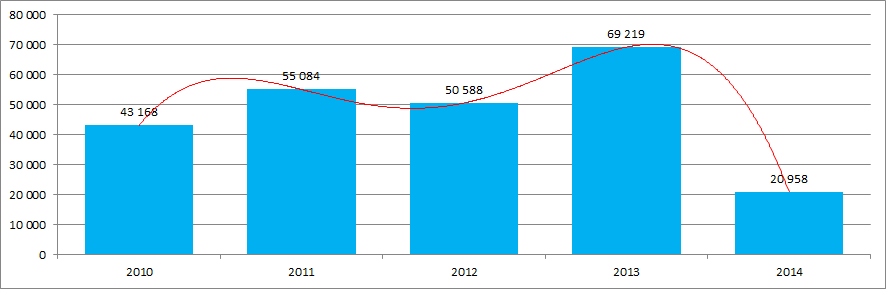

The largest Russian IT-companies in terms of current liquidity ratio

Information Agency Credinform presents the ranking of Russian IT-companies. The largest companies (TOP-10), engaged in using of computing machinery and information technologies, in terms of revenue were selected according to the data from the Statistical Register for the latest available period (2014). The companies were ranged by current liquidity ratio (Table 1).

Current liquidity ratio (х) is a ratio of total working capital to short-term liabilities, it shows the funds sufficiency for repayment of debts.

The recommended value is from 1,0 to 2,0. Ratio value less than 1 demonstrates excess of short-term liabilities over current working capital.

For the most full and fair opinion about the company’s financial position, not only compliance with standard values should be taken into account, but also the whole set of financial indicators and ratios.

| Name, INN, Region | Net profit of 2014, mln RUB | Revenue of 2014, mln RUB | Revenue of 2014 to 2013 % | Current liquidity ratio, (х) | Solvency index Globas-i |

|---|---|---|---|---|---|

| LLC YANDEX INN 7736207543 Moscow |

18 720,8 | 51 506,0 | 127 | 3,30 | 172 The highest |

| LLC MAIL.RU INN 7743001840 Moscow |

3 637,4 | 13 385,7 | 108 | 2,34 | 204 High |

| LLC SAP CIS INN 7705058323 Moscow |

863,5 | 19 462,0 | 99 | 1,45 | 253 High |

| JSC I-TECO INN 7704160892 Moscow |

533,3 | 14 836,1 | 90 | 1,24 | 200 High |

| JSC CROC INCORPORATED INN 7701004101 Moscow |

502,0 | 22 455,1 | 95 | 1,09 | 238 High |

| LLC DISCOM INN 7705878220 Moscow |

21,3 | 19 982,2 | 117 | 1,03 | 249 High |

| JSC SOFTLINE TRADE INN 7736227885 Moscow |

97,1 | 21 096,2 | 123 | 1,02 | 191 The highest |

| LLC RN-INFORM INN 7725624249 Moscow |

1 332,6 | 16 946,2 | 145 | 1,02 | 231 High |

| LLC LUKOIL INFORM INN 7705514400 Moscow |

58,3 | 19 728,9 | 106 | 0,91 | 262 High |

| JSC NVISION GROUP INN 7703282175 Moscow |

-1 612,8 | 14 262,1 | 75 | 0,74 | 300 Satisfactory |

Values of the current liquidity ratio for the TOP-10 companies vary from 3,30 to 0,74. The average value of the current liquidity ratio of the 10 largest IT-companies in 2014 was 1,41 with average value 1,81 for the top-100 companies.

First two places of the ranking take LLC YANDEX and LLC MAIL.RU with current liquidity ratios exceeding the upper limit of recommended value, while working capital of the enterprises significantly exceeds short-term liabilities.

Ratios of LLC LUKOIL-INFORM and JSC NVISION GROUP are below the recommended values.

The TOP-10 companies except for JSC NVISION GROUP, ended 2014 with profit, at that LLC SAP CIS, I-TECO, JSC CROC INCORPORATED and LLC LUKOIL INFORM have value decrease in relation to the previous period.

JSC NVISION GROUP has got satisfactory solvency index Globas-i due to the available information of its participation as a defendant in debt collection arbitration proceedings, cases оf delay payment and loss in financial structure. The solvency rate of the company does not guarantee full and well-timed discharge of liabilities.

The rest 9 companies of the TOP-10 list have got the highest and high solvency index Globas-i that characterizes them as financially stable.

Picture 1. Revenue and current liquidity ratio for 2014 of the 10 largest IT-companies (TOP-10)

Following the results of 2014, the annual total revenue of the TOP-10 companies was 84,3 bln RUB, that is almost 20% of the total revenue of the companies from the corresponding TOP-100 list. This value has 9% grown related to 2013.

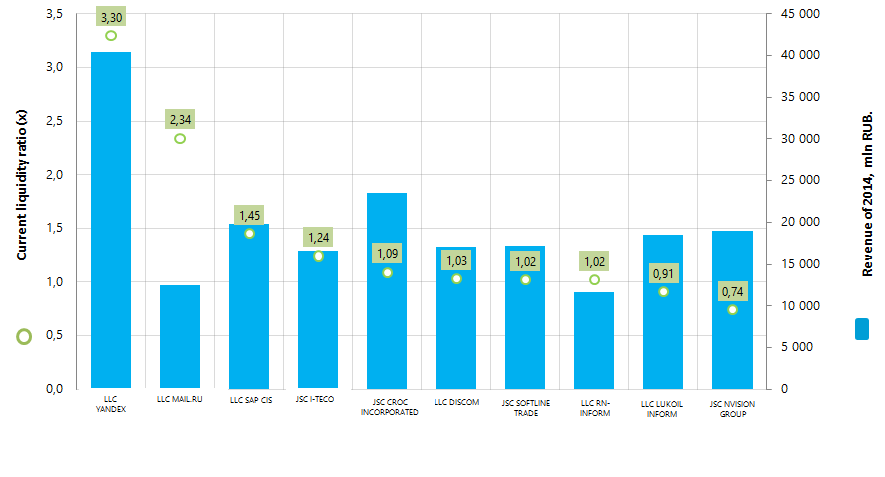

Therefore, inspite of difficult economic conditions, the industry demonstrates positive dynamics. The same information confirm data of the Federal State Statistics Service (Rosstat) showing dynamics in working capital of the companies engaged in using of computing machinery and information technologies (Picture 2 and Table 2).

Picture 2. Working capital according to the type of activity (Annual value, bln RUB)

The largest working capital have IT-companies dealing with software protection and consultancy in this sphere.

| 2010 | 2011 | 2012 | 2013 | 2014 | 2014 to 2010, % | |

|---|---|---|---|---|---|---|

| Software protection and consultancy in this sphere | 89,6 | 103,7 | 161,0 | 235,6 | 275,0 | 307 |

| Other activities connected with using of computing machinery and information technologies | 51,9 | 60,3 | 124,9 | 132,1 | 170,9 | 329 |

| Activities connected with development and usage of data bases and information resources, including Internet resources | 63,8 | 50,4 | 79,8 | 105,7 | 123,4 | 193 |

| Consultancy connected with hardware of computing machinery | 19,9 | 56,1 | 32,0 | 45,2 | 63,0 | 317 |

| Maintenance and repair of office and computer machinery | 15,1 | 15,9 | 20,0 | 34,6 | 45,4 | 301 |

| Data processing | 13,8 | 20,0 | 22,4 | 31,6 | 41,7 | 302 |

The highest rate of working capital have the IT-companies carrying on other activities connected with using of computing machinery and information technologies.

High business concentration in Moscow – the largest financial center in the country – is typical for IT-companies. This fact is confirmed by the data from the Information and analytical system Globas-i on the regional distribution of 100 largest registered companies of the industry in terms of 2014 revenue (TOP-5 Regions):

| Region | Number of registered companies |

|---|---|

| Moscow | 74 |

| Saint-Petersburg | 6 |

| Moscow region | 5 |

| The Republic of Tatarstan | 3 |

| Rostov region | 2 |

Investment climate: tax benefits at the increase in control

By the RF Government Resolution as of 27.04.2016 N365 “On amendments to certain acts of the Government of the Russian Federation on provision of state guarantees under credits or bonded loans raised for investment projects implementation”, the procedure for provision of state guarantees under credits or bonded loans raised for investment projects implementation was amended.

The primacy has the protection of the national interests in guarantees against unfair recipients of the state support.

The force of rules of provision of state guarantees under credits or bonded loans for investment projects implementation for legal entities, statutorily selected by the Government, is prolonged for the whole June. The rules were added with the methods of conducting the analyses of the recipient’s financial situation, which will be implemented by Vnesheconombank during the check of the potential recipient’s financial situation at the stage of consideration of documents. Moreover, the list of documents necessary for support granting now also contains the form with the potential recipient’s financial situation data and its compliance with other conditions for granting state guarantees.

After the granting, the recipient is obliged to notify Vnesheconombank on all amendments to the accountings. If there are amendments indicating negative financial situation of the recipient, the state guarantees will be withdrawn.

Along with the state control strengthening, the Government ordering by the President has set profit tax relief for participants of regional investment projects. They are applied by the Federal law N144-FL as of 23.05.2016 “On amendments to Part One and Part Two of the Tax Code of the Russian Federation”.

Now regional authorities are allowed to zero out the profit tax rate or reduce it to 10% for the providers invested from 50 to 500 mln RUB to the manufacturing during 3 years, or over 500 mln RUB for 5 years. In this regard the sales income has to be at least 90% of profit earned by the enterprise.

However the following categories will not be able to get tax benefits: investors already using special tax regimes, residents of special economic zones or members of consolidated group of taxpayers, banks, insurance companies, non-government pension funds, professional participants of the securities market and non-profit organizations.

These amendments to the Tax Code will come into force after a month from the date of the Federal law official publication.

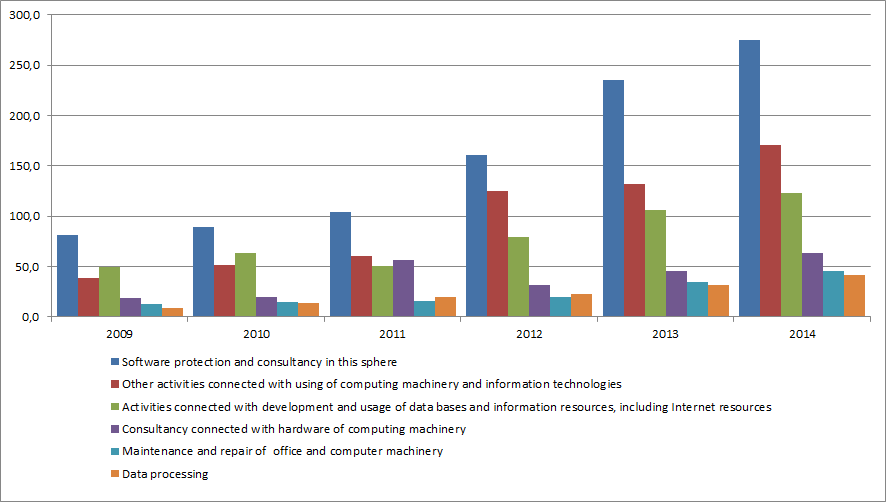

The Government pays careful attention to create favorable environment for investment to the Russian economy for a reason. Reduction in investment is an outstanding feature not only for Russia, but for the world economy in general. According to the data of the United Nations Conference on trade and development (UNCTAD), world foreign direct investment in 2014 reduced by 16,3% and amounted to 1,23 trillion USD. That reduction took place on the background of increase in the gross domestic product, trade, capital investment and employment. The reduction in direct investment to the Russian economy in 2014 was almost 70% in comparison to 2013, which is revealed by the data of the Central Bank of the RF (Picture 1).

Picture 1. Indicators of direct investment to the Russian Federation (according to the balance of payments, mln US dollars)