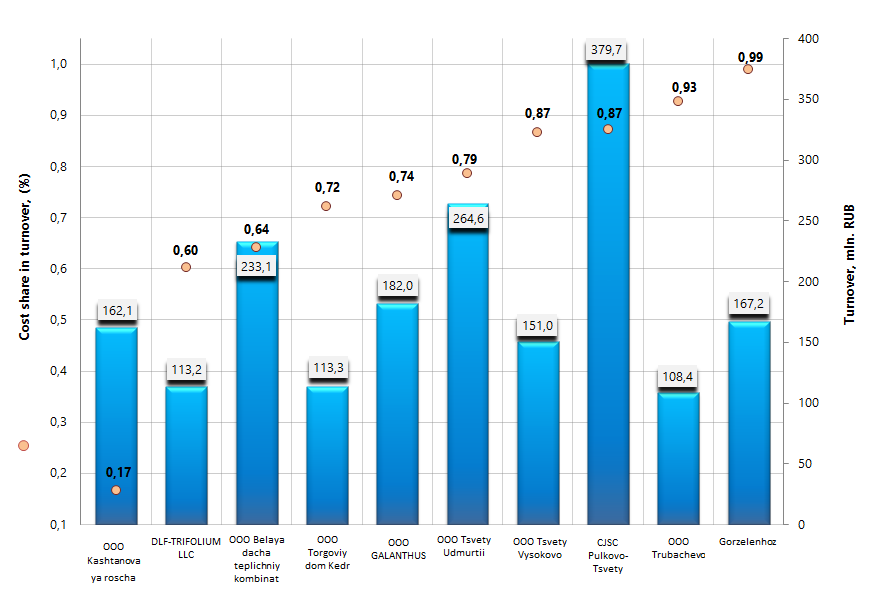

Products cost of enterprises engaged in ornamental horticulture

Information agency Credinform prepared a ranking of companies engaged in ornamental horticulture. Companies with the mentioned activity type and the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2013). The enterprises of were ranked by decrease in products cost share in the turnover.

The cost price is a cost (expenses) for raw materials, fuel, energy, labor and other. It is an important qualitative indicator reflecting how much the company costs on production and marketing. The lower is the cost price, the higher are profit and profitability. Normative values for this indicator are not specified. For evaluating the effectiveness of cost management, it is necessary to look through the percentage of the cost price in the company's turnover.

| № | Name, INN | Region | Turnover 2013, mln. RUB | Products cos, mln. RUB | Cost price share in turnover, (%) | Solvency index Globas-i® |

|---|---|---|---|---|---|---|

| 1 | ООО Kashtanovaya roscha INN: 5025017037 |

Moscow region | 162, 06 | 27,00 | 16,7% | 248 (the highest) |

| 2 | DLF-TRIFOLIUM Limited Liability Company INN: 7715833236 |

Moscow | 113,20 | 68,20 | 60,3% | 269 (high) |

| 3 | ООО Belaya dacha teplichniy kombinat INN: 5027228964 |

Moscow region | 233,11 | 149,66 | 64,2% | 195 (the highest) |

| 4 | ООО Torgoviy dom Kedr INN: 1655178526 |

the Republic of Tatarstan | 113, 30 | 81,79 | 72,2% | 292 (high) |

| 5 | OOO GALANTHUS INN: 4026006318 |

Kaluga region | 181, 97 | 135,26 | 74,3% | 181 (the highest) |

| 6 | ООО Tsvety Udmurtii INN: 1827011427 |

the Republic of Udmurtia | 264,64 | 208,34 | 78,7% | 184 (the highest) |

| 7 | ООО Tsvety Vysokovo INN: 4414010191 |

Kostroma region | 151,01 | 130,95 | 86,7% | 240 (the highest) |

| 8 | CJSC Pulkovo-Tsvety INN: 7810081963 |

Saint-Petersburg | 379,70 | 331,35 | 87,3% | 217 (the highest) |

| 9 | ООО Trubachevo INN: 7014052499 |

Tomsk region | 108,43 | 100,54 | 92,7% | 262 (high) |

| 10 | Municipal agricultural decorative enterprise "Gorzelenhoz" INN: 711026380 |

the Kabardino-Balkarian Republic | 167,24 | 165,65 | 99,0% | 253 (high) |

The average cost price share in the turnover of the Russian ornamental plant nurseries is 73,20%. That shows high expenses on production and can be an indicator of an outdated industrial base.

Cost of the largest enterprises engaged in production farm goods, Top-10

The Top-4 is presented with the following companies: ООО Kashtanovaya roscha (0.17%), DLF-TRIFOLIUM Limited Liability Company (0,60%), ООО Belaya dacha teplichniy kombinat (0,64%), ООО Torgoviy dom Kedr (0,72%). The companies shown acceptable values of production costs relative to their turnover. This result demonstrates the balanced products cost. The enterprises got high and the highest solvency index Globas-i® in terms of financial and non-financial factors set; that characterizes them as financially stable.

The rest of the Top-10 companies have shown the value of the index above the average (73,20%), that indicates that enterprises of the industry should be more rational in approach to their own costs management to improve competitiveness.

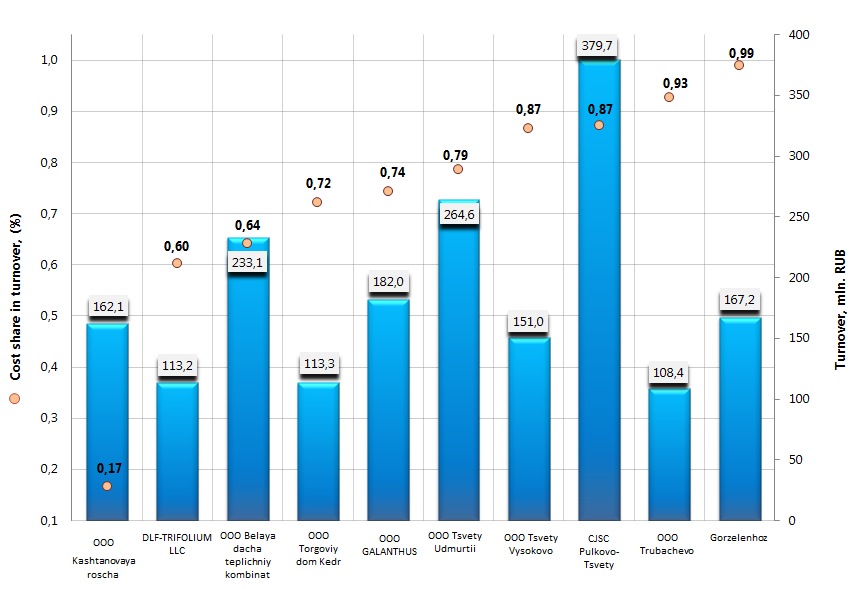

Products cost of enterprises engaged in ornamental horticulture

Information agency Credinform prepared a ranking of companies engaged in ornamental horticulture. Companies with the mentioned activity type and the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2013). The enterprises of were ranked by decrease in products cost share in the turnover.

The cost price is a cost (expenses) for raw materials, fuel, energy, labor and other. It is an important qualitative indicator reflecting how much the company costs on production and marketing. The lower is the cost price, the higher are profit and profitability. Normative values for this indicator are not specified. For evaluating the effectiveness of cost management, it is necessary to look through the percentage of the cost price in the company's turnover.

| № | Name, INN | Region | Turnover 2013, mln. RUB | Productscos, mln. RUB | Cost price share in turnover, (%) | Solvency index Globas-i® |

|---|---|---|---|---|---|---|

| 1 | ООО Kashtanovaya roscha INN: 5025017037 |

Moscow region | 162, 06 | 27,00 | 16,7% | 248 (the highest) |

| 2 | DLF-TRIFOLIUM Limited Liability Company INN: 7715833236 |

Moscow | 113,20 | 68,20 | 60,3% | 269 (high) |

| 3 | ООО Belaya dacha teplichniy kombinat INN: 5027228964 |

Moscow region | 233,11 | 149,66 | 64,2% | 195 (the highest) |

| 4 | ООО Torgoviy dom Kedr INN: 1655178526 |

the Republic of Tatarstan | 113, 30 | 81,79 | 72,2% | 292 (high) |

| 5 | OOO GALANTHUS INN: 4026006318 |

Kaluga region | 181, 97 | 135,26 | 74,3% | 181 (the highest) |

| 6 | ООО Tsvety Udmurtii INN: 1827011427 |

the Republic of Udmurtia | 264,64 | 208,34 | 78,7% | 184 (the highest) |

| 7 | ООО Tsvety Vysokovo INN: 4414010191 |

Kostroma region | 151,01 | 130,95 | 86,7% | 240 (the highest) |

| 8 | CJSC Pulkovo-Tsvety INN: 7810081963 |

Saint-Petersburg | 379,70 | 331,35 | 87,3% | 217 (the highest) |

| 9 | ООО Trubachevo INN: 7014052499 |

Tomsk region | 108,43 | 100,54 | 92,7% | 262 (high) |

| 10 | Municipal agricultural decorative enterprise "Gorzelenhoz" INN: 711026380 |

the Kabardino-Balkarian Republic | 167,24 | 165,65 | 99,0% | 253 (high) |

The average cost price share in the turnover of the Russian ornamental plant nurseries is 73,20%. That shows high expenses on production and can be an indicator of an outdated industrial base.

Cost of the largest enterprises engaged in production farm goods, Top-10

The Top-4 is presented with the following companies: ООО Kashtanovaya roscha (0.17%), DLF-TRIFOLIUM Limited Liability Company (0,60%), ООО Belaya dacha teplichniy kombinat (0,64%), ООО Torgoviy dom Kedr (0,72%). The companies shown acceptable values of production costs relative to their turnover. This result demonstrates the balanced products cost. The enterprises got high and the highest solvency index Globas-i® in terms of financial and non-financial factors set; that characterizes them as financially stable.

The rest of the Top-10 companies have shown the value of the index above the average (73,20%), that indicates that enterprises of the industry should be more rational in approach to their own costs management to improve competitiveness.