Amendments to the Licensing act

Since August 13, 2019, the purchase from citizens of products made from precious metals and stones, the processing of scrap from them is subject to obligatory licensing.

This provision is contained in the Federal law №282-ФFZ dated 02.08.2019.

In particular, amendments to the «Federal law on licensing of certain types of activity» provide for licensing of the following activities:

- purchase from individuals of jewelry and other goods made from precious metals and precious stones, scrap of these products;

- working and processing of scrap and waste of precious metals, with the exception of scrap and waste obtained and collected by organizations and sole proprietors while their own producing, or jewelry and other goods made from precious metals of own production, unrealized and returned to manufacturers.

Organizations and sole proprietors, performing these types of activities at the time the amendments were introduced, must obtain the appropriate licenses or complete this activity no later than 1,5 years from the start date of the law.

It should be noted that the Russian Classification of Economic Activities (OKVED), approved by the Order of Rosstandart №14-st from 31.01.2014 in force as of 20.02.2019, does not contain the type of activity on the purchase from individuals of jewelry and other goods made from precious metals and precious stones, scrap of these products.

According to the Information and Analytical system Globas, currently there are about 2300 operating business entities in Russia that process waste and scrap of precious metals. Information on these legal entities and sole proprietors is available in full to subscribers of Globas.

Trends in activity of companies of Khabarovsk region

Information agency Credinform has prepared a review of activity trends of the largest companies of the real economy sector in Khabarovsk region.

The largest companies (ТОP-1000) in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2012 - 2017). The analysis was based on data of the Information and Analytical system Globas.

Net assets is a ratio reflecting the real value of company's property. It is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The ratio is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest company in terms of net assets is Transneft Far East LLC. In 2018 net assets of the company amounted to more than 229 billion RUB.

The smallest size of net assets in TOP-1000 had JSC AMURMETAL, which is in process of being wound up since11.10.2013. The lack of property of the company in 2018 was expressed in negative terms -39,8 billion RUB.

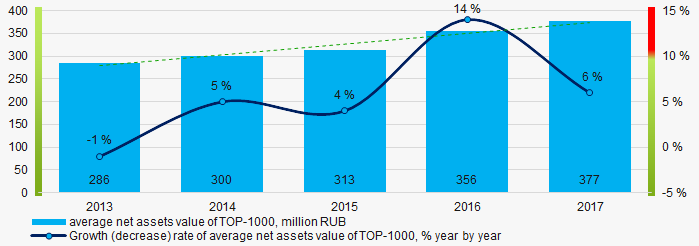

For the last five years, the average values of TOP-1000 net assets showed the growing tendency (Picture 1).

Picture 1. Change in average net assets value of ТОP-1000 companies in 2013 – 2017

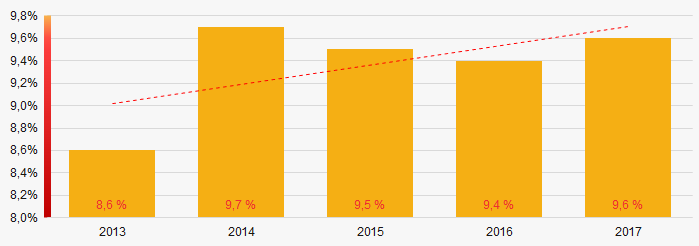

Picture 1. Change in average net assets value of ТОP-1000 companies in 2013 – 2017 For the last five years, the share of ТОP-1000 enterprises with lack of property is growing (Picture 2).

Picture 2. The share of enterprises with negative net assets value in ТОP-1000

Picture 2. The share of enterprises with negative net assets value in ТОP-1000Sales revenue

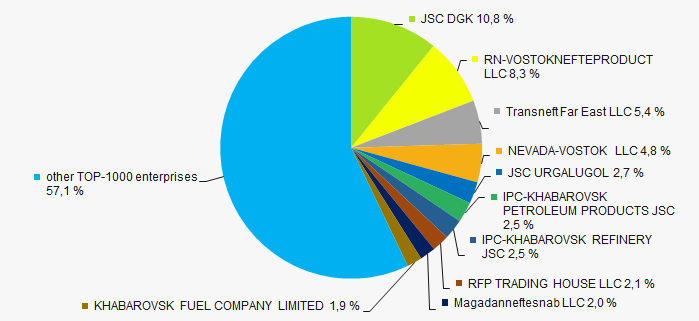

In 2017, the total revenue of 10 largest companies amounted to almost 43% from ТОP-1000 total revenue (Picture 3). This fact testifies the high level of industrial concentration in Khabarovsk region.

Picture 3. Shares of TOP-10 in TOP-1000 total revenue for 2017

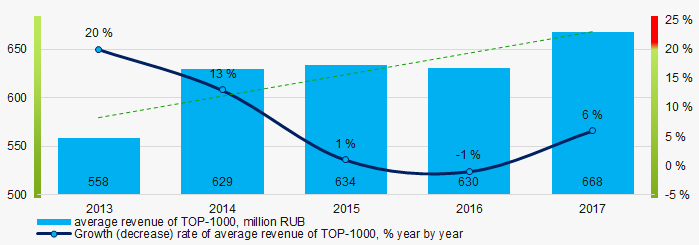

Picture 3. Shares of TOP-10 in TOP-1000 total revenue for 2017In general, the growing trend in sales revenue is observed (Picture 4).

Picture 4. Change in average revenue of TOP-1000 in 2013 – 2017

Picture 4. Change in average revenue of TOP-1000 in 2013 – 2017Profit and loss

The largest company in terms of net profit is JSC DALTRANSUGOL. In 2018 the company’s profit amounted to 2,5 billion RUB.

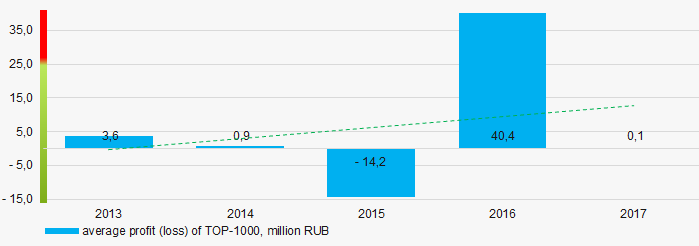

For the last five years, the average profit values of TOP-1000 show the growing tendency (Picture 5).

Picture 5. Change in average profit of TOP-1000 in 2013 – 2017

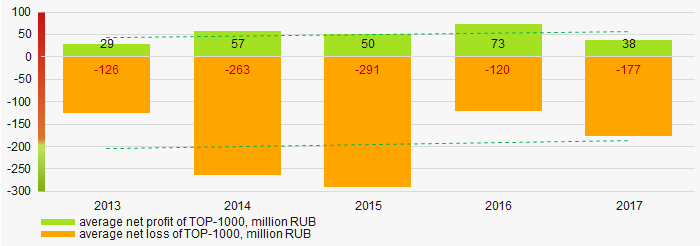

Picture 5. Change in average profit of TOP-1000 in 2013 – 2017Over a five-year period, the average net profit values of ТОP-1000 show the growing tendency, along with this the average net loss is decreasing (Picture 6).

Picture 6. Change in average net profit/loss of ТОP-1000 companies in 2013 – 2017

Picture 6. Change in average net profit/loss of ТОP-1000 companies in 2013 – 2017Main financial ratios

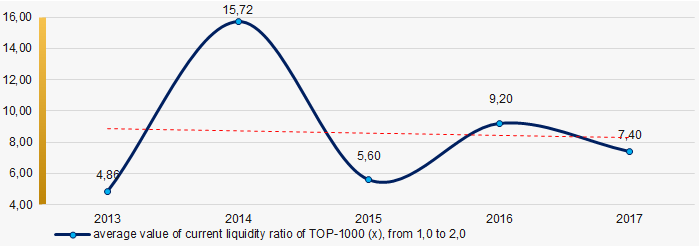

For the last five years, the average values of the current liquidity ratio were higher than the recommended values - from 1,0 to 2,0, with downward trend (Picture 7).

The current liquidity ratio (ratio of total working capital to short-term liabilities) shows the sufficiency of company’s assets to meet short-term obligations.

Picture 7. Change in average values of current liquidity ratio of TOP-1000 companies in 2013 – 2017

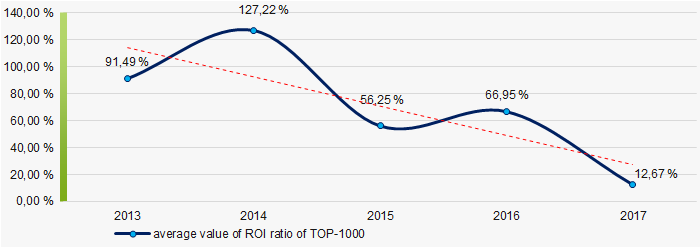

Picture 7. Change in average values of current liquidity ratio of TOP-1000 companies in 2013 – 2017For the last five years, the high level of the average values of ROI ratio with downward trend is observed (Picture 8).

The ROI ratio is calculated as a ratio of net profit to sum of stockholder equity and long-term liabilities and shows the return from equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average values of ROI ratio in 2013 – 2017

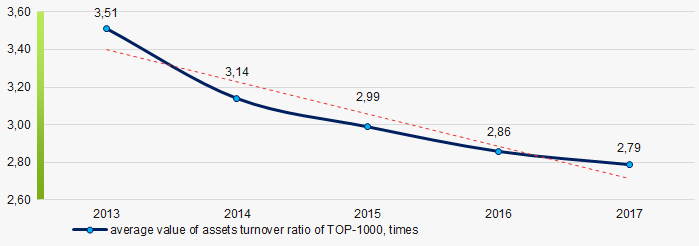

Picture 8. Change in average values of ROI ratio in 2013 – 2017Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

For the last five years, this business activity ratio demonstrated the downward trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio of TOP-1000 companies in 2013 – 2017

Picture 9. Change in average values of assets turnover ratio of TOP-1000 companies in 2013 – 2017Small businesses

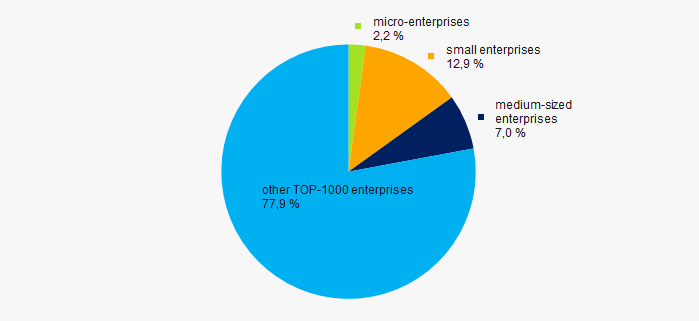

77% of ТОP-1000 companies are registered in the Unified register of small and medium-sized enterprises of the Russian Federal Tax Service. Herein, their share in TOP-1000 total revenue amounted to 22%, which is the national average value (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in ТОP-1000

Picture 10. Shares of small and medium-sized enterprises in ТОP-1000Main regions of activity

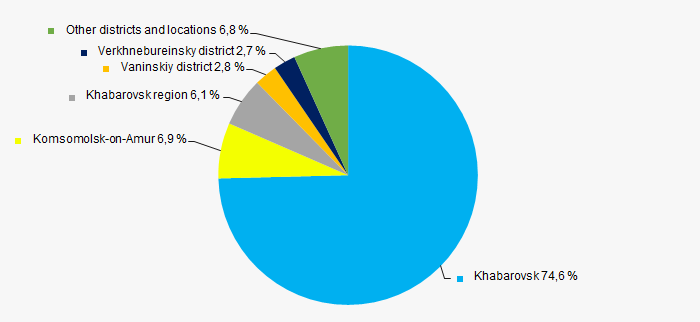

ТОP-1000 companies are unequally located across the country and registered in 20 regions of Russia. Almost 75% of the largest enterprises in terms of revenue are located in the regional center – Khabarovsk city (Picture 11).

Picture 11. Distribution of TOP-1000 revenue by the districts of Khabarovsk region

Picture 11. Distribution of TOP-1000 revenue by the districts of Khabarovsk regionFinancial position score

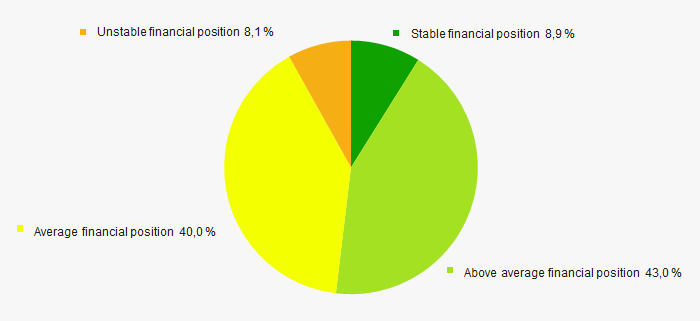

An assessment of the financial position of TOP-1000 companies shows that the largest part have above average financial position (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

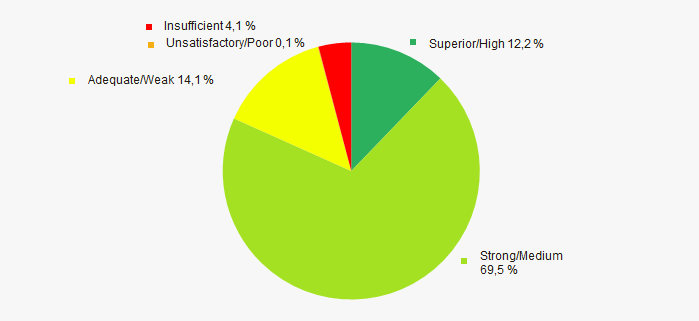

Most of TOP-1000 companies got superior/high or strong/medium Solvency index Globas, this fact shows the ability of the companies to meet their obligations in time and fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by Solvency index Globas

Picture 13. Distribution of TOP-1000 companies by Solvency index GlobasIndustrial production index

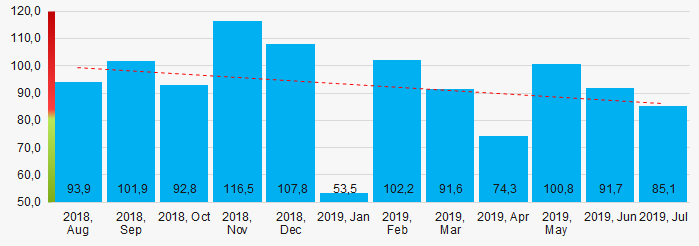

According to the Federal Service of State Statistics, there is a downward trend in the industrial production index in Khabarovsk region during 12 months of 2018 – 2019 (Picture 14). Herewith the average index from month to month amounted to 92,7%.

Picture 14. Industrial production index in Khabarovsk region in 2018-2019, month by month (%)

Picture 14. Industrial production index in Khabarovsk region in 2018-2019, month by month (%)According to the same data, the share of enterprises of Khabarovsk region in the amount of revenue from the sale of goods, works, services made 0,491% countrywide in 2018 and 0,540% for the 6 months of 2019, that is higher than in the 2st quarter 2018 (0,493%).

Conclusion

A complex assessment of activity of the largest companies of Khabarovsk region real economy, taking into account the main indexes, financial ratios and indicators, demonstrates the presence of positive trends (Table 1).

| Trends and assessment factors | Relative share, % |

| Growth/drawdown rate of average net assets value |  10 10 |

| Increase / decrease in the share of enterprises with negative net assets |  -10 -10 |

| The level of capital concentration |  -5 -5 |

| Growth/drawdown rate of average revenue |  10 10 |

| Growth/drawdown rate of average net profit (loss) |  10 10 |

| Increase / decrease in average net profit of companies |  10 10 |

| Increase / decrease in average net loss of companies |  10 10 |

| Increase / decrease in average values of current liquidity ratio |  -10 -10 |

| Increase / decrease in average values of ROI ratio |  -5 -5 |

| Increase / decrease in average values of assets turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses by revenue more than 22% |  10 10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Industrial production index |  -10 -10 |

| Dynamics of the share of enterprises in the total amount of revenue from the sale of goods, works, services countrywide |  10 10 |

| Average value of factors |  1,9 1,9 |

favorable trend (factor),

favorable trend (factor),  unfavorable trend (factor).

unfavorable trend (factor).