Amendments to the notification procedure about business opening

Legal entities and individual entrepreneurs are obliged to inform the correspondent authorities of the state control or supervision about opening a business. That is required by the Federal Law of 26.12.2008 №294-FL «On protecting rights of legal entities and individual entrepreneurs during the execution of the public control (supervision) and municipal control».

According to the Law, the regulations for presenting of notifications for carrying out particular types of business were developed (The Decree of the Government of 16.07.2009 №584). By the Decree the order of filing of notifications to the correspondent federal executive authorities (or territorial bodies) was established in terms of actual location of providing works or services.

According to the Decree of the Government of the RF of 09.12.2017 №1500, since January 1, 2018 notification about business opening can be filed regardless from location of providing works or services.

It should be noted that by the same Decree of the Government of the RF of 16.07.2009 №584 edited from 09.12.2017, the List of works and services as a part of particular types of business activities, that should be provided with notification, was approved. Among these activities:

- Provision of hotel services, domestic services, public food services;

- Wholesale;

- Provision of services for transportation of passengers, luggage and cargo by automobile transport;

- Transportation of cargo and freight luggage by marine, railroad transport;

- Manufacture of food products (bread, bakery and confectionary products, milk and dairy products, refined oils and fats, sugar, flour, grain, mineral water, soft drinks, meat and poultry meat products, cocoa, chocolate, sugar confectionary products, tea, coffee, spices, condiments, baby food, dietetic food products);

- Manufacture of prepared pet foods;

- Exploitation of explosive and chemically hazardous production facilities of IV hazard class;

- Treatment of medical products;

- Manufacture of textiles, wearing apparel, clothes, leather, leather apparel, footwear;

- Publishing and printing activities;

- Wood processing and manufacture of wood and cork products, except for furniture;

- Manufacture of tare and wrapping, furniture, individual protective gear, fire-fighter products, low voltage equipment, construction materials and apparel;

- Provision of social services and activities of touristic agencies;

- Processing and preserving of potatoes, fruits, vegetables, fish- and sea food products;

- Technical maintenance, repair and technical diagnostics of domestic gas equipment.

Subscribers of the Information and Analytical system Globas can get comprehensive information about contractor`s notifications for opening a business in the section «Licences. Certificates» of the company report.

Trends in the field of power supply activity

Information agency Credinform represents an overview in the field of power supply activity.

Enterprises with the largest volume of annual revenue (TOP-10 and TOP-500), trading with electricity, were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2015 and 2016). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Sales revenue

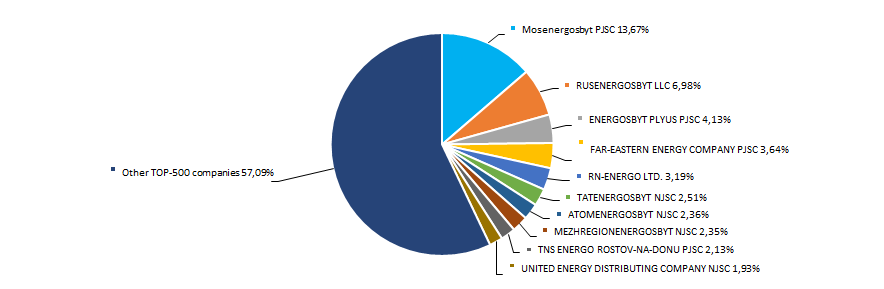

The revenue of 10 industry leaders made 43% of the total revenue of TOP-500 companies in 2016. It points to a relatively high level of monopolization in the industry. Mosenergosbyt PJSC – guaranteeing supplier of electric power in the territory of Moscow and Moscow region – became the largest company in terms of revenue in 2016 (Picture 1).

Picture 1. Shares of participation of TOP-10 companies in the total revenue of TOP-500 companies for 2016

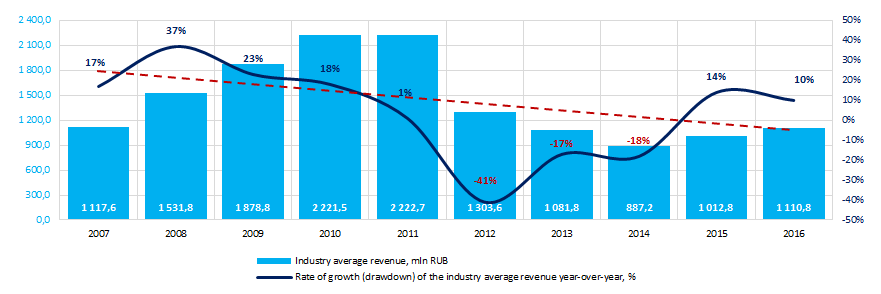

Picture 1. Shares of participation of TOP-10 companies in the total revenue of TOP-500 companies for 2016The best results in the industry in terms of revenue for the ten-year period were achieved in 2011. During the crisis periods in the economy in 2012 – 2014 the industry average indicators decreased. In general, there is a trend towards a decrease in volume revenue (Picture 2).

Picture 2. Change in the industry average revenue of companies in the field of power supply activity in 2007 – 2016

Picture 2. Change in the industry average revenue of companies in the field of power supply activity in 2007 – 2016Profit and losses

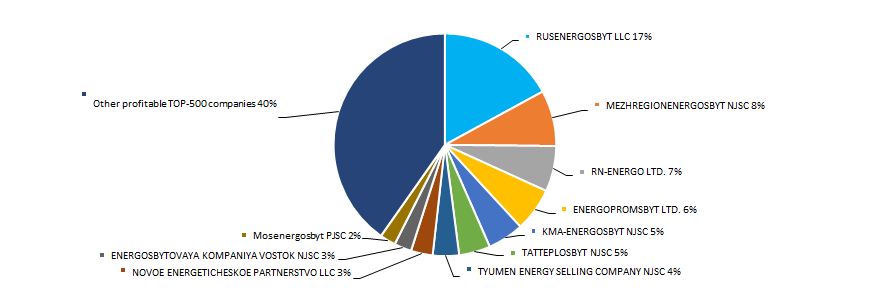

The profit volume of 10 industry leaders in 2016 made 60% of the total profit of TOP-500 companies. The leading position in terms of profit volume in 2016 is taken by RUSENERGOSBYT LLC – one of the largest power supply companies in Russia, delivering electricity to more than 105 000 customers in 60 regions of the country (Picture 3).

Picture 3. Share of participation of TOP-10 companies in the total volume of profit of TOP-500 enterprises for 2016

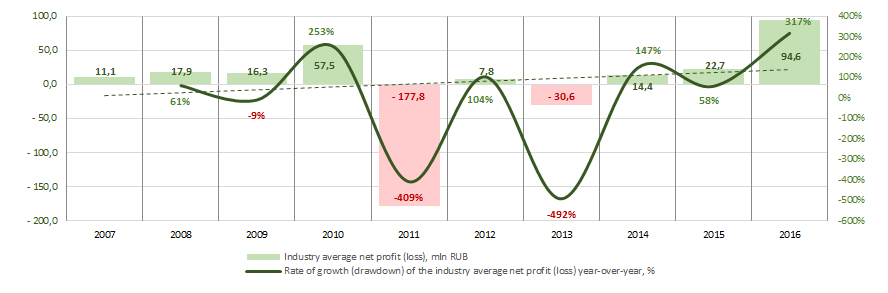

Picture 3. Share of participation of TOP-10 companies in the total volume of profit of TOP-500 enterprises for 2016Industry average indicators of profit of companies of the industry for the ten-year period are not stable. Negative values of the indicator were observed in 2011 and 2013. In general, profit indicators tend to increase. The industry showed the best results in 2016 (Picture 4).

Picture 4. Change in the industry average indicators of profit of companies in the field of power supply activity in 2007 – 2016

Picture 4. Change in the industry average indicators of profit of companies in the field of power supply activity in 2007 – 2016Key financial ratios

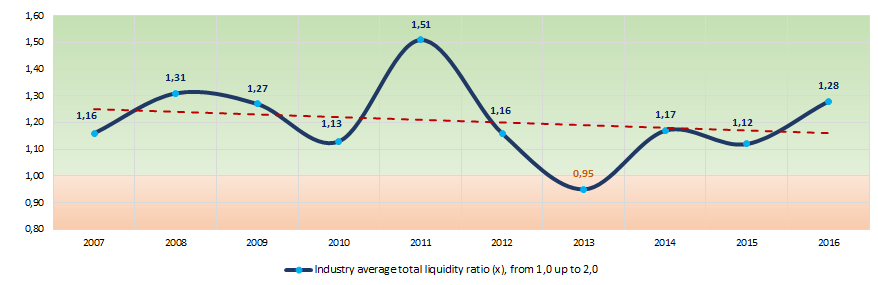

Over the ten-year period the industry average indicators of the total liquidity ratio were in the range of recommended values – from 1,0 up to 2,0, except the year 2013 (Picture 5). In general, the ratio indicator tends to decrease.

The total liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

The experts of the Information agency Credinform, taking into account the actual situation both in the economy as a whole and in the sectors, has developed and implemented in the Information and Analytical system Globas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry. For companies in the field of power supply activity the practical value of the total liquidity ratio made from 0,77 up to 2,46 in 2016.

Picture 5. Change in the average industry values of the total liquidity ratio of companies in the field of power supply activity in 2007 – 2016

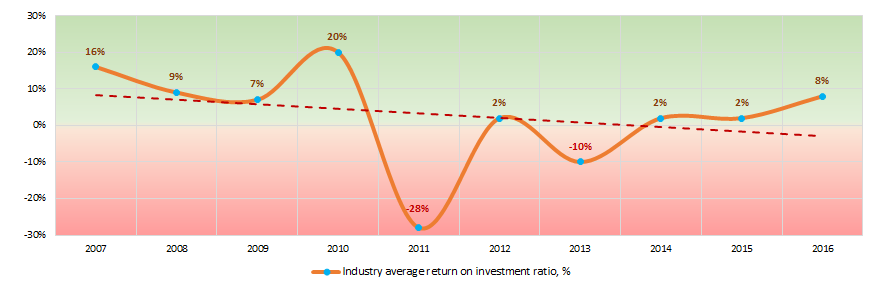

Picture 5. Change in the average industry values of the total liquidity ratio of companies in the field of power supply activity in 2007 – 2016There has been an instability observed in indicators of the return on investment ratio for ten years, with a tendency to decrease. In 2011 and 2013 the indicators decreased to negative values (Picture 6). The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity of own capital and the long-term borrowed funds of an organization.

Picture 6. Change in the average industry values of the return on investment ratio of companies in the field of power supply activity in 2007 – 2016

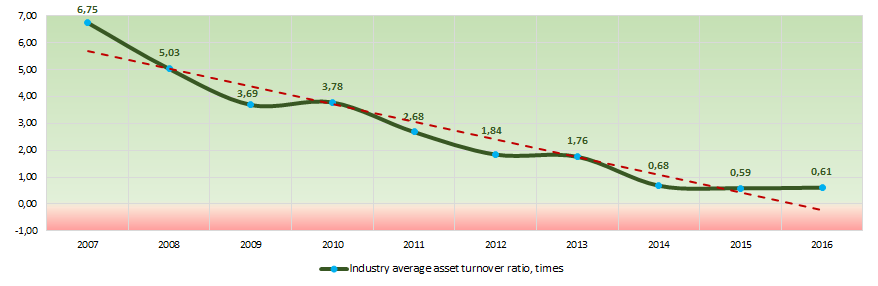

Picture 6. Change in the average industry values of the return on investment ratio of companies in the field of power supply activity in 2007 – 2016Asset turnover ratio is calculated as the relation of sales proceeds to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

As a whole, this activity ratio showed a tendency to decrease over the ten-year period (Picture 7).

Picture 7. Change in the average industry values of the asset turnover ratio of companies in the field of power supply activity in 2007 – 2016

Picture 7. Change in the average industry values of the asset turnover ratio of companies in the field of power supply activity in 2007 – 2016Main regions of activity

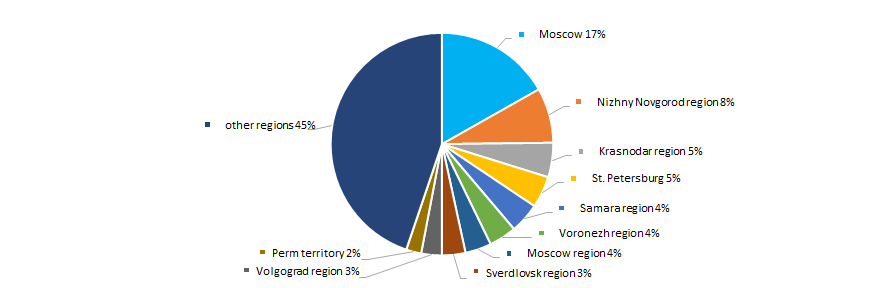

The companies of the industry are unequally distributed across the country. Their largest number is registered in Moscow – the biggest industrial and financial center of the country (Picture 8).

TOP-500 companies are registered in 74 regions of Russia.

Picture 8. Distribution of TOP-500 companies by regions of Russia

Picture 8. Distribution of TOP-500 companies by regions of RussiaFinancial position score

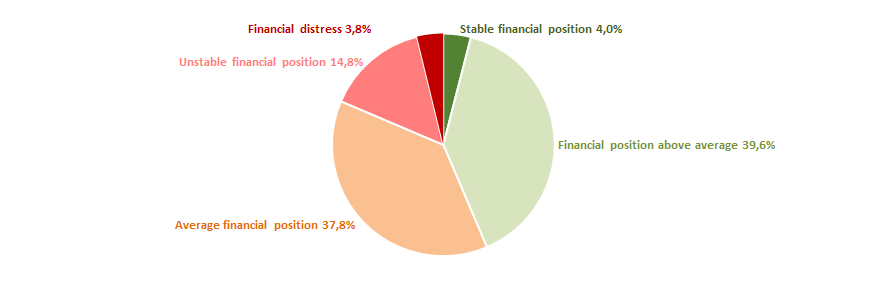

An assessment of the financial position of companies in the industry shows that their the largest number are in a stable financial position and above the average (Picture 9).

Picture 9. Distribution of TOP-500 companies by financial position score

Picture 9. Distribution of TOP-500 companies by financial position scoreLiquidity index

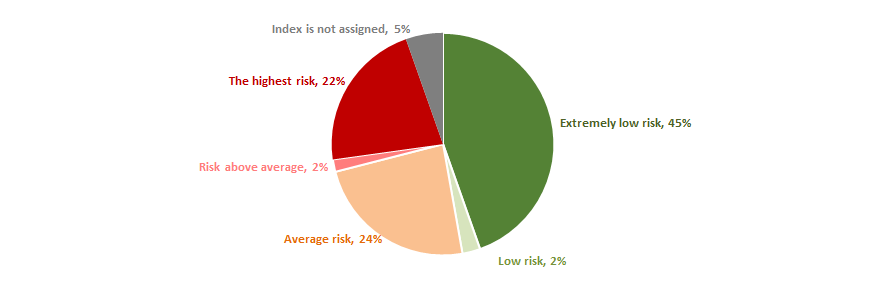

Almost half of companies of the industry show an extremely low bankruptcy risk in the short-term period. However, almost a quarter of companies has the highest and above average level of bankruptcy risk (Picture 10).

Picture 10. Distribution of TOP-500 companies by liquidity index

Picture 10. Distribution of TOP-500 companies by liquidity indexSolvency index Globas

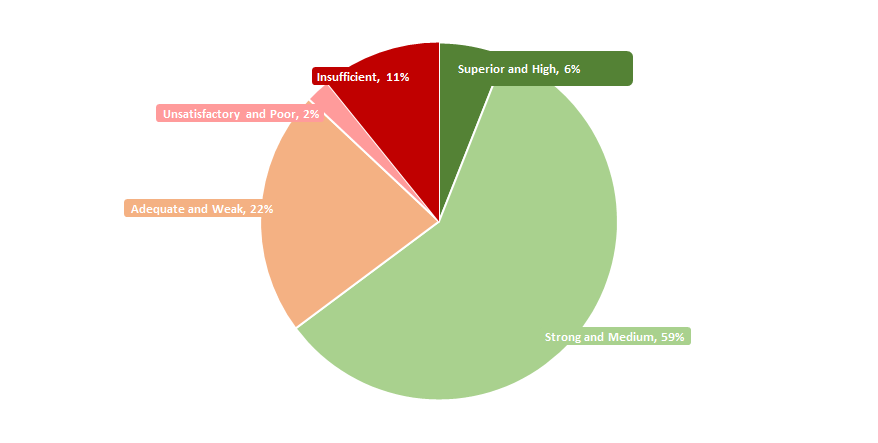

Most of TOP-500 companies got Superior/High or Strong/Medium Solvency index Globas, that points to their ability to repay their debts in time and fully (Picture 11).

Picture 11. Distribution of TOP-500 companies by solvency index Globas

Picture 11. Distribution of TOP-500 companies by solvency index GlobasThus, a comprehensive assessment of enterprises in the field of power supply activity, taking into account the main indices, financial indicators and ratios, points to relatively favorable trends in the industry, as a whole.