Amendments to legislation in 2019

VAT increase, abolition of movable property tax, new procedure of financial statements filing and 7 more changes in companies activity, 5 tax news and 3 draft laws.

COMPANIES ACTIVITY

1. Free of charge web registration of individual entrepreneur or LLC.

Since January 1, 2019, state registration of legal entities and individual entrepreneurs, liquidation of a legal entity out of bankruptcy proceedings, termination of an individual entrepreneur and all amendments to the statutory documents will be free of duties when filing to the FTS online.

Ground: Federal Law as on 29.07.2018 N 234-FL.

2. Procedure of reporting will become easier.

Beginning from the financial accounts for 2019, all companies will be obliged to file accounts only in electronic form. Small business entities have to file electronic reports since 2020. Along with these, there will be no obligations to file financial accounts to the state statistics authorities. According to the amendments, the State information resource of accounting (financial) statements will be organized in Russia. The Federal Tax Service is authorized to maintain the resource.

Those are not obliged to file accounts to this resource: public sector organizations; the Central bank of Russia; religious organizations; credit and non-credit institutions filing accounting statements to the Central Bank of Russia; organizations that accounting statements are concerned as state secret; ther organizations – according to the decision of the Government of the RF.

Ground: Federal Law as on 28.11.2018 N 444-FL.

3. The State will insure bank deposits and accounts of small business.

Since January 1, 2019, the deposit insurance system will be implemented to micro and small business entities. If the Central Bank revokes or cancels the bank’s license, the company will have zero-loss recovery of funds up to 1,4 million RUB. Previously, this service was available only for natural persons.

To minimize the risks, it is recommended to open accounts and deposits in publicly owned banks largest by assets (Top-10), as they have almost zero probability of license revocation.

Ground: Federal law as on 03.08.2018 N 322-FL.

4. Mass adoption of online cash registers.

Since July 1, 2019, online cash registers will be mandatory for the entire Russian business when settling with counterparties and returning loans. Entrepreneurs using patent system of taxation and single tax on imputed income, as well as those hiring no employees, may conduct the activity without online cash registers until July 1.

Ground: Federal Law as on 03.07.2016 N 290-FL, Letter of the Ministry of Finance of Russia as on 18.07.2018 N 03-01-15/50059.

5. Employers who have not conducted a special assessment of working conditions will be required to pay a fine.

From January 1, 2019, all companies and individual entrepreneurs are obliged to conduct a special assessment of working conditions of employees (excluding out- and remote workers). Previously, in some cases the special assessment was not mandatory. If violation of the legislation occurs, there will be a fine from 60 to 80 thousand RUB for the company, and from 5 to 10 thousand RUB for director or individual entrepreneur (Part 2 of Art. 5.27.1 of the Code on Administrative Offenses).

Ground: Federal Law as on 28.12.2013 N 426-FL.

6. The procedure of obtaining the documents by the FTS officers during inspections will become easier.

Tax officers have rights to require reporting from auditing companies after inspection of their clients since January 1, 2019. Auditing documents prior to this date are not disclosed. This requirement was introduced by the Article 93.2 of the Tax Code of Russia and could be implemented if the company did not provide the requested documents or there was a request from competent authorities of foreign states.

Ground: Art. 93.2 of the Tax Code (introduced by the Federal Law as on 29.07.2018 N 231-FL).

7. Regulatory authorities will inspect small business

From January 1, 2019, supervising vacations for scheduled inspections of small business entities will be cancelled. The moratorium was in effect from January 1, 2016.

Ground: Art. 26.1 of the Federal Law as on 26.12.2008 N 294-FL.

8. Employees will have compensatory time off for periodic health examination.

Triennially, the employers are obliged to grant compensatory time off for periodic health examination upon the request of an employee. The employer cannot reject the request, but days of absence have to be agreed.

Ground: Federal Law as on 03.10.2018 N 353-FL.

TAXATION

1. Standard VAT rate will increase to 20%.

Since January 1, 2019, VAT rate will be increased from 18% to 20%. Preferential rates of 0 and 10% will be kept.

Ground: Federal Law as on 03.08.2018 N 303-FL.

2. Companies will not pay movable property tax.

From January 1, 2019, movable property tax will be cancelled for organizations. They will be obliged to pay only immovable property tax. To reduce the tax base, these assets have to be excluded from the reporting.

Movable property is determined in Art. 130 of the Civil Code of the Russian Federation: movable property is any items, including money and securities, not classified as real estate.

Ground: Federal Law as on 03.08.2018 N 302-FL.

3. Russian companies and individual entrepreneurs will not pay “Google tax”.

Since January 1, 2019, foreign providers of digimatic services in Russia will be obliged to pay VAT. Russian service buyers will be granted a remission of this obligation.

Ground: Federal Law as on 27.11.2017 N 335-FL.

4. Level of income for the simplified tax system (STS) is freezed, and agricultural producers paying unified agricultural tax (UAT) will have to pay VAT.

Annual income limit for the simplified tax system is freezed until 2020. Usually the limit increases due to annual increase of the deflator ratio for which income is indexed. As in 2018, according to the end of the financial (tax) period the income in 2019 should not exceed 150 million RUB to be applied for STS.

Ground: Order of the Ministry of Economic Development as on 30.10.2018 N 595.

From January 1, 2019, entrepreneurs using UAT will be obliged to pay VAT.

Ground: Federal Law as on 27.11.2017 N 335-FL.

5. Reduced insurance payments will not be prolonged for small and medium sized business.

From January 1, 2019, reduced insurance payments will be cancelled for companies using simplified tax system, single tax on imputed income and patent system of taxation. According to the general tariff, the insurance payment for them will be 30% instead of 20%. Only charity and non-profit organizations, applying STS, will keep tariff of 20%.

Ground: Federal Law as on 03.08.2018 N 303-ФЗ, Letter of the Ministry of Finance of Russia as on 01.08.2018 N 03-15-06/54260.

6. While calculating salaries and benefits the new minimum wage should be considered.

Since January 1, 2019, the federal minimum wage will be defined according to the minimum subsistence level of working population throughout Russia for the 2nd quarter of the previous year. The minimum wage for 2019 is 11 280 RUB, which has to be taken into account when calculating the minimum wage, sickness and children's benefits.

Ground: Federal Law as on 28.12.2017 N 421-FL; Order of the Ministry of Labor of Russia as on 24.08.2018 N 550н.

DRAFT LAWS

1. Registration and reporting.

Until January 1, 2020, it is planned to adopt the federal law, which will enable small businesses to apply the legal address issued at the opening of a bank account or provided in the post office. Thus, the state aims to release the company from the formal obligation to have a physical office. On the other hand, if the law is adopted, new type of shell companies may emerge.

In January 2020, an initiative is expected to be implemented that will legitimize the possibility of non- providing of tax return to STS applying organizations and individual entrepreneurs with the income as the object of taxation. Tax officers will receive all necessary reports through online cash registers on their own.

2. Preferential rent of property.

By December 1, 2021, it is planned to adopt a law obliging to transfer unused state property to lease to small and medium-sized businesses on preferential terms. The list of such property will be compiled and updated annually based on the results of inventories.

3. Participation in procurement.

It is planned that in 2020 the amendments to the legislation on procurement will be adopted in order to bring the share of small business as suppliers of state and municipal customers up to 18% of all their purchases for the year. Now the required bar is slightly lower - 15%. Huge money is being circulated in the Federal Contracting System: for the incomplete 2018, notices under the 44-FL at the amount of 7,6 trillion RUB and at the amount of 20 trillion RUB under the 223-FL were placed. Participation in procurement is a significant additional source of funding.

By May 2020, it is expected to make amendments to the Administrative Code of the Russian Federation, which will introduce fines for delaying payment by the customer of goods and services to supplier. Currently, there is no such obligation and customers, taking advantage of gaps in the legislation, often postpone payments under the guise of various circumstances.

There will be many significant changes in 2019. We will continue to inform about entering into force of new laws, and analyze of consequences of their enforcement. Whether cancelation of benefit will cause a decline in operating efficiency? Will the intention to replenish the budget be satisfied due to tax increase? Let’s hope, there will be more useful improvements for business, such as cancellation of company registration fees, simplified reporting procedure, insurance of deposits of legal entities that will have positive effect on the economic growth.

Trends in water transport industry

Information agency Credinform has observed trends in the activity of the largest Russian water transport companies.

Sea and river transport companies with the largest volume of annual revenue (TOP-10 and TOP-1000), were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2015-2017). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net assets is an indicator, reflecting the real value of company's property, is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

| № | Name, INN, region, type of activity | Net assets value, bln RUB | Solvency index Globas | ||

| 2015 | 2016 | 2017 | |||

| 1 | 2 | 3 | 4 | 5 | 6 |

| 1 | FAR-EASTERN SHIPPING COMPANY PLC INN 2540047110 Moscow Sea cargo transport activities |

30,71 |  26,50 26,50 |

17,88 17,88 |

309 Adequate |

| 2 | LLC OBORONLOGISTICS INN 7718857267 Moscow Sea cargo transport activities |

1,19 |  1,26 1,26 |

8,39 8,39 |

249 Strong |

| 3 | JSC VOLGA-SHIPPING INN 5260902190 Nizhniy Novgorod region Activities of inland water cargo transport |

5,96 |  7,23 7,23 |

7,55 7,55 |

153 Superior |

| 4 | JSC NORTH-WESTERN SHIPPING COMPANY INN 7812023195 Saint-Petersburg Sea cargo transport activities |

4,84 |  5,23 5,23 |

5,97 5,97 |

164 Superior |

| 5 | LLC NUTEP INN 2315024369 Krasnodar territory Sea cargo transport activities |

1,43 |  3,60 3,60 |

4,81 4,81 |

173 Superior |

| 996 | LLC NAKHODKA-PORTBUNKER INN 2508060331 Maritime territory Sea cargo transport activities Bankruptcy proceedings |

-0,13 |  -1,03 -1,03 |

-1,24 -1,24 |

550 Insufficient |

| 997 | LLC AQUAMARIN INN 7702655931 Moscow Activities of inland water passenger transport |

-1,78 |  -1,87 -1,87 |

-2,13 -2,13 |

348 Adequate |

| 998 | LLC PALMALI INN 6164087026 Rostov region Sea cargo transport activities In the process of liquidation since 21.11.2018 |

-3,04 |  -2,85 -2,85 |

-4,72 -4,72 |

600 Insufficient |

| 999 | LLC Magadan-Tranzit DV INN 4909910131 Magadan region Activities of sea passenger transport Bankruptcy proceedingsм |

0,02 |  0,03 0,03 |

-5,42 -5,42 |

600 Insufficient |

| 1000 | JSC 'VOLZHSKI OIL SHIPPING COMPANY ''VOLGOTANKER'' INN 6317019185 Samara region Sea cargo transport activities In the process of liquidation since 17.03.2008 |

4,29 |  -7,80 -7,80 |

-7,82 -7,82 |

600 Insufficient |

— growth of the indicator to the previous period,

— growth of the indicator to the previous period,  — decline of the indicator to the previous period .

— decline of the indicator to the previous period .

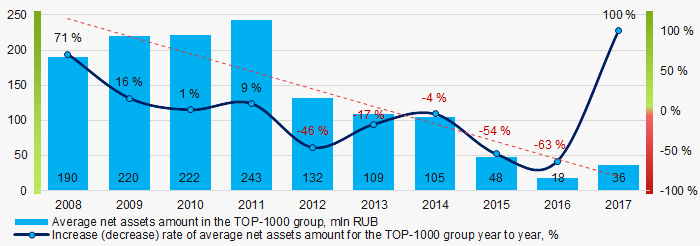

For ten years average amounts of net assets of TOP-1000 companies have decreasing tendency (Picture 1).

Picture 1. Change in TOP-1000 average indicators of the net assets amount of water transport companies in 2008 – 2017

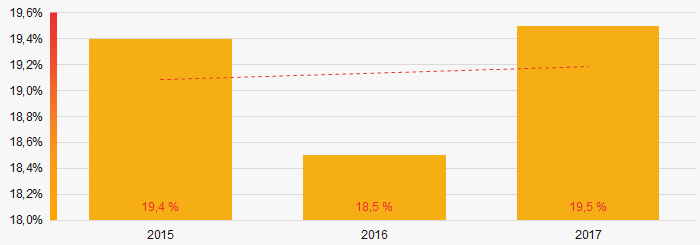

Picture 1. Change in TOP-1000 average indicators of the net assets amount of water transport companies in 2008 – 2017 Share of companies with insufficiency of property among TOP-1000 for the last three years tends to increase (Picture 2).

Picture 2. Share of companies with negative value of net assets amount in TOP-1000 in 2015 – 2017

Picture 2. Share of companies with negative value of net assets amount in TOP-1000 in 2015 – 2017 Sales revenue

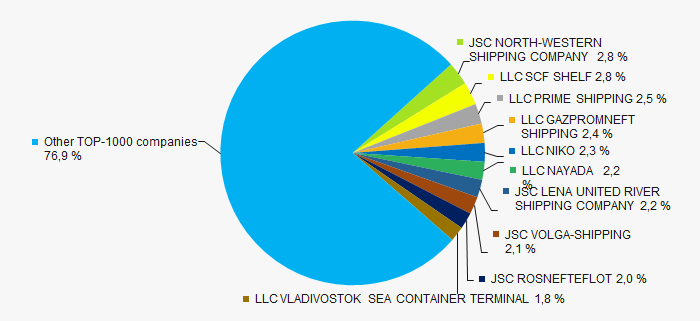

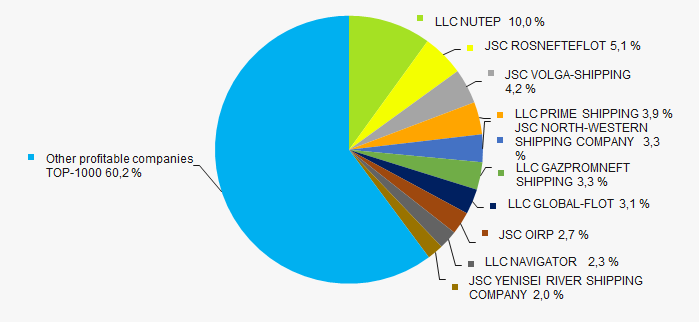

The revenue of 10 leaders of the industry made 23% of the total revenue of TOP-1000 companies in 2017. It demonstrates high level of competition in the industry (Picture 3).

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 companies for 2017

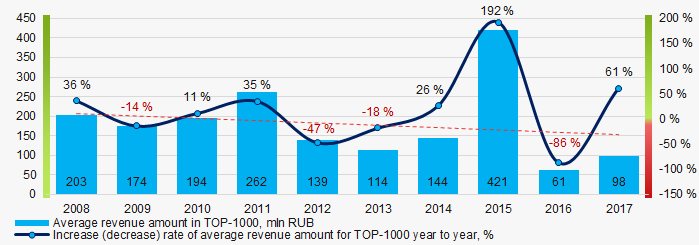

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 companies for 2017 Picture 4. Change in the average revenue of TOP-1000 water transport companies in 2008 – 2017

Picture 4. Change in the average revenue of TOP-1000 water transport companies in 2008 – 2017Profit and losses

The profit volume of 10 leading enterprises in 2017 made 40% of the total profit of TOP-1000 companies (Picture 5).

Picture 5. Share of participation of TOP-10 companies in the total volume of profit of TOP-1000 companies for 2017

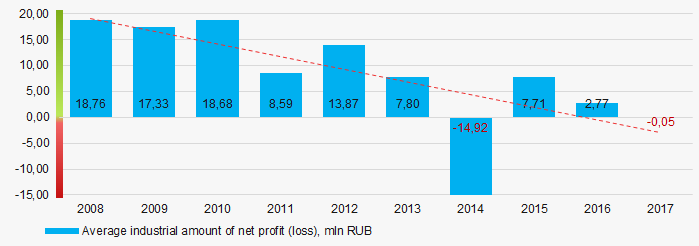

Picture 5. Share of participation of TOP-10 companies in the total volume of profit of TOP-1000 companies for 2017Over a ten-year period, the average values of profit indicators of TOP-1000 companies tend to decrease (Picture 6).

Picture 6. Change in the average indicators of net profit of TOP-1000 water transport companies in 2008 – 2017

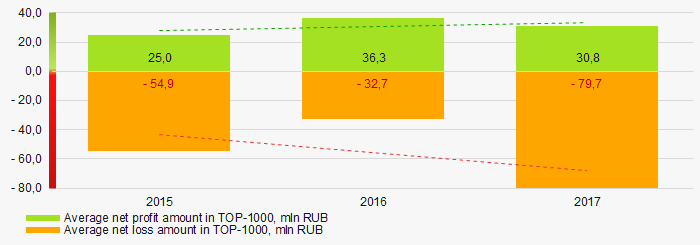

Picture 6. Change in the average indicators of net profit of TOP-1000 water transport companies in 2008 – 2017 Over the three-year period average values of net profit indicators of TOP-1000 companies have increasing tendency, besides, average amount of net loss is increasing. (Picture 6).

Picture 7. Change in the average indicators of profit and loss of TOP-1000 companies in 2015 – 2017

Picture 7. Change in the average indicators of profit and loss of TOP-1000 companies in 2015 – 2017 Key financial ratios

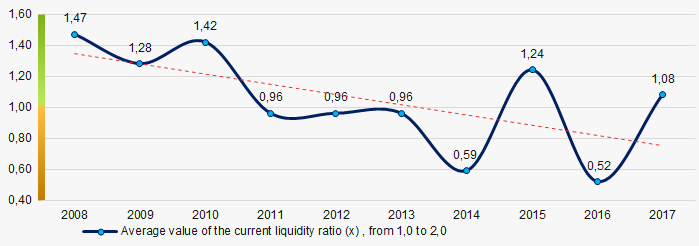

Over the ten-year period the average indicators of the current liquidity ratio were above the range of recommended values – from 1,0 up to 2,0 with decreasing tendency (Picture 8).

The current liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 8. Change in the industry values of the current liquidity ratio of TOP-1000 companies in 2008 – 2017

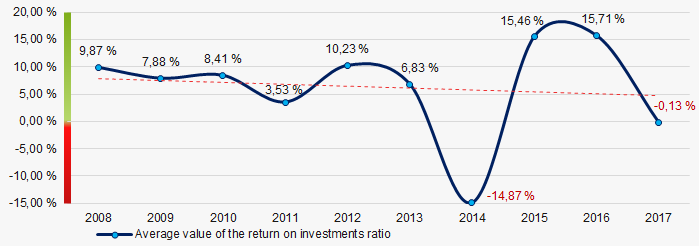

Picture 8. Change in the industry values of the current liquidity ratio of TOP-1000 companies in 2008 – 2017 The indicators of the return on investments ratio were at the relatively low level with decreasing tendency for ten years. (Picture 9).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity of own capital and the long-term borrowed funds of an organization.

Picture 9. Change in the average values of the return on investments ratio of TOP-1000 water transport companies in 2008 – 2017

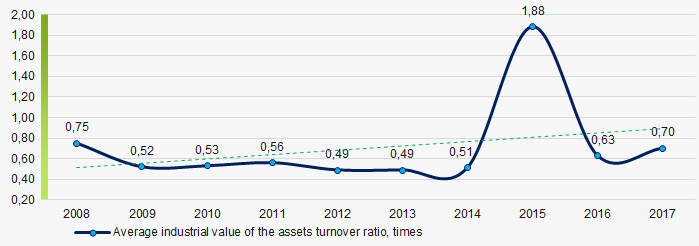

Picture 9. Change in the average values of the return on investments ratio of TOP-1000 water transport companies in 2008 – 2017Asset turnover ratio is calculated as the relation of sales revenue to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

This business activity ratio showed a tendency to increase for ten-year period (Picture 10).

Picture 10. Change in the average values of the asset turnover ratio of TOP-1000 companies in 2008 – 2017

Picture 10. Change in the average values of the asset turnover ratio of TOP-1000 companies in 2008 – 2017 Service structure

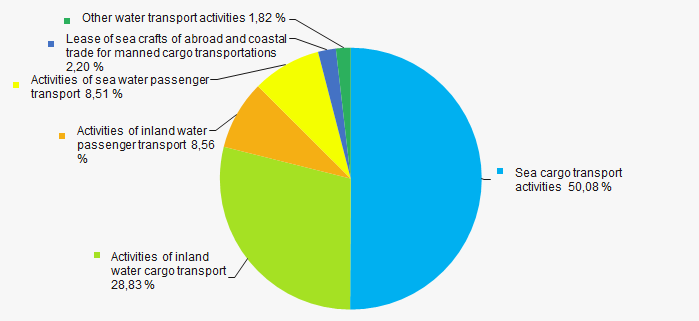

The largest share in the total revenue of TOP-1000 is owned by companies, specializing in sea cargo transportations (Picture 11).

Picture 11. Distribution of companies by types of output in the total revenue of TOP-1000

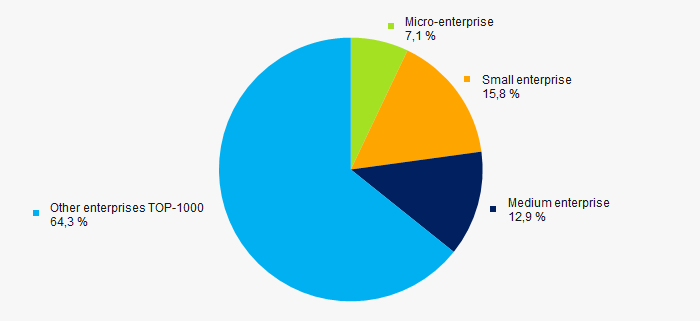

Picture 11. Distribution of companies by types of output in the total revenue of TOP-100083% of TOP-1000 companies are registered in the Register of small and medium enterprises of the Federal Tax Service of the RF. Besides, share of the companies in the total revenue of TOP-1000 amounts to 36% in 2017 (Picture 12).p>

Picture 12. Shares of small and medium enterprises in TOP-1000 companies, %

Picture 12. Shares of small and medium enterprises in TOP-1000 companies, %Main regions of activities

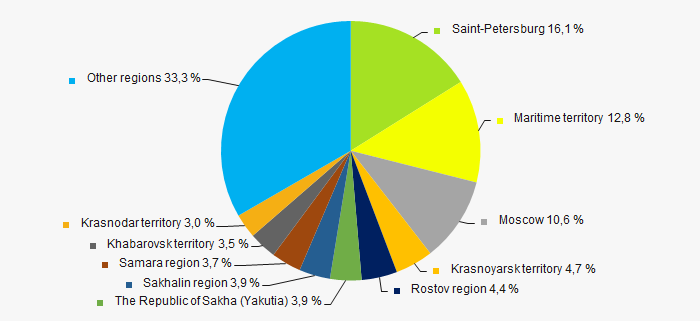

TOP-1000 companies are quite equally distributed on the territory of Russia, taking into account type of activity and geographic position and registered in 62 regions. The largest companies in terms of revenue volume are concentrated in Saint-Petersburg and Maritime territory (Picture 13).

Picture 13. Distribution of revenue of TOP-1000 companies by regions of Russia

Picture 13. Distribution of revenue of TOP-1000 companies by regions of Russia Financial position score

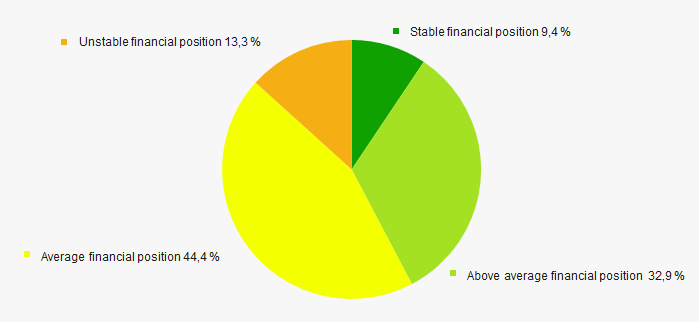

An assessment of the financial position of TOP-1000 companies shows that major part of companies is in an average financial position (Picture 14).

Picture 14. Distribution of TOP-1000 companies by financial position score

Picture 14. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

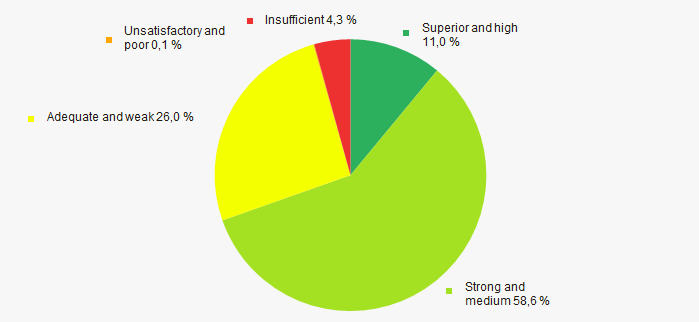

Most of TOP-1000 companies have got from Adequate to Superior Solvency index Globas, that points to their ability to repay their debts in time and fully (Picture 15).

Picture 15. Distribution of TOP-1000 companies by solvency index Globas

Picture 15. Distribution of TOP-1000 companies by solvency index GlobasConclusion

Comprehensive assessment of the activity of largest water transport companies, taking into account the main indexes, financial indicators and ratios, demonstrates the presence of some unfavorable trends (Table 2).

| Trends and assessment factors | Share of factor, % |

| Rate of increase (decrease) of average amount of net assets |  -10 -10 |

| Increase / decrease of share of companies with negative values of net assets |  -10 -10 |

| Increase (decrease) rate of average revenue amount |  -10 -10 |

| Rate of competition / monopolization |  10 10 |

| Increase (decrease) rate of average net profit (loss) amount |  -10 -10 |

| Increase / decrease of average net profit amount of TOP-1000 companies |  10 10 |

| Increase / decrease of average net loss amount of TOP-1000 companies |  -10 -10 |

| Increase / decrease of average industrial values of the current liquidity ratio |  -10 -10 |

| Increase / decrease of average industrial values of the return on investments ratio |  -10 -10 |

| Increase / decrease of average industrial values of the assets turnover ratio |  10 10 |

| Share of small and medium enterprises in the industry in terms of revenue volume more than 30% |  10 10 |

| Regional concentration |  10 10 |

| Financial position (major share) |  5 5 |

| Solvency index Globas (major share) |  10 10 |

| Average value of factors |  -0,4 -0,4 |

— positive trend (factor) ,

— positive trend (factor) ,  — negative trend (factor).

— negative trend (factor).