indicator values of companies ARMAVIRSKY ZAVOD TYAZHOLOGO MASHINOSTROENIYA OJSC (0,92), Uralskie lokomotivy LLC (0,92) and OJSC ALTAISKOGO VAGONOSTROENIYA (0,82) deviate a little from recommended values, all three enterprises got a high solvency index GLOBAS-i®.

The last enterprise in the ranking list is UPRAVLYAYUSHCHAYA KOMPANIYA BRYANSKY MASHINOSTROITELNY ZAVOD CJSC with the value of the total liquidity ratio 0,61, what is lower, than recommended values, and can testify that there are insufficient current assets for repayment of short-terms liabilities. However, for the objective assessment of financial stability of a company it is necessary to consider the combination of financial and non-financial indicators, that’s why this company also got a high solvency index GLOBAS-i®.

For the growth of the total liquidity ratio and maintenance of its minimum required value some rules must be known and observed. For stably high (within the normative range) total liquidity ratio it is important the profitable operation of an enterprise, including its growth. The financing of investment program (investments into noncurrent assets) should be accounted for long-term and not for short-term credits. Also it is necessary to aim at reasonable minimization of inventory and WIP, i.e. at decrease of the least liquid current assets.