Trends in public catering in time of crisis

Information agency Credinform has prepared a review of activity trends of the largest Russian public catering companies during the financial crisis of 2008-2009. The largest public catering companies (restaurants and cafes, dining halls, buffets and cafeterias, food delivery services, etc.) (ТОP-1000) in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2006 - 2011). The analysis was based on data of the Information and Analytical system Globas.

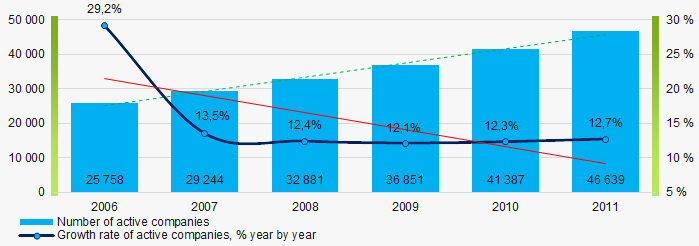

Number of active companies

Within 2006 - 2011 the number of active companies was growing, however in time of crisis and in the beginning of recovery, the growth rate was decreasing.

Picture 1. Dynamics of active companies in 2006 – 2011

Picture 1. Dynamics of active companies in 2006 – 2011Net assets is a ratio reflecting the real value of company's property. It is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The ratio is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest company in terms of net assets was LLC McDonald’s, INN 7710044140, Moscow. In 2011 net assets of the company amounted to more than 12 billion RUB. In 2018 the indicator amounted to more than 21 billion RUB.

The smallest size of net assets in TOP-1000 had LLC RISONT, INN 7724260447, Moscow, process of being wound up since 15.08.2016. The lack of property of the company in 2011 was expressed in negative terms -219 million RUB and - 126 million RUB in 2014.

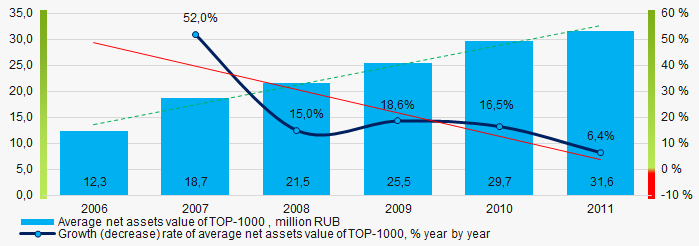

Within 2006-2011, the average values of TOP-1000 net assets showed the growing tendency, however the growth rate was decreasing (Picture 2).

Picture 2. Change in average net assets value of ТОP-1000 companies in 2006– 2011

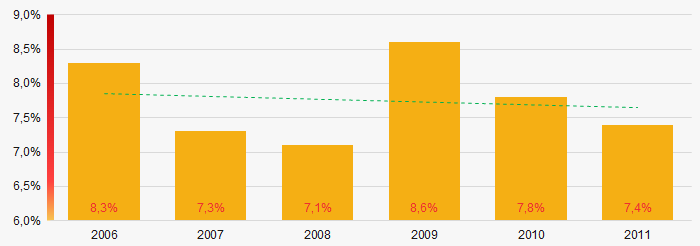

Picture 2. Change in average net assets value of ТОP-1000 companies in 2006– 2011In general, within 2006 - 2011, the share of ТОP-1000 enterprises with lack of property was decreasing (Picture 3). Within the acute phase of crisis, the share of enterprises with lack of property was growing.

Picture 3. The share of enterprises with negative net assets value in ТОP-1000 in 2006 – 2011

Picture 3. The share of enterprises with negative net assets value in ТОP-1000 in 2006 – 2011 Sales revenue

The largest company by sales revenue was also LLC McDonald’s, INN 7710044140, Moscow. In 2011, the indicator amounted to more than 34 billion RUB and more than 69 billion RUB in 2018.

In general, the growing trend in sales revenue with decreasing growth rate was observed (Picture 4).

Picture 4. Change in average revenue of TOP-1000 in 2006 – 2011

Picture 4. Change in average revenue of TOP-1000 in 2006 – 2011Profit and loss

The largest company in terms of net profit was also LLC McDonald’s, INN 7710044140, Moscow. In 2011 the company’s profit amounted to 3,6 million RUB and 4,4 million RUB in 2018.

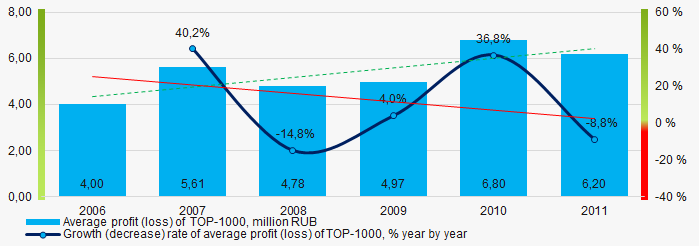

Within 2006 – 2011, the average profit values of TOP-1000 showed the growing tendency with decrease in the growth rate (Picture 5).

Picture 5. Change in average profit (loss) of TOP-1000 in 2006 – 2011

Picture 5. Change in average profit (loss) of TOP-1000 in 2006 – 2011In 2006 – 2011 the average net profit values of ТОP-1000 showed the growing tendency, along with this the average net loss was increasing (Picture 6).

Picture 6. Change in average net profit/loss of ТОP-1000 in 2006 – 2011

Picture 6. Change in average net profit/loss of ТОP-1000 in 2006 – 2011Main financial ratios

In 2006 – 2011 the average values of the current liquidity ratio were higher than the recommended values - from 1,0 to 2,0, with growing trend (Picture 7).

The current liquidity ratio (ratio of total working capital to short-term liabilities) shows the sufficiency of company’s assets to meet short-term obligations.

Picture 7. Change in average values of current liquidity ratio of TOP-1000 companies in 2006 – 2011

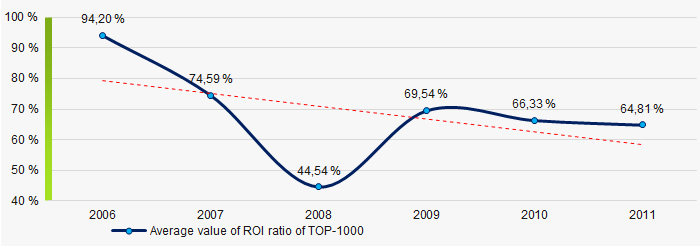

Picture 7. Change in average values of current liquidity ratio of TOP-1000 companies in 2006 – 2011Within 2006 - 2011 the decreasing trend of the average values of ROI ratio with downward trend in the crisis 2008 was observed (Picture 8).

The ROI ratio is calculated as a ratio of net profit to sum of stockholder equity and long-term liabilities and shows the return from equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average values of ROI ratio in 2006 – 2011

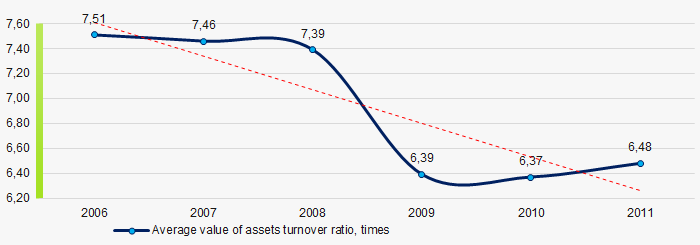

Picture 8. Change in average values of ROI ratio in 2006 – 2011Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

In 2006 – 2011 this business activity ratio demonstrated the decreasing trend with significant drop within the acute phase of crisis (Picture 9).

Picture 9. Change in average values of assets turnover ratio of TOP-1000 companies in 2006 – 2011

Picture 9. Change in average values of assets turnover ratio of TOP-1000 companies in 2006 – 2011Small businesses

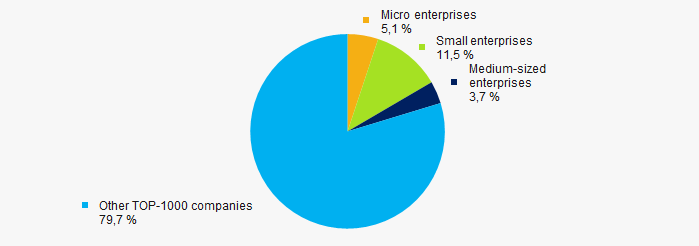

73% of ТОP-1000 companies are registered in the Unified register of small and medium-sized enterprises of the Russian Federal Tax Service. Herein, in 2011 their share in TOP-1000 total revenue was more than 20% (Picture 10).

Picture 10. Revenue of small and medium-sized enterprises in 2011

Picture 10. Revenue of small and medium-sized enterprises in 2011 Main regions of activity

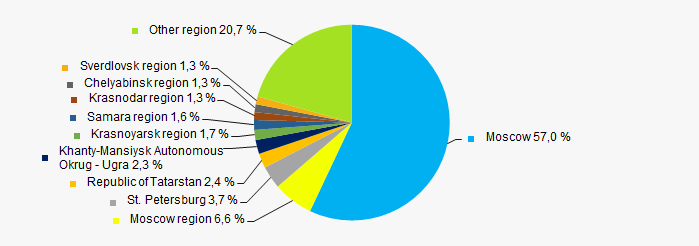

ТОP-1000 companies are unequally located across the country and registered in 77 regions of Russia. More than 67% of the largest enterprises in terms of revenue are located in Moscow, Moscow region and St. Petersburg (Picture 11).

Picture 11. Distribution of TOP-1000 revenue by regions of Russia in 2011

Picture 11. Distribution of TOP-1000 revenue by regions of Russia in 2011Financial position score

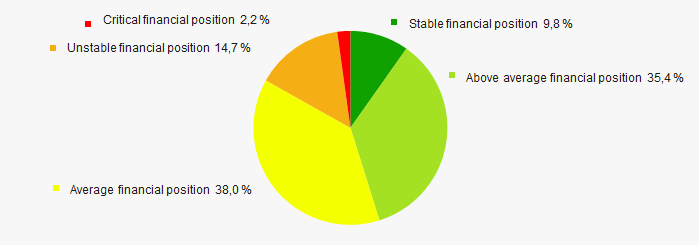

An assessment of the financial position of TOP-1000 companies shows that in 2020 the largest part have the average financial position (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score in 2020

Picture 12. Distribution of TOP-1000 companies by financial position score in 2020Solvency index Globas

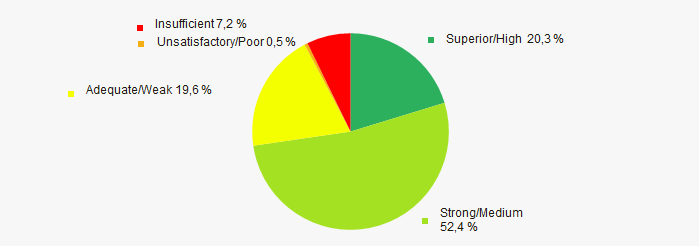

In 2020 the most of TOP-1000 companies got superior/high or strong/medium Solvency index Globas, this fact shows the ability of the companies to meet their obligations in time and fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by Solvency index Globas in 2020

Picture 13. Distribution of TOP-1000 companies by Solvency index Globas in 2020Conclusion

A complex assessment of activity of the largest Russian public catering companies, taking into account the main indexes, financial ratios and indicators, demonstrates the presence of positive trends within 2006-2011 (Table 1).

| Trends and assessment factors | Relative share, % | Possible forecast |

| Dynamics of active companies |  10 10 |

|

| Growth rate of active companies |  -10 -10 |

During the acute phase of crisis, the number of active companies may decrease. |

| Dynamics of average net assets value |  10 10 |

|

| Growth/drawdown rate of average net assets value |  -10 -10 |

During the crisis recovery the growth rate of average net assets may decrease. |

| Increase / decrease in the share of enterprises with negative net assets |  10 10 |

During the acute phase of crisis number of enterprises with negative net assets may increase. |

| Dynamics of average revenue |  10 10 |

|

| Growth/drawdown rate of average revenue |  -10 -10 |

In time of crisis, the growth rate of revenue may decrease. |

| Dynamics of average profit |  10 10 |

|

| Growth/drawdown rate of average net profit (loss) |  -10 -10 |

In time of crisis, the growth rate of profit may decrease. |

| Increase / decrease in average net profit of companies |  10 10 |

|

| Increase / decrease in average net loss of companies |  -10 -10 |

In time of crisis and its recovery the net loss may increase. |

| Increase / decrease in average values of current liquidity ratio |  5 5 |

|

| Increase / decrease in average values of ROI ratio |  -10 -10 |

During the acute phase of crisis, the ROI ratio may decrease. |

| Increase / decrease in average values of assets turnover ratio, times |  -10 -10 |

In time of crisis, the business activity is declining and during the recovery - is slowly growing. |

| Share of small and medium-sized businesses by revenue more than 20% |  10 10 |

|

| Regional concentration |  -10 -10 |

|

| Financial position (the largest share) |  5 5 |

|

| Solvency index Globas (the largest share) |  10 10 |

|

| Average value of factors |  0,6 0,6 |

favorable trend (factor),

favorable trend (factor),  unfavorable trend (factor).

unfavorable trend (factor).

Solvency ratio of public catering companies

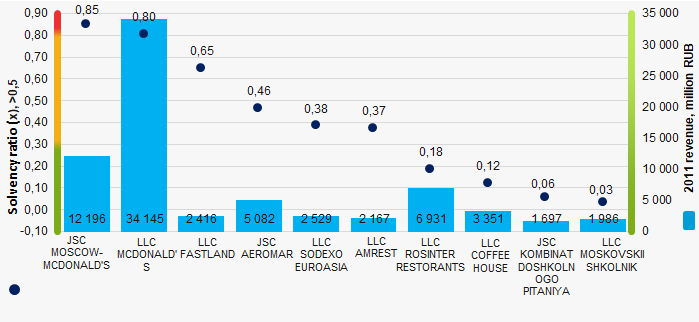

Information agency Credinform has prepared a ranking of the largest Russian public catering companies. The largest enterprises (TOP-10) in terms of annual revenue were selected according to the data from the Statistical Register for the available periods (2006-2011). Then the companies were ranged by solvency ratio (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Solvency ratio (х) is calculated as a ratio of equity capital to total balance. The ratio shows the company’s dependence from external borrowings. The recommended value of the ratio is >0,5.

The ratio value less than minimum limit signifies about strong dependence from external sources of funds; such dependence may lead to liquidity crisis, unstable financial position in case of deterioration in market conditions.

For the most full and fair opinion about the company’s financial position the whole set of financial indicators and ratios should be taken into account.

| Name, INN, region, trademark | Revenue, million RUB | Net profit (loss), million RUB | Solvency ratio (x), >0,5 | Solvency index Globas 2020 | |||

| 2009 | 2011 | 2009 | 2011 | 2009 | 2011 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| JSC MOSCOW-MCDONALD'S INN 7710044132 Moscow (MCDONALDS, HAPPY MEAL, BIG MAC, Quarter Pounder, Filet-O-Fish, MCHAPPY PLACE, ROYAL CHEESEBURGER, MCCAFE, Big Tasty) |

12 190,5 12 190,5 |

12 196,2 12 196,2 |

890,0 890,0 |

941,5 941,5 |

0,86 0,86 |

0,85 0,85 |

155 Superior |

| LLC MCDONALD'S INN 7710044140 Moscow |

21 049,4 21 049,4 |

34 145,0 34 145,0 |

1 983,3 1 983,3 |

3 679,9 3 679,9 |

0,85 0,85 |

0,80 0,80 |

176 High |

| LLC FASTLAND INN 7703234453 Moscow (MU-MU) |

1 503,4 1 503,4 |

2 415,6 2 415,6 |

76,0 76,0 |

160,6 160,6 |

0,31 0,31 |

0,65 0,65 |

239 Strong |

| JSC AEROMAR INN 7712045131 Moscow region (SKYSERVICE, AEROMAR) |

2 801,8 2 801,8 |

5 082,4 5 082,4 |

307,9 307,9 |

421,3 421,3 |

0,22 0,22 |

0,46 0,46 |

164 Superior |

| LLC SODEXO EUROASIA INN 7722267655 Moscow |

1 777,1 1 777,1 |

2 529,2 2 529,2 |

102,0 102,0 |

64,2 64,2 |

0,63 0,63 |

0,38 0,38 |

285 Medium |

| LLC AMREST INN 7825335145 St. Petersburg (Pizza Hut, KFC) |

1 651,1 1 651,1 |

2 167,5 2 167,5 |

-26,7 -26,7 |

48,8 48,8 |

0,37 0,37 |

0,37 0,37 |

238 Strong |

| LLC ROSINTER RESTORANTS INN 7737115648 Moscow (SHIKARI, COSTACOFFEE, ROSINTER RESTORANTS HONORED GUEST, PLANETA SUSHI, PATIO, PLANETA VOSTOK) |

5 152,4 5 152,4 |

6 931,1 6 931,1 |

101,4 101,4 |

-355,8 -355,8 |

0,20 0,20 |

0,18 0,18 |

208 Strong |

| LLC COFFEE HOUSE INN 7704207300 Moscow |

2 501,1 2 501,1 |

3 351,0 3 351,0 |

-124,9 -124,9 |

-45,5 -45,5 |

-0,32 -0,32 |

0,12 0,12 |

302 Adequate |

| JSC KOMBINAT DOSHKOLNOGO PITANIYA INN 7726221073 Moscow |

1 005,4 1 005,4 |

1 697,0 1 697,0 |

6,8 6,8 |

1,2 1,2 |

0,24 0,24 |

0,06 0,06 |

170 Superior |

| LLC MOSKOVSKII SHKOLNIK INN 7713213445 Moscow |

928,4 928,4 |

1 986,0 1 986,0 |

2,1 2,1 |

1,3 1,3 |

0,08 0,08 |

0,03 0,03 |

221 Strong |

| Average value for TOP-10 companies |  5 056,1 5 056,1 |

7 250,1 7 250,1 |

331,8 331,8 |

491,7 491,7 |

0,34 0,34 |

0,39 0,39 |

|

| Average industry value |  101,2 101,2 |

131,2 131,2 |

4,9 4,9 |

6,1 6,1 |

0,49 0,49 |

0,45 0,45 |

|

growth of indicator in comparison with prior period,

growth of indicator in comparison with prior period,  decline of indicator in comparison with prior period

decline of indicator in comparison with prior period

The average value of solvency ratio of TOP-10 companies is lower than ТОP-1000 value. Three companies have the ratio higher than the recommended value and four companies improved the results in 2011 in comparison with 2009.

Picture 1. Solvency ratio and revenue of the largest Russian public catering companies (ТОP-10)

Picture 1. Solvency ratio and revenue of the largest Russian public catering companies (ТОP-10)Within 5 years, the average values of solvency ratio of TOP-1000 are below the recommended value with a slight upward trend (Picture 2).

Picture 2. Change in average values of solvency ratio of TOP-1000 Russian public catering companies in 2006 – 2011

Picture 2. Change in average values of solvency ratio of TOP-1000 Russian public catering companies in 2006 – 2011