Trends in aerospace industry

Information agency Credinform has prepared a review of trends of the largest Russian companies of the aerospace industry.

The largest trading companies (TOP-100) in terms of annual revenue were selected for the analysis according to the data from the Statistical Register for the latest available periods (2013-2018). The analysis was based on the data of the Information and Analytical system Globas.

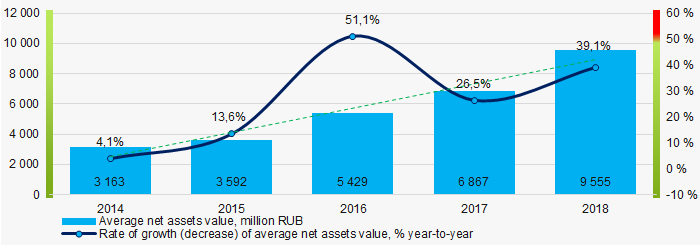

Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

The largest company in term of net assets is State Space Corporation ROSCOSMOS, INN 7702388027, In 2018, net assets value of the corporation exceeded 244 billion RUB.

The lowest net assets volume among TOP-50 belonged to JSC EXPERIMENTAL MACHINEBUILDING PLANT OF KOROLEV ROCKET SPACE CORPORATION ENERGIA, INN 5018037000, Moscow In 2018, insufficiency of property of the company was indicated in negative value of -2,5 billion RUB.

Covering the five-year period, the average net assets values have a trend to increase (Picture 1).

Picture 1. Change in average net assets value in 2014 – 2018

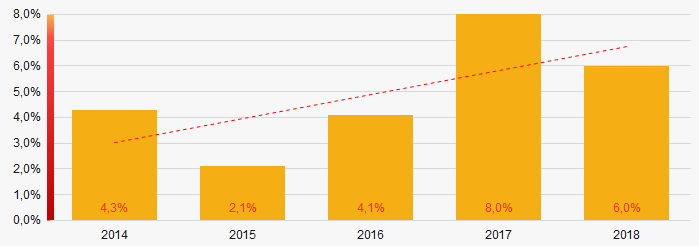

Picture 1. Change in average net assets value in 2014 – 2018The shares of TOP-50 companies with insufficient property have trend to increase over the past five years (Picture 2).

Picture 2. Shares of companies with negative net assets value in TOP-50

Picture 2. Shares of companies with negative net assets value in TOP-50Sales revenue

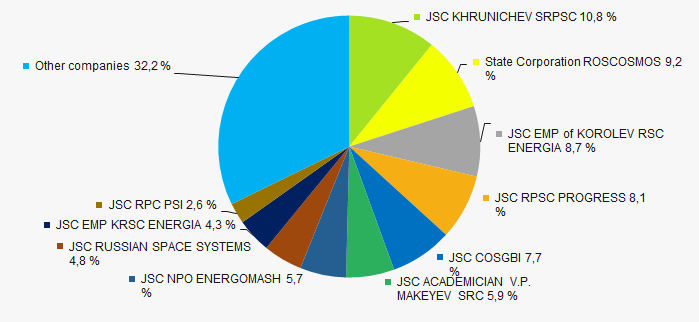

In 2018, the revenue volume of 10 largest companies of the industry was 68% of total TOP-50 revenue (Picture 3). This is indicative of high level of monopolization in the industry.

Picture 3. The share of TOP-10 companies in total 2018 revenue of TOP-50

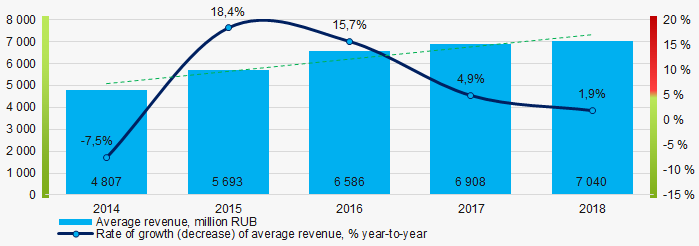

Picture 3. The share of TOP-10 companies in total 2018 revenue of TOP-50 In general, there is a trend to increase in revenue with a slowdown of the growth rate over the past three years (Picture 4).

Picture 4. Change in average net profit in 2014 – 2018

Picture 4. Change in average net profit in 2014 – 2018Profit and loss

The largest company in term of net profit is State Space Corporation ROSCOSMOS, INN 7702388027, Moscow. The company’s profit for 2018 almost reached 10 billion RUB.

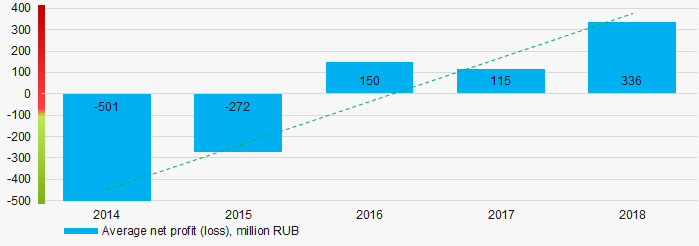

Covering the five-year period, there is a trend to increase in average net profit (Picture 5).

Picture 5. Change in average net profit (loss) values in 2014 – 2018

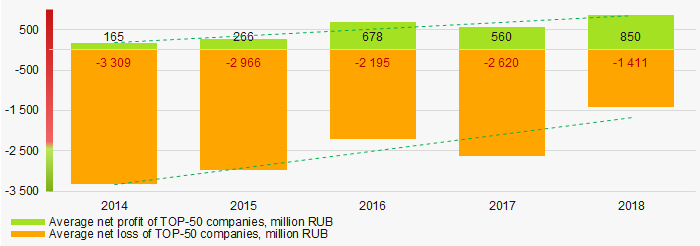

Picture 5. Change in average net profit (loss) values in 2014 – 2018For the five-year period, the average net profit values of TOP-50 have the increasing trend with the decreasing net loss (Picture 6).

Picture 6. Change in average net profit and net loss of ТОP-100 in 2014 – 2018

Picture 6. Change in average net profit and net loss of ТОP-100 in 2014 – 2018Key financial ratios

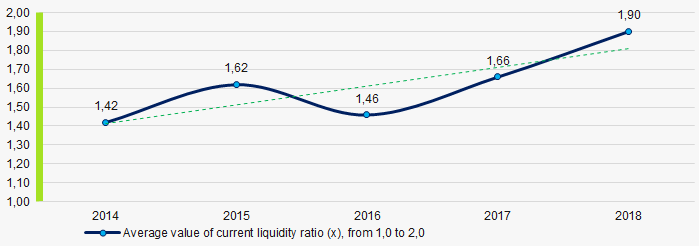

Covering the five-year period, the average values of the current liquidity ratio were mainly within the recommended one - from 1,0 to 2,0 with a trend to increase (Picture 7).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of company’s assets to repay on short-term liabilities.

Picture 7. Change in average values of current liquidity ratio in 2014 – 2018

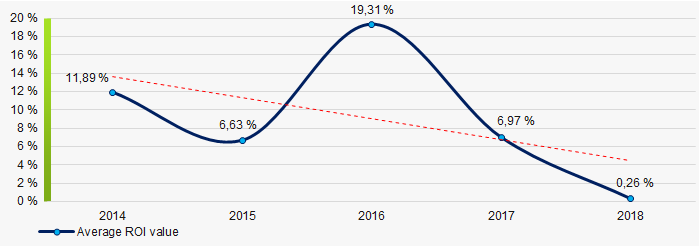

Picture 7. Change in average values of current liquidity ratio in 2014 – 2018 Covering the five-year period, the average values of ROI ratio have a trend to decrease (Picture 8).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average values of ROI ratio in 2014 – 2018

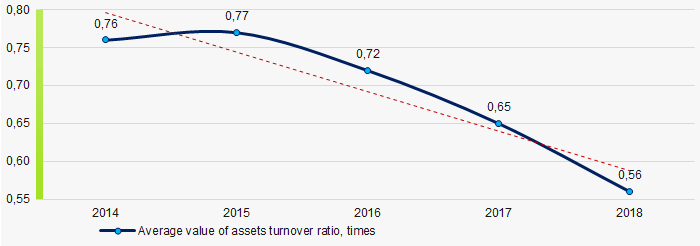

Picture 8. Change in average values of ROI ratio in 2014 – 2018Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

Covering the five-year period, business activity ratio demonstrated the decreasing trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio in 2014 – 2018

Picture 9. Change in average values of assets turnover ratio in 2014 – 2018Small business

Only one company from TOP-50 is registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. Its share in total revenue of TOP-50 companies is 0,02%.

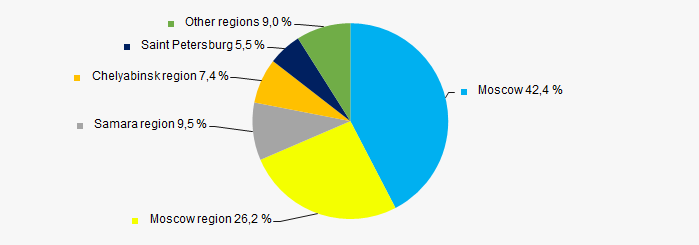

Main regions of activity

Companies of TOP-50 are registered in 14 regions of Russia, and unequally located across the country. Almost 69% of companies largest by revenue are located in Moscow and Moscow region (Picture 10).

Picture 10. Distribution of TOP-50 revenue by regions of Russia

Picture 10. Distribution of TOP-50 revenue by regions of RussiaFinancial position score

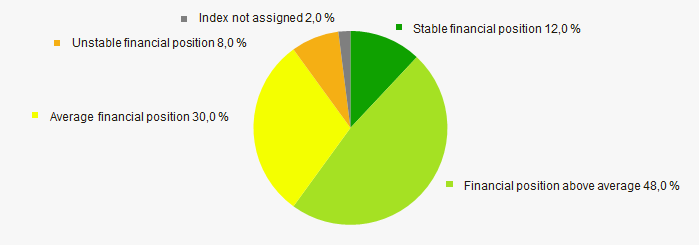

Assessment of the financial position of TOP-50 companies shows that the majority of them have financial position above average (Picture 11).

Picture 11. Distribution of TOP-50 companies by financial position score

Picture 11. Distribution of TOP-50 companies by financial position scoreSolvency index Globas

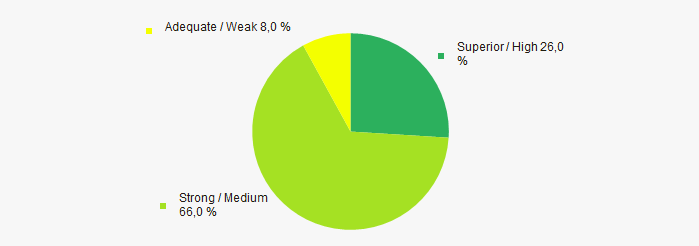

Most of TOP-50 companies got Superior / High and Strong / Medium index Globas. This fact shows their ability to meet their obligations fully (Picture 12).

Picture 12. Distribution of TOP-50 companies by solvency index Globas

Picture 12. Distribution of TOP-50 companies by solvency index GlobasConclusion

Complex assessment of activity of the largest Russian companies of the aerospace industry, taking into account the main indexes, financial ratios and indicators, demonstrates the prevalence of positive trends in 2014-2018 (Table 1).

| Trends and evaluation factors | Relative share of factors, % |

| Rate of growth (decline) in the average size of net assets |  10 10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  -10 -10 |

| Level of competition / monopolization |  -10 -10 |

| Rate of growth (decline) in the average size of revenue |  5 5 |

| Rate of growth (decline) in the average size of profit (loss) |  10 10 |

| Growth / decline in average values of companies’ net profit |  10 10 |

| Growth / decline in average values of companies’ net loss |  10 10 |

| Increase / decrease in average values of total liquidity ratio |  10 10 |

| Increase / decrease in average values of return on investment ratio |  -10 -10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses in terms of revenue being more than 20% |  -10 -10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of relative share of factors |  1,1 1,1 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).

Legislation amendments

The rules of an easy-term loan for the systemically important enterprises, approved earlier by the Order of the Government of the Russian Federation No. 582, were corrected by the Order of the Government of the Russian Federation No. 712 from 20.05.2020.

According to the amendments, not only the systemically important enterprises, but also their subsidiaries belonging to the industries the most affected by a new coronavirus infection, can now receive the easy-term loans for financing of working capital. An extensive list of such sectors was approved by the Order of the Government of the Russian Federation No. 434 from 03.04.2020. In particular, these are:

- air transportation and airports;

- road transportation;

- cultural, leisure and entertainment companies;

- health and fitness and sport organizations;

- travel agencies and other tourism companies;

- hotels and catering companies;

- establishments providing additional education and non-state educational institution;

- exhibition and conference management services companies;

- household services to population (repairs, laundry, dry cleaning, hair and beauty salons);

- public health organizations;

- nonfood retailers;

- mass media and printing establishments.

The full list called «Business entities of affected industries. Moratorium on bankruptcy» is available in the «Lists we recommend» of the Information and Analytical system Globas.

According to the new rules, the easy-term loans are available for the borrowers whose revenue reduced by more than 30% compared to the same period last year.

Besides, the maximum period for loan agreement was extended from 12 to 36 months. The effective period of promotional rates can not exceed 12 months from the date of conclusion of the agreement and end no later than December 31, 2021. This rule applies to the loans provided after April 25, 2020.

The maximum loan amount, received by the systemically important enterprise, includes the loans granted by its subsidiaries under the same state program. This also refers to the loans provided after April 25, 2020.

The maximum loan amount and promotional rate have remained the same: 3 billion RUB and up to 5% per annum respectively.

The requirements for borrowers were significantly increased:

- for the first time, a loan agreement should be concluded under this state program;

- the borrower should not be in the process of reorganization, liquidation or bankruptcy, and its activities should not be suspended;

- the borrower must be under Russian jurisdiction, and the total share of offshore participation should not exceed 50%. This requirement applies to the loans provided after April 25, 2020;

- during the interest rate financing, the borrower is required to keep the number of staff at least 90% from the number of employees as of May 1, 2020;

- before effecting a loan agreement, the subsidiary must obtain the consent from the parent company.

After the loan was received, the following restrictions are imposed on borrowers:

- loan funds should not be used to refinance previously received loans. This also refers to the loans provided after April 25, 2020;

- during the interest rate financing, the payment of dividends is prohibited, except cases provided by the separate decisions of the Government of the Russian Federation.