Profit level in recycling

Information agency Credinform has prepared a ranking of the largest Russian companies engaged in waste collection and recycling. The largest enterprises (TOP-10) engaged in waste collection and recycling, except metal waste, in terms of annual revenue were selected according to the data from the Statistical Register for the available periods (2015-2017). Then the companies were ranged by net profit ratio (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Net profit ratio (%) is calculated as a ratio of net profit (loss) to sales revenue. The ratio reflects the company’s level of sales profit.

The ratio doesn’t have the standard value. It is recommended to compare the companies within the industry or the change of a ratio in time for a certain company. The negative value of the ratio indicates about net loss. The higher is the ratio value, the better the company operates.

The calculation of practical values of financial indicators, which might be considered as normal for a certain industry, has been developed and implemented in the Information and Analytical system Globas by the experts of the Information Agency Credinform, taking into account the actual situation of the economy as a whole and the industries. In 2017 the average practical value of net profit ratio for companies engaged in waste collection and recycling was higher than 2.33%.

For the most full and fair opinion about the company’s financial position the whole set of financial indicators and ratios should be taken into account.

| Name, INN, region, activity | Revenue, mln RUB | Net profit (loss), mln RUB | Net profit margin, % | Solvency index Globas | |||

| 2016 | 2017 | 2016 | 2017 | 2016 | 2017 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| LLC KHARTIYA INN 7703770101 Moscow Waste collection |

2345 2345 |

2539 2539 |

243 243 |

262 262 |

10,36 10,36 |

10,31 10,31 |

202 Strong |

| LLC ORIS PROM INN 7725146955 Moscow Recovery of sorted materials |

3761 3761 |

5781 5781 |

18 18 |

323 323 |

0,47 0,47 |

5,59 5,59 |

149 Superior |

| LLC SHLAKSERVIS INN 7445026038 Chelyabinsk region Recycling of other secondary non-metallic raw materials |

1743 1743 |

1808 1808 |

84 84 |

72 72 |

4,80 4,80 |

3,97 3,97 |

175 High |

| NAO AVTOPARK #6 SPETSTRANS INN 7830000440 Saint-Petersburg Waste collection |

1273 1273 |

1601 1601 |

19 19 |

52 52 |

1,49 1,49 |

3,25 3,25 |

161 Superior |

| LLC EKOLAIN INN 7734690939 Moscow Waste collection |

1657 1657 |

2334 2334 |

217 217 |

53 53 |

13,10 13,10 |

2,27 2,27 |

255 Medium |

| NAO EKOS INN 8619008017 Sverdlovsk region Waste collection |

7160 7160 |

5898 5898 |

367 367 |

123 123 |

5,12 5,12 |

2,09 2,09 |

200 Strong |

| LLC MINERALOPT INN 5905291122 Perm region Waste collection |

3580 3580 |

1704 1704 |

44 44 |

31 31 |

1,22 1,22 |

1,82 1,82 |

268 Medium |

| AVTOPARK #1 SPETSTRANS INN 7830002705 Saint-Petersburg Waste collection |

1733 1733 |

2207 2207 |

-129 -129 |

2 2 |

-7,44 -7,44 |

0,07 0,07 |

220 Strong |

| SPB GUDP TSENTR INN 7812021254 Saint-Petersburg Waste collection |

2812 2812 |

2984 2984 |

-95 -95 |

-37 -37 |

-3,37 -3,37 |

-1,24 -1,24 |

217 Strong |

| NAO MUSOROUBOROCHNAYA KOMPANIYA INN 2308131994 Krasnodar region Collection of non-hazardous waste |

2137 2137 |

2158 2158 |

22 22 |

-33 -33 |

1,04 1,04 |

-1,54 -1,54 |

267 Medium |

| Total for TOP-10 companies |  28201 28201 |

29014 29014 |

789 789 |

847 847 |

|||

| Average value for TOP-10 companies |  2820 2820 |

2901 2901 |

79 79 |

85 85 |

2,68 2,68 |

2,66 2,66 |

|

| Average industry value |  94 94 |

98 98 |

1,3 1,3 |

1,7 1,7 |

1,37 1,37 |

1,75 1,75 |

|

— growth of indicator in comparison with prior period,

— growth of indicator in comparison with prior period,  — decline of indicator in comparison with prior period.

— decline of indicator in comparison with prior period.

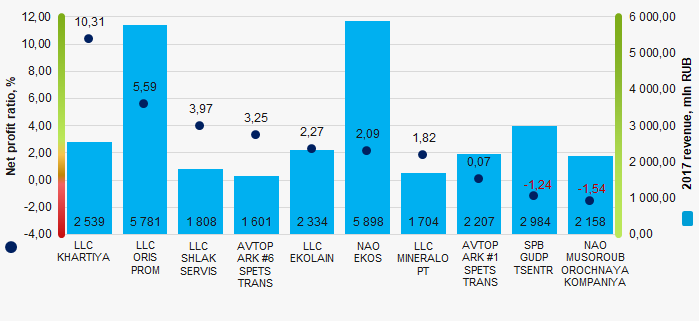

Average value of net profit ratio for TOP-10 companies is higher than average industry and practical values. In 2017 five companies from the TOP-10 list improved their indicators in comparison with prior period.

Picture 1. Net profit ratio and revenue of the largest Russian companies engaged in waste collection and recycling (ТОP-10)

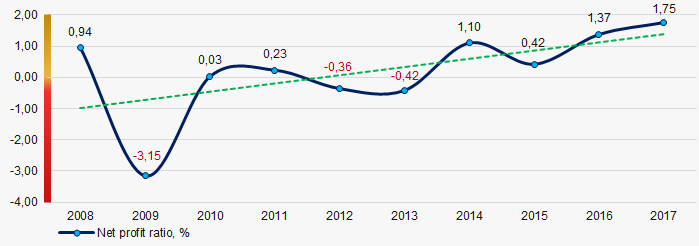

Picture 1. Net profit ratio and revenue of the largest Russian companies engaged in waste collection and recycling (ТОP-10)For the last 10 years, the average values of net profit ratio showed the increasing tendency (Picture 2).

Picture 2. Change in average industry values of the net profit ratio of the Russian companies engaged in waste collection and recycling in 2008 – 2017

Picture 2. Change in average industry values of the net profit ratio of the Russian companies engaged in waste collection and recycling in 2008 – 2017 Russian Ecological Operator

The Russian President’s Decree No. 8 from January 14, 2019 establishes the Russian Ecological Operator, a public nonprofit entity for creation of a comprehensive municipal solid waste management system.

The company is established under the National Project Ecology, and is to provide compliance with municipal solid waste (MSW) management legislation and activation of investment initiatives.

The company will get the right to buy land for construction of MSW recycling facilities, and buy buildings, structures, special machinery and equipment for waste treatment and recycling.

The national operator will work alongside with regional operators, and it will distribute environmental fees among the regions for funding of waste recycling and disposal projects.

69 regions have switched over to the new MSW treatment system since January 1, 2019. Federal cities – Moscow, St. Petersburg and Sevastopol – will transfer to the new system in 2022. 13 regions are not ready for the MSW management reforms yet, due to their landfills’ unfitness and lack of regional operators. A number of regions, such as the Moscow region, Novosibirsk region, Belgorod region, Murmansk region, Samara region, the Republic of Adygea, the Chechen Republic and the Stavropol territory, are to switch to new waste management principles in the first half of 2019.

According to the Information and Analytical system Globas there are over 19,000 active waste treatment, disposal and recycling companies in Russia at the moment. A subscription to Globas provides an opportunity to explore information about them and their business activity.