Provision of loans trends

Information agency Credinform presents a review of activity trends of the largest companies in the sphere of loans provision.

The largest companies (TOP-1000), engaged in consumer lending, international trade financing, providing cash loans, pawnshop services, etc, were selected for the analysis according to the data from the Statistical Register and the Federal Tax Service for the latest available accounting periods (2011 – 2020). The selection of companies and the analysis were based on the data from the Information and Analytical system Globas.

Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

The largest company in the industry in terms of net assets is NAO CENTRAL FUEL COMPANY, INN 7709221179, Moscow, provision of loans and other types of credit. In 2020, net assets amounted to over 28 billion RUB.

ARDIAY INVEST LLC had the smallest amount of net assets in the TOP 1000, INN 7751000769, Moscow region, provision of loans and other types of credit. Property insufficiency in 2020 was expressed by a negative value of -342 million RUB.

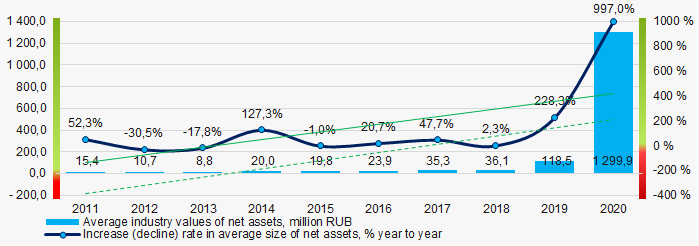

Covering the ten-year period, average net assets of the industry and their growth rates have an upward trend (Picture 1).

Picture 1. Change in average industry net assets ratios in 2011-2020

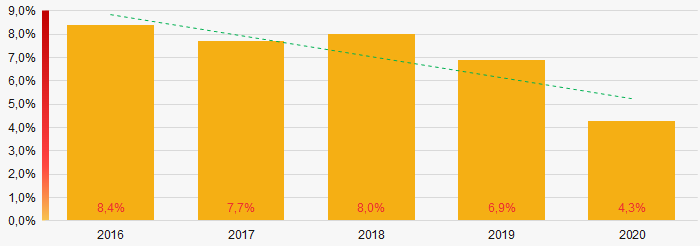

Picture 1. Change in average industry net assets ratios in 2011-2020Shares of companies with property insufficiency in the TOP 1000 had a positive downward trend over the past five years (Picture 2).

Picture 2. Shares of the TOP 1000 companies with negative net assets in 2016-2020

Picture 2. Shares of the TOP 1000 companies with negative net assets in 2016-2020Sales revenue

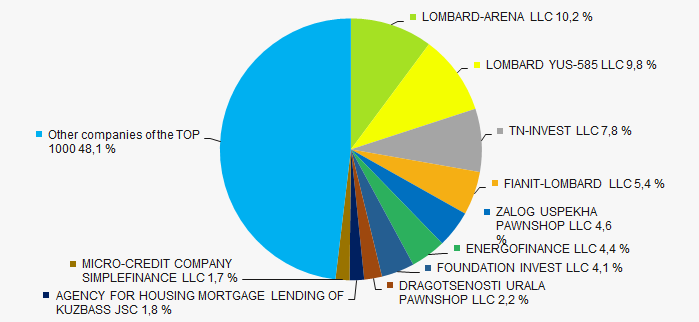

The revenue of the TOP 10 companies in 2020 amounted to almost 52% of the total revenue of the TOP 1000 companies. (Picture 3). This indicates a high level of monopolization in the industry.

Picture 3. Shares of the TOP 10 companies in the total revenue 2020 of TOP 1000

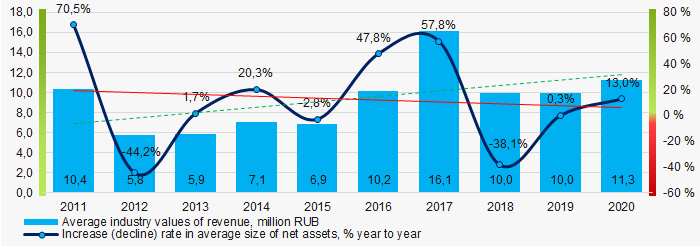

Picture 3. Shares of the TOP 10 companies in the total revenue 2020 of TOP 1000In general, there is a trend in revenue increasing and growth rates decreasing. (Picture 4).

Picture 4. Change in average industry revenue values in 2011-2020

Picture 4. Change in average industry revenue values in 2011-2020Profit and loss

The largest company in the TOP 1000 in terms of net profit in 2020 is AQUA-CAPITAL LLC, INN 7825123775, Saint Petersburg, provision of loans and other types of credit. The profit amounted to over 5 billion RUB.

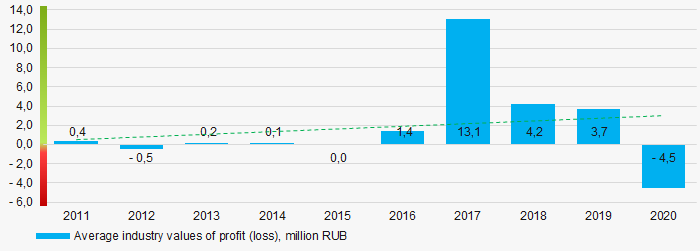

Covering the ten-year period, indicators of average industry profit margins tend to increase. (Pictures 5).

Picture 5. Change in average profit (loss) ratios of the TOP 1000 in 2011-2020

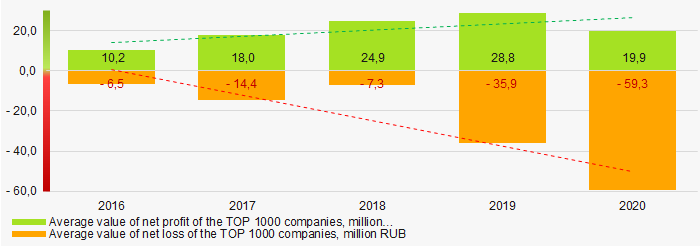

Picture 5. Change in average profit (loss) ratios of the TOP 1000 in 2011-2020Covering the five-year period, average values of net profit of the TOP 1000 companies are increasing, while average net loss is also growing (Picture 6).

Picture 6. Change in average values of net profit and net loss ratios of the TOP 1000 companies in 2016-2020

Picture 6. Change in average values of net profit and net loss ratios of the TOP 1000 companies in 2016-2020Key financial ratios

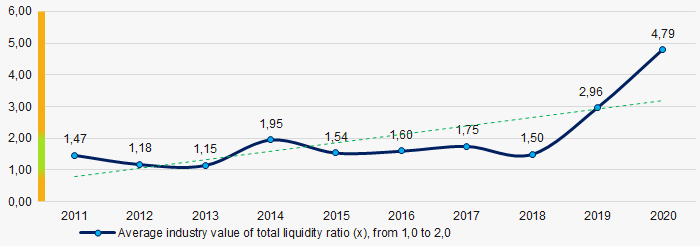

Covering the ten-year period, average industry indicators of the total liquidity ratio were mainly in the range of recommended values - from 1.0 to 2.0, with an upward trend. (Figure 7).

Total liquidity ratio (current assets to short-term liabilities) shows sufficiency of a company’s assets to settle short-term liabilities.

Picture 7. Change in average values of total liquidity ratio in 2011-2020

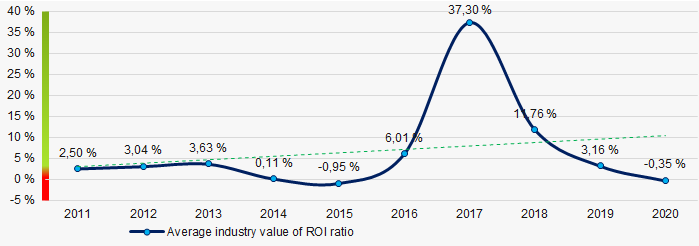

Picture 7. Change in average values of total liquidity ratio in 2011-2020For the ten years period, average values of return on investment ratio showed a tendency to increase (Picture 8).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in ROI average values in 2011-2020

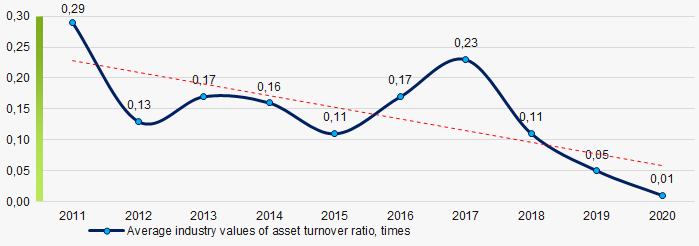

Picture 8. Change in ROI average values in 2011-2020Asset turnover ratio is calculated as ratio of sales revenue to average value of total assets for a period and implicates the efficiency of use of all available resources, regardless of the sources they were raised. The ratio shows how many times per year the full cycle of production and turnover is performed generating the corresponding effect in the form of profit.

Covering the ten years period, values of the said business activity ratio showed a trend to decrease (Picture 9).

Picture 9. Change in average values of asset turnover ratio in 2011-2020

Picture 9. Change in average values of asset turnover ratio in 2011-2020Small enterprises

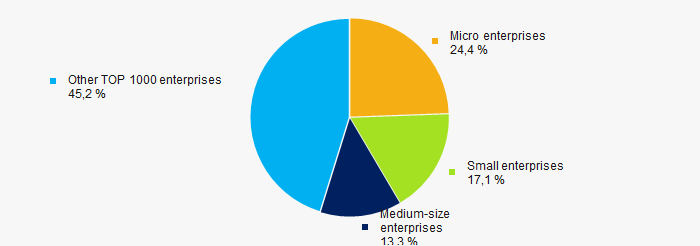

94% of the TOP 1000 companies are registered in the Unified Register of Small and Medium-sized Businesses of the Federal Tax Service of the Russian Federation. At the same time, the share of their revenue in the total volume of the TOP 1000 in 2020 is almost 55%, which is almost three times higher than the national average in 2018-2019. (Figure 10).

Picture 10. Revenue shares of small and medium-sized enterprises in the TOP-1000

Picture 10. Revenue shares of small and medium-sized enterprises in the TOP-1000Main regions of activity

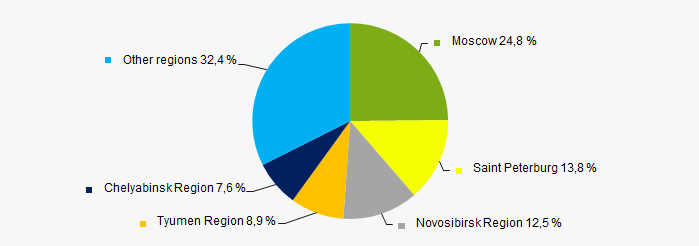

The TOP 1000 companies are registered in 78 regions (92% of the subjects of the Russian Federation) and are distributed unevenly across the country. More than 51% of the total revenue of the TOP 1000 companies in 2020 is concentrated in Moscow, St. Petersburg and the Novosibirsk region (Picture 11).

Picture 11. Distribution of the TOP 1000 companies' revenue by Russian regions

Picture 11. Distribution of the TOP 1000 companies' revenue by Russian regionsFinancial position score

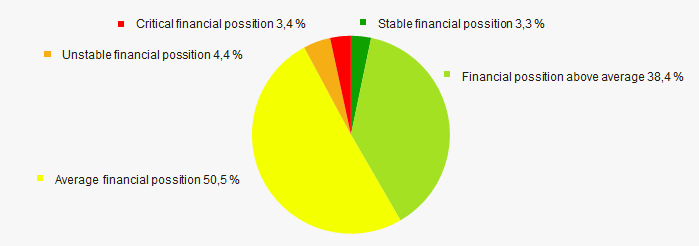

Financial position assessment of the TOP 1000 companies shows that the largest part of them is in average financial position. (Picture 12).

Picture 12. Distribution of the TOP 1000 companies by financial position score

Picture 12. Distribution of the TOP 1000 companies by financial position scoreGlobas Solvency Globas

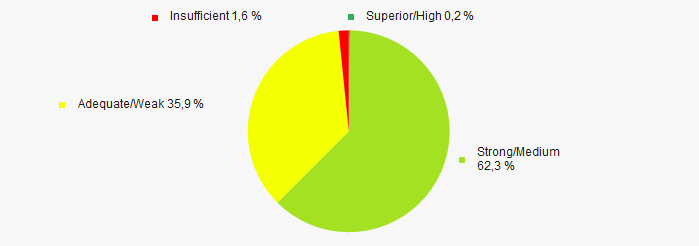

The largest part of the TOP-1000 companies has been assigned an Adequate/Weak GlobasSolvency Index. This indicates that they cannot fully meet their debt obligations (Picture 13).

Picture 13. Distribution of the TOP 1000 companies according to the Globas Solvency Index

Picture 13. Distribution of the TOP 1000 companies according to the Globas Solvency IndexConclusion

Comprehensive assessment of activities of the largest companies providing loans, that takes into account main indexes, financial indicators and ratios, indicates predominance of positive trends in their activities in the period from 2012 to 2020. (Table 1).

| Trends and evaluation factors | Share of factor, % |

| Dynamics of average net assets value |  5 5 |

| Increase (decline) rate in average size of net assets |  5 5 |

| Increase / decrease in share of enterprises with negative values of net assets |  10 10 |

| Level of monopolization / competition |  -10 -10 |

| Dynamics of average revenue value |  -10 -10 |

| Increase (decline) rate in the average size of revenue |  -10 -10 |

| Dynamics of average profit (loss) |  5 5 |

| Increase / decline in average values of net profit |  10 10 |

| Increase / decline in average values of net loss |  -10 -10 |

| Increase / decrease in average values of total liquidity ratio |  10 10 |

| Increase / decrease in average values of return on investment ratio |  10 10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses in terms of revenue exceeding 20% |  10 10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  5 5 |

| Globas Solvency Index (the largest share) |  10 10 |

| Average value of factors share |  1,3 1,3 |

positive trend (factor),

positive trend (factor),  negative trend (factor)

negative trend (factor)

Changes in legislation

The assignment of information to the category of limited access is regulated by 111 legislative acts, including decrees of the President of the Russian Federation, codes and federal laws.

This kind of information, in its most general form, includes the following types of secrets:

- legal professional privilege and audit confidentiality;

- banking confidentiality;

- physician–patient privilege;

- state, commercial, tax and notarial secrecy;

- official secrecy in the field of defense;

- secrecy of: wills, confessions, pawnshop, communications, investigation, deliberations of judges, insurance, adoption.

The Federal Law No. 206-FL of 11.06.2021 introduced amendments to the Code of Administrative Offenses of the Russian Federation, tightening the liability for disclosing the limited access information and establishing administrative liability for illegal obtaining limited access information. Such offenses are subject to administrative fines:

- for private individuals – from 5 to 10 thousand RUB;

- for officials - from 40 to 50 thousand RUB or disqualification for up to 3 years;

- for legal entities – from 100 to 200 thousand RUB.

In addition, the administrative responsibility for the illegal dissemination of information about protected persons has been strengthened. The concept of protected persons is regulated by Art. 2. “Persons subject to state protection” of the Federal Law No. 45-FL of 20.04.1995. Those involved:

- judges, arbitration court assessors and jurors;

- prosecutors, investigators, interrogators and persons carrying out operational-search activities;

- military personnel, employees and federal state civil servants of the internal affairs bodies of the Russian Federation, institutions and bodies of the penal system, the troops of the National Guard of the Russian Federation, the Armed Forces of the Russian Federation, enforcement bodies of the Russian Federation;

- employees of the foreign intelligence agencies of the Russian Federation, the federal security service, the Investigative Committee of the Russian Federation, state security;

- employees of the State Fire Service, servicemen of rescue military formations and federal state civil servants of the federal executive body in the field of emergency prevention and elimination of the consequences of natural disasters;

- employees of the control bodies of the President of the Russian Federation, exercising control over the implementation of laws and other regulatory legal acts, detection and suppression of offenses;

- employees of customs and tax authorities, antimonopoly authorities, federal bodies of state control, the Federal Service for Financial Monitoring, the Accounts Chamber of the Russian Federation, as well as other categories of state and municipal employees according to a separate list of the Government of the Russian Federation;

- relatives of the above persons.

Moreover, the Federal Law No. 216-FL of 11.06.2021 amended Art. 183 and 320 of the Criminal Code of the Russian Federation, clarifying the rules on the illegal disclosure of commercial and tax secrecy, and banking confidentiality, as well as information on security measures in relation to officials of law enforcement or regulatory agencies.

Thus, an amendment has been made that this information can also be collected by deception, blackmail or coercion.

The maximum term of correctional labor for illegal disclosure or use of such information, without the consent of its owner by the person to whom it was entrusted or became known in the service or work, has been increased to 4 years.

Increased liability is provided for these offenses committed by a group of persons in a preliminary conspiracy or by an organized group.

Responsibility for the disclosure of information about security measures applied to officials of law enforcement and regulatory bodies, as well as their relatives, occurs if it is committed by a person to whom the information was entrusted or became known in connection with his official activities.

Possible punishments for such crimes include compulsory work for up to 480 hours or restriction of freedom for up to 2 years.