Companies using transfer pricing are threatened with tax inspections

After last year’s enactment of the legislation, focused on the regulation of transfer pricing in matters of tax base assessment (Section V-1 of the Tax Code of the Russian Federation), fiscal bodies tackled seriously the inspection of organizations, which use such scheme of tax payment.

Federal Tax Service (FTS) has begun to inspect about 300 enterprises as far back as since the end of 2013. This year the work will be continued. Such statement was made by the Head of the FTS Mikhail Mishustin.

As a reminder, a transfer price is the price, at which goods (or services) are sold between different divisions of a company or between companies in the same group. Transfer prices allow redistributing of total income of the group of persons in behalf of persons located in states with lower taxes. This is the most simple and widespread scheme of the minimization of tax payment via the decrease of tax base.

Major taxpayers have an opportunity to coordinate in advance the principles of the price formation of such transactions with taxmen, by signing of an agreement with the FTS, in which there are positions of parties specified concerning the procedure for determination and usage of methods of the price formation on concrete transactions between related parties. By that the reasonableness of a contract market price, on which basis the tax liabilities are estimated, is not needed to be checked by fiscal bodies. Therefore, the administration of major taxpayers is simplified and possible expenses of enterprises in view of tax inspections are removed.

In other cases, companies are obliged to submit reports, confirming the market price of a transaction with affiliated companies, to tax authorities. For drawing up of the necessary report it can help a special module, contained in specialized software products Ruslana, Orbis, Amadeus of the European publisher of electronic databases Bureau van Dijk (BVD). Besides, the Agency Credinform is developing own transfer pricing module, the release is slated for 2014.

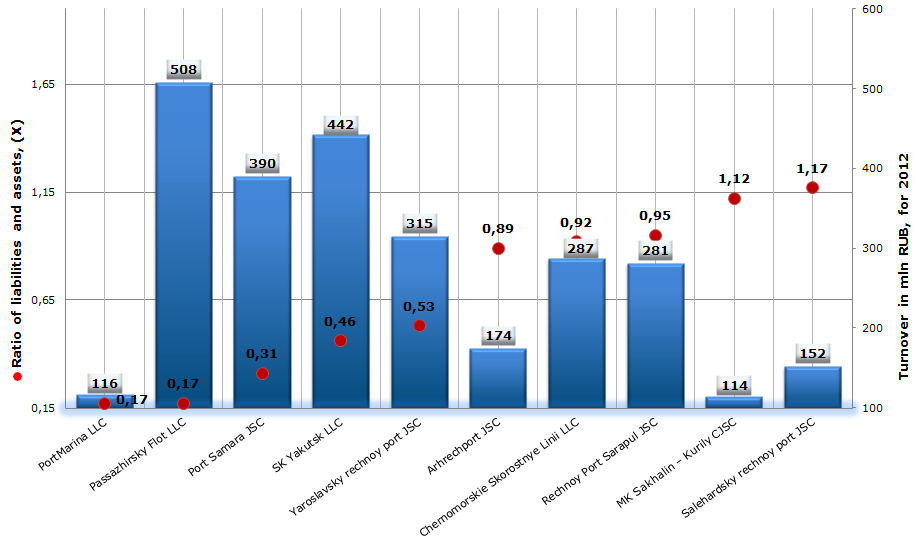

Ratio of liabilities and assets of enterprises offering passenger water transportation services

Information agency Credinform prepared a ranking of the ratio of liabilities and assets of Russian enterprises, offering passenger water transportation services. The companies with highest turnover in this branch were selected for this research according to data from the Statistical Register for the latest available period (for the year 2012). Then, the first 10 enterprises selected by turnover were ranked by increase in value of the ratio of liabilities and assets, and if the value is identical then by increase of solvency index GLOBAS-i®.

The ratio of liabilities and assets presents what share of assets of an enterprise is funded with loans and is calculated as the ratio of total borrowing to total balance. This ratio refers to a group of indexes of financial stability. By the financial stability of an enterprise it is meant such financial standing which guarantees its constant solvency and which is one of key factors of company’s survival and the fundamental base of its stability. There is the recommended value of the mentioned ratio in the economic practice which ranges from 0,2 to 0,5.

| № | Name, INN | Region | Turnover for 2012, mln RUB | Ratio of liabilities and assets (%) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | PortMarina LLC INN 2540155242 |

Primorski Krai | 116 | 0,17 | 255 (high) |

| 2 | Passazhirsky Flot LLC INN 4723003201 |

Leningrad region | 508 | 0,17 | 259 (high) |

| 3 | Samarsky rechnoy port JSC INN 6317023569 |

Samara region | 390 | 0,31 | 222 (high) |

| 4 | Sudohodnaya kompaniya Yakutsk LLC INN 1435130134 |

The Republic of Sakha Yakutia | 442 | 0,46 | 229 (high) |

| 5 | Yaroslavsky rechnoy port JSC INN 7607001209 |

Yaroslavl region | 315 | 0,53 | 270 (high) |

| 6 | Arhangelsky rechnoy port JSC INN 2901011040 |

Arhangelsk region | 174 | 0,89 | 279 (high) |

| 7 | Chernomorskie Skorostnye Linii LLC INN 2304047188 |

Krasnodar Terrotiry | 287 | 0,92 | 276 (high) |

| 8 | Rechnoy Port Sarapul JSC INN 1827018020 |

The Udmurtian Republic | 281 | 0,95 | 291 (high) |

| 9 | Morskaya Kompaniya Sakhalin – Kurily CJSC INN 6509007063 |

Sakhalin region | 114 | 1,12 | 238 (high) |

| 10 | Salehardsky rechnoy port JSC INN 8901001660 |

The Yamalo-Nenets Autonomous District | 152 | 1,17 | 305 (satisfactory) |

The first and the second places of the ranking belong to PortMarina LLC and Passazhirsky Flot LLC. The companies have the same ratio of liabilities and assets – (0,17), that practically satisfies recommended values. It means that enterprises use effectively enough own and borrowed funds. Both companies got high solvency index GLOBAS-i®.

Ratio of liabilities and assets of enterprises offering passenger water transportation services, TOP-10

The value of the ratio of two companies in the ranking list, ОАО Samarsky rechnoy port JSC and Sudohodnaya kompaniya Yakutsk LLC, is within the recommended values, what indicates that enterprises approach effectively their budgeting. Both companies got high solvency index GLOBAS-i®, that characterizes them as financially stable.

The ratios of liabilities and assets of Arhangelsky rechnoy port JSC, ООО Chernomorskie Skorostnye Linii LLC and Rechnoy Port Sarapul JSC are essentially higher than recommended values, but not above 1. Such ratio points at coming trend to equalization of the amounts of loans, credits and accounts payable to all assets of enterprises. Herewith companies got high solvency index GLOBAS-i®, that testifies of company’s ability to repay its financial liabilities in time and fully.

The value of the ratio of liabilities and assets of companies Morskaya Kompaniya Sakhalin – Kurily CJSC and Salehardsky rechnoy port JSC is more than 1. It means that enterprises misappropriate borrowed funds. Their management should follow closely the ratio of assets and all their loans and credits, because the substantial surplus of liabilities can dent the financial stability of the enterprise. However, Morskaya Kompaniya Sakhalin – Kurily CJSC got high solvency index GLOBAS-i®, that characterizes it as financially stable and confirms once again the rule, that it should be considered financial and non-financial factors for objective assessment of a company.