Own funds flexibility ratio of pharmaceutical companies

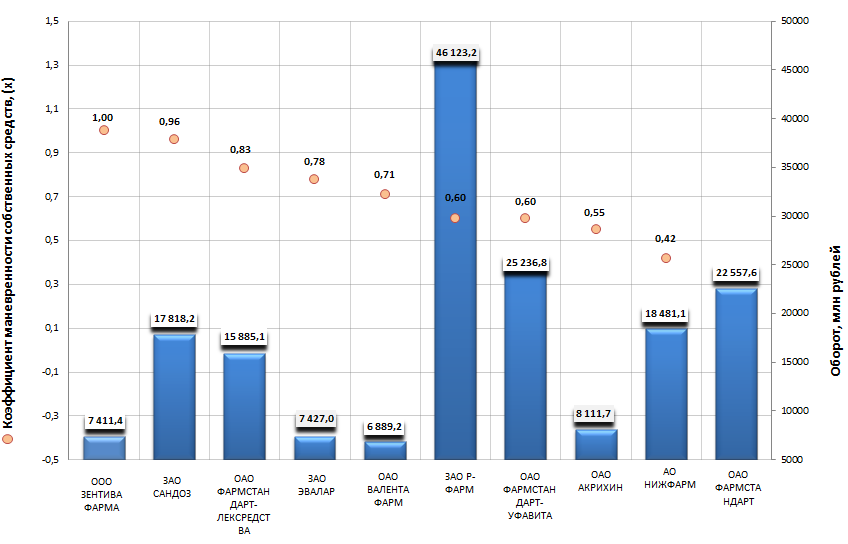

Information Agency Credinform has prepared the ranking of pharmaceutical companies by own funds flexibility ratio. The largest enterprises engaged in this activity in terms of turnover were selected according to the data from the Statistical Register for the latest available period (for the year 2013). Then, the first ten companies by turnover were ranged by decrease in own funds flexibility ratio.

Own funds flexibility ratio (х) shows the ability of the company to support the level of own working capital and to replenish current assets from its own sources in case of need. It is calculated as a ratio of current assets to total equity. The recommended value is from 0,2 to 0,5.

The decrease of the indicator shows possible delay in collection of receivables or toughening of terms of trade credit granting by suppliers and contractors. The increase shows the growing ability to repay the current liabilities.

| № | Name, INN | Region | Turnover 2013, mln. RUB. | Own funds flexibility ratio, (х) | Solvency index Globas-i® |

|---|---|---|---|---|---|

| 1 | LLC ZENTIVA PHARMA INN 7704510025 |

Moscow | 7411 | 1 | 212 (high) |

| 2 | CJSC SANDOZ INN 7717011640 |

Moscow | 17 818 | 0,96 | 277 (high) |

| 3 | JSC PHS-LEKSREDSTVA INN 4631002737 |

Kursk Region | 15 885 | 0,83 | 159 (the highest) |

| 4 | CJSC Evalar INN 2227000087 |

Altai Region | 7427 | 0,78 | 159 (the highest) |

| 5 | JSC Valenta Pharm INN 5050008117 |

Moscow Region | 6889 | 0,71 | 192 (the highest) |

| 6 | CJSC Company R-Pharm INN 7726311464 |

Moscow | 46 123 | 0,6 | 222 (high) |

| 7 | PJSC PHARMSTANDARD-UFIMSKIY VITAMIN PLANT INN 274036993 |

Republic Of Bashkortostan | 25 237 | 0,6 | 187 (the highest) |

| 8 | OJSC CHEMICO-PHARMACEUTICAL WORKS AKRIKHIN INN 5031013320 |

Moscow Region | 8112 | 0,55 | 168 (the highest) |

| 9 | OJSC Nizhpharm INN 5260900010 |

Nizhny Novgorod Region | 18 481 | 0,42 | 182 (the highest) |

| 10 | OJSC PHARMSTANDARD INN 274110679 |

Moscow Region | 22 558 | -0,46 | 220 (high) |

The first place of the ranking takes LLC ZENTIVA PHARMA with ratio value equal 1, that means the circulation of almost 100% of own working capital, it also shows the high efficiency of resources use. The company has the high solvency index Globas-i®, that shows the company’s stable financial condition.

Picture. Own funds flexibility ratio of the largest pharmaceutical companies in Russia, Top-10

The industry leader by turnover CJSC Company R-Pharm takes the sixth place of the ranking with ratio value 0,6, that corresponds to the generally accepted standards. The company also has the high solvency index Globas-i®.

OJSC PHARMSTANDARD is the only company with the negative ratio value, that means the capitalization of the most part of own working capital. This may lead to delay in collection of receivables. However according to total financial and non-financial indicators, the high solvency index Globas-i® was assigned to the company.

In general, all companies of TOP-10 showed rather high level of own funds flexibility ratio, that shows the ability of the vast majority of leaders of the Russian pharmaceutical market to provide flexibility in use of own funds.

Banks don't want to be equal with international ratings

Association of the North-West Banks asks the Ministry of Finance to change the requirements for banks, which participate in auction on placement of free budget funds on deposits, in part of international ratings for long-term solvency. Now banks with rating not lower than ВВ- by Fitch or S&P classification and not lower than Ва3 (Moody’s) are admitted to trading. Implementation of this requirement is rather problematic for most of Russian banks in view of agencies’ systematic decrease in ratings and forecasts both for Russia and banks - in most cases with solvency preservation.

At the same time, according to Association of the North-West Banks, the city budget funds can be placed almost only in banks with state participation. The Association suggests considering the ratings of national agencies, which are accredited by the Ministry of Finance («Expert RA», «National Rating Agency», «AK&M», «RusRating»), or using the method of the Central Bank by abandoning the absolute values of individual international ratings of a particular bank.

In most cases the rates are politically committed and caused by Russia's position in the Ukraine. American mortgage market situation in 2008 showed that the calculations of leading rating agencies are far from a real assessment of company’s financial condition, country's economic situation. In this regard, the position of Russian banks not to be equal with ratings of American agencies looks quite reasonably.